每日观察:关注日本社交游戏热门虚拟道具类型(5.4)

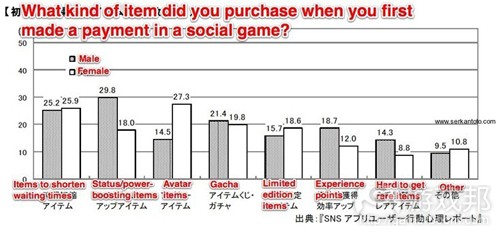

1)东京杂志发行商Enterbrain(旗下最重要资产是日本最大的电子游戏杂志《Famitsu》)最近发布行业报告指出,日本最受欢迎的游戏付费虚拟商品是那些可助玩家缩短时间的道具(游戏邦注:例如加速受伤角色恢复体力或建造房屋的道具),男性用户最青睐那些有利于提升“地位”的道具,而女性用户比较喜欢为与虚拟形象相关的道具付费(如下图所示)。

以上图表调查样本是1600名年龄介于15-59岁的日本用户,他们每周至少玩2-3次社交游戏;调查执行于2012年2月25至28日。

2)Zynga首席运营官John Schappert在MCV采访中表示,他认为社交及手机游戏已让传统游戏领域面临压力,掌机游戏一般都需要大笔制作预算,并且开发周期动辄长达数年,如果一开始就下错赌注,之后就很难翻身。

但有观察者认为,社交游戏领域目前也开始出现与传统领域类似的制作成本上涨,质量门槛高升的倾向。

3)据彭博社报道,最近有“三名知情者”透露韩国网游公司Nexon目前正与EA商谈面向亚洲市场发行MMO足球游戏《FIFA Online》合作事宜,而非传闻所说的两者合并一事。

EA打算借助Nexon的亚洲网络服务器和开发者资源向该市场推出这款网游,可能在今年6月敲定这项合作。

4)Facebook在最近的IPO路演视频中指出,Facebook广告在美国和加拿大每名用户的平均收益为9.51美元,欧洲则是4.86美元,亚洲是1.79美元,其他地区为1.42美元。

Facebook目前的MAU已达9.01亿,其网络用户增长空间已经趋近饱和,而在亚洲地区仍面临重重挑战,例如无法进入中国市场。

之前有报道称Facebook收益主要由广告和支付服务这两部分组成,但广告收益在第一季度已出现下滑,而支付服务的收益却基本上与去年第四季度持平(游戏邦注:今年第一季度Facebook支付服务收益为1.86亿美元,去年第四季度则是1.88亿美元)。观察者指出,Zynga同一时期在Facebook平台的游戏收益也并无显著增长,多数收益增长来自移动平台,因此Facebook需要尽快推出其他类型的支付服务,否则这一业务将面临停滞发展。

5)据Social Games Observer报道,英国游戏开发商King.com日前向Facebook发布类似《Solitaire》的社交游戏《Pyramid Solitaire Saga》,将玩家流放至埃及,要求他们玩一些金字塔风格的纸牌游戏以便找到出路。

目前该游戏仅4万活跃用户,但需注意的是,这款游戏几乎没有进行任何营销或交叉推广。玩家在游戏中要玩6个不同环节的游戏,每一环节都要完成10个关卡。与其他Saga游戏一样,玩家可以通过一个世界地图看到好友的游戏进程,并且可帮助好友摆脱困境,比较游戏进程及分数。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)What Kind Of Virtual Items Are Japanese Users Paying For? [Social Games]

Dr. Serkan Toto

There’s no doubt that there’s a lot of money in Japan’s social gaming market to be made: GREE and Mobage operator DeNA alone are projected to hit up to US$2 billion each in sales this fiscal year (see here and here).

Both companies make around 90% of their money with virtual item sales (the rest via ads, lead gen, etc.). But for what kind of virtual items – in social games – are Japanese users actually paying for?

Enterbrain, a Tokyo-based magazine publisher (whose most important asset is Japan’s biggest video game magazine Famitsu), has tried to answer this question in a new industry report (sample / Japanese only).

The most popular items overall are those that shorten waiting times (for example, when waiting for a wounded character to heal or a house to be built). Men apparently favor items that boost their “status”, while women tend to like paying for avatar-related items.

For an explanation of what “gacha” is, please click here.

Here is what Enterbrain found out (translations added by me):

Note:

The chart is based on a user survey among 1,600 Japanese people aged between 15 and 59 (selected out of 69,750 people). These users stated they play social games at least 2-3 times per week.

They were surveyed between February 25 and 28 this year, answering the question what kind item they purchased when they first made a payment in a social game. Multiple answers were possible.(source:serkantoto)

2)Zynga: It’s time for console game makers to sweat the social stuff

by Joe Osborne

As if the folks at Microsoft, Sony and Nintendo needed any more of a warning. Zynga COO John Schappert told MCV in an interview that social and mobile games have, in his opinion, put the console game makers against the wall. The new Zynga executive defected from the console game space after leaving EA for Zynga, so he might know a thing or two about the subject.

“Traditional gaming is under a little bit of pressure,” Schappert admitted to MCV. “If those businesses are not ready and want to live in the traditional world, they can. It’s just there’s only going to be a few big games a year. If you’re one of those games, more power to you. If you’re not, it’s going to be tough.”

The traditional gaming world is more consolidated than ever, meaning the fat cats call the shots on what’s hot and make a majority of the cash. Plus, according to Schappert, “Big console games take years to make. They need massive budgets and you have to hope the bet you started three years ago pays out. If it doesn’t, it’s a game changer for you. And not in a good way.”

But wait a second, all of this talk sounds terribly familiar. The social gaming scene looks more and more like the picture that Schappert has painted for us. Just look at the top 25 Facebook games of this month … and last month … and the month before that. As far as developers (and games, frankly) are concerned, do the lists look all that different?(source:games)

3)Nexon, EA in talks regarding distribution partnership, not merger – report

by Mike Rose

Seoul-based online game publisher Nexon is not looking to buy out Electronic Arts, as recently rumored, but rather the two companies have been discussing the distribution of FIFA Online in Asia, according to media sources.

South Korean newspaper MK Business News reported last week that Nexon was looking to buy EA. However, “three people with knowledge of the matter” have now told Bloomberg that the two companies were simply discussing a distribution deal.

EA is looking to make use of Nexon’s online servers and developers in Asia for free-to-play soccer MMO FIFA Online, claims the report, and hopes the partnership will led to an increase in virtual item spending on the title. The partnership may be cemented as early as June, said Bloomberg’s sources.(source:gamasutra)

4)Stats: Facebook Made $9.51 in Ad Revenue Per User Last Year In The U.S. and Canada

Kim-Mai Cutler

Even though Facebook’s IPO roadshow video was a mostly touchy-feely affair with videos of friends have coffee and babies blowing out candles, there were some new stats tucked away in it.

For the first time, the company gave a look at how it monetizes on a per user basis in different parts the world. There was one chart of most interest.

It shows that Facebook made about $9.51 in advertising revenue per user in the U.S. and Canada. Europe was about half that much with $4.86 in ad revenue per user. Asia and the rest of the world follow that at $1.79 and $1.42 per user. What this shows is the revenue trajectory that other more economically developed markets like Western Europe and Japan could get to if Facebook successfully grows there or convinces more regional brand advertisers to come on board.

But these revenues are also affected by seasonal and macroeconomic trends. The average price per ad in Europe actually declined in the first quarter from the holiday season because the weak economy there, according to Facebook’s most recent IPO filing.

Plus, Asia and the rest of the world will be a challenge for awhile. These economies can’t support the kind of spending per user that the U.S. or Europe can. Also keep in mind that Facebook is still blocked off from China, where competitors like Sina, Tencent and Renren are thriving.

There are six main factors that affect how much Facebook’s advertising revenues can grow over the next several years. They’re listed below and they have to do with raw growth (or how many users Facebook has) to engagement (or how sticky and addictive the product is) to targeting (how well Facebook can route the right ads to the right users).

Facebook is at 901 million monthly active users, so it’s running out of room to grow given the sheer limit of world Internet usage. More importantly, it’s gotten a lot of the low-hanging fruit, or users in developed countries. It’s also continuously changing the product, which can affect short-term revenues. Facebook has bumped up the numbers of ads per page to seven units from four over the past year.

In terms of Facebook’s overall ad pitch, the company’s chief operating officer Sheryl Sandberg said that the company’s long-term goal is to be the place where 70 million businesses worldwide go to offer personalized, relevant advertising.

She said, “Every day on Facebook is like the season finale of American Idol times two,” in a reference to the home page.

She also added that advertising budgets are not moving online fast enough to match user behavior. Of the roughly $600 billion spent on advertising every year, only 11 percent of it is devoted toward online ads. Another $1.5 billion in advertising is spent on mobile devices.

Overall, as we’ve reported before. Facebook’s revenues have two components: advertising and payments. Both are up on a year-over-year basis, but advertising revenue actually declined going into the first quarter, which Facebook says happened because of seasonal spending habits. Plus payments revenue is virtually flat from the fourth quarter into the first one.

If we look closer at payments revenue, it’s up by quite a bit year-over-year. Facebook earns a 30 percent revenue share from apps and games on its platform. But this isn’t a fair comparison since Facebook only made the revenue share mandatory in July. Payments revenue is pretty much flat on a sequential quarter-over-quarter basis, at $186 million from $188 million in the fourth quarter.

The concerning thing is that if you look at games on the platform, Zynga’s quarter-over-quarter bookings for the Facebook canvas aren’t really growing anymore. Most of their bookings growth is coming from mobile. So unless Facebook turns on other kinds of payments revenue soon, this figure is going to stagnate.

Facebook’s chief financial officer David Ebersman stressed that the company may cut its 30 percent revenue share if it expands payments beyond gaming, which we reported on a few weeks ago.

He also pointed out that Facebook’s operating margins are declining. A measure of how profitably the company can run, operating margins fell to 36 percent in the first quarter from 53 percent in the same time a year earlier. Ebersman said this has a lot to do with share-based compensation expenses.

He also added that the company is still in growth mode and will make decisions that will hurt its short-term profitability from time to time. For example, even though Facebook has only started to bring in revenue from its mobile apps, it will still continue to spend aggressively on them.

“We believe mobile usage of Facebook is critical to our future,” he said. “Expect us to invest in it even if mobile monetization is uncertain.”(source:techcrunch)

5)King.com’s social game saga continues with Pyramid Solitaire Saga

by Joe Osborne

The proverbial Zynga of Europe is at it again. This time, developer King.com has unleashed a social version of solitaire on Facebook. Titled Pyramid Solitaire Saga in vein of, well, every King.com game on Facebook, the game sees players stranded in Egypt (or somewhere like it) with the only way out being several games of pyramid-style solitaire.

The game quietly launched on Facebook recently, according to Social Games Observer, and has attracted just 40,000 daily players so far. Keep in mind, however, the game has received little to no marketing, press outreach or cross promotion yet. Players, who navigate the game world as someone named Helena, can play through six different episodes, each with 10 levels to complete.

Like all of King.com’s “Saga” games, players can see their friends’ progress on an over world map that links each level together. On that map, players have the option to send their friends free lives to help out and compare progress or highest scores. And as players finish episodes, they’ll earn numerous power-ups, like extra time, bonus tiles, extra jokers, mixed tiles and score boosters, according to SGO.

King.com mixes up the classic mode of pyramid solitaire by not only ranking players on speed, but introducing enemies like scarabs to crush mid-game. Pyramid Solitaire Saga also gives players additional missions to complete outside of the core play hook. With games like Solitaire Blitz by PopCap tearing it up, Pyramid Solitaire Saga stands to keep the saga going.(source:games)

闽公网安备35020302001549号

闽公网安备35020302001549号