facebook数据:小型游戏公司社交游戏发展并非没有机会

现在,在各种社交游戏会议上,我们经常可以看见许多小型游戏开发者们正陷入一种焦灼的状态。因为Zynga、EA等主流社交游戏公司拥有足够的资金和精力对他们发起挑战。

支撑上述言论最有力的证据就是,现在社交游戏领域已经出现拥堵现象。自2009年末得到巅峰状态之后,社交游戏从2010年春天开始出现下降趋势。

这一趋势恰恰说明了目前社交游戏开发公司之间的激烈竞争。其中像Zynga这类资金丰裕(近5亿美元),日盈利高并与Facebook合作良好的大型社交游戏公司对于其他小型公司而言无疑是个威胁。

今年初,我们开始怀疑社交游戏行业的真实发展状况,而怀疑的理由很简单。从前我们一向把Zynga的游戏流量作为一种测量器,而自2009年末之后,Zynga旗下最热门游戏FarmVille的月活跃用户(MAU)已经从8400万下降到6200万,而日活跃用户(DAU)也从3200万下降到了1600万。而该公司的其他小游戏,如Roller Coaster Kingdom等已停止运营。

然而,比这更糟的是仍有许多游戏公司纷纷涌进社交游戏市场,他们在2009年发售的好几款大型社交游戏都轻松地获得了3000万MAU。此外,Zynga公司在2010年发售的两款游戏FrontierVille和Treasure Isle也轻松突破2000万MAU,但随后Treasure Isle的玩家流量飞速下降。排除Zynga公司,在其他所有游戏开发商中,Playdom公司发行的Social City以1260万MAU,310万DAU取得最佳成绩,但现在这款游戏的MAU仅余600万,DAU则是66万3823。

以上这些数据都引起了同行对社交游戏行业发展潜力的担忧。现在,Zynga,EA,CrowdStar和Playdom等大型社交游戏公司都已经实现盈利,并且拥有较为稳定的用户基础,即使玩家人没有提升也还可以继续生存。但其他游戏公司则需要更多的增长。

对增长的重新思考

或许就像本文的标题一样,社交游戏市场的悲观前景往往会被一些高层的观点所掩饰。

因此,从几个月前开始开发AppData程序以来,我们还开发了一些市场行情分析工具。其中就有一款可以纵观2008年以来的历次游戏排行榜。在此基础上,我们发现对许多业内人士对社交游戏市场前景的看法并不正确。

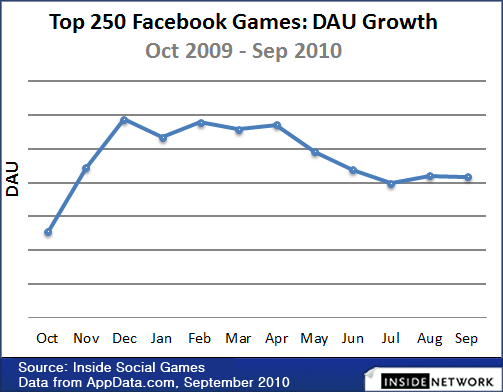

从2009年10月开始,我们记录排名前250的每一款游戏每个月的DAU情况(DAU数据比MAU的价值较高)。以下是排名前250游戏自2009年10月的DAU变化图(请注意我们没有标注年份):

从上图我们可以确定,社交游戏的流量呈现下降趋势。从今年2月到9月的7个月时间里DAU流量下降了18%,即1130万。这对于一个本应蓬勃发展的市场而言并不是什么好兆头。

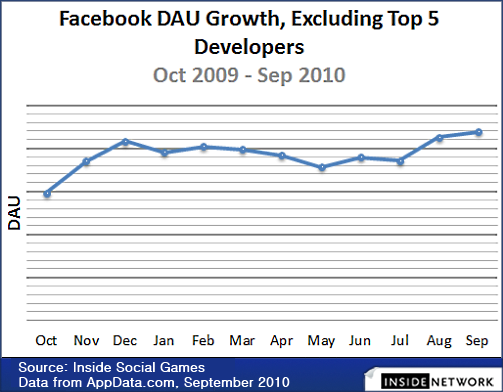

但从另外的一些角度看来,社交游戏还保持着成长势头。首先,我们排除了五大社交开发公司发布的所有游戏——根据它们目前的规模,这五家游戏公司分别是Zynga,EA,CrowdStar、Playdom和RockYou。排除这些游戏后,每月仅余下175款社交游戏。下图是这些中小型社交游戏开发公司的流量增长图:

从上图我们可以看出,这175款社交游戏自去年12月登顶后,在今年5月流量触底之后开始逐渐回复。今年9月流量突破历年最高。但我们必须承认,这10多家游戏开发公司的175款游戏所占用的DAU仅是五大开发公司的63%。

在这些社交游戏中,有一些游戏的增长主要归功于正确的发布时机和执行决策,有些游戏则刚一问世就创下了100多万DAU。但今年还有许多成功的独立制作游戏,如Camelot的Kindoms,Family Feud。Baking Life、Millionaire City和Mall World等。

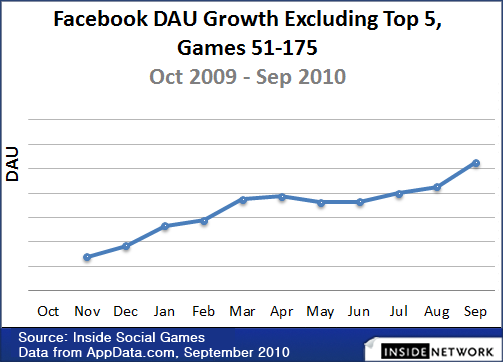

最后,我们还有一个疑问:如果我们将Baking Life或Millionaire City这类黑马从排行榜上去掉 ,那么社交游戏市场的局势又会变得怎么样呢?那些独立开发者的小型游戏究竟市场前景如何呢?

结果证明,这类小型游戏保持着最良好的发展势头。我们排除了175款游戏中的前50名,仅保留下DAU低于20万的125款游戏:

2009年10月时,排行榜上的许多游戏规模都很小——其中很多都是一些最初级游戏,或者其他热门游戏的山寨版。但现在,这些小型社交游戏的种类更加丰富多样了,例如Lucky Train, Ameba Pico和Chocolatier等。

总结

Facebook并不是一个可以轻易取得成功的发布平台,但其中的确有一些游戏成功了。从2009年末到2010年春的这一段时间里,Facebook平台创造了令人难以置信的高速增长。

但现在,这些促进高增长的因素似乎失去了效力,它们在今年春的表现隐藏了社交游戏市场增长的潜流。许多小型游戏开发公司告诉我们,自Facebook从春天减少公告后,很多大型社交游戏公司的流量减少或持平。因此这些小型社交游戏公司对自己的新款游戏充满了信心。

然而,平台也不能让个开发商时刻放心。最近Facebook在Feed上的变化就是最好的例子。很多人开始担心Facebook会重新阻碍小型游戏开发公司的发展,而向那些可以引进大量广告的大型公司开放更多空间。

现在,许多游戏开发商开始转向小型市场,例如Nightclub City和Monster World。 很多大型游戏公司却仍占据着重要地位,小型公司们只能在夹缝中求生。

在接下来的几周,我们Inside Virtual Goods仍会持续关注社交游戏市场的未来发展趋势。(本文由游戏邦/gamerboom.com编译)

In the social gaming world, whether at a conference or a more informal gathering, it’s not uncommon to hear that small developers are in for trouble. Leading companies like Zynga and Electronic Arts, the common wisdom goes, have too much power and money for independents to be able to put up a fight.

When this theory comes up, the evidence that’s usually offered is that social games are already undergoing a squeeze. Growth was highest near the end of 2009, and has fallen since it peaked in the spring of 2010.

Declining traffic means more intense competition for the existing pool of players, and more cutthroat tactics for viral distribution of the games. A company like Zynga, with over half a billion dollars raised, huge daily revenue and (some say) a close relationship to Facebook, is too much of a threat to small companies.

Earlier this year, we began to wonder how accurate this “common wisdom” take on the social game industry truly is. The source of the worries was clear. Zynga’s own traffic is often used as a barometer; its hit FarmVille is down from 84 million monthly active users and 32 million daily active users, to a its current 62 million MAU and 16 million DAU. Smaller Zynga titles like Roller Coaster Kingdom have been closed altogether.

Worse than FarmVille’s decline from its peak is the fact that no other company has stepped in with a comparable hit. Several of the biggest games released in 2009 easily topped 30 million MAU. In 2010, two Zynga releases — FrontierVille and Treasure Isle — have gone over 20 million MAU, but no other game has come close, while Treasure Isle quickly declined. The highest point reached by any other company was Playdom with Social City, which maxed out at 12.6 million MAU and 3.1 million DAU. The title is now under six million MAU and has only 663,823 DAU.

These sort of data points have led many to worry about the potential of social gaming. Zynga, Electronic Arts, CrowdStar and Playdom are already profitable, and have the advantage of circulating their existing playerbase between their games; even without growth, they will survive. But other companies clearly need new growth.

Reconsidering Growth

As the title of this post implies, the pessimistic take on the social gaming market is belied by a higher-level view. Since we rolled out AppData Pro a few months ago, we’ve been building in tools that allow us to more easily detect broad market trends. One of our newest tools is the ability to look at the historical leaderboard for any given day, going back to AppData’s inception in 2008. Using this tool, we’ve found clear evidence that the common wisdom that social gaming is in a holding pattern is simply wrong.

That’s not immediately obvious, even from the high level. Starting on September 10th, we recorded the top 250 games for the same day of every month, going back a full year. We looked at daily active user counts rather than MAU, because developers find DAUs more valuable.

Here’s what growth looked like for all 250 games (note that we’ve removed the Y-axis labels of these graphs):

The above view seems to confirm the thesis that social game traffic is declining. From a February high point traffic has declined about 18 percent in just seven months to 113 million DAU — not a good sign, for what’s supposed to be a growing market.

The growth lies elsewhere. For a different view, we removed all games from the five developers with the largest audiences — in order of their current size, those are Zynga, Electronic Arts, CrowdStar, Playdom and RockYou. Once we were done, we were down to a set of 175 games for each month. The next chart shows traffic growth for both small and mid-sized developers like Digital Chocolate and Wooga:

As you can see above, a December peak was followed by a dip into May, then a recovery. September will be the best month ever for social games by developers other than the top five.

It’s worth acknowledging here that 175 games by dozens of developers share just 63 percent of the DAU enjoyed by five companies led by Zynga. But many of these smaller games are potentially able to be sustainable themselves. The smallest value for any game in our September measurements was 38K DAU, and the median was almost three times as large.

Some of this growth is certainly driven by a set of games that is winning through a combination of good timing and execution. Some of the largest titles pull in over a million DAU by themselves. We’ve talked about many of these successful, independently-produced games throughout the year, like Kingdoms of Camelot, Family Feud, Baking Life, Millionaire City and Mall World.

Each of these growing games tends to be offset by a declining older game — Farm Town, the precursor to FarmVille, being an example that many would recognize. But there are, at this point, more growing games than shrinking.

The last question we had was what the numbers would look like if we removed surprise hits like Baking Life and Millionaire City from the rankings. How are smaller games by independent developers, which rarely get any attention, doing?

As it turns out, this group of smaller games (by smaller developers) is the healthiest of all. We removed the top 50 games from our sample of 175, which left us with a sample of 125 games, each of which had no more than 200,000 DAU:

Our extended look at the games on the list suggests that these scrappy smaller games are the real trend on Facebook. Back in October 2009, the first month of the sample, the games in these leaderboard rankings were not only much smaller — many of them were also rudimentary, or direct copies of other, far more successful games.

Now there are a wide variety of more full-featured social titles. Check out Lucky Train, Ameba Pico, or Chocolatier for an example of what we mean.

Conclusion

Facebook is clearly not an easy platform to become successful on — but few are. The period from late 2009 to spring of 2010 saw unrealistically high growth across the Facebook platform, often driven by out-of-control virality and questionable marketing tactics. Normal growth processes were short-circuited, and a handful of young startups grew at a rate almost without precedent.

The unsustainable components of that growth have now somewhat faded away. But their presence through spring obscured the undercurrent of gains we show above. Many small developers have told us that they have done well since Facebook tuned down notifications this spring, while some of the larger companies have declined or remained flat. Those same small developers are largely confident in their ability to create compelling new games.

However, fears about the platform will never completely abate. The latest example is the recent change to the feed, which caused fresh concerns that Facebook has again hampered organic growth for small developers, leaving the field to larger competitors who can pour millions into advertising.

We are seeing a broader trend of players moving to more niche offerings, ranging from Nightclub City to Monster World. The larger companies are still picking their areas of emphasis, leaving some openings for creative small developers.

We’ll continue to examine these trends in coming weeks, as well as in our Inside Virtual Goods reports on the future of social gaming.

The data used in this post is sourced from AppData Pro, our membership service that includes in-depth categorization, historical reports, trend analysis, and more. If you’re an AppData Pro subscriber, you will receive an email followup with full data and research notes today.(Source:Inside Social Games)

闽公网安备35020302001549号

闽公网安备35020302001549号