每日观察:关注微软及亚马逊手机应用商店发展速度(4.20)

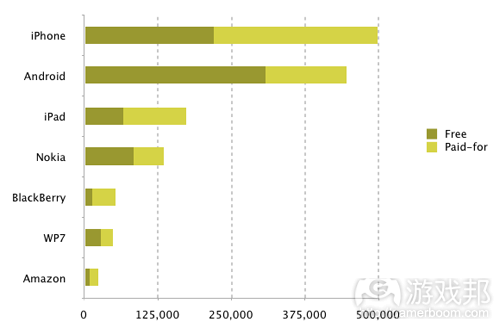

1)Distimo及CSS Insight最近报告指出,微软Windows Phone 7 Marketplace及亚马逊Appstore已成为发展最为迅速的应用商店。

Windows Phone 7 Marketplace在2011年每季度的应用数量增长率最为显著,很快就将超越RIM黑莓App World,该平台在4月份的应用数量超过8万款,突破了1月底时的6万款。

得益于Kindle Fire的成功销售,亚马逊Appstore应用数量在2011年第四季度也增长40%。

从总体上看,iPhone App Store仍是规模最大的应用商店,其应用数量增长率仍然超过竞争对手Google Play。

截止2011年末,全球应用商店共有近140万款应用,其中免费产品占比53%,付费应用占比47%。

2)FourBros Studio最近宣布旗下Windows Phone手机游戏《Taptitude》发布一年平均每日收益达1000美元。

这款免费游戏原先通过AdDuplex等交叉推广网络及微软pubCenter平台的广告服务进行盈利,后来依托日常广告印象实现创收。得益于诺基亚Lumia系列产品的发售,FourBros目前平均每天可通过100万次广告印象创收1000美元。

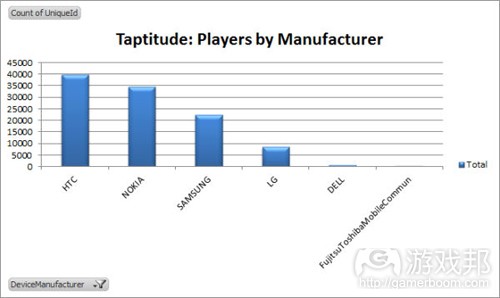

该公司发布的数据显示,《Taptitude》用户分布最广的平台是HTC移动设备,但诺基亚用户也在快速追赶(如上图所示)。据其所称,FourBros Studio看好迅速发展的Windows Phone市场前景,它是一个有利于独立开发者获得成功的平台。

3)手机游戏公司TinyCo(其游戏在iOS和Android平台前25名营收榜单中均占据一定席位)日前表示,旗下模拟游戏《Tiny Village》在亚马逊Appstore每用户盈利性比iTunes用户高80%,亚马逊Kindle Fire用户盈利性也比iPad用户高43%,由此来看,亚马逊Appstore盈利性优于苹果App Store。

从谷歌Google Play的情况来看,TinyCo游戏在Android平台的每用户盈利性约是iPhone用户的82%(游戏邦注:移动分析公司Flurry之前报告曾指出,如果每名iOS用户为App Store创收1美元,亚马逊Appstore每用户盈利就是0.89美元,而Google Play用户则是0.23美元;另一家独立手机游戏开发商Storm8入驻亚马逊Appstore首月就创收70万美元)。

观察者称出现这种情况可能有4个原因:一是Google Play在电子商务及支付领域并不具备亚马逊那种优势;二是谷歌缺乏亚马逊及苹果所掌握的用户信用卡数据库;三是亚马逊Kindle Fire仍处于早期阶段,其初期用户基本上是手头宽裕的群体,随着该设备的普及,这一平台的每用户平均收益将呈现下滑趋势;四是亚马逊Appstore目前仅向美国用户开放服务,而iTunes和Google Play则已入驻许多非发达国家市场。

4)荷兰市场调研公司Newzoo最新报告指出,亚马逊Kindle Fire销量已达1000万部(据称称该设备在2011年销量为500万部)。值得注意的是,Newzoo认为该设备目前有1740万活跃用户,但却并未说明理由,并称美国目前有3050万iPad活跃用户。

Newzoo认为有650万美国用户同时使用Kindle Fire和iPad,美国平板电脑用户达5900万,其中有36%是游戏玩家。(游戏邦注:pocketgamer报道认为,Newzoo这份报告存在疑点,因为iPad全球销量已超过5500万部,而如果按照与Kindle Fire相似的使用率来看,目前在美国投入使用的iPad设备仅为1750万部,这明显低估了美国市场规模;另外,Newzoo报告称美国有370万Kindle Fire英国用户,但该设备并未在美国以外的地区发售)

5)休闲游戏公司PopCap日前发布《植物大战僵尸》iOS更新版本,在该游戏中首次引进了IAP微交易功能,支持通过玩游戏获得虚拟货币,或者付费购买虚拟货币加速游戏进程。

但与《宝石迷阵闪电战》不同的是,这款游戏引进IAP模式后并未转向免费增值模式,其iPad版本目前售价为6.99美元,iPhone版本售价2.99美元;游戏中的虚拟货币包售价为0.99至3.99美元。

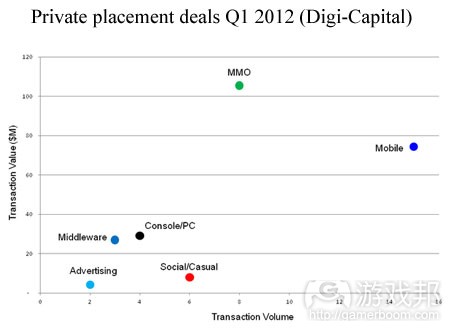

6)投资银行Digi-Capital日前发布的2012年第1季度报告预测,2012年社交游戏市场已进入合并阶段,手机游戏市场仍将吸引大量资本。

报告称2011年是游戏投资年,这一市场共产生152笔投资交易,以及20亿美元的交易额,平均每笔交易额为1200万美元。

从企业合并及收购领域来看,2011年共产生113笔合并及收购交易,总额为34亿美元,平均每笔交易额为3000万美元。

2012年第1季度共产生38笔投资交易,产值为2.48亿美元,平均每笔交易额为700万美元。社交及休闲领域平均每笔交易额下滑的趋势表明,比起2011年,社交游戏领域的投资热已经有所降温。

而手机及MMO游戏则是这一时期的主要投资目标,手机平台仍将成为2012年游戏投资领域的重要驱动力。

7)据报道,由微云代理发行的iOS游戏《战神之怒》日前在在AppStore大陆和香港地区上线12小时后迅速跻身相关排行榜前列(如下图所示)。

(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)The Windows Phone Marketplace and the Amazon Appstore are the fastest growing app stores

Kathleen De Vere

Microsoft’s Windows Phone 7 Marketplace and Amazon’s Appstore are the fastest growing app stores according to Distimo and CSS Insight’s App Vu Global Report.

The Windows Phone 7 Marketplace saw the largest quarter over quarter growth in 2011 and may soon overtake RIM’s BlackBerry App World in terms of the total number of apps available. The Windows Phone 7 Marketplace had more than 80,000 apps at the beginning of April, up from 60,000 at the end of January.

Although still the smallest app market, Amazon’s Appstore is also growing quickly thanks to the success of the Kindle Fire. According to the report, the Amazon Appstore’s number of available apps grew by 40 percent in the fourth quarter of 2011.

Overall, the iPhone App Store is still the biggest app store and is still adding apps at a faster rate than its closest competitor, Google Play.

At the end of 2011 there were almost 1.4 million apps in app stores worldwide, 53 percent were free or freemium and 47 percent were paid.(source:insidemobileapps)

2)FourBros Studio earning $1,000 per day from Windows Phone game Taptitude

by Tom Worthington

Over a year after launching Taptitude on Windows Phone, developer FourBros Studio says interest in the game has spiked – it’s seeing on average $1,000 in daily income.

Releasing Taptitude as a free title, the Washington-based developer originally used a combination of advertising services to generate revenue including cross-promotion network AdDuplex and Microsoft’s own pubCenter, that latter paying on a daily ad impressions basis.

Daily impressions sky-rocketed recently with the launch of Nokia’s Lumia range which now sees FourBros average $1,000 daily from an impression rate averaging 1 million per day.

So much for first impressions

The chart below shows the recent day-by-day figures showing how revenue has spiked.

FourBros broke down the details on its official site which shows record numbers of players using Lumia phones.

HTC still remains Taptitude’s most popular platform but Nokia’s range is quickly catching up, as you can see in the bar graph below.

Being one of the few success stories to come out of the Windows Phone crowd, FourBros have proved it can be a viable platform especially for indie developers.

“Windows Phone is a rapidly growing market where indie developers can be successful,” said FourBros in a post of their official site.

“We are looking forward to an even better second year as indie game developers, and can’t wait for Windows 8!”(source:pocketgamer)

3)Amazon Appstore’s Revenue Per User Beats Out iOS, Google Play, Says Game Developer TinyCo

Kim-Mai Cutler

TinyCo, a mobile gaming startup backed by Andreessen Horowitz, is yet another major game developer that has come forward to show that revenue per user on Amazon’s appstore is tracking much higher than it is on Google Play.

The company, which has top #25 grossing games on both iOS and Android, looked at its title Tiny Village, a prehistoric-themed simulation game that’s available on all three stores from Google, Apple and Amazon, and found that when you break it out by platform, Amazon’s store monetizes 80 percent better per user than iTunes. If you break out the tablet market, Amazon Kindles monetize 43 percent better per user than iPads do. So Amazon is doing even better than Apple is, according to their numbers.

This is not to rag on Google Play though. TinyCo’s numbers are actually not that bad when looking at Google’s store. When you look at just Android phones (which would exclude any Amazon devices since they don’t offer a phone), these devices generate 82 percent of the revenue-per-user that iPhones do.

Update: Some readers are complaining that I am pointing to an isolated case of a single developer, which of course isn’t representative of an entire market. So here’s the thing: TinyCo is one of a few dozen game developers that has actually had top grossing rankings in all three stores. Amazon’s market is still small and they only released in-app purchases out of beta a few weeks ago, so there really aren’t that many developers who have meaningful ARPU (average revenue per user) data.

And here’s the broader picture: TinyCo’s numbers are a little bit different from recent data out of mobile analytics provider Flurry, which looked at a basket of apps that were available across all three stores. Flurry found that for every $1 generated per user in the iOS store, Amazon’s store generated $0.89 and Google Play produced $0.23. Flurry’s analytics are in more than 150,000 apps, so they have a very large sample size.

Another big, independent developer also shared some promising stats about Amazon’s Appstore a few weeks ago: Storm8 said it generated $700,000 in revenue during its first month in Amazon’s store.

There are a couple things to think about with any early data out of the Amazon store, however. 1) Google hasn’t had the years experience that Amazon has in processing payments and managing an e-commerce-centric revenue model. 2) They lack the database of credit cards that both Amazon and Apple have, which creates extra friction for consumers when they want to pay and have to enter in their personal information. 3) It’s still early days so Amazon Kindles may just be selling to early adopters, who have more disposable income. Over time, revenue-per-user numbers may trend downward as a device or platform crosses over into the mainstream. 4) Amazon’s Appstore is still only available to U.S. consumers. So the iTunes and Google Play numbers are averaging in customers from less lucrative international markets.(source:techcrunch)

4)Dutch market research company wildly guesses Kindle Fire UK install base while underestimating US iPad sales

by Jon Jordan

Most companies are keen to trumpet their successes but Amazon is notorious reticent about giving out numbers when it comes to its Kindle hardware.

Of course, analysts abhor a vacuum and Amazon’s coyness gives them licence to get all expansive with the realeconomik.

One such is Dutch intelligence outfit Newzoo, which says Amazon has sold 10 million of its Kindle Fire Android tablets.

Finger in the air

To be honest, it’s not rocket science given that the device – still only officially available in North America – was reckoned to have sold five million during 2011.

Slightly more interestingly, the company calculates that the device has 17.4 million active users. How, it doesn’t say.

Expanding its horizons, it thinks there are 30.5 million active users of iPad in the US, this despite the fact that more than 55 million iPads have been sold globally.

On a similar usage basis to Kindle Fire, this would suggest there are only 17.5 million iPads in the US – clearly an underestimate.

Moreover, Newzoo reckons 6.5 million Americans use both devices, with the US tablet user total being 59 million-strong. Newzoo guesses 36 percent of this audience plays games.

But perhaps the most strange aspect of Newzoo’s research is that it thinks there are 3.7 million Kindle Fire users in the UK, despite the fact the device isn’t available in the UK and you can only download content if you have an Amazon US account.(source:pocketgamer)

5)In-app purchases come to PopCap’s Plants vs. Zombies

by Tom Curtis

Newsbrief: Casual game giant PopCap has released a new update to its popular Plants vs. Zombies on iOS that introduces the game’s first ever in-app microstransactions.

With this new update, players can purchase in-game currency in addition to earning it via gameplay, thereby giving users an opportunity to spend real-world money to accelerate their progress through the game.

Unlike PopCap’s freemium game Bejeweled Blitz, Plants vs. Zombies has not become a free-to-play app following the addition of in-app purchases. The game is available for $6.99 on iPad and $2.99 on iPhone, while the in-game coin packs cost between $0.99 and $3.99. (source:gamasutra)

6)As Facebook market slows, mobile social gaming companies now attract key investment

by James Nouch

Investment bank Digi-Capital has published the Q1 2012 update for its Global Games Investment Review of 2012.

Its figures suggest that while the social gaming market is entering a period of consolidation, the mobile market will continue to attract investment throughout 2012.

The report states that 2011 was a record year for games investment, with 152 transactions generating $2 billion transaction value. The average transaction was $13 million.

In terms of mergers and acquisitions, 2011 saw 113 transactions, totalling $3.4 billion. The average deal was $30 million.

Picking up pace

The figures for Q1 2012 show 38 transactions, which generated $248 million, at an average of $7 million.

That reduction in average transaction value stems from a decline in the social and casual sector, as the venture capital market “appears to have slowed down its frenetic pace of social games investment from 2011.”

Facebook droop

Even social studios which attract high numbers of daily active users are struggling in terms of revenue and/or profitability, according to Digi-Capital’s analysis of the top 50 Facebook games companies.

This, the report claims, is prompting consolidation in the social games market, and 2012 “could be shaping up as a bumper year for games mergers and acquisitions” as companies look to sell themselves.

Coupled with Zynga’s recent $180 million acquisition of OMGPOP, this could lead to a change in ‘operation investment dynamics’ in social games, as companies attempt to churn out big hits in the hopes of being acquired at a similarly high cost.(source:pocketgamer)

闽公网安备35020302001549号

闽公网安备35020302001549号