分析预测《The Sims Social》的营收和发展潜力

作者:James Au

虽然《The Sims Social》2011年的流量似乎难以超越Zynga的《CityVille》,但游戏有望成为Facebook收益最高的作品之一。

EA Playfish的这款生活模拟游戏因其显著发展而备受媒体关注,但随着游戏开始步入成熟阶段(游戏邦注:即流量减少,但人均收益提高),我们开始将关注焦点转移至游戏的潜在收益,预估其年收益至少会达到8200万-1.63亿美元。我们的看涨预测是基于游戏当前的覆盖族群和营收情况,以及EA Playfish未来几季度的扩充计划和《模拟人生》品牌的总体实力。此报告将详细陈述此营收预测背后的关键要素。

《The Sims Social》的用户族群

《The Sims Social》执行制作人Tom Mapham表示,这款游戏的主流用户是25-35岁族群,女性略占优势。Mapham认为这些玩家很大部分都是年轻时熟知《模拟人生》的PC或掌机玩家。

此用户分布模式与Playfish先前作品的主流用户形成鲜明对比,例如《Restaurant City》,这款游戏65%的玩家都是女性,主要是25岁或以下的群体。相比这些作品或其他热门社交游戏,《The Sims Social》的用户族群更年长,男女比例更均衡。这给营收带来显著影响:据数据显示,18-34岁的男性玩家相比其他族群更倾向在免费模式游戏中掏钱。若Mapham的观点正确,此族群的用户将给《The Sims Social》创造巨大收益,连同那些倾向在游戏中消费的“Facebook妈妈级玩家”。

营收:收入预测和《The Sims Social》的虚拟商品

我们预测《The Sims Social》年收益有望增至8200万-1.63亿美元是基于以下两大假设:

——《The Sims Social》用户人均每月创造1-2美元收益。这是收益颇佳的模拟游戏典型的创收潜力。

——EA Playfish能够维持或超越游戏当前用户粘性水平一整年。

《The Sims Social》当前有680万DAU,因此我们预测游戏每月能够创收680万-1360万美元,那么一年就是8200万-1.63亿美元。但游戏的总收益可能会更接近最高极限,这要归功于游戏拥有大量愿意掏钱的用户(见上),EA Playfish的扩充计划及公司的销售计划(见下)。

此估值居于两位权威电子游戏分析师的预测范围之内。M2 Research高级分析师Billy Pidgeon预测《The Sims Social》年收益有望达到1.1亿,或是介于1-1.2亿。他预测数值假设3%-5%的玩家会转换成付费用户,3%-5%的付费用户会转换成“鲸鱼用户”(游戏邦注:这里是指每月至少在一款游戏中投资25美元的用户)。Pidgeon的营收估值也将8个月后游戏会流失部分用户的情况考虑在内,但这依然是个相当高水平的整体转换率。关于这点,他引用Raptr(这是瞄准用户的游戏追踪服务公司)10月公布的分析报告,报告称有许多游戏用户转向EA Playfish的这款Facebook游戏。Pidgeon强调称1.1亿美元是保守估计,即便考虑到社交游戏市场的不稳定性,“游戏还是非常有望取得超乎此估值的收益”。

另一位分析师是Wedbush Morgan的Michael Pachter,他预计《The Sims Social》将取得8000万-1.6亿美元的年收益。他表示,“Electronic Arts最近在某会议上表示,公司预计每位DAU将带来2-4美分的收益。所以将1000万DAU X 365天 X 0.02美元,所得结果大约是7300万-1.46亿美元。”但他公布的预算结果是8000万-1.6亿美元。

许多接近或超过1.63亿美元的看涨预测都是基于游戏拥有高比例的25-35岁男性族群,这些用户更倾向在游戏中掏钱。除此之外,《The Sims Social》最近和即将问世的添加内容也大大提高游戏的收益潜力。

《The Sims Social》的销售内容:分类和趋势

就某些带来丰厚收益的《The Sims Social》虚拟商品而言,Playfish的Tom Mapham谈到两类商品:

机制或强化消耗品——扩充或强化玩家玩法的一次性道具,如能量补充道具。

耐用虚拟商品——能够持久存在于游戏环境中的道具。在《The Sims Social》中,这主要针对玩家虚拟角色和虚拟房屋的装饰品,或是满足虚拟角色需求的功能道具。需求机制是《The Sims Social》的核心玩法要素,这是游戏的特殊收入来源,在这里玩家或多或少需要购买床和马桶之类的道具,以在游戏中获得优胜条件。

耐用虚拟商品允许新玩法体验——创建上述满足需求的道具,这类虚拟商品能够让玩家在购买后参与不同玩法活动。例如,单人床允许玩家的虚拟角色进行睡觉或小眠活动,而更昂贵的双人床道具则允许虚拟角色执行睡觉、打盹和同异性共度良宵操作。其他道具(游戏邦注:如立体声或露台),允许虚拟角色跳舞。这些基于道具的互动构成病毒式传播要素,玩家能够分享其他玩家的Facebook Wall活动,从而吸引更多用户购买这些道具。

《The Sims Social》的未来发展潜力

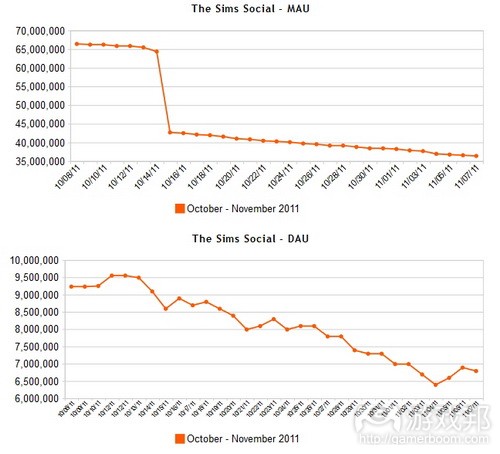

正如下列表格所显示的,《The Sims Social》最近的DAU和MAU都步入滑坡阶段,因为游戏开始步入成熟阶段。

多数社交游戏都会在问世后的第3-4个月出现削弱趋势,因为此时终身价值较低的用户纷纷退出游戏,只有高终身价值的用户依然继续存在。但在EA 10月下旬的第二季度FY2012营收会议上,公司主管暗示,EA计划通过“扩充计划”带动第二波的用户增长。这个术语可以运用至小范围的更新内容或更大玩法调整或补充内容。虽然公司没有透露具体细节,但EA Playfish的Mapham表示,这些新功能同《模拟人生》的热门扩充内容类似,这些内容会带来新玩法体验——例如,PC游戏《模拟人生 3》最近发行的宠物扩充内容。鉴于《模拟人生》扩充内容过去的表现和社交游戏当前试验的类似内容,这些补充内容有望创造持续1-2个月的新发展势头。

此外,EA目前正在探索新商品选择,这有望带来新用户。例如,公司在10月份发行价值15美元的Facebook Credits礼品卡,贴有《The Sims Social》商标,其中包含特殊《The Sims Social》道具。若礼品卡在圣诞节期间的销量不错,将会在沃尔玛出售。我们的“Future of Social Gaming 2011”报告预测,预付卡市场2010年总营收约为2-2.5亿美元,2011年的复合增长率有望达到50%-100%。这些收入多半来自《The Sims Social》之类的热门Facebook游戏。根据保守估计,《The Sims Social》的3650万MAU中,约有3%-5%用户会购买这些沃尔玛礼品卡。这会带来1600-2700万美元的收入(游戏邦注:还有游戏创造的直接收益)。

除沃尔玛预付卡外,《模拟人生》的既有品牌知度名的影响也不容忽视。《模拟人生》售出1.4亿多份,包括自原始作品2000年初推出以来各平台的续集和扩充内容(游戏邦注:其最新扩充内容《Sims 3: Pets》最近刚入驻PC、Mac、 PlayStation 3、Xbox 360、Nintendo 3DS、Wii和Nintendo DS平台)。随着此扩充内容和其他《模拟人生》填充内容的知名度和销售好势头不断延续至假期结束,有些玩家也会将注意力转移至《The Sims Social》。但多数社交游戏还是基于体验内容的好坏而或兴或衰,但EA Playfish的补充内容也有超过10年的市场知名度以及广泛的品牌实力。

《The Sims Social》在社交游戏历史中的地位

《The Sims Social》是款独一无二的社交游戏,不论是就其PC原生品牌,还其在Facebook获得的显著发展而言。鉴于游戏规模庞大,EA影响巨大,且未来EA会继续在Facebook平台推陈出新,而Zynga的IPO计划也即将临近,媒体必然会将这款游戏同Zynga的《CityVille》进行大肆比较。但此比较缺乏前提,《The Sims Social》是款截然不同的作品,游戏相对较年轻,入驻Facebook只有83天。但在探究《The Sims Social》营收情况的过程中我们收获颇多,从中知晓随着新游戏类型纷纷入驻社交平台,这类游戏将找到更多新创收方式。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

The Sims Social: Revenue Forecast and Growth Potential

By James Au

While it looks like The Sims Social may have lost its chance to pull ahead of Zynga’s CityVille in traffic during 2011, the game is on track to be one of the highest-grossing Facebook games to date.

EA Playfish’s life simulation game has captivated the media with its massive growth, but as the game enters the mature part of its lifespan — where traffic decreases as average revenue per user rises — we turn our attention to the revenue potential, estimating an annual run rate of at least $82 million to $163 million. Our bullish estimate is based on the game’s current demographic spread and monetization activity, EA Playfish’s probable expansion plans in the next few quarters, and the overall strength of the Sims franchise brand. This report will explore key factors behind this revenue forecast in greater detail.

Demographics of Sims Social

Tom Mapham, executive producer for The Sims Social, reports that the game’s largest player demographic is between 25-35, slightly skewed female. Mapham believes a significant percent of these players were PC or console gamers who became familiar with the Sims franchise in their teens.

This demographic pattern contrasts significantly with the bulk of previous Playfish games, such as Restaurant City, which is 65% female and a majority of players 25 and younger. Compared to these and many popular social games, The Sims Social appeals to an older, more gender-balanced playerbase. This has important implications for monetization: According to data collected for our Inside Virtual Goods report series, male gamers between the ages of 18 to 34 tend to monetize in freemium games at higher rates than most other demographics. If Mapham is right, it’s probable this segment will contribute significant revenue to The Sims Social, joining the “Facebook moms” segment who are already prone to monetize at high rates.

Monetization: Revenue Estimates and Virtual Goods in The Sims Social

Our forecast of The Sims Social’s $82 million to $163 million annual run rate is based on two key assumptions:

- That The Sims Social game generates $1 to $2 in revenue per month per daily user, per month. This is a typical revenue pattern for a well-monetized simulation game, according to Inside Virtual Goods.

- That EA Playfish can sustain or exceed the game’s current levels of engagement for a full year.

The Sims Social currently has 6.8 million DAU, and therefore, we estimate it to be earning $6.8-13.6 million in revenue per month, which annualizes to $82-163 million. However, it’s probable that total revenue will be closer to the high end of this forecast, due to the game’s very monetizable user demographics (see above), and EA Playfish’s expansion plans and merchandising (see below).

This estimate is within range of forecasts from two leading video game industry analysts. The first, M2 Research Senior Analyst Billy Pidgeon, estimates that Sims Social will earn $110 million in annual revenue or fall somewhere in a range of $100 million to $120 million. His forecast assumes that 3 to 5% of the playerbase will convert to paying customers, with 3 to 5% of that monetized segment becoming “whales,” (defined here as users that spend in excess of $25 per month on at least one game). Pidgeon’s revenue estimate also takes into account a certain percentage of churn-out after eight months, and relatively strong overall conversion rates. In this, he cites an October analysis by Raptr, a consumer-facing gameplay tracking service, which reports strong conversion of its userbase to EA Playfish’s Facebook game. Pidgeon stressed that $110 million is a conservative estimate, “and it could certainly over-perform,” even taking into account the volatile market of social gaming.

The second analyst, Wedbush Morgan’s Michael Pachter, estimates The Sims Social to be earning $80 million to $160 million in annual revenue. “Electronic Arts said at a recent conference that it expects 2 to 4 cents per DAU,” he tells us. “So roughly 10 million DAUs time 365 days times $.02 equals $73 million at the low end and $146 million at the high end.” For his published estimate, he rounds up to the $80million to $160 million.

Again, the more bullish forecast which approaches or exceeds $163 million in annual revenue is due to the high number of male gamers 25-35 playing The Sims Social, who tend monetize at higher rates than most other age/gender segments. On top of this, recent and upcoming additions to the game will also increase Sims Social’s revenue potential.

What Sells in Sims Social: Categories and Trends

In terms of the particular virtual goods that generate the most revenue in The Sims Social, Playfish’s Tom Mapham reports two categories:

Gameplay or consumable boosts — One-use items that expand or enhance a player’s gameplay, like energy refill items.

Durable virtual goods — Items that are persistent in the game environment beyond a single use. In The Sims Social, this is largely decoration items for the player’s Sim, the Sim’s virtual home, or items with functional benefits that satisfy the Sim’s needs. As the needs mechanic is a core gameplay element to The Sims Social, this provides a unique revenue stream for the game where players are more or less required to purchase items like beds or toilets to achieve winning conditions in the game.

Durable virtual goods that enable new gameplay experiences — Building off of the needs-satisfying items described above, this category of virtual good allows the player to engage in different gameplay activities when purchased. For example, a single-bed allows the player’s Sim to perform sleeping or napping actions while a more expensive double-bed item allows the Sim to engage in sleeping, napping, and sexual intercourse actions (referred to in-game as “WooHoo”). Other items — like a stereo or a gazebo — allow Sims to dance. These item-based interactions also feature a viral component where a player can share the activity on other players’ Facebook Walls, thereby attracting more users to purchase the item.

Near-Future Growth Potential for Sims Social

As our AppData chart below indicates, The Sims Social has recently entered a period of decline across monthly and daily active users as the game transitions into the mature part of its lifespan. (Note that the mid-October sharp drop in MAU reflects a Facebook update to its accounting methods for active users across all apps.)

It is typical for most social games to experience a tapering off effect in their third or fourth month as users with lower lifetime value exit the game and high lifetime value users remain. However, during EA’s Q2 FY2012 earnings call in late October, executives hinted that the company planned to drive second stage user growth in The Sims Social with “expansions.” This term can be applied to small-scale content updates or larger gameplay experience adjustments or additions that run within the app.While declining to detail specifics, EA Playfish’s Mapham indicates that these new features would be similar to the Sims franchise’s popular expansion packs, which tend to offer new gameplay experiences — for example, the recently-released Pets expansion for The Sims 3 PC game. Based on both past performance of Sims expansions and social games currently experimenting with similar content, these additions will likely drive a new growth curve that lasts approximately one to two months.

Additionally, EA is currently exploring merchandising options that could bring new users into the game. For example, in October, the company launched a $15 Facebook Credits gift card branded with The Sims Social that also included a special Sims Social item included in the purchase. Good through Christmas, these gift cards will be sold at Walmart, placing The Sims Social in one of the world’s largest retail chains. Our “Future of Social Gaming 2011” Inside Virtual Goods report estimated the total market opportunity for prepaid cards to be $200-250 million in 2010 revenue, with compound growth rates of 50% to 100% expected for 2011. Much of this revenue will be earned by top Facebook games like The Sims Social. For a rough and conservative estimate, assume 3-5% of The Sims Social’s monthly 36.5 million users purchase one of these Walmart cards (or are given them as gifts). This would translate to $16 to $27 million in revenue on top of revenue earned directly through the game.

In addition to the Walmart prepaid card, the existing brand awareness of The Sims franchise cannot be overstated. The Sims has sold over 140 million copies, including sequels and expansion packs across multiple platforms since the original game launched in early 2000, with the latest expansion, Sims 3: Pets, just released for PC, Mac, PlayStation 3, Xbox 360, Nintendo 3DS, Wii, and Nintendo DS. As awareness and sales of this expansion and other Sims offerings continue over the holidays and beyond, expect some carry over interest to benefit The Sims Social. Whereas most social games rise or fall on the strength of the game experience, EA Playfish’s offering also has over a decade of market awareness and broader franchise strength to draw from.

Final Thoughts on The Sims Social’s Place in Social Gaming History

The Sims Social is unique among social games both in its PC game franchise origins and in the massive growth achieved on the Facebook platform. Given the both the game’s size and the clout of its developer, it’s inevitable that comparisons to Zynga’s CityVille will dominate media discussion as EA continues to release games on Facebook and Zynga moves closer toward its IPO. This discussion lacks context, however, as The Sims Social is a completely different gameplay experience and a much younger product with just 83 days of life on Facebook so far. Rather, we learn more from examining the revenues of The Sims Social, finding that as new game types are adapted to social network platforms, games kind find new — and more profitable — ways to monetize.(Source:insidesocialgames)

闽公网安备35020302001549号

闽公网安备35020302001549号