每日观察:关注手机游戏IAP收益分布情况(12.7)

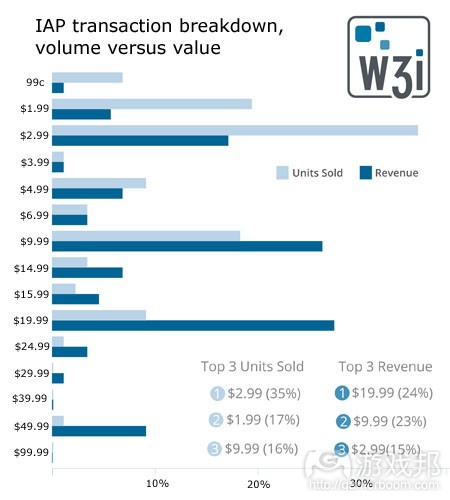

1)W3i最近调查报告显示,有47%的手机游戏IAP收益来自每笔9.99-19.99美元的交易,而来自0.99-1.99美元的交易仅占所有游戏收益的6%(游戏邦注:其数据采自W3i的数百家合作伙伴的游戏,这些游戏在iOS和Android平台的MAU达6600万)。

W3i发现阿拉伯联合酋长国(UAE)与日本是最具盈利性的市场,在UAE有55%的收益来自19.99美元的交易,而日本市场的这一比例则是43%。

每笔9.99美元的交易是加拿大和中国市场的主要收益来源,它在两个市场所占比例分别为33%和29%。

在英国9.99美元交易占比27%,49.99美元交易占比8%。

2)据gigaom报道,亚马逊日前宣布其应用商店Appstore在过去一年中下载量增幅超过500%,其最大发展动力很可能是亚马逊Kindle Fire平板电脑,以及开发者的支持力度。

3)移动广告网络Millennial Media最新报告指出,苹果是Millennial网络第三季度广告印象排名第一的移动设备制造商,其广告印象占比达31.5%,三星占比24.3%,HTC则占比8%,RIM占比7.9%。

谷歌Adnroid是该季度排名第一的手机操作系统,所占广告印象为52%,iOS占比34%,黑莓占比8%。

游戏是应用内置广告印象的第一大来源,紧随其后的是音乐和娱乐应用。与此同时,通信应用则从第五名攀升至第三名,而办公&工具类应用则分别位居第五和第十名。

第三季度有四分之三广告印象来自智能手机,5%来自功能性手机,20%来自非手机连网设备(游戏邦注:例如平板电脑和电子阅读器)。

4)据pocketgamer报道,游戏行业顾问Nicholas Lovell在最近的手机游戏欧洲大会上表示,他并不认为免费增值模式会危及付费模式,如果开发商投入足够的营销资源,付费模式未必会成为用户接触游戏的障碍。

他举例称德国网页游戏发行商Bigpoint发现,《Dark Orbit》这款游戏的多数收益来自占比仅0.02%的用户。但其剩余的大多数非付费玩家也并非毫无价值,因为人们总喜欢花钱战胜好友或者在他们面前满足自己的虚荣心,这一点也会提升付费玩家的转化率。

Lovell指出,人们不会为内容付费,但他们会为地位花钱。

他认为“鲸鱼”玩家的定义就是那些为游戏创造了50%收益的用户,但最好是根据玩家消费行为,而非花钱模式来定义此类玩家。鲸鱼玩家可能会在游戏中消费100美元而后就将游戏抛在脑后,但真正的粉丝不但会为游戏掏出100美元,而且还会向好友推荐游戏。

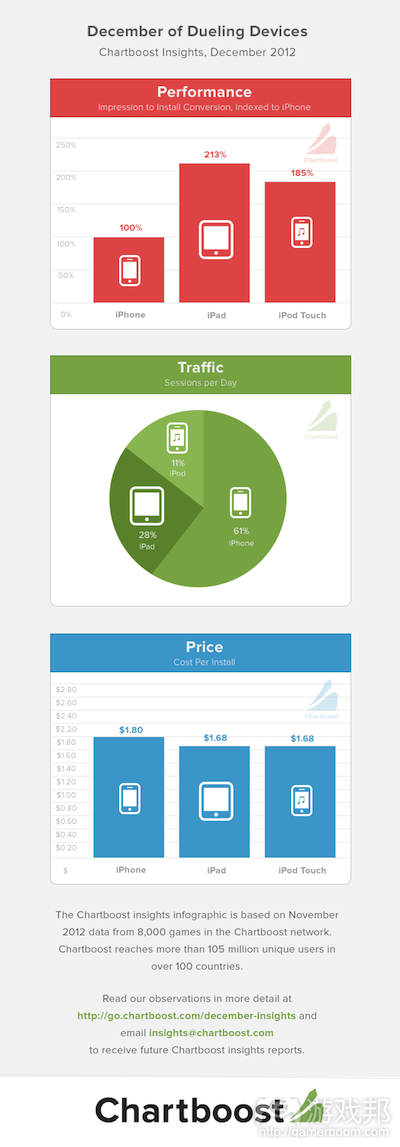

5)移动广告网站Chartboost最新报告显示,iPad是手机游戏开发商广告投资回报最高的平台,但iPhone仍是影响力最大的iOS游戏平台,其手机游戏收益在iOS设备中占比高达61%。因此尽管iPad和iPod touch的用户获取成本相对较低,广告商仍愿意向iPhone平台投入费用以获取大量用户。

比起iPhone游戏玩家,iPad用户回应插页广告并购买新游戏的意愿更高,并超过iPhone的两倍,另外iPod touch用户的这种反应也比iPhone用户多85%。

但iPhone用户玩游戏的频率更高,是iPod touch用户的5倍左右;因此尽管广告商在iPhone平台的CPI(每次安装成本)约比iPad多12美分,但仍然相对划算,可以获得更高的下载量。

(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)Hey big spender: 47% of mobile game IAP revenue comes from $10-$20 transactions

by Jon Jordan

With the top grossing charts in 2012 ruled by free-to-play games, it’s no surprise that in-app purchase are industry’s key driver.

However, according to research from monetisation experts W3i, not all IAP are equal.

As has been previously suggested by individual developers at an anedoctal level, most revenues are being generated by transactions of $9.99 or more.

Big bucks

Breaking out specific figures, W3i’s research says that 47 percent of total revenue comes from transactions costing $9.99 to $19.99.

Transactions from $0.99 to $1.99 only contribute an average of six percent to total game revenue.

The research was based on data from hundreds of W3i’s partners, accounting for 66 million monthly active users across iOS and Android.

Country breakdown

Looking down at how the data varies between countries, W3i found that the UAE and Japan were the most lucrative markets.

55 percent of revenue in the UAE came from $19.99 transactions, while it was 43 percent in Japan.

$9.99 was the key transaction amount in Canada and China, respectively making up 33 percent and 29 percent of revenue.

Whereas in the UK, 27 percent of revenue came from $9.99 transactions, and 8 percent of revenues came from $49.99 purchases.(source:pocketgamer)

2)Amazon’s Appstore is on fire: 500% more downloads this year

By Kevin C. Tofel

Even without a platform of its own, Amazon is doing just fine when it comes to mobile apps. The company announced on Thursday that “[a]pp downloads in the Appstore have grown more than 500 percent over the previous year.” The two biggest drivers of such growth are likely to be Amazon’s Kindle Fire tablet line, introduced in September 2011, and strong developer support for programmers to create compelling Android applications for Amazon’s tablets.

While Amazon has had its own Appstore for Android devices since March 2011, I suspect most of the growth came from Amazon’s own mobile devices and not Android smartphones or tablets made by others. A few phones have come with the Amazon Appstore pre-installed, but most do not. That means consumers have to learn about Amazon’s storefront on their own and then install it themselves. Google’s own Play store is central to the Android experience, which is a potential barrier here.(source:gigaom)

3)Games the number one source of in-app advertising in Q3

by Zen Terrelonge

And Android is the top operating system with a 52 per cent share of impressions.

Mobile ad network Millennial Media has released its latest Mobile Mix Report, which shows that Apple was the leading OEM for ad impressions in Q3 with 31.5 per cent share, while Samsung, HTC and RIM rounded off the top four with 24.3, eight and 7.9 per cent shares, respectively.

However, Google’s Android was the number one OS for the quarter, with a 52 per cent share of impressions, followed by 34 per cent for iOS and eight per cent for BlackBerry. In fact, Android powered 15 of the top 20 ad-serving mobile phones.

Gaming apps were the number one source of in-app ad impressions for the second consecutive quarter, with music and entertainment apps remaining in second. Meanwhile, communications apps climbed from fifth to third, while productivity & tools and dating entered the top ten in fifth and tenth spots, respectively.

Three-quarters of all impressions came from smartphones and five per cent from feature phones, but 20 per cent came from non-phone connected devices (tablets and e-readers etc) which is a six per cent year-on-year increase.(source:mobile-ent)

4)Mobile Gaming Europe 2012: Lovell defines the difference between Whales and True Fans

by Jon Jordan

Anyone who’s been around the mobile games conference scene for any length of time will have likely heard a talk from Nicholas ‘Freemium’ Lovell.

The consultant was happy to expand his perceived remit, though, at the Mobile Gaming Europe conference in London.

“I’m not a freetard. I’m not completely obsessed by free,” he said.

“Paymium is fine if you have enough marketing resource to overcome the friction of your game being paid.”

Open doors

His wider point is that to be successful in the games business, you need a very large audience and being free is the easiest way to generate this.

Yet, maybe the surprising fact is despite these large audiences, only a tiny proportion of them are valuable in terms of generating direct revenue.

For example, German browser game publisher Bigpoint found that in one game Dark Orbit, 0.02 percent of its audience was generating the majority of its revenue.

However, the rest of the playing audience is important because people will spend a lot of money to impress (or defeat) their friends and the general playing audience.

‘People don’t pay for content but they will pay for status,’ Lovell stated.

Big beasts

Of course, this argument is the basic construction of the so-called ‘whale’; that is a player who will spend hundreds of dollars because they love your game so much.

There’s much argument about just how big whales are.

Lovell’s working definition is that ‘whales are the users who make up 50% of your revenue’, although pointing out that such players are likely best defined by their behaviour, not by the hard spending patterns.

Still, anecdotal evidence states that some games companies have player – often labeled as professional soccer players – who are spending $1,000 daily for months or even years.

Similarly, it’s said that in China, some game companies have physical VIP support stores for their games that are only available for players who have spent more than $100,000 (or perhaps $1 million – it’s China, so no one knows right?).

Yet, moving on from whales, perhaps the better definition is ‘True Fan’ – the people who spend a lot of money and also act as evangelists for your game.

“Whales might be the people who spend $100 in your game and regret it, while True Fans spend $100 and tell all their friends about it,” Lovell ended. (source:pocketgamer)

5)iPad Users More Likely To Buy Games Via Ads, But iPhone Users Still The Most Desirable Audience

Darrell Etherington

A new report from mobile ad network Chartboost suggests that while the iPad is the best platform in terms of getting return on advertising spend for mobile game developers, the iPhone is still seen as the marquee iOS platform for mobile games, since it commands an impressive 61 percent of all gaming time spent on iOS devices. So despite lower acquisition costs on iPad (and iPod touch), advertisers are still willing to pay more to gain access to the much broader audience of iPhone gamers.

iPad owners are more than twice as likely (113 percent more likely, to be precise) as people playing games on iPhone to respond to interstitial ads and purchase new gaming titles based on that marketing channel, Chartboost finds, and iPod touch owners are more than 85 percent more likely to do the same. Why the gulf? It’s hard to know for sure, but it’s possible that users spend a much greater percentage of their time on iPads and iPod touches playing games than they do on their phones, since those devices come in Wi-Fi-only flavors that are often used more exclusively for entertainment purposes compared to a smartphone.

Still, the iPhone wins by session volume, grabbing the most eyeballs overall, and it leads by a wide margin, too. It has 5 times the gaming sessions of iPod touch, for instance. The iPad has more than double the gaming sessions of the iPod touch, but still less than half those on the iPhone. So even though the cost-per-install advertisers have to spend on iPhone is around 12 cents more on average on iPhone than it is on iPad, it’s likely seen as a fair trade in order to potentially get much greater download volume.

Chartboost thinks that there’s an opportunity here to make smart investments on iPad-specific marketing campaigns, especially for teams with a smaller budget that might face a lot of competition with other similar titles on the iPhone. Pushing for iPad customers might mean grabbing a bigger chunk of users early on for less than you’d pay to get the same number on iPhone, and there’s also higher average revenue per user on iPad to keep in mind. That means that free-to-play titles could actually stand to gain more revenue overall with less initial investment by targeting a smaller audience on iPad, vs. the larger pool of potential users on iPhone.(source:techcrunch)

闽公网安备35020302001549号

闽公网安备35020302001549号