每日观察:关注各游戏题材的用户粘性及留存率(12.15)

1)Appcelerator/IDC最新季度报告显示,苹果iPhone和iPad仍是开发者支持率最高的平台,在2749名受访者中的支持比例分别达到89%和86%。

不过Android智能手机支持率也达到77%,Android平板电脑支持率则是64%。多数开发者有意开发跨平台应用,而并不仅仅针对特定平台开发内容,有49%受访者针对两个平台开发内容,31%则瞄准了三个不同的平台。

值得注意的是,有88.4%开发者表示将在2013年针对两三个移动平台开发应用,而上一季度的这一比例仅为68.9%。

有53.8%开发者“很有兴趣”针对Nexus设备开发内容;多数开发者似乎都很看好谷歌Android硬件设备(尤其是平板电脑),有35.1%受访者称其他Android设备制造商的产品应向Nexus设备看齐,还有26%认为谷歌是一家设备制造公司,仅有7%受访者表达了对谷歌Android设备的不满。

除此之外,尽管多数开发者认为微软Surface平板电脑是优秀的硬件设备,但该设备及Windows 8系统仍存在大量改进空间。

仅有19%开发者认为苹果在处理平台分裂性问题上做出了足够的努力,90%开发者将苹果的审核流程、盈利措施等问题仍然较为棘手。

多数移动开发者认为,奉行移动优先策略的公司将对微软、谷歌和Facebook等网络巨头形成挑战,有62.4%受访者称Facebook很可能在新兴移动公司面前将丧失社交领域的霸权(上一季度的这一比例为66%)。

2)应用分析及广告公司Flurry最近针对各种题材的iOS和Android免费游戏的报告指出,纸牌游戏在90天内的用户留存率位居榜首,而用户粘性(即玩家访问频率)最高的则是战略游戏。

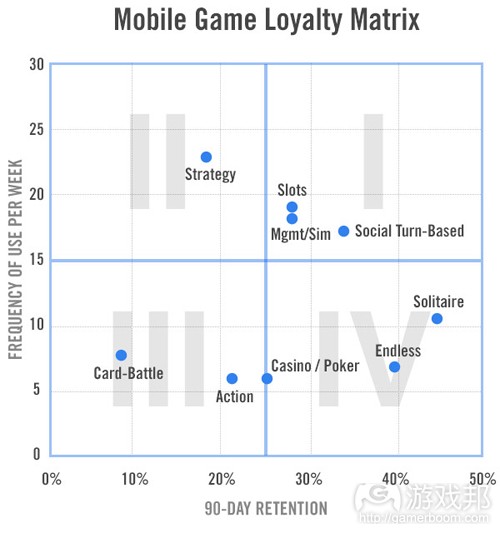

从以下的Flurry坐标图中可以看出,位居第一象限的代表获得最理想的用户粘性及留存率的游戏,其中典型是战略游戏;位居第二象限的是在较短的用户生命周期内,获得较高用户粘性的游戏,主要类型是老虎机游戏、资源管理/模拟游戏,以及回合制社交游戏;第三象限代表较低用户留存率以及低用粘性的游戏,其中包括卡牌和战斗游戏;第四象限则代表“用户重玩频率较高,但可能难以促使用户进行大规模IAP交易”的这种游戏,其中代表是博彩/扑克游戏、纸牌游戏等。

由此可见,尽管卡牌战斗游戏《Rage of Bahamut》是2012年的一个成功典范,但这种游戏题材却并不容易获得成功。

3)网页浏览器Opera移动广告平台2012年第三季度报告指出,苹果iOS仍是其平台最具盈利性的移动操作系统,平均eCPM达到1.64美元(游戏邦注:Opera向1万多个移动网站及应用推出服务,每月广告印象超过400亿次)。

RIM的eCPM则是1.06美元,Android是0.88美元,诺基亚Symbian则是0.37美元。

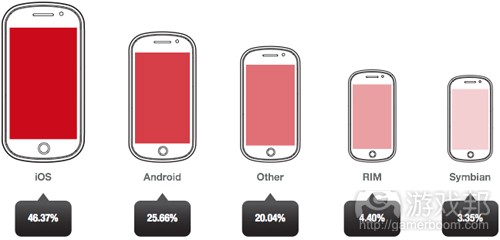

从流量和收益来看,iOS设备占据46.37%的广告流量,以及58.4%的收益;Android在Operan平台的广告流量中占比25.66%,在收益中占比16.79%;其他设备(包括微软Windows Phone产品)在所有流量中占比20.04%,在收益中占比19.67%,其平均eCPM为1.28美元。

iPad是盈利性最高的苹果设备,平均eCPM达4.42美元(第二季度为3.96美元),超过iPhone eCPM(1.48美元)的两倍,并且是iPod Touch(0.82美元)的三倍。

移动应用为Opera平台创造了73%的收益,该平台其余广告收益来自移动网站内容。

从发行商类型来看,财经及投资领域发行商创造的广告收益高于其他类型的发行商。

从英国市场的情况来看,黑莓在英国地区的流量几乎是其美国流量的4倍,Opera在英国有14%的流量来自RIM设备,而在美国的这一比例仅为4.4%。

Opera预计将在2012年为移动发行商创造4亿美元以上的收益,远超2011年时的2.4亿美元。

4)Informa Telecoms & Media最近报告预测,2013年全球移动广告市场收益将达128亿美元,远超2012年时的80亿美元。

尽管移动广告市场收益逐年增长,但企业及广告商在移动平台的营销投入仍然低于在PC/桌面电脑、电视、平面媒体和广播上的预算。

移动网站的展示性广告、移动搜索广告收益将占据最大份额,但手机应用的内置广告收益将呈现更大的增长趋势。

智能手机用户的增长将成为应用内置广告的核心驱动力,iPhone和Android用户的表现尤其明显,这两个用户群体使用应用程序的时间正在赶超浏览网页的时间。

5)据Techcrunch报道,热门儿童应用工作室Toca Boca日前宣布其16款iOS下载量已超过2200万次,并将以Kindle Fire起步进军Android市场。

Toca Boca成立于2010年9月,第一款应用《Toca Tea Party》发布于2011年3月。该公司最热门的系列产品是《Toca Hair Salon》,其下载量超过了1000万次。该应用续集《Hair Salon 2》最近在18个市场的iPad付费榜单登顶,跻身55个市场的前10名,目前在美国榜单排名第三。Toca Boca向全球146个国家/地区发布产品,其售价介于99美分至2.99美元,但也推出了一些免费版本。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)iPhone And iPad Continue To Reign Over Developer Interest, But Cross-Platform Apps Are Now On Everyone’s Mind

Darrell Etherington

Apple’s iPhone and iPad devices are still the most desirable platforms for developers, according to the latest Appcelerator/IDC quarterly report, grabbing 89 and 86 percent of interest respectively among a pool of 2,749 respondents. Android isn’t far behind in smartphones, with 77 percent of interest, but trails considerably on tablets with 64 percent. The good news is that most developers are looking to build cross-platform apps instead of targeting just one, with 49 percent of respondents aiming for two platforms, and 31 percent going after three different operating systems.

Overall the interest in iOS and Android is pretty much unchanged from developer opinions expressed in the Q3 2012 Appcelerator/IDC survey, with Apple gaining two and four percentage points for iPhone and iPad respectively among devs who are “very interested” in their platforms, and Android losing two points for tablets and gaining two for phones. But the big difference is in cross-platform interest, which sees 88.4 percent of mobile devs expressing intent to develop for two or more mobile platforms in 2013, vs. 68.9 percent saying the same thing in the previous quarter.

Appcelerator and IDC break out interest in Nexus devices as its own category, and that’s where Android is seeing strong growth. 53.8 percent of developers said they were “very interested” in targeting Nexus devices, which far outweighs the interest expressed in fully separate mobile platforms like BlackBerry and Windows Phone. Developers seem to see Google taking a stronger role in Android hardware, especially with tablets, as a positive thing, with 35.1 percent saying that other Android manufacturers should take the Nexus line as a model for their own devices going forward, vs. 26 percent saying Google is just another device maker, and only 7 percent expressing any kind of negative sentiment about how Google making hardware affects the overall ecosystem.

Other findings in the survey include a generally negative reaction by developers to Microsoft’s Surface tablet, with most expressing the belief that despite delivering nice hardware, the tablet and Windows 8 need a lot of work before they can become truly successful. Windows tablets experienced a modest rise in developer interest, but still trailed far behind Nexus, Android and iPad categories.

Developers also expressed concern about Apple’s recent hardware introductions, with only 19 percent agreeing that Apple has done enough to manage the fragmentation issues introduced by introducing new screen sizes as with the iPhone 5. And while the iPad mini retains the same resolution of the original iPad and iPad 2, developers still see reason to tailor designs to it, since the smaller physical screen means the relative size of touch targets shrink. 90 percent of developers also rated Apple as either equally or more difficult when it comes to the submission process, monetization and other issues, a sign Appcelerator and IDC interpret as an opening of the door for alternative platforms to gain more traction.

Finally, mobile developers saw it as likely that a mobile-first company could arise and disrupt big tech companies like Microsoft, Google and Facebook. Facebook especially looks vulnerable to a mobile-first social startup, according to survey respondents, with 62.4 percent of developers saying the network would lose its social dominance to a mobile-first competitor eventually. That’s pretty close to what developers believed in the previous quarter (66 percent), despite Facebook launching a completely overhauled mobile strategy between the two. But of course, this survey is targeting mobile devs, many of whom could actually be working on (or know someone who’s working on) what they believe will be a Facebook-killer, so it’s worth taking that stat with a big grain of salt.(source:techcrunch)

2)Flurry breaksdown game genres by retention and usage; sims, strategy, social and slots score best

by James Nouch

Freemium slots games, social turn-based titles and resource management/simulation games occupy a ‘sweet spot’ that sees them “used intensively by a set of highly retained users.”

That’s according to the latest report from app analytics and advertising outfit Flurry. Its research charts the retention rates and frequency of use in the top nine freemium game genres on iOS and Android.

Flurry’s results, which draw on a network of more than 300 million consumers, find that Soliatire games have the best 90-day retention rates of any freemium genre. Strategy games, meanwhile, encourage the most frequent use.

Chart a course

Flurry’s ‘mobile game loyalty matrix’ is reproduced below.

Quadrant I represents the aforementioned ‘sweet spot’, quadrant II shows intensive use over a short customer lifecycle, while quadrant IV is full of ‘evergreen’ titles that inspire repeat play, but may “lack the depth required to generate sizeable in-app purchases.”

It’s interesting to note that quadrant III – which contains genres that attract low retention rates and relatively infrequent use – is home to the card-battle genre.

It would seem that, despite the fact that Rage of Bahamut is a notable success story of 2012, the genre is not an easy one to succeed in.(source:pocketgamer)

3)iOS leads the pack in eCPM, traffic, revenue on Opera’s mobile ad platform, iPad average eCPM of $4.42

Scott Reyburn

Once again Apple’s iOS is the most lucrative platform on Opera’s mobile ad platform, with an average eCPM (effective cost per thousand impressions) of $1.64, according to the web browser maker’s Q3 2012 State of Mobile Advertising report.

The Oslo, Norway-headquartered company’s mobile ad platform, which touts itself as world’s leading mobile ad platform, serves more than 10,000 mobile sties and apps and delivers more than 40 billion ad impressions per month.

Platforms below iOS’s eCPM of $1.64, which was 25 percent more than the worldwide average of $1.31 eCPM, was RIM at $1.06, Android at $0.88 and Nokia’s Symbian OS at $0.37.

In terms of traffic and revenue, iOS devices accounted for 46.37 percent of total ad traffic and 58.40 percent of revenue. Android made up 25.66 percent of traffic for Opera and 16.79 percent of revenue, which are traffic and revenue percentages that are far fewer than that of Apple’s suite of iOS devices. Microsoft’s Windows Phone devices, which were shoehorned into “Other,” represented 20.04 percent of traffic and 19.67 percent of revenue, with an eCPM of $1.28.

At the Masters of Monetization session at this week’s Appnation event in San Francisco, Mahi De Silva, executive vice president, consumer mobile for Opera, said despite there being more Android devices than iOS in the ecosystem, people use more apps on iOS than Android. He added that advertisers want an audience they can reach and it’s easier to integrate ads on iOS versus Android, so advertisers tend to favor iOS.

The iPad remained the most lucrative Apple device ($3.96 eCPM in Q2 2012), averaging $4.42 eCPM, which is more than double the eCPM of the iPhone at $1.48 and more than triple the eCPM of the iPod Touch at $0.82.

“If you look at some of the big media companies, on iPad they are getting CPMs they never saw on the desktop because of the rich-media experience on the device,” said De Silva at Appnation.

Between mobile apps and web, apps grabbed the two-thirds majority of advertising dollars, generating 73 percent of revenue for Opera. The remainder of ad revenue came from mobile web.

Publisher category-wise, the business, finance and investing category generated the most revenue per impression compared to other publisher categories while the sports category displayed the most growth.

Opera took a closer look at the U.K., one of its best performing regions, in this report. Surprisingly, BlackBerry traffic in the U.K. is almost four times higher than BlackBerry traffic in the U.S., with 14 percent of total traffic in the U.K. coming from RIM devices compared to 4.40 percent in the U.S. Also, publisher categories the U.K. favored include the arts and entertainment and the health, fitness and self help categories.

Publishers using Opera’s mobile ad platform include Pandora, Shazam, and CBS, and some advertisers include Samsung, Walmart and American Express.

Data for this report was collected from Opera’s subsidiaries including AdMarvel, Mobile Theory, and 4th Screen Advertising, three mobile advertising companies it purchased for upward of $100 million in total.

Opera says it remains on track to generate more than $400 million for mobile publishers in 2012, which is a large increase over 2011 when it generated $240 million.(source:insidemobileapps)

4)Mobile ad revs to hit $12.8bn in 2013

by Daniel Gumble

Global mobile advertising market to experience significant growth from $8bn in 2012.

The worldwide mobile advertising market is set to reach revenues of $12.8bn in 2013, showing significant growth from $8bn in 2012, Informa Telecoms & Media has reported.

Despite the year-on-year growth of mobile advertising revenues, brands and advertisers are still spending far less on mobile than they are spending on PC/desktop, TV, print and radio.

Revenues from display ads on mobile sites and mobile search will account for the lion’s share of mobile advertising revenues in 2013. However, advertising in mobile apps will experience even greater growth, with many ad-networks now seeing larger revenues being generated through in-app advertising.

Several mobile ad networks are now seeing the majority of their ad impressions on smartphones, many of which are being served in mobile apps. The growing number of smartphone users appears to be the core driver for in-app advertising, especially amongst iPhone and Android users, who are now spending an increasing amount of time using apps than browsing the web.

Meanwhile, messaging and voice looks set to continue to play a crucial role in mobile advertising, with many internet-based campaigns relying on SMS short codes or a click-to-call function for consumer response.(source:mobile-ent)

5)Kids App Maker Toca Boca Passes 22 Million Downloads, Expands To Android With Kindle Fire Debut

Sarah Perez

If you’ve never heard of Toca Boca, then you must not have kids. The studio behind a series of popular children’s applications for iOS (iPhone and iPad) has just passed 22 million downloads across its portfolio of now 16 applications, and is today expanding to Android, starting with support for the Kindle Fire. More Android releases are planned for early next year, the company says.

Toca Boca, for those unfamiliar, operates like a startup within the family-owned, 200-year-old Swedish publishing company Bonnier. Founded in September 2010, Toca Boca CEO Björn Jeffery describes the company’s structure as “a startup with a very friendly bank”: It’s independently run, but doesn’t have to worry about fundraising. That’s a different sort than many in the space. Often, kids app makers are either independent studios or are backed by VC funding.

Bonnier, says Jeffery, saw the potential for the iPad early on. “It was another take on media, instead of repurposing old IP and old materials,” he explains. “A lot of media companies just take what they have and put them on a new screen, and say ‘right, we’re finished.’” Toca Boca, however, grew out of earlier research in Bonnier’s R&D division, where the company had developed concepts for how its media content could work on a digital, touchscreen computer. This research, in fact, was performed before the iPad was even released.

After the iPad’s launch, Jeffery says they realized some of their earlier ideas were right, and others were a bit off. But what stuck out the most was the way the iPad was being brought into family homes and shared. “We thought it would be very interesting to see how we could make a shared experience on the touchscreen for children,” says Jeffery. “The touchscreen itself gives kids the possibility to have their first interactive media experience.”

Toca Boca’s debut app, launched in March 2011, was Toca Tea Party, which mixed digital and real-life play. (The iPad served as the host for a virtual tea party.) Subsequent releases have evolved that original concept of interactivity, but generally now have the child interacting with the characters in the app instead. The most popular series within Toca Boca’s portfolio,

Toca Hair Salon, allows kids to wash, cut, color and style various characters’ hair, for example. So far, this series alone has produced over 10 million of the 22 million total Toca Boca app downloads. These are digital “toys,” says Jeffery, not digital games. The company had just 5 million downloads this time last year.

Today, the company is trying to spin off that success with the release of a sequel, Hair Salon 2. Although it’s early, the potential is there for another hit. The app is now No. 1 on iPad in 18 markets, and top 10 in 55 markets. That’s in paid apps overall, mind you, not kids apps. In the U.S., Toca Boca’s largest market, it’s currently sitting in the No. 3 spot. Toca Boca’s apps are available in 146 countries worldwide and range in price from 99 cents to $2.99. A few are free. The company previously announced it was profitable, but it doesn’t discuss revenues.

As for what’s next, the plan is to continue careful expansion into the Android market in 2013. Jeffery says that they have to research what that market looks like for them. Because of the fragmentation, they want to make sure they’re supporting the majority of their target market, but need to make sure the experience is sufficiently good on all the hardware. That’s one reason Toca Boca started by launching on Hair Salon 2 on the Kindle Fire. The other is that the Fire tends to have a “family-friendly ecosystem.”(source:techcrunch)

闽公网安备35020302001549号

闽公网安备35020302001549号