分析2011年初十大Facebook游戏年底运营表现

作者:James Au

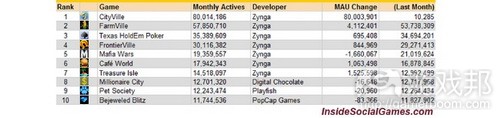

下面就来看看AppData 2011年1月汇总的10款热门游戏到2011年12月表现如何?

就2009年后发行的Facebook游戏来看,前1年通常是生命周期最黄金的阶段。在前12个月里,游戏会在头3个月快速发展,达到流量高峰,然后在随后6个月逐步缩水。在此缩水阶段,DAU/MAU通常会降至10%。我们会发现若粘性低于10% DAU/MAU,游戏多半就会消亡(游戏邦注:因为开发商希望减少损失)。

截至2011年12月,1月份的10款热门作品几乎都已流失绝大多数流量。但这并不意味着它们将在2012年步入末日。这些游戏很多依然具有相当高的粘性,继续给开发商带来丰厚收益。至少有款游戏,即EA PopCap的《宝石迷阵闪电战》,2011年间在保持流量的同时粘性水平依然持续见涨。

2011年初,据AppData数据显示,基于MAU的10大热门Facebook游戏是:

2011年1月,位居榜首的《CityVille》存在刚发行的优势,这款游戏在前1个月推出。而且,若干发行于2008年的热门作品(《宠物社区》、《德州扑克游戏》及《黑手党战争》)依然保持名列前10(榜单其他作品主要发行于2010年中旬,除《FarmVille》发行于2009年中旬外)。

截至年末,Facebook的10款热门作品名单已发生巨大改变,1月份的热门作品中只有3款作品继续出现在2011年12月的榜单中:

3款常青作品——《CityVille》、《FarmVille》和《德州扑克》都出自Zynga之手,这说明公司始终在市场上居于主导位置,其策略是通过发行众多新作品及进行交叉推广维持自己的领先位置。但自那以后很多竞争公司都竭力发展自己的用户规模,旨在保留自己前10位置。

下面是2011年1月的10款热门作品。

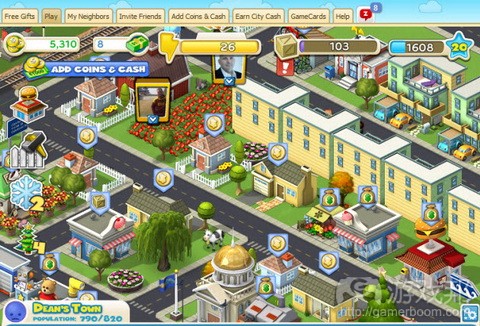

《CityVille》——Zynga:MAU 4890万;DAU 1040万

12月份的MAU排名:1

游戏发行于2010年底,是Zynga的首款城市管理模拟游戏,游戏自2011年1月MAU超过1亿后开始平稳发展。在2月和3月份,游戏DAU达到顶峰,约2100万。但自那以后《CityVille》的MAU和DAU就开始出现稳步下滑。游戏虽然依然保持第一位的位置,但其MAU和DAU相比高峰时期下降超过50%。与此同时,《CityVille》的DAU/MAU依然非常突出,全年都保持在20%。

《FarmVille》——Zynga:MAU 3170万;DAU 730万

12月份的MAU排名:2

游戏自发行来就一直备受关注,Zynga的这款农场模拟游戏的MAU和DAU在整个2011年都呈现稳步下滑趋势(游戏邦注:年初游戏的MAU和DAU分别是6000万和1600万)。和《CityVille》一样,这款游戏截至年末流失近一半用户。《FarmVille》的DAU/MAU在整个2011年起伏不定,游走于20%-30%之间,现在维持在24%,依然保持较高粘性。

《德州扑克》——Zynga:MAU 2890万;DAU 630万

12月份的MAU排名:4

2011年末,Zynga的在线扑克游戏依然保持在前10水平,甚至在头几个月还出现增长趋势(游戏1月份的MAU和DAU分别是3500万和700万,然后2月份达到高峰,分别是3800万和775万)。在维持8个月的稳定水平后,游戏开始流失流量。但和Zynga的《CityVille》和《FarmVille》相比(两款游戏在2011年间的用户流失量约是高峰时期的一半),《德州扑克》年末的用户量依然维持在2011年初的85%左右。游戏的DAU/MAU甚至还在2011年间有所提高,起初波动于16%-20%间,但从10月底到现在,始终游走于21%-23%。

《FrontierVille》——Zynga:MAU 120万;DAU 23万

12月份的MAU排名:83

由于游戏8月份推出独立扩充内容《Pioneer Trail》,Zynga的这款探险/角色扮演游戏2011年的表现有些复杂。2011年初,《FrontierVille》的MAU和DAU约是3000万和600万。截至《Pioneer Trail》发行时,原生作品的MAU和DAU跌至1200万和300万。起初,Zynga鼓励《FrontierVille》玩家安装新《Pioneer Trail》应用,最后它将此迁移设置成自动化模式,这样试图搜索或访问《FrontierVille》的用户会直接被引导至《Pioneer Trail》。《FrontierVille》如今只有120万MAU和24万DAU,其DAU/MAU是18%。相反,《Pioneer Trail》的MAU和DAU维持在530万和170万,其DAU/MAU非常惊人,约是30%,是12月份的25款热门Facebook游戏之一。所以虽然《FrontierVille》相比2011年初用户数量降低很多,但其后续作品依然受到很多用户的青睐。

《黑手党战争》——Zynga:MAU 270万;DAU 59万

12月份的MAU排名:37

Zynga的这款犯罪主题角色扮演游戏2011年的表现依然颇令人关注。《黑手党战争》2011年初的MAU和DAU水平创历史新高,分别是2000万和350万,但随后则逐步流失流量,截至年末用户数量只有年初的85%。与此同时,游戏2011年间的DAU/MAU出现适度增长,从1月份的15%提高至10-11月份的20%-25%。尽管Zynga于10月份强势发行《黑手党战争 2》,但原作的用户粘性依然有所提高。虽然续作流量很高(游戏邦注:当前MAU和DAU分别是740万和67万),但其DAU/MAU在过去几个月依然游走于7.5%-8.5%间。鉴于《黑手党战争 2》用户的稳步下滑(相比《黑手党战争》的稳定性而言),到2012年游戏原生内容的表现有可能会让续作黯然失色。

《咖啡世界》——Zynga:MAU 660万;DAU 150万

12月份的MAU排名:17

Zynga的餐厅模拟游戏用户数量相比年初流失率高达60%。但和Zynga《黑手党战争》一样,《咖啡世界》的用户流失伴随着粘性的提高。游戏1月份的DAU/MAU是18%,到2011年最后3个月,此数据变成22-30%。高粘性意味着这款2009年的游戏拥有众多忠实粉丝。

《金银岛》——Zynga:MAU 210万;DAU 41万

12月份的MAU排名:55

相比1月份的1500万MAU和300万DAU,Zynga的这款寻宝游戏在2011年间流失近83%用户。尽管用户流失很多,《金银岛》的DAU/MAU这一年间依然相当稳定,游走于20%-25%间。

《大富豪世界》——Digital Chocolate:MAU 240万;DAU 41万

12月份的MAU的排名:44

Digital Chocolate的这款城市模拟游戏2011年间的用户流失量高达80%,其DAU/MAU由1月份的22%降至10-12月份的16-18%。

《宠物社区》——EA-Playfish:MAU 620万;DAU 100万

12月份的MAU排名:19

EA Playfish的宠物照料模拟游戏相比1月份(当时游戏拥有MAU 1200万,DAU 225万)用户流失量超过50%。用户粘性整年都维持在较低水平,全年游走于12-16%。

《宝石迷阵闪电战》——EA/Popcap:MAU 870万;DAU 290万

12月份的MAU排名:14

在2011年1月份的10款热门游戏中,EA PopCap的休闲电子游戏今年表现最突出,如今用户依然维持在12个月前的70%。此外,游戏全年的用户粘性也很高,在26-36%间起伏。

值得关注的是,有些游戏在发行1-3年后依然持有较高DAU/MAU,高于20%。只有3款作品(《FrontierVille》、《大富豪世界》和《宠物社区》)当前的DAU/MAU接近15%。此比例虽然不是最佳水平,但依然代表较高用户粘性。因此多数2011年1月的热门作品2012年都有望继续给开发商带来丰厚收益。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

How January 2011′s Top 10 Facebook Games Are Doing in December 2011

By James Au

Here’s a look at where AppData‘s top 10 games of January 2011 are now in December 2011, as the calendar year draws to a close.

A year is typically the better part of a social game’s life cycle for titles launched on Facebook after 2009. During those first 12 months, a game will grow rapidly in first three months, peak in overall traffic, then begin to shrink over the following six months. During this shrinking period, the percent of daily active users as a percent of monthly active users (or DAU/MAU) will often decline toward 10%. Generally, we find that if engagement rates fall below 10% DAU/MAU, a game has a very strong chance of being sunsetted, as its developers seek to cut their losses.

By December 2011, almost all of January’s top 10 games have lost much of the traffic they had at the start of 2011. However, this does not necessarily mean they’re candidates for sunset in 2012. Many of these games maintain high levels of engagement, and probably continue to earn decent revenue for their developers. At least one game, EA PopCap’s Bejeweled Blitz, retained most of its traffic while increasing engagement levels through 2011.

At the start of 2011, these were the top 10 Facebook games by MAU, according to AppData:

In January 2011, top entry CityVille had the advantage of being the newest game among the first 10, having launched the month before. Still, several top games which launched in 2008 — Pet Society, Texas HoldEm, and Mafia Wars — also maintained ranks in the top 10. (The others in the January’s top 10 launched in mid 2010, with the exception of FarmVille, which launched in mid 2009.)

By the end of the year, Facebook’s top 10 had changed dramatically, with just three games in the January 2011 list ranking in the top 10 for December 2011:

The three January 2011 holdovers — CityVille, FarmVille, and Texas HoldEm Poker — are from Zynga, reflecting the company’s continued dominance in the market, and its strategy of maintaining the lead by releasing numerous new games and cross-promoting across its titles. However, several competing developers managed to grow their own audiences to attain top 10 status since then.

Here is where January 2011′s top 10 games stand now, according to AppData:

CityVille – Zynga: 48.9 million MAU, 10.4 million DAU

December rank, by MAU: 1

Launched at the end of 2010, Zynga’s city management sim enjoyed stratospheric growth in January 2011, when it reached over 100 million MAU. In February and March, the game attained a peak of daily active users (or DAU) of about 21 million. Since then, however, CityVille has experienced a slow but steady decline in both MAU and DAU. While it retains the number one position in December, its MAU and DAU have fallen by over 50% from its peak. At the same time, CityVille’s DAU as a percent of MAU has remained strong, at about 20%, throughout the year.

FarmVille – Zynga: 31.7 million MAU, 7.3 million DAU

December rank, by MAU: 2

Popular since its launch in 2009, Zynga’s farming sim steadily lost MAU and DAU through 2011, beginning the year with nearly 60 million MAU and 16 million DAU. As with CityVille, it lost about half of those users by year’s end. DAU/MAU for FarmVille has fluctuated throughout 2011, falling and rising between about 20 to 30%. It now stands at nearly 24%, retaining strong engagement rates (if many less total users.)

Texas HoldEm Poker – Zynga: 28.9 million MAU and 6.3 million DAU

December rank, by MAU: 4

At the close of 2011, Zynga’s online poker game maintains its place in the top 10, and even grew during the first few months. (The game had about 35 million MAU and 7 million DAU in January, then grew to a peak of about 38 million MAU and 7.75 million DAU in February.) After some eight months of relatively stable user rates, the game began losing traffic. However, compared to Zynga’s CityVille and FarmVille, which both lost about half their maximum number of users over the year, the HoldEm Poker game has retained about 85% of the total players it had at the start of 2011. The game even managed to increase DAU/MAU engagement rates over the year, at first fluctuating between 16 to 20% through 2011, but from late October to now, fluctuating between 21 to 23%.

FrontierVille – Zynga: 1.2 million MAU, 230 thousand DAU

December rank, by MAU: 83

The 2011 performance of Zynga’s adventure/RPG game is somewhat complicated, due to the launch of Pioneer Trail, a standalone expansion to the game released in August. At the start of 2011, FrontierVille had about 30 million MAU and 6 million DAU. By the time Pioneer Trail launched, the original game had dropped to about 12 million MAU and 3 million DAU. At first, Zynga encouraged FrontierVille players to install the new Pioneer Trail app, then eventually made redirection automatic, so that users attempting to search or access FrontierVille would instead be taken directly to Pioneer Trail. FrontierVille now has just 1.2 million MAU and 240,000 DAU, with a 18% in DAU/MAU. By contrast, Pioneer Trail maintains 5.3 million MAU and 1.7 million DAU, for an impressive DAU/MAU rate of about 30% and claimed a place on the top 25 Facebook games for December. So while FrontierVille has fallen far from its high usage rates at the beginning of 2011, its successor has inherited a relatively large and very committed base of players.

Mafia Wars – Zynga: 2.7 million MAU, 590,000 DAU

December rank, by MAU: 37

Zynga’s crime-theme role-playing game also had an interesting performance in 2011. Mafia Wars enjoyed a peak of about 20 million MAU and 3.5 million DAU at the beginning of the 2011, but steadily lost traffic through the year, down by 85% from its January totals. At the same time, the game enjoyed a modest increase of DAU/MAU in 2011, going from about 15% in January to between 20 and 25% from October to November. This increase in engagement occurred despite Zynga’s heavily promoted launch of Mafia Wars 2 in October. While the sequel still enjoys higher traffic (now 7.4 million MAU and 670,000 DAU), its DAU/MAU has fluctuated between 7.5% and 8.5% over the last couple months. Given Mafia Wars 2′s steady decline of players compared to Mafia Wars’ relative stability, it’s quite possible the original game will eclipse its sequel in 2012.

Café World – Zynga: 6.6 million MAU, 1.5 million DAU

December rank, by MAU: 17

Zynga’s restaurant sim has lost over 60% of the audience it had at the beginning of the year. However, as with Zynga’s Mafia Wars, Café World’s loss of total players was coupled to a gain in engagement. The game climbed from a DAU/MAU rate of about 18% in January, to between 22 and 30% in the last three months of 2011. This high engagement suggests the 2009 game has managed to maintain a large group of dedicated players.

Treasure Isle – Zynga: 2.1 million MAU, 410,000 DAU

December rank, by MAU: 55

Dropping from a peak of 15 million MAU and 3 million DAU in January, Zynga’s treasure hunting game lost some 83% of its audience in 2011. Despite this loss, Treasure Isle’s DAU/MAU ratio has remained relatively consistent and healthy through the year, fluctuating between between 20 and 25% for most of 2011.

Millionaire City – Digital Chocolate: 2.4 million MAU, 410,000 DAU

December rank, by MAU: 44

Digital Chocolate’s city sim lost some 80% of its traffic through 2011, and saw a decline of DAU/MAU from 22% in January, to between 16 and 18% from October to December.

Pet Society – EA-Playfish: 6.2 million MAU, 1 million DAU

December rank, by MAU: 19

EA Playfish’s pet care sim lost over 50% of the players it had in January (when it enjoyed 12 million MAU and 2.25 DAU). Engagement rates have remained relatively low through the year, fluctuating between 12 and 16% for most of 2011.

Bejeweled Blitz, EA/Popcap: 8.7 million MAU, 2.9 million DAU

December rank, by MAU: 14

Of all the games in the top 10 for January 2011, EA PopCap’s casual arcade game has seen the strongest performance this year, maintaining 70% of the players it had 12 months ago. It also enjoyed extremely high engagement rates throughout the year, fluctuating between 26 and 36% DAU/MAU through 2011.

It’s interesting to note that most of these games still maintain healthy DAU/MAU rates above 20%, even one to three years after their launch. Only three, FrontierVille, Millionaire City, and Pet Society, currently have a DAU/MAU rate closer to 15%. However, this rate, while not optimal, is still suggestive of relatively strong engagement rates. It’s therefore likely that most of January 2011′s top 10 will continue to generate revenue for their developers well into 2012.(Source:insidesocialgames)

闽公网安备35020302001549号

闽公网安备35020302001549号