透过主要游戏创收情况把握Zynga发展态势

作者:Tony

种种迹象表明Zynga IPO蓄势待发。Zynga通过接连发行《Adventure World》和《黑手党战争 2》加快自己的更新脚步。此外,Zynga还举行新闻发布会,细述未来发展计划和游戏发行工作。Zynga还向SEC提交最新S-1文件。Zynga股票将以“ZNGA”代号在纳斯达克进行交易。

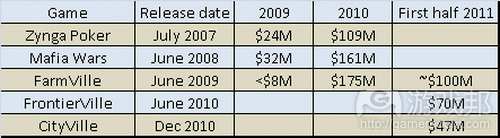

最新S-1文件公布2009、2010及2011上半年公司若干游戏的营收数据。事实上Zynga只提供这期间某些游戏的收益增幅情况,但根据以往数据和游戏发行时间,我们很容易算出游戏的总收益。下面是S-1文件公布的Zynga游戏各时期的创收情况。

《Zynga Poker》(发行于2007年7月)2009和2010年的收益分别是2400万美元和1.09亿美元;《黑手党战争》(发行于2008年6月)2009和2010年的收入分别是3200万美元和1.61亿美元;《FarmVille》(发行于2009年6月)2009、2010及2011上半年的收入分别是不到800万美元、1.75亿美元和1亿美元左右;《FrontierVille》(发行于2010年6月)2011年上半年的收入是7000万美元;《CityVille》(发行于2010年12月)2011年上半年的收入是4700万美元。

这些是收益数据,很大程度取决于Zynga预期生命周期的计算方法,但这是我们必须考虑的元素。再来是若干观察结果。《FarmVille》创造的总收益2011年底有望达到4亿美元。微软和Epic最近宣布,《战争机器 3》发行头一周就售出300万份,游戏总销售收入达10亿美元。也就是说,这款AAA游戏历时5年创收10亿美元。《FarmVille》有望在2年半内达到此收益水平的40%。包括《FarmVille》,《黑手党战争》、《Zynga Poker》、《FrontierVille》和《CityVille》的总收益都已或将于今年底达到1亿美元。1亿美元相当于全价掌机游戏售出200万份所创造的收益,所以算是非常不错。我原本觉得《CityVille》的收益相比《FarmVille》会更高,结果如何只有等到未来的季度销售数据报告揭晓,我们就能够知晓该游戏是发展步伐慢,还是创收能力低。

此前众人盛传Zynga是因市场环境而推迟IPO进程,而我怀疑这更多是由于公司日益恶化的运作情况,及Zynga不想自己刚上市,头季度表现就不尽如人意。的确,在Zynga公布的6月份季度报告中,公司注册用户首次出现连续下滑,盈利水平也明显出现下滑。近来公司频繁发行新作,且市场情况也有好转,Zynga正在加快脚步,顺势把握此天赐良机。我觉得Zynga上市应该不会拖延太久。EA、迪斯尼等竞争者势头迅猛,尽管市场新作品层出不穷,但Zynga的活跃用户规模依然呈扩大趋势。

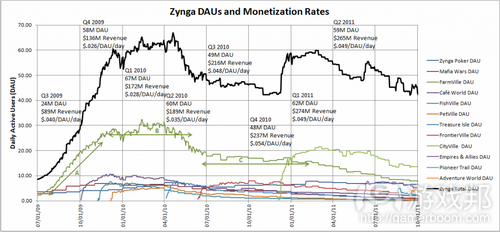

下表是Zynga从2009年第3季度到2011年第3季度的DAU数量及游戏季度营收情况。

彩色曲线代表Zynga主要作品的DAU情况。黑色曲线代表Zynga DAU的总量。黑线所显示的数据只是各主要作品之和,所以要比Zynga的实际DAU数量少几百万。

值得注意的是,Zynga DAU总量在2010年第2季度达到顶峰。此后,Zynga陆续推出许多热门作品,包括Facebook最杰出的游戏《CityVille》,尽管如此,公司后来的DAU数量还是无法超越2010年第2季度的水平。其实你会发现Zynga目前的DAU数量相当于《CityVille》未发行时的水平。

另一值得关注的有趣之处是公司DAU每天的人均创收趋势。其Rev/DAU在2009年第3季度及2010年第3季度–2011年第2季度达到历史最高。我觉得这完全符合社交游戏的生命周期。以《FarmVille》为例,我将游戏划分成3个阶段,分别是“A”、“B”和“C”。阶段“A”是游戏发行,然后迅速被接受。这些初期用户通常是给游戏带来丰厚收益的狂热粉丝。阶段“B”通常是DAU数量达到极限的时刻。此阶段的用户获取成本更高,所创造的收益也不如初期用户多,因此用户获取进程就会开始终止,DAU数量就会开始下滑。接着就进入阶段“C”,在这个阶段,忠诚度较低的用户就会离开游戏,只留下高度忠诚的用户,因此rev/DAU就会再次出现上升。从表中你可以发现,Zynga rev/DAU最高的阶段是2010年第4四季度,也就是《FarmVille》进入阶段“C”,而《CityVille》刚刚步入阶段“A”的时候。

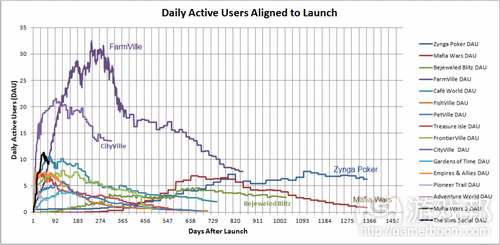

Zynga在《FarmVille》之后所发行作品的生命周期都有所缩短。我的意思是说这些作品更早达到DAU高峰,然后很快开始下滑。下面是Facebook主要作品在发行后的DAU变化。

表中包含Zyang及其他公司的热门作品。你会发现存在这样的既定模式:游戏在头3-4个月达到高峰,然后开始逐步下滑。但这也存在例外情况。《 Zynga Poker》发行4年后DAU依然处在接近高峰时期的水平。《黑手党战争》推出2年后,DAU才达到高峰。《宝石迷阵闪电战》亦是如此。

Zynga的主要问题是目前公司的两款主要作品都处在逐步下滑中,随后发行的作品就巅峰DAU水平和寿命期限而言,都不如之前成功。除非Zynga证明自己能够克服此问题,否则我很怀疑其估值是否能够达到之前预测的水平(游戏邦注:即150-200亿美元)。

Zynga无疑非常擅于将既有用户转移至新作品,如今他们似乎也开始瞄准掌机领域的玩家。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

Zynga IPO on Track

By Tony

All signs indicate that it is full steam ahead with Zynga’s IPO. Zynga has picked up the pace of game releases with the recently launched Adventure World and Mafia Wars 2. Zynga also held a press event where they detailed future plans and game releases. Zynga also filed another updated S-1 with the SEC. Zynga’s shares will trade on the Nasdaq under the symbol “ZNGA”. I have gone back and tagged all the relevant posts for convenience.

Included in the updated S-1 filing were revenue figures for specific games for 2009, 2010, and the first six months of 2011. Actually Zynga only provided the increases in revenue for each of those periods from specific games, but it was easy enough to figure out roughly the total revenue contributions from past period figures and when the games launched. Below are the revenue contributions for the periods I could determine from the information provided in Zynga’s S-1.

Zynga Poker (launched in July 2007) contributed $24 million in 2009 and $109 million in 2010; Mafia Wars (launched in June 2008) contributed $32 million in revenue in 2009 and $161 million in 2010; FarmVille (launched in June 2009) contributed less than $8 million in revenue in 2008, $175 million in 2010, and roughly $100 million in the first six months of 2011; FrontierVille (launched in June 2010) contributed $70 million in the first six months of 2011; and CityVille (launched in December 2010) contributed $47 million in the first six months of 2011.

These are revenue figures, not bookings, so it is subject to Zynga’s expected lifetime accounting methods, but it is all we have to work with. A couple observations. FarmVille’s life to date revenues are on track to reach $400 million by the end of 2011. To put that into perspective, Microsoft and Epic recently announced that with the 3 million units sold in the first week for Gears of War 3, the franchise had eclipsed $1 billion in lifetime sales. That is three AAA blockbuster games over a period of almost 5 years to reach $1 billion in sales. FarmVille will have reached around 40% of that in 2 1/2 years. Besides FarmVille, Mafia Wars, Zynga Poker, FrontierVille, and CityVille all either already surpassed, or will by the end of this year, $100 million in lifetime sales. $100 million in revenue is like a full priced console title selling roughly 2 million units (more if you are figuring profits instead of just revenue), so that is not bad at all. I would have thought that CityVille’s revenues would be higher, so it will be interesting to see when future quarter figures are released if it was just a slow starter or really is a lower monetizer than FarmVille.

When word first hit awhile back about Zynga delaying its IPO due to market conditions, I suspected that it might have had more to do with worsening performance and Zynga not wanting its first quarter as a public company to be a poor one. Indeed, when Zynga reported its results for the June quarter it revealed its first ever sequential decline in bookings and dramatically reduced profitability. With an increased pace of game releases and an upturn in the general markets it appears that Zynga is moving quickly to take advantage of this window of opportunity. I do not think Zynga can afford to wait much longer. Competitors such as EA and Disney are coming on strong, and Zynga continues to struggle to grow overall active users despite numerous game launches.

Below is a chart I made showing Zynga’s DAU (daily active users) and quarterly game revenues from Q3 2009 through Q3 2011.

Shown in various colors are DAUs for Zynga’s major games. Shown in black is Zynga’s total DAUs. The black line is simply the sum of the major games plotted, so it is a couple million lower than Zynga’s actual total DAUs.

It is important to note that Zynga’s total DAU count peaked in Q2 2010. From that quarter on Zynga released several major games, including the most successful Facebook game of all time – CityVille, and despite that has not managed to surpass its peak DAUs reached in Q2 2010. In fact you will note that Zynga’s current total DAU count is roughly back to where it was before CityVille was released.

Another interesting thing to note is the trend in revenue per DAU per day. Rev/DAU was highest in Q3 2009 and Q3 2010 through Q2 2011. I believe this can be explained by the life-cycle of social games. As illustrated in the case of FarmVille, there are three phases which I labeled “A”, “B”, and “C”. Phase “A” is the release and rapid adoption of a game. These early adopters are likely to include the game’s most enthusiastic players who monetize at a higher rate. Phase “B” is characterized by a topping out in DAU count. Players acquired during this phase may have had higher acquisition costs and not monetized as well as the early adopters, and thus acquisition efforts are stopped and DAU count begins to drop. This leads to phase “C” where the less engaged players have left the game, leaving only the more dedicated players leading to an increase in rev/DAU again. Looking at the chart, you will observe that Zynga’s highest rev/DAU quarter was in Q4 2010 when FarmVille was in phase “C” and CityVille was just ramping up into its phase “A”.

After FarmVille’s success the life-cycles of Zynga’s subsequent releases became more compressed. By that I mean they reached peak DAU count much earlier, and began to decline much sooner as well. Below is a chart I made showing DAU count for major Facebook games aligned to their launch day.

Included on the chart are all of Zynga’s major games along with some of the most successful games not made by Zynga. You will note that there is a dominant pattern of games peaking in DAUs within the first 3-4 months or so and then beginning a steady decline. There are a few notable exceptions. Zynga Poker is still near its peak DAU count nearly 4 years after release. Mafia Wars didn’t reach peak DAU until nearly 2 years after release. The same with Bejeweled Blitz.

Zynga’s main problem is that its two biggest games are in steady decline and all subsequent releases have been less successful in terms of peak DAU and longevity. Unless Zynga demonstrates that it can overcome this problem I would be wary of Zynga if it ends up trading at valuations mentioned previously ($15-$20 billion).

One last note on Zynga, raptr (the social network for gamers) has been putting out some interesting reports lately based on their internal data. Here is an interesting report they put out on Zynga. Zynga is certainly adept at funneling players from their own games to their new releases, and appear to be making inroads with console game players as well.(Source:tsanalysis)

闽公网安备35020302001549号

闽公网安备35020302001549号