分析2011年3款Facebook游戏续作的表现

作者:James Au

随着许多流行Facebook游戏的开发循环进入成熟阶段,今年社交网络上发布的续作和扩展游戏数量超过以往。本文主要探讨开发商成功发布续作的内在挑战,分析近期的《Pioneer Trail》(游戏邦注:《FrontierVille》的扩展内容)、《Mafia Wars 2》和《Zoo World 2》这3款游戏续作和扩展内容的表现。

发布续作和扩展的挑战:用户诉求、用户转移障碍和应用ID帐号

从理论上来说,为用户量庞大的Facebook游戏开发续作或扩展显然是个获得盈利的机会。开发商可以通过在原游戏中增加信息、链接和安装奖励等服务将现有玩家转移到游戏续作中,同时用游戏续作中的新功能来吸引新玩家。

但是,需要注意的事项仍然不少。关键问题是,续作和扩展内容是否要在与原游戏相同的应用ID上运行。如果应用ID保持不变,将用户过渡到新应用中的难度会降低,但是这种战略也会面临新挑战。根据Facebook的应用政策,开发商更新应用时,不能对其原有的游戏玩法体验做出巨大的改变。所以,如果游戏续作的应用ID保持不变,那Facebook政策就会成为一大障碍,开发商无法采用那些可以增加新用户数量和提高其粘性的措施(游戏邦注:比如添加新的游戏玩法和扩展性内容)。

另一个方面的风险是,续作的潜在用户数量可能不及原游戏,现有用户或许不愿意安装和使用新应用。原版游戏的粉丝可能会认为续作的游戏玩法过于困难,或者会玩续作会影响到他们在原版中的进程。最糟糕的情况是,这种转移可能会让玩家在原版和续作中的投入时间都变少。

这种情况似乎已经出现,比如Playdom的角色扮演系列游戏《Mobsters》。根据AppData数据显示,其原版游戏在2009年8月的MAU超过100万,日活跃用户只有12万左右。当月,Playdom发布了《Mobsters 2: Vendetta》,该续作添加了更深层次的故事线路和主题性任务。一开始,续作不断成长,2009年末MAU数超过500万,DAU为40万。在续作成长之时,《Mobsters》的MAU迅速下滑,2010年初的数量不足10万,大概是原版游戏的玩家都被导向续作游戏。但是,《Mobsters 2》发布4个月后用户量也急剧下滑,2010年6月时MAU下滑至将近100万。现在,《Mobsters》的MAU只有6000,DAU只有200,其续作的MAU也只有19万,DAU只有3万。

现在,让我们来简单分析下2011年发布的3款主流游戏续作和扩展内容的表现:

从《FrontierVille》到《Pioneer Trail》——Zynga

Zynga的《FrontierVille》发布于2010年6月,它将农场模拟游戏玩法同RPG和冒险游戏元素结合起来。2011年初,这款游戏的MAU超过3000万,DAU超过600万。在达到这个顶峰之后,用户量开始下滑,当《Pioneer Trail》于今年8月发布时,原版游戏的MAU已经降至1200万左右。续作延续了《FrontierVille》在野外建立家园的主题,其游戏玩法让人回想起经典冒险游戏《俄勒冈之旅》(游戏邦注:事实上,原版游戏中已经有点“俄勒冈之旅”的迹象,它最终在续作中得到落实)。与《FrontierVille》相比,《Pioneer Trail》的游戏玩法更侧重于探索和冒险,玩家指挥4个各不相同的角色,完成故事任务,在游戏中不断发展下去。

为了将《FrontierVille》的玩家过渡到这个扩展内容中,Zynga在原版游戏中添加了到《Pioneer Trail》的链接,鼓励玩家安装这个新应用,在用户论坛中解释《Pioneer Trail》这款游戏“融合了两类游戏”。当《FrontierVille》的玩家安装了《Pioneer Trail》应用之后,他们在原版游戏中的进程(游戏邦注:包括《FrontierVille》中所建立的家园、所完成的任务、仓库中的物品等)会被转移到新应用中。如果玩家点击游戏中的“回到家园”,他们并不是被导向《FrontierVille》应用中的原家园,而是《Pioneer Trail》中原家园的复制地。该扩展内容发布一段时间后,Zynga强制将《FrontierVille》重新导向到《Pioneer Trail》,试图搜索或进入《FrontierVille》的玩家会被直接引入《Pioneer Trail》。

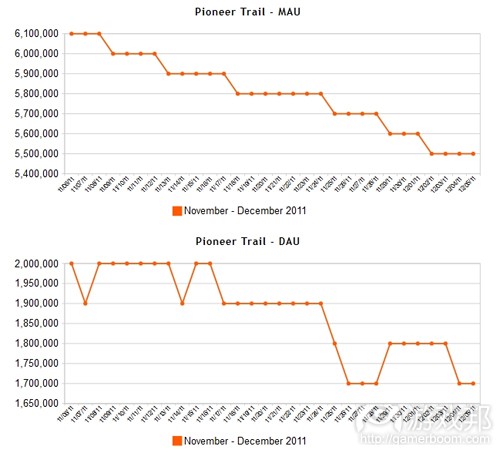

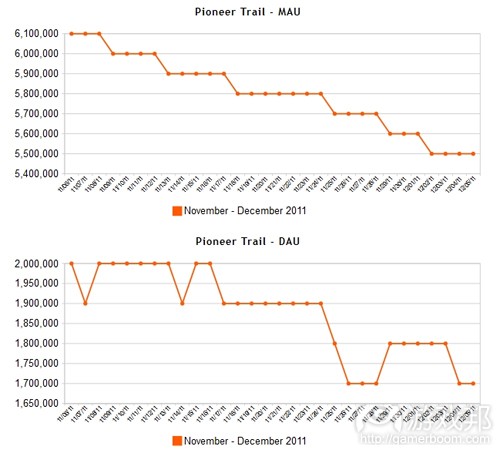

在《Pioneer Trail》发布数个月后,MAU数达到了2200万,随后开始失去用户。此刻,游戏的MAU数只有550万,DAU数只有170万,虽然游戏依然有着很强的用户粘性:在过去30天里,DAU与MAU的比率在30%到35%间浮动(游戏邦注:根据Inside Virtual Goods的数据显示,DAU/MAU超过20%表示游戏的用户留存率和盈利性很强大)。同时,《FrontierVille》的用户量持续缩水,目前的MAU为140万,DAU为26万,DAU/MAU比值为19%。虽然《Pioneer Trail》在发布后的MAU数一度逼近《FrontierVille》的最高点3000万,但仍比该数据少五分之一。同时,从《FrontierVille》到《Pioneer Trail》的用户过渡率并非100%,也就是说,多数《FrontierVille》用户在尝试过《Pioneer Trail》后就不再继续玩下去,而且他们也不再玩《FrontierVille》。从这个角度上来看,Zynga此次《FrontierVille》到《Pioneer Trail》的过渡算不上巨大的成功。

从《Zoo World》到《Zoo World 2》——RockYou

RockYou的动物饲养模拟游戏《Zoo World 2》发布于今年6月,其应用ID与原版《Zoo World》相同。尽管多数游戏玩法保持不变(游戏邦注:这是Facebook对维持相同ID的政策要求),但开发商在新版中增加了动物园自定义和建筑元素,将这两个方面整合到游戏的动物照顾层面中。比如,添加装饰物会影响到园中动物的健康状况,而后者是《Zoo World》系列游戏的核心游戏玩法元素。

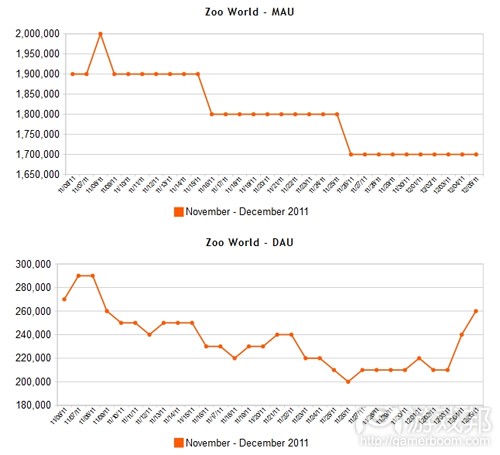

因为《Zoo World 2》使用与原版《Zoo World》相同的应用ID来运行,因而我们难以监测到新版应用的成长情况。此外,该公司一开始还在游戏中添加了“转换”选项,这样老玩家可以从续作中转回原版游戏。我们可以清楚地看到,在《Zoo World 2》发布前的6个月时间里,原版游戏用户量从900万MAU和70万DAU下滑到200万MAU和20万DAU。在《Zoo World 2》发布后,用户数量又开始增加,到8月和9月间MAU数达到800-900万。但是,在这段时间内,DAU/MAU依然很低而且持续下滑,介于15%和5%之间。这表明用户只安装和玩游戏一次后就离开(游戏邦注:可能是新用户和老用户只是登录看下游戏的更新情况)。

公司将用户量下滑的部分原因归咎于9月份发布的新广告平台,报告称尽管用户数量减少,但是10月游戏的每用户平均盈利是原来的两倍以上。RockYou在11月裁员过半,这或许会对游戏的更新和维护造成影响,加大我们对《Zoo World 2》的分析难度。现在该游戏的MAU为170万,过去30天内DAU/MAU在12%到16%间浮动。虽然续作在长达3个月的时间中推动用户增长,但是它无法重新回到2010年春的巅峰状态(游戏邦注:当时有将近2000万MAU和27.5万DAU)。但是,其续作能够留住相对庞大的用户并获得报告所称的盈利,这或许可以算作是中等程度的成功。

从《Mafia Wars》到《Mafia Wars 2》——Zynga

本文列举的最新续作是《Mafia Wars 2》,它可以算是Zynga旗下最古老社交游戏的接班人,原作登陆Facebook的历史可以追溯到2008年。原版内容是个回合制角色扮演游戏,即便到现在,该游戏依然保持着相当庞大和坚实的用户基础,MAU数310万,DAU数64万,DAU/MAU比率为21%。

原作的游戏玩法非常简单,但《Mafia Wars 2》可算是该系列游戏的颠覆性版本,新作的扩展性游戏玩法世界采用2.5D图像,有类似Zynga旗下《CityVille》的模拟化“帝国”建设和维护元素,并用动画来呈现打斗效果。Zynga于10月中旬发布《Mafia Wars 2》,进行了大量的报道和营销,同时对现有用户进行交叉推广。

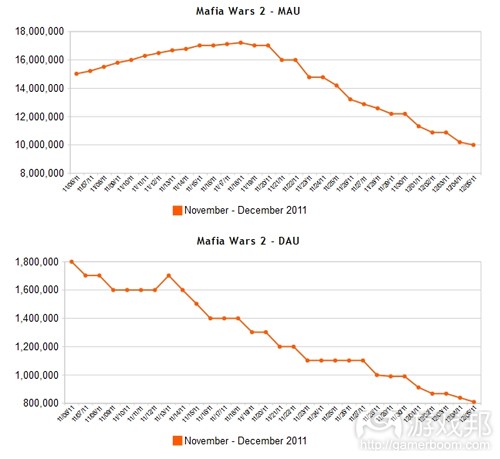

但是,Zynga仍然需要面对的挑战是,如何将原版游戏的玩家过渡到有着不同游戏玩法的新游戏中。在10月和11月期间,原版《Mafia Wars》的MAU在325万和350万间浮动。《Mafia Wars 2》在10月末的表现达到巅峰,MAU数量将近1700万,但是在11月用户量开始减少,现在的MAU只有1000万左右。更值得关注的是,DAU/MAU也在11月中旬下滑到不足10%,当前比例为8%。这表示,原版《Mafia Wars》的玩家仍然维持较高的参与度,但是他们对续作的兴趣并不像原版那么大。

现在还不宜过早判定《Mafia Wars 2》就是一款表现不佳的续作。Zynga最近几周忙于推广新游戏《CastleVille》,但有可能在短期内用新的内容和促销行动来提升《Mafia Wars 2》的用户量。但从目前总体情况来看,我们仍然可以断定在Facebook上发布成功游戏续作并非易事。

虽然2011年发布的游戏续作和扩展结果并不十分顺利,但《The Sims Social》、《It Girl》和《CityVille》等流行游戏明年可能都会相继发布续作。无论2012年发布的续作会面临何种境况,希望开发商能够避开在2011年所面对的问题。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

How Sequels & Expansions to Popular Facebook Games Compare to Their Predecessors

James Au

This year, as many of the most popular Facebook games reached a mature stage in their development cycle, the social network saw the launch of more sequels and expansions than any other year in the platform’s history. This report will consider the challenges inherent in doing this successfully, and then analyze the performance of three recent sequels/expansions: Pioneer Trail (an expansion to FrontierVille), Mafia Wars 2, and Zoo World 2.

Challenges of Launching a Facebook Game Sequel/Expansion: Audience Appeal, Transition Friction, App ID Considerations

In theory, creating a sequel or expansion to a Facebook game with strong engagement rates is an obvious revenue opportunity. The developer can transition existing players to the spinoff game by adding information, links, and installation incentives in the original game, while also creating a new audience drawn to the promise of new and enhanced features.

However, a number of concerns still loom. A key consideration is whether the sequel/expansion will run on the same app ID as the original. If that’s the case, difficulties with transitioning users to a new app can be alleviated, but this strategy comes with its own challenges: According to Facebook’s app policies, a developer may not make updates to an app which significantly changes its original gamplay experience. So while a game’s sequel may exist in the same app ID, Facebook’s policy precludes the kinds of enhancements (such as new gameplay and expanded content) that typically increase new user growth and engagement.

Another point of risk is that the potential audience for a sequel may not be as large as the original, and the existing audience may resist installing and staying engaged with a second app. Fans of the original may consider the follow-up’s gameplay to be too different, for instance, or a distraction from their progress in the original. In a worst case scenario, the transition may cannibalize players away from the first game, who then engage even less with the sequel.

A cannibalization effect seems to have occured, by example, in Playdom’s role-playing game franchise Mobsters. As recorded by our AppData traffic tracking service, the original game enjoyed over 1 million monthly active users and just over 120,000 daily active users going into August 2009. In that same month, Playdom launched Mobsters 2: Vendetta, which added a deeper story-line and themed missions set in numerous locations, among other enhancements to the original. At first, the sequel showed growth rates, exceeding 5 million MAU toward the end of 2009 with about 400,000 DAU. While the sequel grew, Mobsters saw a rapid drop in MAU, presumably as players of that game transitioned to the sequel, falling below 100,000 as it went into 2010. Four months after launch, however, Mobsters 2 also experienced sharp user drop, falling close to 1 million MAU by June of 2010. At the moment, the original Mobsters game has just 6,000 MAU and 200 DAU, and the sequel, just 190,000 MAU and 30,000 DAU.

With these considerations in mind, here’s a brief review of three prominent sequels/expansions released in 2011:

From FrontierVille to Pioneer Trail – Zynga

Launched in June 2010, Zynga’s FrontierVille combined farm sim gameplay with RPG and adventure game elements. By the beginning of 2011, the game had upwards of 30 million MAU and 6 million DAU. After this apex, user activity began a slow decline, and by August of this year, when Pioneer Trail launched, had declined to about 12 million MAU. The sequel continued FrontierVille’s general theme of wildness homesteading, with gameplay reminiscent of the classic adventure title Oregon Trail. (Indeed, the original game included an “Oregon Trail” sign, creating user expectation that the sequel finally fulfilled.) In contrast to FrontierVille, Pioneer Trail’s gameplay was focused more on exploration and adventure, where the player commands a party of four characters with a unique role, who must complete a series of story-driven quests to progress.

To transition FrontierVille players into this expansion, Zynga added a link to Pioneer Trail in the original game, and encouraged players to install the new app, explaining in the user forums that Pioneer Trail represented “two games in one.” When FrontierVille players installed the Pioneer Trail app, their progress in the first game (FrontierVille homestead, completed quests, inventory, etc.) was migrated over to the new app. If the player clicked the game’s “Return to Homestead” option, they were sent not to their original homestead in the FrontierVille app, but to a copy of it housed in the Pioneer Trail app. Shortly after launch, Zynga made the redirection from FrontierVille to Pioneer Trail mandatory, so that users attempting to search or access FrontierVille would instead be taken directly to Pioneer Trail.

In the months after Pioneer Trail’s September launch, the game attracted about 22 million MAU before it began losing users. At the moment, it has just 5.5 million MAU and 1.7 million DAU, albeit with very strong engagement rates: Over the last 30 days, DAU as a percent of MAU has fluctuated between 30-35%. (As supported by data from Inside Virtual Goods, games with a DAU/MAU of 20% or higher have strong user retention and monetization rates.) Meanwhile, FrontierVille continues to shed users; the app currently enjoys 1.4 million MAU and 260,000 DAU, for a 19% DAU/MAU ratio. While Pioneer Trail approached FrontierVille’s high of 30 million MAU at launch, it is now under a fifth of that number. While the user transition rate from FrontierVille to Pioneer Trail was not one-to-one, it’s still fair to say that most FrontierVille users who tried Pioneer Trail did not continue playing it — and that most did not continue playing FrontierVille, either. From that perspective, the move from FrontierVille to Pioneer Trail has been at best a very limited success for Zynga.

From Zoo World to Zoo World 2 – RockYou!

RockYou’s animal raising sim Zoo World 2 was launched this June within the original Zoo World app ID. While most of the gameplay remained the same (as required by Facebook to maintain the same ID), the developers added zoo customization and building elements, which were integrated into the animal care aspect of the game. For example, adding decorations influences the well-being of the zoo animals, which is the Zoo World franchise’s core gameplay element.

Since Zoo World 2 runs in the original Zoo World’s app ID, it is difficult to form an early picture of the app’s growth. In addition, the company at first gave the game a “toggle” option, so longtime players could switch from the sequel to the original game. We can see clearly, though, that in the six months leading up to Zoo World 2′s launch, usage had trended downward from about 9 million MAU and 700,000 DAU to about 2 million MAU and 200,000 DAU. With the launch of Zoo World 2, user growth returned, reaching 8-9 million MAU for the months of August and September. However, during this same period, DAU/MAU remained low, trending downward between 15% and 5%. This user activity pattern is suggestive of one-time installs or plays (presumably as new and returning users checked out the game’s updates).

The company attributes this waning usage in part to difficulties with a new ad platform that were addressed in September, and reports that despite the declining user numbers, has more than doubled the game’s average revenue per user in October. To further complicate analysis of Zoo World 2, RockYou laid off half its staff in November, which may have impeded updates and maintenance to the game. The game now has a MAU of 1,7 million and a DAU/MAU that’s fluctuated between 12 to 16% over the last 30 days. While the sequel helped drive user growth for about three months, it could not regain the numbers it enjoyed at peak in Spring 2010 (about 20 million MAU, 275,000 DAU). However, by retaining a relatively large audience while earning a reported profit, the sequel might be described as a modest success.

From Mafia Wars to Mafia Wars 2 – Zynga

The most recent sequel in this report, Mafia Wars 2, is the successor to one of Zynga’s very oldest social games, dating back to 2008 on Facebook. The original is a turn-based role-playing game, and as of today, the game still maintains a relatively large and engaged user base, with 3.1 million MAU and 640,000 DAU, for a 21% DAU/MAU ratio.

While the first game has very simple gameplay (outcomes to player moves are generally resolved by a single click and depicted in terms of static illustrations and player stat updates), Mafia Wars 2 is a vastly re-imagined version of the franchise, with 2.5D graphics in an expansive gameplay world, sim-type “empire” construction and maintenance similar to Zynga’s CityVille, and combat visually depicted in animated sequences. Zynga launched Mafia Wars 2 in mid-October with a large press and publicity campaign, along with heavy cross-promotion to its existing users.

However, Zynga still faced a challenge of transitioning players of the original game to this sequel that features very different gameplay. Throughout October and November, the MAU of the original Mafia Wars fluctuated between 3.25 million and 3.5 million MAU, while the sequel, which reached a peak of almost 17 million MAU in late October, began losing users through November, and now has just 10 million MAU. More concerning, DAU/MAU also dropped below 10% by mid November, and currently stands at 8%. This activity pattern is consistent with a low monetized game with light engagement rates. It appears that players of the original Mafia Wars, which still maintains much higher engagement rates, did not take to the sequel, at least with the same degree of interest as they do the first game.

It may be too early to write off Mafia Wars 2 as an ineffective sequel, however. While Zynga has devoted far more promotional energies to its new game CastleVille in recent weeks, it’s possible the company many soon try to boost user and engagement rates of Mafia Wars 2 with new content, offers, and promotions, especially in the run-up to its IPO. At the moment, however, it’s also fair to conclude that the game offers a cautionary example of the difficulty in launching a successful Facebook game sequel.

Despite the ambivalent results of sequels and expansions like these in 2011, it’s likely that the new year will see additions to The Sims Social, It Girl, and CityVille, among many other popular titles. Whatever games do get the sequel treatment in 2012, one hopes that developers will better avoid the shortcomings they often faced in 2011. (Source: Inside Social Games)

闽公网安备35020302001549号

闽公网安备35020302001549号