每日观察:关注第二季度全球平板电脑出货量(8.3)

1)据pocketgamer报道,热门手机游戏《Temple Run》发布一年下载量已突破1亿次,其中iOS下载量为6800万次,Android下载量为3200万次。

该游戏开发商Imangi工作室指出,自2011年8月以来,玩家访问《Temple Run》超过100亿次。Imangi目前正与Dimensional Branding Group合作推出基于该游戏的周边产品,并与迪士尼Pixar联手推出基于动画电影《Brave》的手机游戏《Temple Run:Brave》。

2)据insidemobileapps报道,跨媒体娱乐管理公司Saban Brands(归属于Saban Capital)日前收购手机游戏开发商The Playforge,计划推出自己的免费增值手机游戏,但目前并未公布具体收购金额。

The Playforge代表作是《僵尸农场》,但其后推出的《Zombie Life》、《Tree World》及《Zombie Farm 2》均未获得堪比《僵尸农场》的成就(游戏邦注:另外《僵尸农场》虽然同DeNA旗下的Mobage平台合作发布Android版本,但这一版本并未获得成功)。

The Playforge仍将继续以自己的品牌推出手机游戏,同时还将协助Saban Brands扩展现有授权、周边产品及媒体项目。

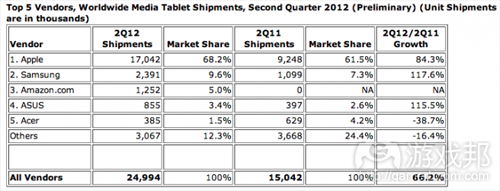

3)IDC日前发布报告显示,亚马逊平板电脑Kindle Fire并未像预期那样成为iPad竞争对手。今年第二季度全球平板电脑出货量为2500万部,其中苹果iPad出货量达1700万部,占比68%(同比去年增长将近7%)。而亚马逊同一时期平板电脑出货量仅125万部,市场份额位居三星之后(三星平板电脑出货量为240万部)。

从总体来看,全球平板电脑同一时期的出货量增长速度超过智能手机,比去年同期增长66%(智能手机增幅为32%)。其中苹果增幅为84%,三星为118%,华硕为116%(游戏邦注:亚马逊于去年第四季度才发售平板电脑,因此尚无增幅参照数据)。

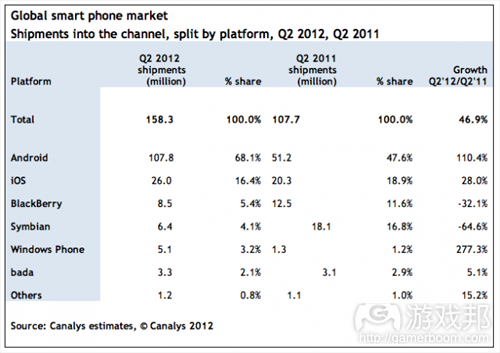

4)Canalys日前发布报告显示,第二季度全球智能手机出货量为1.58亿部,其中Android占比68%,手机出货量为1.08亿部,比去年同期增长110%。苹果在美国等发达市场居主导地位,而Android在中国等新兴市场表现最为强劲。

该时期三星全球手机出货量超过4500万部(Strategy Analytics的这一数据则是5050万),目前占据31%的全球智能手机市场份额(IDC的这一数据则是33.6%)。苹果和诺基亚分列第二和第三席位,HTC位居第四,而RIM该时期出货量仅850万部。

第二季度中国智能手机出货量为4200万部,比去年同期增长199%,比上季度增长32%。而同一时期全球智能手机销量增幅仅47%,也就是说中国市场增幅是世界其他地区的4倍左右。中国市场份额在全球智能手机出货量中占比27%,美国排名第二,占比16%。

Android及其衍生版本在中国智能手机出货量中占比81%,全球最大的智能手机设备制造商在中国所占份额为17%,但中兴、联想和华为等本土制造商发展更为迅速,增幅分别达171%,2665%和252%。中国本土制造商设备出货量为2560万部,同比去年增长518%,所占市场份额达60%。海外制造商在中国出货量为1670万部,市场份额仅增长67%。

同一时期诺基亚在中国市场份额下降47%,摩托罗拉也同样出现下滑。而台湾HTC出货量则增长389%,达到180万部。

5)据mobile-ent报道,虽然苹果尚未正式公开iPhone 5的相关消息,但已有传言称该设备将于9月21日发布,日前又有Twitter消息声称“iPhone售价800美元”。

6)eMarketer最近广告报告预测,2012年美国移动广告投入将达22.9亿美元,有可能超过日本成为全球移动广告投入最多的市场。

预计2012年日本移动广告市场规模将达17.4亿美元,超过2011年时的13.6亿美元,2010年时的10.1亿美元。

报告还指出,尽管移动广告投入增长迅速,但仍仅占全球广告投入的1%。移动广告去年在全球广告投入中所占比例不足1%,仍需经过相当一段时间方有望追赶电视、平面媒体和互联广告等主流广告领域。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)Temple Run blasts past 100 million downloads in a year

by Keith Andrew

The abundance of endless runners aping Temple Run’s style may hint at the impact Imangi’s effort has had on the smartphone market.

News that the game has hit 100 million downloads, however, confirms it.

The US studio has taken to the wire to reveal the game has hit said milestone one year after making its debut, with 68 million downloads made on iOS alone.

Running up the charts

The remaining 32 million, of course, have been amassed on Android, with co-founder Keith Shepherd claiming the performance of the free-to-play release across both platforms has surpassed all expectations.

The 100 million download strong Temple Run

“We never imagined that the game we were making and loved would be so well received around the world,” said Shepherd.

“The last year has been incredible for us, and we are grateful to fans of the game. We hope to be able to provide them with more entertainment from the brand for years to come.”

Franchise favourite

Imangi reports more than 10 billion Temple Run sessions have been played since August 2011, which is equal to a total of 54,000 years worth of play time.

The Temple Run franchise as a whole also continues to grow.

As well as partnering with Dimensional Branding Group to license the IP out for several runs of merchandise, Imangi also worked with Disney Pixar to launch Temple Run: Brave – a franchise tie in with Pixar’s most recent animated film.

Pixar tie-in Temple Run: Brave

Imangi has also moved to celebrate the milestone by making all of its pre-Temple Run titles free to download for a limited, unspecified time. (source:pocketgamer)

2)Transmedia entertainment group Saban Brands acquires Zombie Farm developer The Playforge

Saban Brands, a transmedia entertainment management group run by Saban Capital, has acquired mobile game developer The Playforge to build on its current and future free-to-play mobile titles.

Terms of the acquisition were not disclosed. The Playforge is best known for Zombie Farm, an early iOS hit that distinguished the developer as one of the few bootstrapped outfits to hold a spot in the upper 25 of the iOS top grossing charts. It’s been almost a year since we’ve profiled the developer — and in that time, Playforge has released Zombie Life, Tree World and Zombie Farm 2 without ever really repeating the success of its first game. Zombie Farm also didn’t seem to make as much of a splash on Android, despite signing onto DeNA’s Android-oriented Mobage platform.

According to the press release, The Playforge will continue to release mobile games under its brand while also assisting Saban Brands in expanding its current licensing, merchandising and media opportunities. Saban Brands bought the rights to the Power Rangers franchise from Disney for $43 million and Paul Frank Industries for an undisclosed sum in 2010. In 2012, Saban Brands partnered with CW Television Network to program its Saturday morning cartoon block, now called “Vortexx.”

Each of these brands and verticals provide plenty of opportunities for The Playforge to develop branded mobile games with recognizable character IP. Given the wording of the press release and the scarcity of mobile game IP jumping to merchandising and entertainment opportunities (with Rovio’s Angry Birds being the notable exception), we don’t anticipate a Zombie Farm cartoon on the CW anytime soon.(source:insidemobileapps)

3)IDC: Apple’s iPad Grew Q2 Tablet Share To 68% As It Braces For Windows 8, Amazon And Nexus Competition

Ingrid Lunden

After Amazon launched its $199 Kindle Fire tablet last autumn, a lot of observers thought it could prove to be the competition to Apple’s iPad that other Android tablets had so far failed to deliver. Some numbers out from IDC today, however, show that as Amazon continues to sell the device in the U.S. alone, that has failed to become the case, as Apple continues to increase its worldwide market share against competitors.

Quarterly tablet shipments worldwide (defined by IDC as devices sent through to distribution channels like operators, retailers or end users) totaled 25 million, with Apple, on the back of the new iPad launch in March, blowing everyone out of the water with record-breaking shipments of 17 million+ iPad tablets, working out to a 68% market share (up by nearly 7 percentage points on last year). Ironically, as competition continues to increase, IDC thinks that might only strengthen Apple’s position, with “baffled” consumers faced with “too many options” opting instead for the market leader.

After a “sluggish” Q1, IDC said that Amazon rebounded this quarter with estimated shipments of 1.3 million units, enough to give it a number-three ranking after Samsung’s 2.4 million sales worldwide, and putting it ahead of other companies that also sell globally, Asus and Acer — signs that seem to indicate that if Amazon had rolled out the tablet more widely, it might have made significant headway.

(As a point of comparison, Strategy Analytics, which ranks by platform not vendor, gave Apple essentially the same marketshare last week).

Overall tablet shipments continue to grow at a stronger pace than smartphones at the moment. IDC says that globally tablet shipments were up by 66% on the same quarter in 2011 (smartphone shipments grew by about 32%), and the largest players are outpacing that: Apple saw growth of 84%; Samsung saw growth of 118%; and Asus was up by 116%. Amazon only launched its tablet in Q4 2011 so has no comparative number.

Perhaps because it doesn’t have a strong-enough global competitor, Apple continues to be the consumers’ preferred tablet choice, with the company capitalizing on that by making further inroads into particular segments. “The vast majority of consumers continue to favor the iPad over competitors, and Apple is seeing increasingly strong interest in the device from vertical markets—especially education,” noted Tom Mainelli, IDC’s research director for mobile connected devices, in a statement. But he also points out, as Apple’s Tim Cook did, that iPad shipments in mature markets are slowing down, although growth in emerging markets “is clearly more than making up the difference.”

There are a few curve balls that could come into play in the second half of the year, IDC notes.

For starters, there is the Google/ASUS co-branded Nexus 7 tablet. These only began shipping recently and are now facing production delays, although early reviews have been largely very positive, they saw huge pre-order demand and the price is Amazon-right: $199.

Another is the fact that we may well see a bigger tablet from Amazon, a smaller tablet from Apple, and Windows 8 tablets enter the market. “In addition to major new products from Amazon and quite likely Apple, we can also expect an influx of Microsoft Windows 8 and Windows RT-based tablets starting in late October,” writes Bob O’Donnell, IDC vice president for clients and displays.

Ironically, rather than shaking up the market, he thinks this could actually be to Apple’s advantage: “If anything, there’s a real risk that people will have too many options from which to choose this holiday season. Consumers baffled by the differences between Amazon and Google versions of Android, or Windows 8 and Windows RT, may well default to market leader Apple,” he writes. “Or they may simply choose to remain on the sideline for another cycle.”(source:techcrunch)

4)Canalys Q2: 68% Of All Smartphones Shipped Were Android; China’s The Biggest Market By A Wide Margin

Ingrid Lunden

One more analyst house, Canalys, has released its numbers on global smartphone sales in Q2, and unlike Strategy Analytics and IDC, it has focused on sales by platforms rather than OEMs. In that light, Google’s Android was the clear, all-out winner: in a market that saw 158 million smartphone shipments worldwide, Android accounted for 68% of them, with its 108 million units an increase of 110% over the same period a year ago. And given that Apple seems to actually be holding its own quite well in countries like the U.S., the strong performance of Android can be largely attributed to how well it’s playing in emerging countries, and in one in particular: the world’s largest smartphone market at the moment, China.

China had “phenomenal” growth this year, Canalys says, and that’s no understatemet. Some 42 million smartphones were shipped in China in Q2, which works out to growth of 199% over last year (and 32% over Q1). By comparison, smartphone sales worldwide grew by only 47%, says Canalys. In other words, China grew at a rate more than four times that of the rest of the world.

China, it says, accounted for 27% of the world’s smartphone shipments, with number-two U.S. at 16%.

Android and forked versions of Android are leading the charge in China, accounting for 81% of all smartphone shipments. The other big trend is that domestic vendors are closing in on Samsung, the world’s biggest Android vendor at the moment. Samsung continued to remain in the lead with 17% of all shipments, but Canalys notes that in fact Samsung’s volumes were flat and ZTE, Lenovo and Huawei in strong 2nd, 3rd and 4th positions and making up about a third of all smartphone shipments. Those three also grew by a massive amount, respectively 171%, 2,665% and 252% over last year. Altogether, domestic vendors, Canalys says, shipping 25.6 million units, grew 518% over last year and made up 60% of the market. International vendors grew only by 67%, shipping 16.7 million units.

Apple, as the company itself admitted last week, had a more challenging Q2 in China. Yes, it was the fifth-largest handset player, with shipments up by 102% over last year, but they were down 37% compared to Q1.

Canalys puts the power of domestic vendors down to their “deep understanding of local consumer behaviour.” Nicole Peng, research director for China, notes that bigger players like ZTE, Lenovo and Huawei are all raising brand awareness and building stronger relationships with operators, but the smaller players are also not to be dismissed. “Tier-two vendors — the likes of Oppo, K-Touch and Gionee — have also stamped their mark, boosting smart phone shipments into tier-three and tier-four cities, predominantly through the open channels,” she writes. “As feature phone vendors, they already have established partnerships and strong brand awareness. These domestic vendors are making significant progress transitioning their portfolios and customer bases to be more focused on smart phones.”

The drive away from international brands is affecting others, too, although these are vendors that have seen declines worldwide as well, so the trend may be larger than China itself.

Canalys notes that Nokia’s volumes in China were down by 47% in Q2, and Motorola also saw a decline. The only one that really did well was the Taiwanese HTC, which has been pushing models designed to be integrated tightly with local Chinese services (and price points). HTC’s shipments gew 389% to 1.8 million units.

Globally, Samsung continued to be the main driver of Android’s strength. Canalys estimates that Samsung shipped “over 45 million handsets” — not too far off Strategy Analytics’ estimate of 50.5 million. (Samsung, unhelpfully, doesn’t provide these numbers itself.) Whichever number you choose to believe, it puts Samsung at the top of the pile, and for the same reasons: a strong product portfolio covering different price points, and a savvy marketing strategy, including a key Olympics sponsorship. Canalys says that Samsung worldwide currently has a 31% share of the global smartphone market (SA by comparison put it at 34.6%; IDC at 33.6%).

Apple and Nokia followed as the second and third-largest smartphone makers, with HTC taking fourth and RIM barely scraping in at 8.5 million units in Q2.(source:techcrunch)

5)iPhone 5 to cost $800?

by Zen Terrelonge

Hashtag trends on Twitter with an extravagant price tag.

The iPhone 5 still hasn’t been announced by Apple, but chatter continues to heat up ahead of its expected September 12th launch.

Now it’s materialised in two Twitter trends: ‘#800dollarsforaniPhone’ and ‘iPhone 5 $800′.

There’s little substance to the hashtags, but naturally users of the mini-blog have voiced their outrage, with some expecting the eye-watering price to ensure the phone is waterproof, fireproof, crackproof, dirtproof, bulletproof, while transforming into a lifesaving autobot on demand.(source:mobile-ent)

6)Global mobile ad spending in 2012? $6.43 billion

by Tim Green

US to become top market after 96 per cent growth in a year.

eMarketer’s mobile ad study says spending in the US will hit $2.29 billion in 2012, and thus move the region ahead of Japan as the world’s top spender.

The Japanese market will be worth $1.74 billion in 2012, compared with $1.36 billion in 2011 and $1.01 billion in 2010.

However, Asia Pacific as a whole is still an exceptionally strong mobile advertising market, and remains well ahead of Europe in mobile spending.

It will reach $2.56 billion in 2012, against $1.4 billion for Europe

Other key findings from the report include:

* Mobile, despite rapid growth, accounts for just one per cent of total ad spending worldwide

* UK mobile advertising is worth 2.3 per cent of total ad spending, but this could rise to 11 per cent by 2016

“Mobile is an exciting, fast-growing category, but it’s still a very small piece of the overall ad pie,” a spokesperson for eMarketer said.

“Mobile advertising accounted for less than one per cent of total ad spending worldwide last year—and it will be a long time before it challenges other mainstay global advertising channels like TV, print and internet ads.”(source:mobile-ent)

闽公网安备35020302001549号

闽公网安备35020302001549号