分析日本社交游戏监管对GREE、DeNA等公司的影响

作者:Kathleen De Vere

kompu gacha违反日本相关法律的消息使GREE、DeNA和其他日本游戏开发商在本周的市值骤降,因为kompu gacha正是出现于许多日本手机社交游戏的高盈利机制。

日本新闻媒体报道称,日本消费者事务局将在不久禁止这项机制的使用。分析人士预测,日本社交游戏公司的盈利将受到巨大的影响。尽管这次的事件只会影响日本手机社交游戏公司的收入,但北美同样有可能出现这种监管。

政府介入

日本手机社交游戏获利颇丰的原因之一便是游戏拥有gacha这项游戏机制,玩家可以花少量金钱随机获得一种游戏内道具。有些日本开发商的半数销售额来自于gacha机制,日本游戏开发商在美国投放的产品同样带有这项机制。例如,GREE的《Zombie Jombie》和DeNA成长最快的Android市场大作《Rage of Bahamut》也都使用了这项机制。

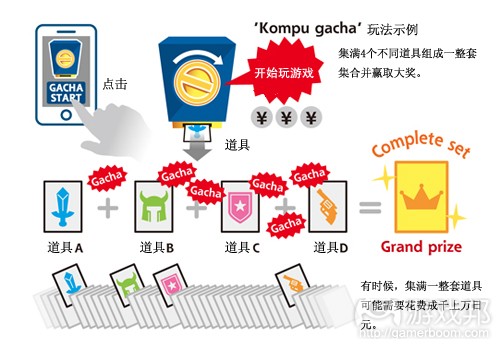

Kompu gacha简称gacha,对玩家进行的是更深层次的物质刺激。玩家并非只是花钱获得额外的道具或商品,kompu gacha还为集齐整套道具的玩家提供丰厚的奖励。据《读卖新闻》报道,集齐整套道具需要尝试数百次,耗费数十万日元。尽管这种机制看上去是种相当良性的激励方案,而且日本社交游戏公司越来越专注于通过kompu gacha来增加盈利,但消费者事务局却发现有关这项机制的抱怨极剧攀升。

在2011年4月到2012年3月期间,事务局收到的家长对孩子因gacha无度消费的投诉达到688次。在某个案例中,一个中学生一个月就花掉了逾5000美元(游戏邦注:约为40万日元)。有个小学生在3天的时间里花掉了1500美元(游戏邦注:约为12万日元)。此类报道使媒体开始关注日本社交游戏行业。

3月,行业观察者Serkan Toto报道称,GREE、DeNA、Mixi、CyberAgent、NHN Japan和Dwango组成行业自律委员会,处理盈利方式的调整问题。尽管GREE和DeNA现在限制了未成年人可在游戏中消费的金额,但kompu gacha依然在不断鼓励玩家花费大量真钱来获得随机的奖励,这似乎还是让日本监管者认为该机制涉嫌赌博。

虽然消费者事务局还未发布官方报告,但据《读卖新闻》所述,当局计划监管游戏公司使用此类机制,将惩罚今后继续在游戏中添加kompu gacha机制的公司。此刻,监管似乎只是个时间早晚的问题。

小监管,大影响

日本手机社交游戏行业的盈利性时常让北美开发商相形见绌。GREE在最近财报中声称公司第3季度净销售额为5.773亿美元(游戏邦注:约为461亿日元),净收入为1.678亿美元(游戏邦注:约为134亿日元)。DeNA财报显示,公司2011年净销售额为17亿美元。对于这两家公司来说,kompu gacha这种鼓励用户购买大量虚拟商品的机制是其主要盈利驱动力。

虽然消费者事务局还未出台具体的监管规则,但监管威胁已经足以撼动日本手机社交游戏公司的股票价格,以上便是主要的原因所在。新闻报道之后,GREE和DeNA的股票价格均下跌逾20%,突破年度日下跌记录,股票价格跌至年度最低点。Capcom、Konami和CyberAgent等运营大量手机社交游戏项目的日本公司股市行情也同样受到冲击。这种下跌是合理的吗?据Credit Suisse分析人士指出,在日本手机社交游戏中移除kompu gacha会导致这些公司销售额下滑20%到30%,整体营业收入将减少40%到50%。其他分析师显得较为乐观,估计GREE和DeNA的净收入将分别下降18%和6%。但即使是保守估计,如果消费者事务局出台监管措施,这两家公司也都会损失成百上千万美元。

对北美的影响

DeNA和GREE之前的战略表明,他们希望进行全球化发展,到目前为止这两家公司都凭借母公司的巨大盈利额大肆收购外国公司。对日本市场收益造成影响的政府监管将对收购价格产生长期的影响,即便购买者不是日本公司。Zynga花费2.1亿美元收购OMGPOP的部分原因在于GREE的竞争抬价。Gloops和Gumi等希望进军美国市场的小公司也将受到影响。

如果kompu gacha被禁,EA、Game Insight和Com2uS等拥有大量日本业务的国际公司收入也将受到影响。投资者已经在猜测北美游戏公司是否会受到此次监管的影响,有人怀疑日本社交游戏监管可能会影响到EA在5月7日发布的第4季度财报。

对北美公司的影响

尽管有点类似于彩票,但kompu gacha从根本上来说不同于会迅速遭禁的赌博游戏(在扑克或虚拟赌博游戏中,金钱直接在玩家和游戏运营者之间流通)。日本或许会制定法规,限制或禁止此类行为的变体,但是美国采取这种监管的可能性相当低。美国联邦政府将司法权交给各州,让它们自行制定针对在线博彩业的政策,而这些监管往往针对网络扑克或赌博机,所以并不适用于手机游戏。

但是,因为GREE和DeNA已经将带有日本式盈利机制的游戏引进北美市场,即便是未将游戏投放到日本的美国开发商都应当密切关注日本事态的进展。

尽管已有媒体进行报道,但日本消费者事务局目前还未公开kompu gacha监管细则。GREE和DeNA的手机社交游戏平台上依然充满大量带有kompu gacha机制的游戏。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

How Japan’s social game regulations will impact GREE, DeNA and the U.S.

Kathleen De Vere

Shares in GREE, DeNA and other Japanese game developers plummeted this weekend on the news that kompu gacha, an extremely lucrative mechanic found in Japan’s highest grossing mobile-social games, violates Japanese law.

With Japanese news outlets reporting the Japanese Consumer Affairs Agency will soon ban the practice, analysts predict Japanese social gaming companies will see a dramatic impact on their revenues. While that alone could affect earnings of Japan’s mobile-social game companies, it could also pave the way for similar regulations in North America.

How the government got involved

One of the reasons Japan’s mobile-social games are so lucrative that is the games have something in them called gacha – a game mechanic where players can pay a small amount of money to get an in-game item at random. Some Japanese developers see half of their sales from coming from gacha, and the Japanese game companies setting up shop in the U.S. are bringing gacha with them. Both GREE’s Zombie Jombie and DeNA’s top-grossing Android hit Rage of Bahamut make use of the mechanic.

Kompu gacha, or “complete” gacha in English, further incentivizes the practice – instead of just acting as a way to get extra items or goods, kompu gacha offers grand prizes to players that can amass a complete set of specific and usually rare items. According to a report in the Yomiuri Shimbun, collecting a complete set can take hundred of tries and hundreds of thousands of yen. Although it seems like a fairly benign motivation scheme, as Japan’s social game companies have focused more and more on kompu gacha to increase revenues, the Consumer Affairs Agency has seen the number of complaints about the tactic increase dramatically.

Between April 2011 and March 2012, parents submitted 688 complaints to the agency about children and gacha. In one case, a boy in middle school racked up more than $5,000 (400,000 yen) in charges in a single month. Another boy in elementary school was able to make $1,500 (120,000 yen) in purchases in just three days. Reports like these have turned press scrutiny against the Japanese social games industry.

In March, industry watcher Dr. Serkan Toto reported GREE, DeNA, Mixi, CyberAgent, NHN Japan and Dwango had formed a self-regulation council specifically to regulate monetization. Although both GREE and DeNA now restrict the amount of money minors can spend on their platforms, the way kompu gacha encourages players to pay lots of real money for random prizes still seems to be too close to gambling for the comfort of Japan’s regulators.

Although the Consumer Affairs Agency hasn’t released its official report yet, according to the Yomiuri Shimbun, the agency plans to ban the practice and impose fines on companies that continue to include kompu gacha in their games. According to Tech in Asia, the ruling will be based on the Japanese law that covers “unjustifiable premiums.” At this point regulation seems to be a question of when, not if.

Small regulation, big impact

Japan’s mobile-social game business routinely turns in profits that dwarf what North American developers earn. In its most recent earnings call, GREE reported third quarter net sales of $577.3 million (46.1 billion yen), and a net income of $167.8 million (13.4 billion yen). DeNA reported $1.7 billion in net sales in 2011. For both companies, tactics like kompu gacha that encourage users to buy lots and lots of virtual goods are a key profit generator.

That’s why even without a definite ruling from the Consumer Affairs Agency, the threat of regulation was enough to tank the stocks of Japan’s mobile-social game companies. GREE and DeNA stocks both lost more than 20 percent of their value after the news broke, hitting their daily loss limits and their lowest prices in a year. The stocks of other Japanese companies with significant mobile-social businesses like Capcom, Konami and CyberAgent took similar beatings. Was the drop justified? According to Credit Suisse analysts, eliminating kompu gacha from Japanese mobile-social games could result in a 20 to 30 percent decrease in sales and an drop of between 40 to 50 percent in operating earnings. Other analysts are being more optimistic, estimating GREE and DeNA will see a drop in net income of about 18 and 6 percent, respectively. Even by conservative estimates, both companies will lose millions of dollars if the Consumer Affairs Agency goes ahead with the widely anticipated ban.

Ripples felt in North America

Both DeNA and GREE have made it clear they’re looking to become global players, and so far both companies have financed their top-dollar acquisitions with cash from home. Regulations that effect earnings in the Japanese market affect acquisition prices in the long term, even if Japanese companies aren’t the ones who are buying. Part of the reason Zynga paid $210 million dollars for OMGPOP was because it was bidding against GREE. Smaller Japanese companies looking to make plays in the U.S., like Gloops and Gumi, could also be affected.

International companies with significant businesses in Japan like EA, Game Insight and Com2uS might also see impacts on their earnings if kompu gacha is banned. Investors are already wondering if North American game companies will be affected by the regulations – one asked if Japanese social gaming regulations would effect EA’s bottom line during the company’s fourth quarter earnings call on May 7.

The future of gambling and mobile-social games

While its similar to a lottery, kompu gacha is fundamentally different from the type of real money games that prompt government regulation, like poker or virtual slots where money goes back and forth from player to game operator. Japan might pass legislation that restricts or bans some variations of the practice, but the likelihood that similar legislation would be passed in the U.S. is fairly low. As it stands, the U.S. federal government has left it to individual states to define for themselves what constitutes lawful Internet gambling and these regulations are most often aimed at Internet poker or slots – so any actual regulation as applied to mobile games could vary by state and game type.

However, with both GREE and DeNA already bringing games that use Japanese-style monetization mechanics to the North American market, even U.S. developers without games in Japan should be watching the situation in Japan closely.

Despite the initial media flurry, Japan’s Consumer Affairs Agency hasn’t made its ruling on kompu gacha public yet. Games that use the kompu gacha mechanic are still widely available on GREE and DeNA’s mobile-social gaming platforms. (Source: Inside Mobile Apps)

闽公网安备35020302001549号

闽公网安备35020302001549号