每日观察:关注日本社交游戏电视广告推广策略(5.12)

1)据serkantoto分析,日本社交游戏在最近几年发展迅速的一大营销策略就是电视广告。

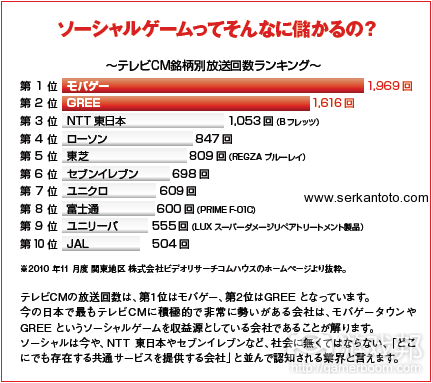

但与欧美市场不同的是,在日本是由平台运营者,例如GREE和DeNA投入营销费用。据Macquarie Research统计,GREE的广告及推广预算中有90%流向了电视媒体。观察者也发现,社交游戏广告经常在日本全国范围的电视频道循环播放(黄金时段也不例外)。

Mobage是2010年11月份日本电视广告界的第一大品牌,而GREE则是第二大广告品牌,甚至超过了日本最大的电信运营商NTT、便利店运营商Lawson、7-11以及东芝。据称日本用户打开电视机,隔10分钟就能看到一个社交游戏广告。

从经济角度来看,只要新用户获取成本低于其终身“价值”,为社交游戏投放电视广告推广也并非不划算的措施。GREE和DeNA还通过电视广告吸引非活跃用户重返游戏,并强化游戏的品牌形象。

2)澳大利亚开发商Halfbrick旗下热门iOS游戏《Jetpack Joyride》日前在Facebook进行公开测试(游戏邦注:该游戏iOS版本下载量已超过2500万次)。

这款游戏的Facebook版本采用了与iOS版本同样的玩法和盈利选项,支持玩家通过Facebook积分排行榜与好友比拼分数。

该游戏去年在App Store发布首周便实现35万次下载量,在今年2月份实现1400万次下载量,在过去三个月中又收获1100万次下载量。

3)NPD Group最新报告显示,4月份美国用户在电子游戏(包括传统游戏,以及数字下载、租借、DLC、订阅、社交网络和手机等平台的数字游戏)中的投入超过10亿美元。在整个传统游戏行业(包括游戏硬件及配件)的6.304亿美元销售额中,软件销售额占2.921亿美元。

4月份盒装软件销售额下滑42%,而数字渠道销售额却乐观发展。

4)据《中国日报》报道,PopCap中国工作室将推出两个版本的《植物大战僵尸》—–《植物大战僵尸长城版》和《植物大战僵尸王国版》。这两个版本都将通过腾讯QQ游戏中心登录Android手机及平板电脑。

其中的长城版将于5月18日上线,而王国版也将在今年夏季上线,该工作室目前正投入开发中文版《宝石迷阵》。

5)据insidesocialgames报道,成立三年的Facebook游戏开发商5th Planet Games仅有30万MAU,但今年收益预计将超过1000万美元(游戏邦注:Zynga在第一季度财报中指出,公司游戏DAU平均收益为5.5美分,在社交及手机平台的DAU为6500万;Kixeye最近在TechCrunch采访中表示预计公司2012年收益为1亿美元,DAU平均收益约80美分左右;Zynga拥有大规模的交叉推广网络,因此其每用户获取成本低于Kixeye,但有报道称Facebook每用户获取成本已上涨为1美元)。

5th Planet于2009年发布了第一款Facebook游戏《Dawn of the Dragons》,该游戏在2010年8月份达到最高峰,当时MAU超过30万DAU达5.4万,留存率超过15%。后来发布的第二款游戏《Legacy of a Thousand Suns》最高峰时的MAU超过50万,DAU达6万,但留存率不足10%。第三款游戏《Clash of the Dragons》于2011年7月发布于Facebook平台,MAU却从未超过10万。

据该公司所称,他们在2011年的每用户获取成本(以下简称CPA)为0.5美元左右,但目前却超过了1美元。他们计划入驻新的游戏平台,并与Kongregate进行合作。但目前5th游戏《Dawn of the Dragons》在Facebook平台的月活跃用户平均收益仍然高于Kongregate平台(前者超过3美元,后者则是2美元),5th目前在Facebook、Kongregate和自己网站的DAU约7万,DAU平均收益约40美分。

6)据TechCrunch报道,Zynga最近可能正在菲律宾测试《FarmVille》续集版本,这个续作主题为“Big Harvest”,拥有3D图像,以及将庄稼转变为饲料等新机制,但Zynga目前拒绝回应此事。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)Examining A Key Success Factor For GREE And DeNA: Heavy TV Promotion [Social Games]

by Dr. Serkan Toto

One question a lot of people are asking me frequently is how and why the social gaming industry in Japan has exploded over the last few years. There are a quite a few reasons for the expansion of the business, and one of them is the usage of good old TV commercials.

In sharp contrast to the US and Europe, for example, it’s the platform providers, GREE and DeNA, in particular that are spending tons of money for this kind of promotion.

Macquarie Research estimates that Gree allocates about 90% of its advertising and promotion budget (about US$250 million in FY6/12) to TV spots. It’s certainly the more aggressive of the two platforms.

Anecdotally speaking, I am seeing social game commercials in heavy circulation on national Japanese TV, both during prime-time and beyond.

And the makers have been using TV as a marketing channel for quite some time. Look at this chart:

According to this overview, Mobage was the top brand in all TV commercials in Japan during November 2010, while GREE was the No. 2 – ahead of heavyweights like NTT (Japan’s largest telco), convenience store operator Lawson, Toshiba, and 7-11.

A few days ago, Tokyo-based Zeta Bridge published a study under which GREE was the No. 2 TV advertiser in March this year in the Kanto region (around Tokyo and Yokohama):

The above is a ranking divided by companies: GREE outpaces P&G (4th), Coca Cola Japan (6th) and Toyota (9th).

DeNA isn’t present in the company ranking, but its social gaming platform Mobage has no problems making it into the ranking of individual brands/products:

Economically speaking, running TV commercials isn’t a problem as long as the acquisition cost of a new user is lower than their life-time “value”. GREE and DeNA also use this marketing channel to rekindle interest in existing but inactive users and strengthen branding in front of a mass audience. The problem is how sustainable this marketing strategy is.

So how do these commercials actually look? If you live in Japan, I would say just turn on the TV and wait for 10 minutes for a spot to appear.

For people living outside Japan, YouTube offers a lot of TV spots promoting GREE and Mobage (especially those featuring celebrities).(source:serkantoto)

2)Jetpack Joyride comes to Facebook as iOS version hits 25M downloads

by Mike Rose

Halfbrick’s popular free-to-play iPhone and iPad title Jetpack Joyride has launched as a public beta on Facebook, as the iOS version surpassed 25 million downloads in total.

This new version of Gamasutra’s 2011 mobile game of the year will feature the same gameplay and monetization options as the original, with friends able to compete against each other via Facebook leaderboards.

When the game originally launched via the App Store last year, it saw 350,000 downloads within the first week. At last count in February, it had been downloaded 14 million times, meaning it has seen 11 million downloads in the last three months. (source:gamasutra)

3)Online and mobile games push US market above $1 billion in April

by Tom Worthington

US consumers spent over $1 billion on videogames in April, according to the latest estimate by the NPD Group.

It’s the first time NPD has taken the entire US games market – including digital-only formats like mobile and social – into consideration over a single month.

Software sales made up $292.1 million of the industry’s overall $630.4 million of traditional ‘boxed’ sales – a figure that also includes games hardware and accessories.

But when digital sales such as downloads, rentals, DLC, subscriptions, social network games, and mobile games are accounted for, the US total consumer spend on videogames surpassed $1 billion.

What goes up…

Boxed software sales fell by 42 percent in April. But NPD’s Anita Frazier noted that digital sales fared better, with virtual currency and pre-paid time cards seeing a significant rise.

“For some insight into digital purchasing of content, we can look at the performance of points and subscription cards which was up 75 percent in units over last April,” said Frazier.

The old industry isn’t dead yet, though. Indeed NPD sounded an optimistic note regarding the performance of the Nintendo 3DS.

“One thing to keep in mind is that the 3DS has outsold the DS by about one million units in their respective first 14 months in the market, and the DS went on to become the best-selling gaming hardware system ever,” Frazier said.(source:pocketgamer)

4)When Chinese zombies attack, you get new Plants vs Zombies games

by Joe Osborne

Localizing games for Chinese audiences is an interesting business. In many cases, American games tailored for China are rewritten entirely, and PopCap’s tower defense hit Plants vs Zombies (PvZ) is no exception. Well, it is an exception when you consider how downright awesome the Chinese versions of the game sound, according to China Daily.

PopCap’s Chinese division will launch two versions of PvZ: Plants vs Zombies Great Wall and Plant vs Zombies Kingdoms. Both will appear on Tencent’s QQ Game Center for Android phones and tablets, and the former has players use plants to protect the Great Wall of China from distinctly Chinese zombies donned in traditional garb, PopCap Greater China country manager Liu Kun told China Daily.

The Great Wall version of PvZ is slated for a May 18, and Kingdoms (a free-to-play version) is due out this summer. A Chinese version of Bejeweled is also in the works, though we doubt that will require much localization … because it’s jewels. Now, don’t you wish you lived in China just a little bit more?(source:games)

5)5th Planet Games making $10M in revenue between Facebook, Kongregate

AJ Glasser

Facebook seems like the last platform on which a small, independent games developer would want to get started. Cost per acquisition is rising, competition is fierce and when someone does come up with a unique game concept, the clones aren’t far behind. It is where 5th Planet Games got started, however, and its story is proof that indies can make it on Facebook despite the odds. At three years old and with just 300,000 monthly active users, the developer is on track to make over $10 million in annual revenue this year.

Here’s what the odds on Facebook look like going into 2012. Zynga dominates the market, projecting up to $1.5 billion in annual bookings for 2012. As of its first quarter earnings report, Zynga makes 5 and a half cents average revenue per daily active user, with 65 million daily active users across social and mobile platforms. Farther down the developer leaderboard, the picture is less clear as private companies avoid disclosing revenue and ARPDAU. Mid-market developer Kixeye, however, recently told TechCrunch it’s expecting $100 million in 2012 revenue at something like 80 cents ARPDAU. Cost per acquisition is lower for Zynga than for Kixeye by virtue of its massive cross-promotion network; but we’ve heard the average CPA on Facebook is around one dollar.

This picture was very different when 5th Planet launched its first game, Dawn of the Dragons, on Facebook in 2009. For one thing, Facebook Credits were not mandated for game developers back then. The social network had also clamped down on virality, cutting off social games from posting stories in News Feed. To get its hardcore collectible card game off the ground with no funding to its name and no actual marketing budget, the 5th Planet had to get creative.

“The only choice we had was guerilla marketing,” CEO Rob Winkler tells us. “We set up our official forums and started talking to people, then we started talking to them on their walls, then in Facebook groups they had for other games and so on. What began touching as many message boards as possible, which grew into over 1,000 posts and messages across hundreds of forums and walls to drive that initial traffic surge.”

Dawn of the Dragons peaked on Facebook at over 300,000 MAU and 54,000 DAU in August of 2010, as tracked by our AppData traffic monitoring service. Those are not big numbers compared to other games of the day, but they were enough to keep retention north of 15 percent (which indicates a reasonably healthy social game). A second game, Legacy of a Thousand Suns, launched later that year and managed to climb to over 500,000 MAU and 60,000 DAU at peak traffic — but retention slipped below 10 percent. Its third game, Clash of the Dragons, launched on

Facebook in July of 2011 and didn’t even break 100,000 MAU. The platform had changed so much that 5th Planet was forced to change the way it did business.

“Facebook Credits and rising CPAs certainly changed the way we viewed the platform,” Chief Business Officer Braden Moulton says. “Our CPA [in 2011 was] in the $.50 range, so we were better than most. Today that same user would be well over $1.”

This led the developer to look at expanding to new platforms and games networks. For its first expansion, 5th Planet settled on Kongregate, a games portal purchased by brick-and-mortar video game retailer GameStop in 2010.

“The integration was very easy,” Moulton explains. “One of the main differences (and attractions) for working with Kongregate is that they handle promotion themselves. So while they take their cut of revenue, we aren’t burdened with driving users to our games. When we launched Clash of the Dragons there in December 2011, Kongregate poured a ton of traffic into our game — 300,000 installs in just 30 days. We had never seen numbers like that.”

At the 2012 Game Developer Conference in San Francisco, Kongregate broke some of those metrics out for the audience — highlight an average spend per paying user of $120 per month and 90 percent of revenue from players spending over $100. Moulton updated us to say that spend per paying user is now closer to $160. Even so, average revenue per monthly active user is still higher on Facebook than Kongregate for Dawn of the Dragons — a little over $3 compared to $2. Across Facebook, Kongregate and its destination site, 5th Planet sees around 70,000 daily active users and calculates ARPDAU at about 40 cents.

5th Planet Games is planning to debut its fourth game exclusively on Kongregate in June before expanding it to Facebook and European platforms. It also plans to release mobile versions of its game sometime this year. Beyond games, 5th Planet recently acquired collectible card game developer To Be Continued and will likely look for other indie studios to acquire as it expands. The developer is still proudly boostrapped, but Moulton says 5th Planet would explore funding if the right opportunity to accelerate growth came along.

As for other small studios looking to get onto Facebook, Moulton advises, “Make something completely unique or make a good slots game. Facebook can still be profitable, but it’s going to be tough.”(source:insidesocialgames)

6)Zynga’s possible FarmVille sequel — It looks like Zynga may be testing out a sequel to FarmVille in the Philippines. TechCrunch reports the game’s working title is “Big Harvest” and features 3D graphics and new mechanics like turning crops into feed, which are then fed to animals in exchange for things like milk and eggs. Zynga is declining to comment on any plans it has for the game.(source:insidesocialgames)

闽公网安备35020302001549号

闽公网安备35020302001549号