每日观察 :关注开发商对Facebook Credit看法(2.9)

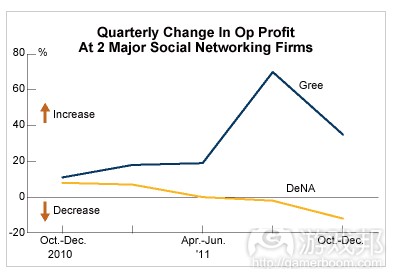

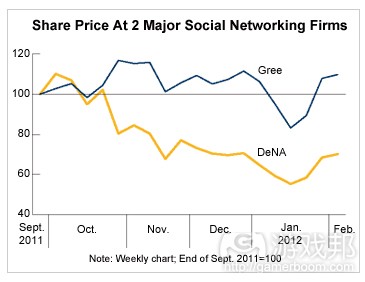

1)据Serkantoto报道,日本社交游戏公司DeNA近日在东京证券交易所市值达49亿美元,而竞争对手GREE则高达78亿美元。日经指数最近绘制的图表显示了两者从2010年10-12月至2011年10-12月的营业利润和股价对比情况(如下图所示):

2)据insidesocialgames报道,社交游戏开发商Kabam首席执行官Kevin Chou最近针对,Facebook Credit虚拟货币系统并未给开发商带来理想的付费转化率,Kabam原先认为采用该货币系统后用户付费转化率会达到15-20%左右,但实际上仅有5-10%。

而Zynga之前已公布2011年第三季度其付费用户达340万,同一时期的MAU为1.52亿,这意味着Zynga游戏玩家付费转化率约2.2%(游戏邦注:Zynga锁定的是休闲游戏用户,所以付费转化率低于Kabam很正常)。

Funzio(代表作包括Facebook游戏《Crime City》)联合创始人Anil Dharni则表示,采用Facebook Credit虽然增加了付费转化率,但每付费用户平均收益却呈现了下降趋势,他们不知如何解释这种现象,Funzio后来就转向了iOS平台,旗下两款游戏《Crime City》和《Modern War》就进入了App Store营收榜单前列。

据观察者所称,Facebook在去年最后一个季度的支付服务营收同比上一季度增长20%,共达1.88亿美元,可见Facebook确实优化了用户支付流程,但该时期Facebook也推出了Credit八折优惠活动,因此我们很难区分Facebook付费用户究竟有何实际增长。

3)Loot Drop首席营销官及游戏设计师Brenda Garno Brathwaite日前表示,她认为山寨现象“令人反感”,并透露其工作室之前也曾遇到游戏理念被剽窃的情况。

她称当时有家发行商与他们一起讨论一个游戏创意,但他们还没动手编码,对方就已经克隆了该游戏理念。Brathwaite认为社交游戏领域存在一种“快进”思维,开发者关注的是如何“换汤不换药”地复制同款游戏,而非制作一款真正优质的游戏。

4)据games.com报道,继推出《Tetris Battle》(目前DAU达370万,MAU为1320万)这款《俄罗斯方块》Facebook版游戏之后,Tetris Online最近又发布一款同类游戏《Tetris Stars》(由Blue Planet开发)。

该游戏已进入公开测试阶段,基本机制与原版游戏相似,但风格更为休闲,完全采用鼠标操作方式。从测试情况来看,游戏功能已较为齐全,外观也已经过润色,但该开以商却并未公布游戏的正式上线日期。

5)据EA最新SEC文件显示,EA首席财务官Eric Brown将于2月3日离职,并将由EA首席会计临时接替其位置。

Brown于2008年4月进入EA任首席财务官,现将加入通讯公司Polycom团队并担任后者首席财务官兼首席运营官。此外EA还宣布将聘请前McAfee高管Mark Tonneson任EA首席信息官,后者将向EA首席技术官Rajat Taneja述职。

6)迪士尼互动传媒近日公布财报显示,本财年第一季度(截止2011年12月31日),迪士尼互动传媒部门营收为2.79亿美元,比去年同期的3.49亿美元下降20%,亏损达2800万美元(去年同期亏损为1500万美元)。

迪士尼报告称这种结果主要归咎于公司发布产品较少,但其社交游戏方面的运营表现部分抵消了下滑趋势,该公司将继续从掌机游戏市场转向社交游戏等新兴领域。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

1)DeNA vs GREE: Profit And Share Price Development Visualized [Social Games]

by Dr. Serkan Toto

It’s not a secret that GREE has been outpacing DeNA in recent months: the market cap today at the Tokyo Stock Exchange for DeNA stood at US$4.9 billion (DeNA stock soared today), while GREE reached US$7.8 billion.

Nikkei Online has tried to visualize the race between the two rivals in recent months with the two graphs you can see below.

Here is how quarterly operating profit changed since the October-December quarter 2010:

For details on GREE’s last quarter, click here (click here for DeNA’s numbers).

The difference in sales and profits are reflected in the stock price of the two companies in recent months.(source:serkantoto)

2) Developers say Facebook Credits is converting fewer paying users than they had hoped

Kim-Mai Cutler

Facebook’s top developers say the company’s payments infrastructure and virtual currency Credits are converting fewer paying users than they had hoped a year ago.

Facebook made it mandatory for developers to use its payments platform in canvas games in July. That meant developers on the platform had to start handing over a 30 percent revenue share to the company, mirroring a similar split on Apple’s iOS. The hope was that a single, universal currency would make it more frictionless for users to start paying for virtual goods.

“We thought that conversions would go up and be around 15 or 20 percent,” said Kevin Chou, the chief executive of Kabam, a social gaming company that targets a more hardcore demographic, at the Inside Social Apps conference in San Francisco. “But it turned out to be around 5 to 10 percent, meaning that we’re taking a 20 percent net tax.”

For comparison, Facebook’s biggest developer, Zynga, revealed in its prospectus that it had 3.4 million unique payers during the third quarter of last year. That’s out of 152 monthly unique users in the same time period, suggesting a 2.2 percent conversion rate. Zynga attracts a much larger, more casual audience, so we’d expect to see a lower conversion rate compared to Kabam.

Anil Dharni, who co-founded Funzio, which has had hits on iOS and Facebook like Crime City, said the move to Credits ended up being roughly even for the company.

“Facebook credits is a wash for us,” he said. “It increased the conversion rate but we actually saw a gradual decrease in average revenue per paying user. It’s hard to know why.” Funzio has since moved its focus to iOS, where it has launched Crime City and Modern War, both titles that reached the top of the grossing charts.

Facebook’s payments revenue increased 20 percent quarter-over-quarter going into the end of last year to $188 million, suggesting that the platform may be improving at getting users to pay.

However, the company also ran promotions during that time, giving some users an 80 percent discount on Credits. So it’s hard to tell whether those are genuine increases.

If Facebook can’t improve at converting more paying users, it risks losing developer talent to competing platforms like Apple’s iOS and Google’s Android. That in turn could mean growth in its payments business will slow or stagnate over the next year. Facebook diversified its business last year to make payments 17 percent of its revenues in the fourth quarter, up from 10 percent the year before. The rest is advertising.

Developers earned $1.4 billion in revenue from transactions on the platform last year, according to Facebook’s filing for an IPO. Apple’s iOS was able to pay developers about half of that or $700 million in a single quarter during the holiday season, according to their most recent earnings call.

“Mobile users are more engaged and they produce higher revenue than our tethered titles on PCs,” said John Spinale, the senior vice president of social games at Disney. He added, “We’re also seeing incredible revenue growth on Android. Android is a little bit unwieldy, but the revenue is meaningful enough that it’s worth the pain of doing.”

One developer, Wooga, which is the biggest social game developer in Europe and trails only Zynga in daily active users, defended Credits. The company’s chief executive Jens Begemann suggested that Facebook takes more flack because it instituted a 30 percent revenue share after several years of not charging developers for earning revenue off its platform. Apple had a split from the beginning.

“We have been on Facebook Credits since Day One. So for us, we don’t see really negative trends,” he said. “I’ve also not heard anyone complain about Apple for their 30 percent revenue share.”(source:insidesocialgames)

3)Loot Drop: We had a game cloned before a line of code had been written

Kathleen De Vere

Loot Drop COO and game designer Brenda Garno Brathwaite calls cloning “disgusting,” revealing her company’s first-hand experience with the practice.

“We had a meeting with a publisher and a game designer discussed an idea for a game,” Brathwaite said during the Trends in Social Gaming panel at Inside Social Apps conference. “The publisher came back next week and said they’d be making the game and they might need us to consult on it. That game had been cloned before a line of code had even been written.”

Brathwaite spoke frankly, calling out the social games industry for its “fast-follow” mentality. ”In the traditional space, a great game would come out and you would say ‘how can we make a game that good and improve on that?’ What we have now is ‘how can we change the narrative and make the same game?’ That’s like putting out the Peaches of Wrath rather than the Grapes of Wrath. In any other medium it would be considered a tremendous fail and I think it’s because the space is about monetization and not about creativity,” she said.

The issue of cloning in the social and mobile games space has come up numerous times in the news recently. Triple Town developer Spry Fox is suing 6waves Lolapps over the similarities between its game and 6waves’ Yeti Town, and San Diego-based NimbleBit criticized Zynga for its upcoming game Dream Heights, pointing out numerous similarities between the two titles. During EA’s third quarter earnings call the company was reluctant to reveal details about its upcoming slate of social games, citing the need to protect its intellectual property.(source:insidesocialgames)

4)Tetris Stars lines up to be the next hit Facebook game

by Joe Osborne

Tetris is the Superman of video games. You can kill it, but it will never, ever die. Tetris Battle has proved to be one of Facebook’s most successful games, with 13.2 million monthly and 3.7 million daily players. Tetris Stars, created by Honolulu-based Blue Planet Software and published by Tetris Online, is the next attempt at replicating if not surpassing that success.

Available now in an open beta, Tetris Stars employs the familiar matching of tetrominoes to clear as many lines as possible. This version, however, appears to be a much more casual take on the popular puzzle game, as it’s controlled entirely via the mouse. (A thousand hardcore Tetris players’ hearts shriveled to the size of a raisin as that last sentence was typed.) Anyway, players must complete lines that rest on dirt as quickly as possible to both beat the 60-second clock and dig up buried power-ups and stars.

Tetris Stars applies Bejeweled Blitz-like play hooks to the the classic Tetris formula, like friendly leaderboards and a selection power-ups before each timed session. What’s different is that the game sends players on special missions to switch up play styles for rewards.

The game is still in an open beta, or as we see it, live “testing”. For being in an open beta, the game looks incredibly polished and full-featured. Still, the developer shows no signs of releasing the game “officially” any time soon. At any rate, the game is worth a shot, if for nothing else than the fact that it’s Tetris. Well, that and to get to say you were playing Tetris Stars before it was cool.(source:games)

5)More executive shuffling at EA with departure of CFO Eric Brown

Kathleen De Vere

Electronic Arts’ chief financial officer has resigned. According to EA’s most recent SEC filing, Brown tendered his resignation on Feb. 3 and his last day will be Feb. 17. Ken Barker, EA’s chief officer of accounting will serve as interim chief financial officer until EA selects a replacement.

Brown has served as EA’s CFO since April of 2008, but is leaving the company to take on an operations role at Polycom, where he will serve as the the company’s chief financial officer and chief operating officer. When asked for comment, EA directed us to its official blog post, which reads:

[Today] we are announcing that Eric Brown, our CFO, will be leaving EA. He has decided to join Polycom, a world leader in communications technology. Eric’s decision was based on his career goal to combine his expertise in Finance with deeper involvement in Operations. We have begun a search for a new CFO and will consider both internal and external candidates.

There is no denying the pace of change at EA is accelerating. The successful launch of blockbusters likeFIFA Soccer 12, Battlefield 3, The Sims Social and Star Wars: The Old Republic; smashing our goal for generating $1B in digital revenue; and the dramatic growth of Origin – each of these is a huge milestone in our digital transformation. EA will exit this fiscal year a profoundly different company than we were at the start. From here on, change is constant.

Brown’s departure is the latest in a series of high profile departures at the company. Last month, Barry Cottle left his position as the executive vice president of EA Interactive to join Zynga.

He became the company’s executive vice president of business and corporate development.

EA also announced that Mark Tonneson has left his position at McAfee to join EA as its chief information officer. Tonnesen will report to EA’s chief technology officer Rajat Taneja. Neither Brown’s nor Tonnesen’s LinkedIn profiles reflect the changes yet.(source:insidesocialgames)

6)Disney’s sparse release lineup leads to slow Q1

by Tom Curtis

The Walt Disney Company’s video game-focused Interactive Media division today reported decreased revenues and widening losses for its fiscal first quarter, coinciding with the company’s conservative game output.

For the quarter ended December 31, 2011, the Interactive Media division saw $279 million in revenue, down 20 percent from $349 million during the same time last year. With these reduced revenues, losses for the division reached $28 million, compared to $15 million year over year.

Disney reported that the lowered results can be attributed to the company’s sparse release lineup, though this decline was offset partially by Disney’s improved results in the social space.

For comparison, Disney’s console lineup in the prior year-quarter included the highly-anticipated Epic Mickey, as well as major movie tie-in titles such as Toy Story 3 and Tron: Evolution. This

quarter, the company’s only major console title was the multiplatform Disney Universe.

Going forward, Disney confirmed that it plans to continue its shift away from the console market to focus its efforts on social games and other emerging platforms. (source:gamasutra)

闽公网安备35020302001549号

闽公网安备35020302001549号