每日观察:关注Facebook IPO对Zynga股票的影响(5.19)

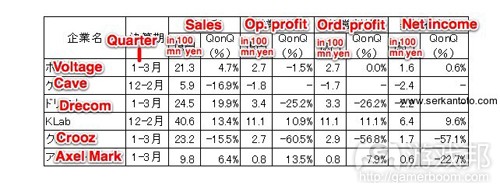

1)日本社交游戏行业博客Social Game Info发布了日本6家上市社交游戏开发商最近财季报告数据,这6家公司分别是(如下图):

*Voltage(主攻社交约会模拟游戏),最近财季销售额为21.3亿日元,同比上一季度增长4.7%;

*Cave(GREE持有该公司股票,在非社交游戏领域也颇具名气),该时期销售额为5.9亿日元,同比上一季度下降16.9%;

*Drecom(最近在美国很活跃),该时期销售额为24.5亿日元,同比上一季度增长19.9%;

*KLab(最近刚进入东京证券交易所股市第一部),该时期销售额为40.6亿日元,同比增长13.4%;

*Crooz(最近鲜有优质作品问世),该时期销售额为23.2亿日元,同比下降15.5%;

*Axel Mark(并不完全锁定社交游戏市场),该时期销售额为9.8亿日元,同比增长6.4%。

2)据Serkantoto报道,日本消费者事务厅(CAA)日前正式宣布,日本社交游戏采用Kompu gacha机制属于非法行为,违反了《反不正当奖励及误导性陈述法案》(Act against Unjustifiable Premiums and Misleading Representations)等日本相关法案。

观察者指出,此举意味着kompu gacha或其他任何类似赌博的社交游戏机制已在日本走向末路。报道称消费者事务厅将于7月1日颁布具体指导方针,而日本6家主流社交游戏公司已经决定在5月31日前移除kompu gacha机制(包括第三方游戏产品)。

3)据pocketgamer报道,日本社交游戏巨头股票在过去12个月中下跌15%,而DeNA则下跌30%,原因是这些公司游戏所采用的kompu gacha机制最近遭遇取缔风波(游戏邦注:据insidemobileapps报道,日本消费者事务厅日前正式宣布取缔这一机制当天,GREE股票收盘时跌至17.2美元,降幅为5.93%;DeNA股票跌至24.51美元,降幅为2.46%)。

不同的是,DeNA在最近6个月的股价一直不甚至理想,而GREE在kompu gacha风波之前的股票还曾比12个月前上涨了35%左右。

4)据gamasutra报道,尽管Facebook在本周五顺利进行IPO,但Zynga当天股票却跌至历史最低点,收盘时每股售价仅7.12美元,降幅约14%。

当天因为Facebook股票需求量极大(截止当天下午1:40,Facebook已售出3.2亿股票),纳斯达克电子交易系统一度出现故障,直到下午2:01才恢复正常,但这并非Zynga股票下跌的真正原因——据分析师所称,有一部分投资者抛售了Zynga股票而转向购买Facebook股票。

虽然Facebook上市首天最初情况并没有预期中那样乐观,但承销商积极买入Facebook股票,保住了38美元的IPO股价(游戏邦注:当天收盘时Facebook股价为38.27美元,Pivotal Research对Facebook股票评级是“售出”)。

当天其他社交网站股市行情也受到影响,LinkedIn股票下滑6%,Group股票下降7%,Yelp流失3个百分点(但之前一天降幅为7%),中国人人网股票下跌21%。

5)据insidesocialgames报道,EA日前宣布将在6月18日关闭Facebook、App Store和Android Market平台的《龙腾世纪传奇》,并鼓励玩家转向《Age of Champions》这款游戏。

目前玩家已无法在《龙腾世纪传奇》中购买虚拟货币,该游戏中的商店也推出了大规模的促销活动,以便玩家消费手中剩余虚拟货币。该游戏正式关闭时,EA将推出可下载版本供玩家体验单人游戏。

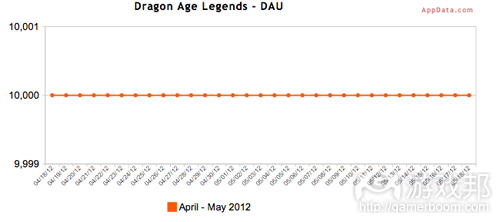

《龙腾世纪传奇》由EA2D开发,它是BioWare游戏《龙腾世纪2》的衍生产品,于2011年3月发布,在3月份最高峰时的DAU为13.2万,但10月份时DAU降至2万,今年3月份仅剩1万左右的DAU。

如果从DAU来看,EA目前在Facebook游戏开发商榜单只能位居第四,已经被King.com和Wooga所超越。今年4月份EA还关闭了《Restaurant City》这款社交游戏,观察者称EA很可能缩减社交游戏开发项目,转向发行第三方游戏。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)Overview: How Are Japan’s 6 Listed Third-Party Social Game Developers Doing Financially? [Social Games]

by Dr. Serkan Toto

Japanese social gaming industry blog “Social Game Info” posted an interesting chart today. The overview sheds a light on the financial performance of Japan’s six listed third-party

social game developers on a quarter-on-quarter basis.

The companies are:

•Voltage (focuses on social dating simulations)

•Cave (GREE holds a stake in this company, which is known for plenty of non-social games, too)

•Drecom (has become active in the US as of late)

•KLab (just made the jump to the first section of the Tokyo Stock Exchange)

•Crooz (failed to roll out good titles lately, which shows)

•Axel Mark (doesn’t fully focus on social games)

Another social gaming-focused company, Nagoya-based Ateam, went IPO in Japan last month.

All these companies published their quarterly financial results in the last few days (see here for GREE’s numbers, and see here for those of DeNA).(source:serkantoto)

2)It’s Official: Government Regulates Japan’s Social Gaming Industry Over Kompu Gacha [Social Games]

by Dr. Serkan Toto

The “kompu gacha” (complete gacha) shock has come to a temporary “official” close today: Japan’s National Consumer Affairs Agency declared [PDF] that the mechanic found in many social games on GREE and DeNA‘s Mobage platform is illegal.

I am not a legal expert (and the written statement the agency issued today doesn’t have an English translation), but apparently “kompu gacha” violates the ”Act against Unjustifiable Premiums and Misleading Representations” and the “Law for Preventing Unjustifiable Extra or Unexpected Benefit and Misleading Representation” in Japan.

With this document, the agency confirms reports about an impending regulation that appeared in Japanese media two weeks ago – a move that some people in the industry (myself included) predicted well before that.

For reference, I summed up the “kompu gacha” shock in chronological form here.

The agency’s document describes the government’s understanding of “kompu gacha” and the reasoning behind the decision to call the mechanic illegal.

Simply put, the agency is opposing concepts used by social game makers under which players must pay to win a string of “mini lotteries/draws” in order to get a prize after the set is complete.

In other words, “kompu gacha” or any other type of (paid) bingo-like mechanics in social games in Japan are dead.

Good news for the industry: the government keeps their hands off the general gacha mechanic, at least for now – it would be a total catastrophe for earnings in just about every social gaming company in Japan if regulation hit gacha, too.

The agency says the guidelines will come into force on July 1. However, Japan’s six main social gaming companies already decided to get rid of the “kompu gacha” mechanic in all titles by the end of May 31 (this includes third-party titles).

My personal view is that this isn’t over and that the big platform providers GREE and DeNA in particular will initiate more moves, including measures to get the real-money trading problem under control – before the government steps in again.(source:serkantoto)

3)As Facebook floats, GREE and DeNA still down more than 20% following complete gacha ban

by Jon Jordan

Japanese social mobile platforms GREE and DeNA are among the most profitable large games companies in the world.

During the first three months of 2012, GREE posted around $560 million in sales and DeNA around $530 million.

Respective operating profit margins were 29 percent and 44 percent, plus GREE has $625 million in cash and DeNA $720 million.

Bump in the road

Things aren’t so rosy when it comes to their recent performance on the Japanese stock exchange, however.

GREE (TYO:3632) is down 15 percent, while DeNA (TYO:2432) is down 30 percent over the past 12 months.

One reason is that over the past two weeks, the companies (and others) have come under pressure from Japanese regulators over their virtual goods activity, in terms of selling to minors, and the peculiar Japanese pseudo-gambling process of ‘complete gacha’.

Stop, start

To be fair to the companies, both issues are now fully resolved with the imposing fixed limits on IAP for those under 18, and the entire industry stopping ‘complete gacha’ activity. It’s since been banned by the Japanese Consumer Agency.

Yet, combined with other macro economic concerns, neither companies’ stock price has recovered.

DeNA’s share price had been under pressure for six months, but prior to the current setbacks GREE’s shares had been up around 35 percent compared to 12 months ago.

It’s certainly a warning to enthusiastic investors currently piling into Facebook’s IPO, in terms of the impact of government scrutiny and the downsides of being a company that’s always in the public eye. (source:pocketgamer)

4)Facebook’s anemic IPO takes heavy toll on Zynga

by Chris Morris

Through sheer force of will, Facebook managed to avoid closing at below its IPO price during its first day of trading on Wall Street. Unfortunately, that didn’t help its allies.

Zynga saw its stock lose roughly 14 percent of its value Friday – after briefly dropping to an all time low. Shares of the company closed at $7.12 following what can only be called an insane day of trading.

The problems started early. Zynga shares began their steep decline in the moments before Facebook began trading, prompting a trading halt at 11:37am – a standard NASDAQ procedure for any stock that moves 10 percent or more in a five minute period. That “time out” move typically lasts no more than five minutes (to give investors time to gather their wits). Zynga shares were halted for over 50 minutes over the course of the two curbs, though.

Put in gaming terms: Nasdaq had an Error 37.

The slide, which cost founder Mark Pincus nearly $130 million (on paper), was tied to a pair of factors – technical snafus at Nasdaq and investors showing disappointment with Facebook’s performance.

On the technical side, Nasdaq was overwhelmed by volume early Friday, due to demand for Facebook shares. (By 1:40pm, more than 320 million shares of the company had been sold.) That seems to have tripped up the electronic trading system. Nasdaq didn’t get things resolved until 2:01pm.

Shares rebounded somewhat once Zynga resumed trading, but they couldn’t hold that recovery. That’s where Facebook is to blame.

Some of the decline came from people who dumped Zynga shares to grab a piece of the year’s big IPO.

“I don’t think there’s anything fundamental about Zynga that has changed this morning,” says Colin Sebastian of Robert W. Baird. “I think there are some investors that sold some of their Zynga shares just to buy Facebook.”

But Facebook had a weak showing on the stock market on its first day. While shares of the company started relatively strong, they didn’t hit the peaks many investors were expecting and fell quickly.

Underwriters aggressively bought shares at the end of the day to ‘defend’ the $38 IPO price, buying actively to ensure the stock didn’t fall below its offering price on its first day, according to CNBC. (They succeeded. Facebook closed at $38.27.)

Zynga has long been considered a Facebook “tracking” stock. Investors who wanted to own a piece of the social media giant saw the chance to use Zynga in remora-like fashion and invested.

And as Facebook failed to live up to expectations, they dumped them.

Other social media sites that served the same purpose to those investors are also taking a hit Friday – Shares of LinkedIn were down 6 percent. Groupon was off 7 percent and Yelp fell 3 percent – a comeback from the 7 percent drop it saw earlier in the day. China-based social networking firm Renren Inc, also saw shares fall by 21 percent.

Investors in those companies were expecting to see a spike as Facebook shares went through the ceiling. But they didn’t count on a few things. For one, Facebook added another 84 million shares to its offering at the last minute – and the company also increased its offering price.

Together, it took some air out of the balloon. And when Nasdaq couldn’t keep up with orders early on (and, let’s be fair, 82 million shares of a single stock being traded in the first 30 seconds is pretty overwhelming), traders backed off, which further hit the stock.

Things might get worse before they get better, too. Friday’s fumble could make for a rocky Monday for the stock. And Pivotal Research has already given Facebook shares a “sell” rating.

Meanwhile, other Wall Street firms will be giving the now public stock a second look in the weeks to come.

If more analysts pile on with poor ratings – and if the company’s stock price continues to waver – Zynga could find itself continuing to play the role of whipping boy for its most important partner. (source:gamasutra)

5)EA shutting down Dragon Age Legends

Mike Thompson

Dragon Age Legends will be taken offline from Facebook, the App Store and Android Market on June 18, according to a post on the game’s official website. Players are being encouraged to move over to Age of Champions with a bonus pack that provides exclusive in-game content.

Starting today, Dragon Age Legends players will no longer be able to purchase crowns, the game’s hard currency. The game’s store will also have a “massive fire sale” for players who still have crowns left over, since crowns won’t transfer over to future BioWare Social titles. Anyone who played Dragon Age Legends in the past three months will receive an Age of Champions bonus pack that contains a Legends-inspired weapon, a Viscount Ravi army unit, extra in-game currency and an exclusive medal for players’ profile pages. Finally, a downloadable version of Dragon Age Legends will be made available when the game shuts down, allowing users to play a solo campaign.

Dragon Age Legends was developed by EA2D and launched in March 2012 as a tie-in to BioWare’s Dragon Age II. The title was a gamble for EA, since mainstream video games tend to fade from the public eye quickly after launch. Between a strong marketing push from EA on platforms outside of Facebook and beta key giveaways, though, Dragon Age Legends accrued some decent early numbers but peaked at 132,000 daily active users in late March. The game quickly began losing users, though, and was down to 20,000 DAU by October. The game dropped even further to 10,000 DAU in March, where it’s remained ever since.

EA’s presence as a social game developer has been slipping over the past few months, particularly due to The Sims Social hemorrhaging users since September. The company’s been knocked to the No. 4 spot on our Facebook game developer leaderboards by DAU, having been overtaken both King.com and Wooga. This is EA’s second high-profile shutdown in as many months, the first being Restaurant City in April. EA may be scaling back on developing social games in favor of publishing third-party titles, as it recently announced it would publish Insomniac Games’s The Outernauts.(source:insidesocialgames)