VisionMobile称应用商店已成开发者首要选择

作者:Matos Kapetanakis

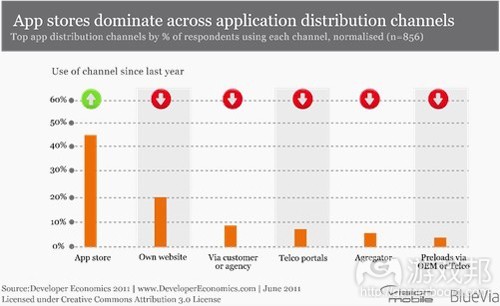

VisionMobile于今年6月份发布的2011年开发者经济报告显示,应用商店已经成为广大开发者创收的首要途径。超过45%的受访者表示,应用商店是其产品走向市场的第一渠道,而其他渠道(游戏邦注:例如自己的网站/门户、第三方聚合器、客户、电信门户网站等)的使用率则开始显著下降。

曾经在欧美占主导地位的电信门户网站已经失势,有开发者指出“平均每家运营商的门户网站每月应用下载量还不足100万次,而苹果App Store每月下载量就超过10亿次”。

用户覆盖面是开发者优先选择应用商店而非其他发布渠道的最主要原因,50%以上通过苹果、谷歌、诺基亚、黑莓应用商店销售应用的开发者表示,获取更多用户是他们选择应用商店的首要原因。

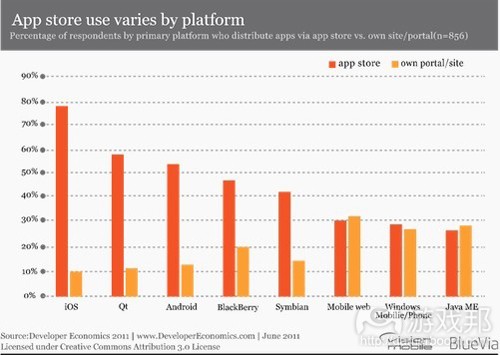

但报告也指出,各平台应用商店的使用率差异显著,与开发者自有门户/网站相比同,基于手机操作系统的原生应用商店使用率最高(如下图)。

从上图中可以看出,Windows Mobile/Phones开发者对自有门户/网站的使用率几乎与原生应用商店相同,报告认为其原因有三:首先,微软主要锁定Xbox Silverlight这两个刚进入移动领域的开发群体;其次,Windows Phone Marketplace发展迅速,但在应用数量上仍然落后于其他竞争对手;第三,发布于Windows Marketplace的产品仅限运行于Windows Phone设备。

应用商店垄断情况

尽管应用领域拥有许多发展机遇,但并非所有应用商店都会成为赢家,当前有70多个应用商店已经处于下风,仅有一小部分成功胜出,其中以苹果App Store和谷歌Android Market最为典型,从App Store、Android Market远甚于其他应用商店的下载量、产品数量可以看出,这个领域已经开始出现垄断现象。

从理论上看,开发者同时向多个应用商店发布产品,这似乎是个理想的选择。但实际操作却表明,应用市场的分裂现象远超乎人们想象,每个应用商店都有自己的一套开发者注册流程,应用审核流程、美术和文书要求、应用认证和批准条件、盈利模式选项、支付条款、税收和结帐条款等。这也就意味着开发者若要向多个应用商店发布同款产品,就需要付出巨大的边际成本。

此外,每个平台都有各自的开发学习难度,有些平台要求使用昂贵的开发工具或仅提供简陋的说明文件,这就在时间和资金层面上增加了开发者进入各个平台的门槛。

报告称Android平台出现了更多独立应用商店,例如Andspot、AndAppStore、SlideME和亚马逊等,它们在用户关注度和开发者发布产品等方面,与Android Market展开了竞争。运营商及OEM应用商店也相继涌现,加剧了应用市场分裂问题。

报告认为应用经济领域需要设定发布应用的单一入口(即每个平台一个入口),以及无数个销售渠道:

*一个应用提交流程,例如单个网站、单项合约、单个审核流程、单个计费/结帐系统以及每个平台的单个混合运营模式。

*无数个销售渠道,例如通过多种类型的定价、推广、捆绑和地区向用户销售应用,并帮助开发者更有效地销售产品。

应用收益及盈利模式

盈利是所有行业的最重要内容,但在应用经济领域,并非所有人都已成功淘金。

约30%受访者每款应用总计收益不足1000美元,这表明这些开发者实际上处于亏损状态(他们投入了大量时间和精力,而且有些平台的开发工具价格极高)。

那么,究竟哪个平台的应用最具盈利性?Symbian的盈利性最低,如果将其盈利指数设置为1,就可以更容易地比较其他平台应用盈利情况。iOS高居榜首,其开发者盈利性是Symbian同行的3.3倍,其次是Java ME(是Symbian的2.7倍),第三名是黑莓(2.4倍)。

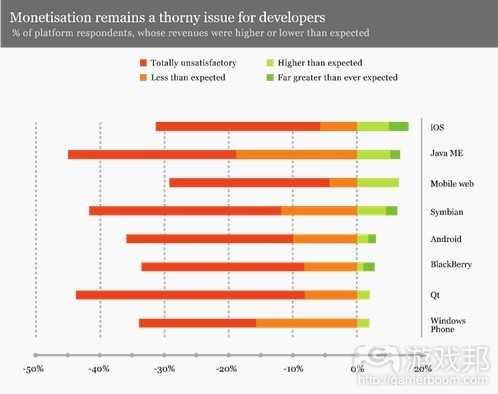

从开发者对实际营收的满意度来看,Java ME开发者每款应用平均收益虽然高于其他平台开发者(除iOS之外),但他们却普遍反映对实际收益较不满意。

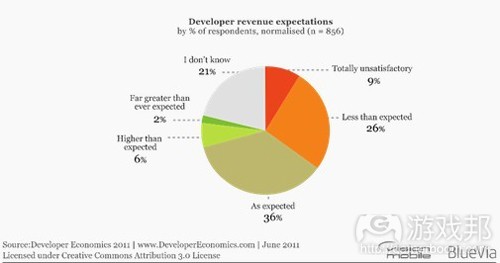

但从所有受访者的调查情况来看,每三名开发者中就有一人表示,应用实际收益符合自己的预期。

结论

首先,应用已经改变了人们搜索、发布和销售内容的方式;其次,应用商店已经成为开发者发布产品的首要渠道,而电信、聚合器、OEM等销售渠道的影响力已被削弱;第三,对开发者而言,盈利性仍然是开发者最为头疼的问题,但与此同时,仍有1000多家公司正接手iPhone和Android开发工作,开发人员的薪水也正呈上涨趋势。

游戏邦注:原文发表于2011年6月,所涉事件及数据均以当时为准。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

Developer Economics 2011 – Why app stores are a one-way streetMatos Kapetanakis Tweet this

[Which are the top app distribution channels for developers? Which platforms offer the highest revenue potential? In this part 2 of our 3-part Developer Economics blog series, Marketing Manager Matos Kapetanakis looks at how app stores have effectively re-written the distribution landscape]

App Store Boulevard

Since the launch of Apple’s App Store in 2008, developers found a market delivery channel that greatly reduced time-to-market and time-to-payment and provided a direct channel to consumers. The result: users started buying more and more smartphones, accessing app stores and downloading billions upon billions of apps.

Today, app stores have become the a one-way street for developers. Over 45% of the respondents in our Developer Economics 2011 report used an app store as their primary route to the market, climbing nearly 30% since last year. At the same time, we found that the use of other distribution channels (own portal/website, 3rd party aggregators, via customers, Telco portals) has greatly decreased since last year’s research.

The decline of traditional challenge comes as no big surprise; Telco portals, that once upon a time dominated content distribution in the US and Europe, have now lost their allure. “Downloads through operator portals are still less than one million per month on average per operator. Compare that to one billion per month downloads from the Apple App Store”, noted an executive at a mobile app development house who participated in our research.

But why do developers choose app stores over other distribution channels? Reach is by far the most important reason behind developers’ preference for app stores as a distribution channel. More than 50% of developers distributing through the Apple, Google, Nokia or BlackBerry app stores cite the ability to sell to more users as the primary reason for app store selection. (also, see individual app store ratings in the full report)

However, the use of app stores as a primary distribution platform varies greatly by platform. As we found in our research, the use of app stores is much more pronounced for platforms that have a native app store.

As some of you will be quick to point out, Windows Mobile/Phone developers use their own portal/site to an almost equal extent as their platform’s native app store. We attribute that to three factors: First, as we discussed in the previous post, Microsoft has tapped into two developers segments (Xbox, Silverlight), which are new to mobile. Second, the Windows Phone Marketplace is rapidly growing, but still lagging behind in terms of app volumes. Third, distributing through the Windows Marketplace has only become mandatory with Windows Phone.

The app store duopoly

Despite the many opportunities in this accelerating app economy, not all app stores enjoy the same level of success. Out of the 70+ app stores currently out there, only a handful have managed to emerge as winners. Out of those, the Apple App and Android Market are in a league of their own.

Together, the Apple App Store and Android Market hold over 700 thousand apps, while their cumulative downloads are somewhere in the area of 20 billion. While other app stores have also enjoyed a level of success, this huge gap means we are in effect witnessing an app store duopoly.

Theoretically, the most reasonable approach for developers would be to distribute their apps via multiple app stores. However, in practice, the app store landscape is far more fragmented than one might think; each app store has its own developer sign-up process, app submission process, artwork and paperwork requirements, app certification and approval criteria, revenue model options, payment terms, taxation and settlement terms. This implies that the marginal cost of distributing an application through one more app store is significant, contrary to popular perception.

Plus, there are added entry costs to each platform, in the form of time and money spent. Some platforms have a steep learning curve (see full report for each platform’s learning curve), while others have expensive tools or poor documentation.

Looking at Android, we see that more and more independent app stores, like Andspot, AndAppStore, SlideME and Amazon, are competing with Android Market for user attention and developer app submission. The same also applies to operator and OEM app stores. There is simply too much app store fragmentation.

We believe that the app economy needs a single entry point for application submission (one per platform), along with a million distribution channels:

- one app submission process, i.e., a single website, single contract, single approval process, single billing & settlement and a single mix of business models per platform

- a million distribution channels, i.e., a million different channels through which to retail and sell apps to consumers with a variety of prices, promos, bundles, and regional access that help developers more effectively market their applications.

App revenues and monetisation

The single most important aspect of any business is monetisation. But, in this gold rush of apps, not everyone is making money.

Around 30% of our respondents make less than $1,000 USD per application in total, which means they’re actually losing money, considering it takes months to develop an app and that some platforms have expensive tools.

Which platforms have the largest revenue potential? Monetisation differs from platform to platform, with Symbian having the lowest revenue potential, as our research indicated. Taking Symbian as having a revenue index of 1, we can compare its revenue potential with other platforms. iOS topped the chart, making 3.3 times more money per app than Symbian developers followed by Java ME (2.7x) and BlackBerry (2.4x).

Another interesting aspect is how the actual revenues compared to the expectations our respondents had. For example, while Java ME offers relatively high revenues per app, Java ME developers did not necessarily respond positively when we asked about their level of satisfaction with revenues (i.e. whether revenues were above or below their expectations).

The previous graph is quite telling. The good news? One in three developers see the level of revenues they expected. The bad news? On average, there are five times more developers who are dissatisfied with their mobile application revenues than there are satisfied developers.

To see the top revenue models, download the full report.

The big picture

What does it all mean? First and foremost, apps have irreversibly changed the way we discover, monetise and distribute content. Second, it’s not Android Market vs. the Apple App Store, but app stores as a whole that have become a one-way street for distributing apps, leaving Telcos, aggregators and OEMs in a diminished role as distribution channels. Third, monetisation may still be a pain point for a significant portion of the developer base, but at the same time 1,000s of companies are after commissioned iPhone or Android work and salaries are on the rise.

One last note: We have yet to see the potential of handsets as app retail outlets, but we believe that OEMs will soon be leveraging on their potential to bundle apps anywhere on the handset real estate and to any region. And, as we know, there’s a higher profit margin in real-estate than in the manufacturing business.(source:visionmobile)

上一篇:分析Zynga如何于2009年一举攻下Facebook平台

下一篇:分析玩家在游戏中的10大普遍情感

闽公网安备35020302001549号

闽公网安备35020302001549号