阐述社交游戏的数据驱动分析法和商业模式

2011年末,旧金山社交游戏巨头Zynga的IPO情况表明,这片新游戏领域存在多种不同的观点。

去年,社交游戏迅猛发展。市场上的游戏数量超过了所有人的预期,从简单的字词和解谜题材游戏到大型多人冒险游戏,各种类型层出不穷。

这种扩张带来了大量的玩家,使盈利获得大幅成长,盈利来源包括订阅、虚拟商品销售和广告。

该行业在2011年末达到巅峰,Zynga在首次公开募股时公司估值逾100亿美元。对于一家创立不足5年的公司,这算是不错的成绩。

但是,尽管该领域取得如此大的成功,仍然有人对社交游戏的未来和游戏本身的长期价值表示怀疑。

游戏行业现有的许多开发商和发行商对社交游戏的许多层面都表示怀疑。

社交游戏免费的事实被视为难以为继,而且会破坏游戏本身的价值。有些人认为,如果没有为游戏付费的需求,玩家就不会认同游戏的价值。

社交游戏对各种社交平台(游戏邦注:如Facebook)的依赖使它们的将来与平台是否成功息息相关。如果社交网络遇到问题(游戏邦注:比如涉及到隐私问题),开始失去大量用户或使得对游戏的支持发生重大改变,那么使用该网络的游戏也会同样遇到困境。

对于社交游戏是否真正算是游戏,行业争论不休。从业人士认为,社交游戏缺乏任何艺术水准。它们只是单纯的营销工具,使用心理学技巧来保持玩家不断回到游戏中,从而吸引他们付费。简单地说,它们的创意、趣味性和设计方法与主机、PC甚至手机游戏都不同,其设计和驱动完全依靠数字。

这些说法是否恰当呢?从某个方面来说,确实如此。但是,部分问题被扩大化到最严重的程度,可能是因为社交游戏给整个游戏行业带来的重大改变和不同之处。

社交游戏市场是个全新的市场。5年之前,它还并不存在。它现在能够取得如此大的成功,得益于Facebook开放其应用程序编程接口(游戏邦注:也就是“API”),使全世界的开发者都能够在这个迅速成长的社交网络上制作自己的东西。

在任何可为面向用户软件提供支持的新设备、技术或平台上,游戏都能够迅速成为最流行的内容。从iPhone和苹果App Store到数字化互动电视再到社交网络,游戏均能够满足用户简单和低成本的娱乐需求。

但是,这些新形式游戏的市场与现有主机和PC市场有很大的不同。在新兴社交、休闲和手机游戏市场中,最成功的游戏都是免费的,至少最开始是免费的。寻找较小较简单游戏形式的用户肯定不会愿意为他们还不确定是否好玩的游戏支付30英镑或40美元。虽然某些市场上出现了很低的价格(游戏邦注:比如0.99美元),但最成功的游戏往往是那些允许用户免费下载和体验的产品。

这种商业模型需要采用完全不同的游戏制作和营销方法。在“传统”游戏市场中,一旦玩家购买游戏,他们是否从中体验到乐趣或完成游戏都与盈利无关(游戏邦注:除非开发商计划发布续作)。但是,免费模式必须鼓励玩家回到游戏中并持续玩游戏,这样才能解锁和出售游戏中的新内容、新虚拟商品和新能力。

许多公司利用这种模型取得了卓越的成效。新关卡、新道具、角色自定义和稀有或独有道具可以出售给喜欢游戏的玩家,至少能够产生与传统做法无异的盈利。有些公司靠预先付费和游戏内置购买的接合找到了成功之道。有些公司不通过游戏本身来盈利,但是在游戏中添加广告链接。

所有这些模型仍处在发展初期,但是有迹象表明通过分析玩家体验游戏的时间和方法,能够促进他们购买新内容的欲望。

但是,这种付费方式在游戏行业中引起广泛的争议,争议点在于社交游戏公司从玩家身上收集到的数据。在PC和主机市场中,玩家与开发商或发行商的联系和互动极为有限。然而,社交游戏是在服务器上运行,所以玩家可以保持同游戏运营公司的联系。

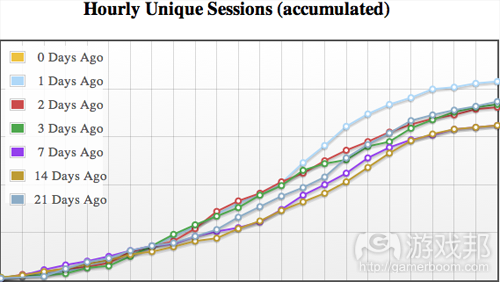

这使社交游戏公司能够获得大量有关玩家在游戏中表现的信息,包括每次鼠标点击、游戏中的进展和道具的使用。

许多社交游戏公司使用这些数据来润色和深化自己的游戏,让它们变得更具吸引力和成瘾性。这使得他们可以在变化中寻找盈利机会,保持用户参与其中,确保他们的玩家不会流失。

这种专注点引发了游戏行业的批判,有些人认为社交市场并非由设计驱动,而是由数据分析和营销驱动。许多开发者将此视为消极的事情,他们认为社交游戏缺乏其他游戏形式的创造性和“艺术性”。

严格地说,这些论断并不公平。依靠更为“休闲”玩家的游戏必须易于接入,能够很容易地上手和理解。游戏需要让玩家多次回到游戏中,这样才能使游戏内置购买发挥盈利作用。这样的游戏就必须具有吸引力和成瘾性,尽管有时候游戏的设计并不有趣。

有关玩家何时以及如何参与到游戏中的数据让社交开发者有机会真正专注于用游戏来吸引玩家,保持他们玩游戏的行为,并且鼓励他们在微交易中付费。反之,这种理解为社交游戏公司提供了某些规则和机制,可以被运用到新的游戏中,构建能够提升用户参与度的体验,并提供更多的盈利机遇。

对于同样能够获得数据的主机和PC游戏公司,也可以在开发和设计中运用类似的方法。主机游戏的制作成本日益提升,多大数千万乃至数亿美元。这些游戏背后的发行商并不是想用这笔钱来赌博。他们也正专注于有效的设计方法、流行的方法以及能够让玩家付费的方法,如同社交游戏公司的做法一样。

这是否意味着数据分析能够替代游戏设计中的人类元素和创意呢?答案显然是否定的。数据分析的作用有限。因为社交游戏市场依然年轻,所以还没有长期使用或用户响应方面的数据。数据分析也无法让开发者找到市场中还未出现的做法。虽然许多流行社交游戏吸引了数百万的玩家,但许多人只不过是尝试下游戏。要通过何种方法来处理未来的这些潜在玩家呢?

数据分析是个很有用的工具。它能够帮助开发者找到游戏中的问题,从而对游戏进行精制和润色,但它不一定对开发者创造前所未有的令人兴奋、创新和独特的新颖体验有所帮助。

对于社交游戏公司不断探索的新商业模型,依然没有足够的长期数据。但是,有许多迹象表明,虚拟商品和游戏内置购买的确能够为全世界的用户所接受。

苹果和Android手机市场上有各种通过应用内置付费、订阅、广告和虚拟商品来盈利的应用,不仅仅是游戏可以采用这种商业模型。如果平台值得信赖、盈利模式方便而且内容有一定的价值,那么用户似乎愿意为其付费。在线电影、音乐和出版物的“租赁”模式也渐渐出现。至于确保内容能够让用户愿意付费,这是制作者该考虑的事情。

Moshi Monsters和Club Penguin等现有在线虚拟社区也展示了有效的新盈利模型,针对的是年龄较小的用户。

简单地说,在线、手机、社交和休闲市场中的许多公司都在探索传统零售模型之外的新商业模型。这对品牌持有者、媒体公司和知识产权持有者来说是好消息,因为他们可以尝试更具互动性的方法与消费者互动,找到新的盈利流和机遇。

最后,社交游戏对单一平台的依赖确实是业界关注的焦点。虽然社交网络仍是个新产品,但已经有明显的迹象表明,所有的网络都可能转瞬即逝,盛极一时的Bebo和MySpace等社区便是例证。但是,Facebook在许多方面重新改写了社交空间的规则。开放的API和大量的用户表明,这个网络将继续发展下去。

但是,这并没有让它成为唯一的平台。用户逐渐选择其他访问互联网的方式。有些人是Twitter粉丝,从未碰过Facebook。有些人转向Google+。在世界上的许多国家中,Facebook并非最大的社交网络。

在世界各地的社交网络、新渠道、社区和网络上,每天都会涌现大量的机遇。尽管Facebook或许目前是社交游戏方面的领头羊,但开发者、媒体公司和品牌持有者需要深思熟虑,确保自己的产品能够接触到最多的潜在用户。

这种新型“主流”游戏市场的底线是,用户就是上帝。你需要活跃于他们正在使用的渠道。你需要制作他们想要玩的游戏。你需要找到他们信任且使用简单舒适的盈利模式。

用户逐渐成为技术不可知论者。他们希望自己最喜欢的内容能够出现在自己拥有的所有设备上,不同设备之间的障碍尽快消失,这使Facebook用户得与同iPhone用户、Android用户、Google+用户甚至新一代的互联网电视用户共同在游戏中参与竞争。

撇开泡沫之类的论调,社交游戏市场的崛起揭露未来的互动娱乐将更加开放、富有挑战性且令人兴奋。

无论使用何种平台、设计方法论、商业模式和营销渠道,未来游戏将会有更好的发展。或许,还会有趣味性存在的空间!

游戏邦注:本文发稿于2012年1月31日,所涉时间、事件和数据均以此为准。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

Data Driven Analytics – What Social Games Do

The IPO of San Francisco social games giant Zynga at the end of 2011 highlighted just how polarised opinion is when it comes to this new area of gaming.

The social games scene exploded in last year. The number of games on the market increased beyond all expectations, as did the variety of games – from simple word and puzzle titles, through to massively multiplayer adventures.

This expansion drew in huge numbers of players and led to massive growth in revenues, from subscriptions, the sale of virtual goods and advertising.

It culminated in late 2011, with Zynga’s initial public offering which valued the company at over one billion dollars. Not too bad for a company which is not yet five years old.

Despite all of the success however, there remains a lot of cynicism over the future of the social games sector and the long-term value of the games themselves.

Many developers and publishers working within the existing games industry have expressed doubt over many aspects of social gaming.

The fact social games are free-to-play is seen as unsustainable and damaging the value of the game itself. If a player does not have to pay for a game, the argument states, then they simply don’t value it.

The reliance of social games on the various social platforms (such as Facebook) ties their future into the ongoing success of that platform. If the network runs into problems (over issues such as privacy), starts to lose large numbers of users, or makes major changes to its support for games, then titles using that network can run into problems.

Then there are the actual games. Perhaps not surprisingly for a creative industry, this is one of the most fiercely held contentions regarding the social market. Social games, it is claimed, lack any sort of artistic merit. They are cynical marketing tools, which use psychological tricks to keep players coming back for more, in order to get them paying. In short they’re not creative, fun or ‘designed’ in the same way as console, pc or even mobile games, but designed and driven entirely by numbers.

Are any of these claims valid, or even fair? In part, yes. However, some of these issues are being viewed in the worst possible light, possibly thanks to the sweeping changes and huge differences social gaming has introduced into the wider games industry.

The social gaming market is something entirely new. Less than five years ago, it did not exist. The fact it does now is down to Facebook opening it’s Application Programme Interface (API), which allowed developers worldwide to go and create their own content for the rapidly growing social network.

On any new device, technology or platform which supports consumer facing software, games have very quickly become the most popular type of content. From the iPhone and Apple App Store, to digital interactive television to social networks, gaming it seems that users are discovering the joys of simple, short and low cost ways to play.

However, the market for these new forms of gaming operate very differently from the existing console and PC sectors. The most successful games in new social, casual and mobile markets are free. At least initially. Users who are looking for smaller, simpler forms of gaming are certainly not going to pay £30/$40 up front for a game they don’t know they’ll enjoy. While much lower price points ($0.99) have appeared on some markets, the most successful games are those which allow users to download and play them for free.

This business model requires an entirely different approach to creating and marketing a game. In the ‘traditional’ games market, once the player has bought the game, whether they enjoy it or finish it is almost irrelevant (until you come to release the sequel). The free-to-play (F2P) model, has to encourage players to return, to play the game again and again, so that new content, new virtual goods and new abilities can be unlocked or ‘sold’ from within the game itself.

Many companies are pushing ahead with this model to great effect. New levels, new items, character customisation and rare/exclusive items can be sold to enthusiastic players and generate as much, if not more than simple up-front game sales. Other companies have found success with an up-front payment and then in-game purchases. Others still have made their entire game free-to-play but have included advertising links within the game.

All of these models are still in their early days, but indications so far are that with care and attention to when and how players are approached, they are willing to buy new content on an ongoing basis.

These points of payment however, have become contentious within the wider games industry, thanks to the data which social games companies can gather from players. Unlike the PC and console market, where a player’s contact and interaction with the developer/publisher is limited, social games run and interact on a server, so the player is in almost constant contact with the company behind the game.

This gives the social games company far, far more information on how their players act within the game – down to individual mouse clicks, progress through the game and items used.

Many social games companies are using this data to refine and hone their titles, to make them more appealing, more compelling and dare we say – addictive. This allows them to look for revenue on an ongoing basis, keep users engaged and make sure their players are still their players in the months to come.

This focus has lead to some criticism from the wider games industry that the social market, rather than being creative or driven by design, is actually being driven by data analysis and marketing. Many developers are looking upon this as a negative thing, taking away much of the creativity and ‘art’ of other forms of gaming.

None of which is strictly fair. A game which relies upon more ‘casual’ players has to be accessible, simple to pick up and easily understood. A game which relies upon players returning many times, so that in-game purchases can be made, has to be compelling and addictive – though oddly enough it does NOT have to be fun.

The data on when and how players take part in games, gives social developers the opportunity to really focus on getting players into the game, keeping them playing and encouraging paid transactions. In turn, this understanding gives social games companies certain rules and mechanisms which can be used in new games and built into experiences which should keep players even more engaged and offer more opportunities for revenue.

There is a case to be made that the console and PC games companies, given access to the same data, would be adopting broadly similar approaches to development and design. Major console games cost tens of millions and increasingly, hundreds of millions of dollars to create. The publishers behind those games are not gambling with those sums of money. They’re focusing just as much on what worked, what was popular and what players will pay for as the companies working on social games.

Does this mean that data analysis can replace the human element and creativity in game design? Clearly not. Data analysis can only take you so far. Since the social games market is still so young, there’s simply no data on long-term use or user response. Nor can data analysis reveal what isn’t yet on the market. While many of the leading social games have pulled in millions of players, many more have yet to give games a try. What is it going to take to address these potential gamers of the future?

Data analysis is a useful tool. It can help make identify problems in games and allows developers to refine and polish their titles, but it won’t necessarily help create exciting, innovative and unique new experiences which don’t yet exist

As for the new business models being explored by social games companies, again there’s no real long-term data. However, there are other platforms and indications that virtual good and in-app purchases are being accepted by users worldwide as interesting and valuable.

The mobile markets from Apple and Android feature a variety of apps, not just games, which feature in-app purchases, subscriptions, advertising funded titles and virtual goods. If the platform is trusted, the revenue model convenient and the content perceived as having value, then consumers seem willing to pay for it. Even ‘rental’ models for online movies, music and publications are beginning to make an appearance. Its up to the creators to ensure that their content is seen to have that value.

Online, existing virtual communities such as Moshi Monsters and Club Penguin have also shown that new revenue models can work – even for audiences of a much younger age.

In short, it seems that the opportunities to move away from the traditional retail model is being explored – successfully – by a large number of companies across the online, mobile, social and casual markets. Which has to be good news for the brand owners, media companies and intellectual properties now looking seriously at these new areas of entertainment for new revenue streams and opportunities to interact with consumers in a new and more interactive ways.

Finally, the concern about relying on a single platform – such as Facebook – is a valid one. While social networks are still a new phenomenon, there is already substantial evidence that all networks are transient. Previously booming communities such as Bebo and MySpace have shrunk to a shadow of their former selves. Yet, Facebook has in many ways rewritten the rules for social spaces. The open API and critical mass of users suggests this network will be around for a significant time to come.

Which does not, however, make it the only platform in town. Users are increasingly choosing their own entry point to the Internet. Some people are Twitter fans and never touch, Facebook. Others have migrated to Google+. In many countries around the world, Facebook is not the leading social network by a large margin.

There are opportunities outwith the world’s biggest social network and new channels, communities, networks and routes to market are appearing on an almost daily basis. So while Facebook may currently by the ’800lb gorilla’ in social gaming, developers, media companies and brand owners need to take a step back and ensure they’re addressing the broadest possible audience.

The bottom line in this new ‘mainstream’ gaming market is that the consumer is king. You need to be active in the channels they’re using. You need to be creating games they want to play. You need to find revenue models that they trust and are comfortable using.

Consumers are increasingly technology agnostic. They want their favourite content on all of their devices and the artificial barriers created by different devices will start to disappear even more quickly, allowing Facebook users to compete against iPhone owners, Android users, Google+ members and even the new generation of Internet connected televisions.

Far from being a bubble, a fad or a niche, the rise of the social games market is revealing a future for interactive entertainment which is more open, challenging and exciting than it’s ever been before.

Regardless of the platforms, the design methodology, the business models and the routes to market, the future promises to be all about games. Who knows, there may even be room for fun! (Source: Scottish Games)

闽公网安备35020302001549号

闽公网安备35020302001549号