每日观察:关注comScore美国平板电脑用户调查情况(8.7)

1)comScore最近调查报告预测,2013年美国平板电脑普及率将达47%。

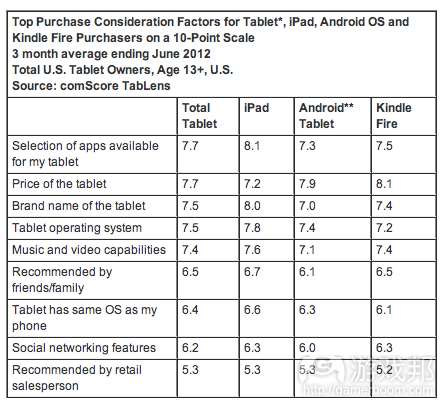

在针对6000名美国平板电脑用户的调查中发现,Kindle Fire在女性用户中更受欢迎,而iPad用户则以男性为主导。苹果iPad用户满意度最高(游戏邦注:其得分为8.8,总分是10分),不过iPad、 Kindle Fire(8.7分)和其他Android平板电脑用户满意度都比较接近,其满意度均高于智能手机(8.1分)。从购买动机来看,功能及价格是用户首先考虑的因素,其次才是品牌。

comScore还发现亚马逊平板电脑女性用户占比56.6%,其用户比例失衡程度甚于iPad和其他Android平板电脑。iPad男性用户占比52.9%,其他Android平板电脑男女用户比例较为均衡。而智能手机则多以男性用户为主,这两者分别占比51.9%和48.1%。

在这些平板电脑和智能手机用户,25-34岁群体最为普遍,其次为35-44岁群体;这些用户家庭年收入一般都超过10万美元。

值得注意的是,亚马逊Kindle Fire尽管号称最实惠平板电脑(售价199美元),但仍被许多用户评为“最昂贵”平板电脑。这意味着这199美元对那些收入较低用户而言仍然价格不菲。

应用内容与设备售价同样是用户购买平板电脑时最为关心的因素,但不同产品的情况略有不同。例如iPad虽然设备售价最高,但由于拥有大量可选应用,其总体得分仍然高于Kindle Fire和其他Android设备。假如苹果推出更平价但功能相同设备,苹果设备可能会独霸整个平板电脑市场。

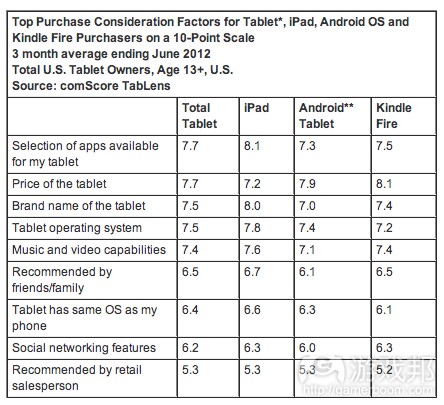

2)Kantar Worldpanel ComTech最近报告指出,三星已是目前欧洲最热销手机品牌,这主要归功于S3设备在5月份时的成功发布,以及大规模的削价活动。在过去12周中(截止7月8日),三星在英国、德国、法国、意大利和西班牙智能手机市场份额已达45%,而苹果在该市场所占份额仅为16%。据Kantar分析师所称,除了英美两国之外,苹果在Kantar所调查的各个国家市场份额均出现下滑情况。

Android目前在欧洲五大国市场份额为66%,远超去年的43%。该时期,Android在澳大利亚所占销售份额为60.5%,在美国所占销售份额仅超过51%。

Kantar报告显示,苹果过去12周中在德国、法国、意大利、西班牙、澳大利亚销量所占份额已比去年下降4.3至11.4个百分点,其中以澳大利亚市场份额下滑最为严重。但苹果在美国销售份额达38.2%,比同比增长9.5%,在英国市场份额为22.9%,增长2个百分点。

Android虽然在全球市场销量领先,但在美国这个关键市场的销售份额已比去年下滑5.3个百分点。分析师认为这一点可能与iPhone、Adnroid手机在美国售价较为接近有关,因此用户通常会选择自己所需要的,而非相对更廉价的设备。

苹果用户对该品牌忠诚度最高,在英国有80%的iPhone用户后来又购买了苹果设备,92%用户有意购买新款iPhone。

RIM在美国市场销售份额仅为3.7%,在英国为10.9%(比去年下降一半),在法国为9.2%。

Windows Phone在Kantar所调查的各个国家市场份额均未突破5%;Symbian目前仅在意大利略有市场,但在该地所占份额仅为12.8%。

3)据《华尔街日报》报道,Zynga移动高管David Ko在最近采访中承认Zynga在移动领域面临挑战,他称Zynga尝试做不同的事情,他们所做的一切并非都是全垒打。如果有人说公司有网络部门、移动部门,他就会指出公司只有一个部门,那就是Zynga。

观察者称他这番话以及Zynga最近提拔David Ko的举措表明:如果你是一家网络公司,并使用基于网络的参数制定自己的决策和运营模式,那就难以考虑移动领域的情况,因为移动平台的用户行为完全不同。所幸Zynga首席执行官Mark Pincus意识到了这一点,并且不否认公司在此面临的挑战。

4)据彭博社报道,有消息称诺基亚将于9月5日在诺基亚全球大会上展示首部Windows Phone 8设备(游戏邦注:略早于9月12日苹果发布iPhone 5的时间)。如果这一消息成真,那么可以推测诺基亚很可能是希望赶在iPhone 5面世前获得媒体曝光度。

微软曾在上月宣布Windows Phone设备(包括诺基亚Lumia 900)无法升级到Windows Phone 8系统,但会提供Windows Phone 7.8版本,这一消息已影响该设备在夏季的销量(Lumia手机第二季度出货量为400万部,但尚未公布最近数月的销售情况)。

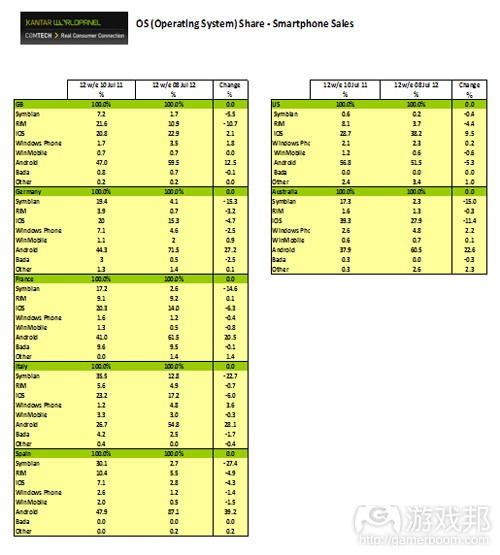

5)Glu Mobile第二季度(截止6月30日)财报显示,公司智能手机业务收益同比去年增长111%,达到1990万美元,超过第一季度时的1740万美元。

iOS和Android游戏收益目前占公司总收益的84%,略高于上一季度的水平。去年同期Glu智能手机业务收益为940万美元,占公司总收益的54%。

该季度公司总收益为2360万美元,营业亏损为520万美元(上季度营业亏损为600万美元)。Glu基于非GAAP的营业收入为602万美元。

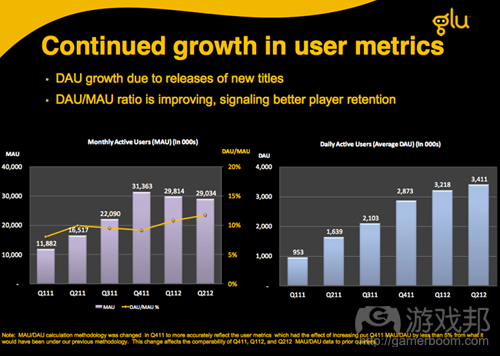

Glu游戏第二季度下载量为4600万次,比第一季度时的5500万次下降16.3%。月活跃用户为2903万,低于第一季度时的2980万。但日活跃用户却增长至340万,同比上季度增长6.25%。

公司旗下女性游戏《Stardom:The A List》转化率和盈利表现最出众,有3.9%的月活跃用户是付费玩家,日活跃用户平均收益(ARPDAU)达13.2美分,日活跃用户为7.4万。

预计第三季度基于非GAAP的智能手机业务收益将降至1750万至1850万美元,整个财年基于非GAAP的智能手机业务收益将介于8190万至8390万美元。

6)Pocketgamer.biz最近发布信息图表显示了亚洲主要国家的手机游戏行业发展情况:

*预计2012年中国手机游戏玩家将达1.92亿,超过PC游戏玩家;

*日本手机游戏巨头2011年销售额达7.95亿美元;

*泰国手机游戏在2011年游戏市场份额仅为3%,但自2006年以来年均增幅达15%,目前市场规模为620万美元;

*在马亚西亚的2.4亿人口中,手机用户占比将近80%;

*亚洲已成为全球最大的手机游戏市场,预计2015年市场规模将达32亿美元,2016年亚洲手机游戏玩家将达9亿。

*预计未来5年中国手机游戏收益将比2011年时的6亿美元增长6倍。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)More Women Than Men Use The Kindle Fire, And iPad Is Getting Highest Satisfaction Score: ComScore

Ingrid Lunden

The tablet market is still relatively young, with penetration in the fast-forward U.S. market only reaching 47% by 2013, but we are already starting to see some usage patterns emerging, according to comScore. In a survey of 6,000 tablet owners in the U.S., the researchers have found the Kindle Fire has more female than male users while iPad skews to males. It also found that Apple’s tablet has the highest satisfaction ratings of all tablets — although across iPad, Android and Kindle Fire tablets, all rate relatively close to each other, and all of them are higher than the average satisfaction ratings for smartphones.

And when assessing what motivates purchases, brands play second-fiddle to functionality and price, with apps availability, along with cost, scoring as the most important factors considered when a consumer purchases a tablet.

ComScore found that Amazon’s tablet has a customer base that is 56.6% female, the highest imbalance among iPad, Android and Amazon devices. The ‘why’ behind this finding is not addressed but it could have something to do with Amazon itself, being first and foremost a reading and shopping site, skews more to women, as we have also seen with its earlier Kindle E-Reader products. It’s also a funny coincidence that Amazon promotes the products with a woman’s hand (pictured).

The iPad attracted a 52.9% male audience, while Android tablets appeared to have the most evenly divided user base. In total, tablets as a general category are equally split between male and female owners. In comparison, smartphones seem to attract a slightly more male than female audience, at 51.9% to 48.1%.

When it comes to age, the 25-34 year-old bracket is the most-common for tablet and smartphone owners, regardless of the make; with the 35-44 segment the second most-popular. This shouldn’t come as too much of a surprise; this age range would hit the sweet spot of having enough disposable income to buy a product that can cost upwards of $199, and being digitally switched on than older users and possibly more sedentary than younger users. Also unsurprisingly, the most common income bracket for both tablet and smartphone owners are those consumers with a household income of over $100,000.

What’s perhaps more surprising is that even the Amazon Kindle, marketed as a price beater with its $199 tag, is largely following the same trend as more expensive tablets. That suggests that either Amazon’s $199 price is still too high for consumers with less money, or that tablets are still largely aimed at a particular kind of user that fits into a specific socioeconomic class — or likely both.

Turning to what gets users to buy tablets, comScore found that on average apps availability and price are just as important as each other to consumers. (That should quiet those who say apps are secondary to the web.) That result varied among different categories — for example the more expensive but app-tastic iPad scored higher for apps than the largely cheaper Android and Kindle Fire tablets. It seems to indicate that if Apple did launch a cheaper device but with most of the same functionality, it could potentially blow all the others out of the water.

Still, today brand name/tablet OS are both a close second. The fact that consumers are so aware of the OS is interesting to me: it seems once more to indicate we are still looking at early adopters here. Interestingly services like music, video and social networking are broken out from apps, and all score lower on their own.

Lastly, in the area of device satisfaction, Apple’s iPad, the most popular tablet in the market today, scored the very highest. But not with as wide a margin as you would assume, given its market share. Apple had an 8.8 on a scale of 1-10, but the Kindle Fire was nearly as good with an 8.7 rating. Interestingly the un-forked Android tablets scored the lowest at 8.2, but that category will contain a very wide range of models. Similarly, the catch-all category of smartphones also showed a comparatively low score of 8.1.(source:techcrunch)

2)Kantar On Smartphones: Samsung 45% Of Euro Sales; Apple Gained Only In UK, US; RIM Holds On In France

Ingrid Lunden

We have seen reports from Strategy Analytics, IDC and Canalys detailing how many smartphones that handset makers shipped in the last quarter (the takeaway: Android is still on top, with Samsung the chief benefactor); today, Kantar Worldpanel ComTech, WPP’s market analytics business, has released its rolling monthly update on how that translates into on-the-ground sales in some of the biggest markets in the world. The results give more weight to Samsung’s current domination; and underscore how important it is for Apple to “wow” the market next month with the launch of a new handset.

Kantar, which bases its conclusions on millions of interviews with consumers every month (1 million in Europe alone, it notes), found that Samsung is currently the top-selling brand in Europe at the moment, thanks in part to a successful launch of the S3 in May, but also aggressive pricing in a region hit by economic pressures. Samsung accounted for 45% of all smartphone sales across the UK, Germany, France, Italy and Spain in the last 12 weeks that ended July 8. Arch-rival Apple, in contrast, accounted for just 16% of all sales in the region, Kantar analyst Dominic Sunnebo tells me. In fact, Apple has declined in every market Kantar surveyed, except for the UK and U.S.

Android’s share of sales across the big-five European countries is now at 66%, a big jump from 43% a year ago, Kantar notes. In Australia, Android took 60.5% of all sales in the period, and in the U.S. it accounted for just over 51% of all sales.

Apple’s lackluster performance in Europe is something that Apple itself highlighted during its last earnings report, blaming the economy and people holding off on purchases until the next iPhone release. Kantar showed that as a result of these factors, Apple took between 4.3% and 11.4% fewer sales in the last 12 weeks than it did a year ago across the markets of Germany, France, Italy, Spain and Australia — with Australia accounting for the biggest of those declines.

Interestingly, despite Android doing so well globally, it actually declined in one key market: the U.S. its 51.5% share of the market is actually 5.3 percentage points down on a year ago.

Was this because the Galaxy S3 launched later there, I asked Sunnebo? No, he says, it’s about consumer preference and price:

“An important point here is that there is very little difference in price between an Apple iPhone or an Android phone in the U.S., so the choice is made purely on what the consumer wants, not what they can afford,” he tells me, “whereas in Europe, Apple continues to command a price premium over Android. With recessionary pressures as they are in Europe this is likely to have an impact.”

Indeed, he notes that the S3 is more of a brand pusher than a direct sales generator: “While the majority of noise is focused on big-name products such as the S3 or S2, it’s easy to forget that Samsung is selling smartphones across all tiers,” he notes in the report. Kantar says that in the UK, for example, Samsung accounts for five of the top 10 best-selling smartphones in the UK, “with even the smartphone/tablet hybrid Samsung Galaxy Note making it into the top ten.”

In the U.S. Apple’s share of sales went up by 9.5 percentage points to account for 38.2% of all sales in the period. The UK was not as strong but also increased: up by 2 percentage points to 22.9% of sales.

Kantar notes that a lot of this appears to be about people holding off from purchases until the next iPhone comes along. “Kantar Worldpanel ComTech data clearly shows that the proportion of Apple consumers who have owned their device for at least 18 months and not upgraded has increased markedly over the last quarter, indicating current owners are holding off upgrading until the release of the iPhone 5,” Sunnebo writes.

Indeed, the Apple brand continues to command “high loyalty”: in the UK 80% of consumers who own an iPhone have bought another; and 92% say they plan to stick with Apple when they next upgrade. “With this in mind, any dip in Apple share is likely to be short-lived with the release of an updated iPhone in quarter three bringing momentum back to the Cupertino giant,” he concludes.

Other brands. The story is not great. While Apple’s declines may be short-lived, RIM’s seem more indicative of a longer-term issue. The only country where it has managed to stave off market share declines is in France, where it only accounted for 9.2% of sales. In the U.S., which used to be RIM’s proud, top market, it only accounted for 3.7% of sales. Ouch. The UK is the only market where RIM managed to go into double digits for sales, with 10.9% of sales in that country, although that is half of what it was last year.

The story for Windows Phone is similar to that of iPhone and iOS, notes Kantar — that is, people appear to be holding off for Windows Phone 8 releases. That’s happening on a much smaller and more depressing scale, though. Windows Phone did not break through even 5% of sales in any market Kantar researched, as you can see in the full tables below. And just as RIM has a (sort of) break out market in the form of the UK, Symbian is still seeing a bit of life in Italy, where it accounted for 12.8% of sales, although that is a decline of more than 22 percentage points on last year.(source:techcrunch)

3)Zynga on its Mobile plans: We are working on it

By Om Malik

This Zynga like many of its big web counterparts is grappling with the shift of consumers to the mobile platforms. Lack of mobile monetization opportunities are only part of the problem for the company that is beholden to Facebook and desktop-web for its growth and revenues.

When I met with Zynga founder Mark Pincus in March 2012, he was candid enough to admit that like many of the big web giants, he was still trying to figure out the mobile quandary, which he determined was a whole new beast. Fast forward to today and despite its splashy $200 million acquisition of Draw Something parent, OMGPOP, Zynga is still struggling to unlock the mobile mystery. Or at least that is the impression I got after reading this story in The Wall Street Journal.

“We’re going to try different things..I’m not saying everything we do is a home run. ”I always tell people if they say, ‘Oh, there’s a Web division, there’s a mobile division.’ I’m like, ‘No. There’s one division’,..”That division is called Zynga.” [David Ko tells the Wall Street Journal.]

The recent actions undertaken by Zynga such as having chief mobile officer David Ko reporting to CEO Pincus are just papering over the big issue: when you are a web native company and web-based metrics define your decisions and business model, it is hard to think of mobile. Mobile is an entirely different user behavior. Good news: Pincus knows that and unlike others, is not in denial about his company’s mobile challenge.(source:gigaom)

4)Nokia’s new Windows Phone 8 devices could be unveiled before iPhone 5 next month

Devindra Hardawar

Nokia is expected to be the first company to show off Windows Phone 8 devices, and now it looks like that could happen as soon as September 5, sources tell Bloomberg.

That’s when Nokia’s annual Nokia World conference begins in Helsinki, Finland, and it’s also a week before the expected iPhone 5 unveiling on September 12.

If the news is true, Nokia is likely trying to preempt the media storm around the next iPhone. But given the general media insanity leading up to a new iPhone announcement, Nokia likely needs more than a week of lead time to truly make consumers excited about its new devices. And given Nokia’s history with the Lumia line, it’s new phones probably wouldn’t be available for several weeks after its unveiling — long after the iPhone 5′s expected September 21st release.

Microsoft announced at its Windows Phone developer summit last month that existing Windows Phone devices won’t be upgraded to Windows Phone 8, including Nokia’s flagship Lumia 900.

Microsoft will instead be offering a “Windows Phone 7.8″ upgrade that will bring many of the visual refinements in WP8 to older devices. Given that the Lumia 900 only hit U.S. stores in April, the decision not to upgrade it could have affected its sales over the summer.

Nokia shipped 4 million Lumia phones in the second quarter, but we don’t yet know how the platform has fared in recent months. Bloomberg points to lack of consumer awareness as one reason for the Lumia’s slow sales in America. Even though AT&T said that it would be promoting the Lumia 900 heavily when it launched, one potential buyer noted that the phone wasn’t on display at one AT&T store, and the sales associate never mentioned the phone as an option.(source:venturebeat)

5) Glu Mobile’s smartphone revenues climb 111% to $19.9 million in Q2

Kathleen De Vere

Glu Mobile reported a better-than-expected second quarter this week. According to the company’s second quarter earnings report, Glu saw an 111 percent increase in its smartphone revenue year-over-year to $19.9 million in the second quarter, up from the $17.4 million the company earned in the first quarter.

Revenue from iOS and Android games now accounts for 84 percent of Glu’s revenues, a slight increase from last quarter, when smartphone revenues accounted for 81 percent of the company’s earnings. By comparison, in Q2 2011 Glu’s smartphone revenues were $9.4 million, and accounted for 54 percent of the company’s total revenue.

Overall, Glu’s total revenue for the quarter ending June 30 was $23.6 million, good enough for an operating loss of $5.2 million, down slightly from last quarter’s operating loss of $6.0 million. Under non-GAAP (generally accepted accounting principals) terms, Glu’s operating income was $602,0000. The company is still predicting a return to profitability under non-GAAP terms in the fourth quarter.

Glu also revealed it had acquired GameSpy for 600,000 shares, a deal worth approximately $2.7 million based on Glu’s current share price of $4.52. Glu is planning to use GameSpy’s technology to provide cross-platform matchmaking, player statistic tracking, leaderboards, asynchronous PVP, text and voice chat, and cloud storage capabilities to its games, with a long-term focus on increasing player lifetime value.

Glu’s catalogue of games drove 46 million downloads during Q2, down a noticeable 16.3 percent from the 55 million installs the company reported in Q1. Glu’s monthly active users also continued to fall in the second quarter, dropping slightly to 29.03 million MAU, from 29.8 million MAU in the first quarter. Although MAU declined for the second quarter in a row, the company’s daily active users increased again, rising 6.25 percent quarter-over-quarter to 3.4 million.

On the financial side, Glu only reported average revenue per daily active user (ARPDAU) for the iOS versions of its titles. In June, the company’s female-focused game Stardom: The A List had the highest conversion and ARPDAU, with 3.9 percent of all MAU becoming paying customers, ARPDAU of 13.2 cent and 74,000 DAU.

Looking forward, Glu is predicting its non-GAAP smartphone revenues will fall somewhere between $17.5 and $18.5 million in the third quarter, the same estimate it gave for Q2. For the full year, the company is estimating total non-GAAP smartphone revenues will be between $81.9 and $83.9 million, up from the company’s previous estimate of $76.4 million to $81.5 million. Glu has also updated its outlook for cash on hand, and is predicting to end the year with $21.5 million, up 19.4 percent from its previous estimate of $18.0 million.(source:insidemobileapps)

6)Infographic: Why you can’t ignore the Asian mobile games market

by Owain Bennallack

We know a lot about the Japanese and Korean mobile gaming markets, and China is in all our thoughts.

But Asia is a much more sophisticated and fragmented market when it comes to games and mobile devices.

So in the first of a ongoing series of neat infographics from PocketGamer.biz, we’ve broken out some of detail from territories that don’t always get the attention of the larger countries – notably Indonesia, Malaysia and Thailand.(source:pocketgamer)

闽公网安备35020302001549号

闽公网安备35020302001549号