实例解析判断Facebook游戏发展潜力的5个标准

作者:James Au

回头看看早期社交游戏的发展,也许我们便能够判断Facebook游戏是否真正获得了实质性的成功,或者只是徒有大量用户的昙花一现。

因为Facebook拥有广大的用户基础,所以对于任何一款游戏来说,只要在这个平台上发行短短数周后,便能够获得上百万甚至是上千万的游戏玩家,有些游戏甚至因此获得了爆炸式的巨大成功。然后,如果我们是按照用户粘性以及用户留存率来定义一款游戏的“成功”,那么这些看起来风风光光的Facebook游戏也就很难与“成功”这个词沾上边了。通常来看,一款Facebook游戏能够在发行第一个月便获得上百万的玩家,但是也会在后来的几个月中丢失掉大量玩家,或者说,这些突然涌进游戏的大量玩家很难成为游戏的日活跃用户(而很难为游戏带来盈利)。

幸运的是,仍有很多潜在因素能够为游戏创造出更多利益。有关于游戏月活跃用户(MAU)和日活跃用户(DAU)及其波动可以参照AppData的数据。除了这些数据,我们还需要对游戏整体以及性能进行更深层次的剖析。下面我们将深入描写这些潜在因素,并以Facebook上两款早前社交游戏为例进行说明。而最后,我们也会以最近一款新游戏进行案例分析。

观察Facebook游戏发展潜力的实用参数

发行三个月后仍持续增长的MAU

一些主流开发商旗下的新游戏总是能在正式发行后的3个月中获得显著的增长。而这些增长很大程度上归功于同家公司旗下一些游戏的交叉推广以及Facebook的匹配广告宣传。然而,如果游戏的基础用户不愿意坚持回到游戏中,也就是说这些基础用户多为“一次性”玩家,那么游戏的日活跃与月活跃用户指数将会快速减少。

发行三个月后仍稳定增长的DAU

日活跃用户是游戏最重要的参数,因为每日玩家的活跃度更能为游戏带来利益。基于这个原因,如果一款游戏拥有较高的DAU,也就是说达到6位数或者更多,而不管它的DAU/MAU比值,那么按照游戏收益的评判标准,这真的算得上是一款优秀的游戏。同时我们还需要注意,如果一款游戏投入大量的广告促销,那么它在发行后前2、3个月的DAU将会较高,但这只能反应用户的初次安装情况。真正能够用来测试游戏DAU必须从游戏发行后3个月算起。

发行三个月后相对较高的DAU/MAU比值

真正能够用来指示一款游戏是否取得了突破性成功的标志是游戏的DAU/MAU比值。一般情况下,根据Inside Virtual Goods的相关数据,如果一款游戏拥有20%以上的DAU/MAU比例,那就表明它拥有较为稳定或者强大的用户留存率,并且能够获得持续盈利。再次,我们还需要记住的是,这也必须是游戏发行三个月后所得到的参数,也就是“一次性”玩家都相继离开游戏后所得到的数据。要注意的是,在游戏发行的第一个月期间DAU/MAU比值会较高。换句话说,如果这是一款Facebook游戏,并且游戏测试阶段已经吸引了一部分用户,那么在第一个月期间游戏的MAU值将会较高。但是如果游戏每天的用户在后来几个月中能够继续增加,那么这才会对游戏真正有益。

早期潜在的主观影响因素

品牌意识,发行商实力,新闻报道,广告等等。

一款新发行的游戏会因为各种外部因素而经历一些非典型的增长率变化。例如,利用同一家开发商旗下那些已成功游戏进行交叉推广,那么它将能够受益于之前存在的品牌意识(游戏邦注:如《The Smurfs & Co.》或者《模拟人生社交版》),匹配广告(特别是Facebook上的广告)以及在科技/游戏/主流媒体中的报道情况。我们在谷歌上搜索游戏的名字也将能够获得与之相关的新闻报道,而许多有名的Facebook游戏也会频繁地进行广告宣传。一般地,如果公司的规模越大,他们投入于新游戏中的广告宣传成本就会越多。等等这些因素都能够促使一款原本看起来不怎么起眼的游戏取得惊人的成绩。

还有一些因素会阻碍游戏的发展。例如,技术问题和发布问题等都可能引起较高的用户流失率。但是基本上,这些问题都能够得到解决,并且最后也能够帮助争取到更多玩家。同时还需要记住,有些游戏的成功并非取决于首要目标,特别是当游戏开发时间极其有限的时候,例如根据电视剧《权力的游戏》改制,并出现在该剧Facebook页面中的社交游戏《Battle for the Iron Throne》,比起单纯的盈利,这款游戏的发行宗旨是将电视剧粉丝引向游戏中。

终端用户体验

当所有的使用数据都能够用于判断游戏的成功潜力,针对于游戏进行亲身体验也是一个很好的方法。一些带有技术问题的社交游戏有时候并不适于Facebook平台,或者不能够吸引目标用户的注意。而有些缺少适当定位的游戏,或者用户界面太过混淆/不够吸引人等也将不利于游戏的发展。而只要你浅尝游戏,便很容易发现这些存在的问题。

同时,你也应该提防游戏过分强制性的病毒式传播:例如Facebook游戏要求玩家只有邀请好友进入游戏才能够完成一些主要任务。过分强制性的病毒式传播虽然能够为游戏争取到更多的安装率,但是也会给游戏造成较高的用户流失率,因为有许多玩家反感这种要求“发送垃圾邮件邀请好友”的行为。

案例分析:Kixeye旗下的《Backyard Monsters》

《Backyard Monsters》发行于2010年5月,是Kixeye旗下一款策略游戏,也是Facebook上一款广受欢迎的游戏,现在拥有80万的DAU和300万的MAU,以及高达28%的DAU/MAU比值。在这款游戏中,玩家通过收获资源而建造属于自己的基地,并以此为后盾向其他玩家或者一些NPC发动攻击,或者做出防御。我们能否在游戏生命周期之初便预测到这款游戏能否取得突破性的成功?以下是这款游戏发行头三个月之后的表现:

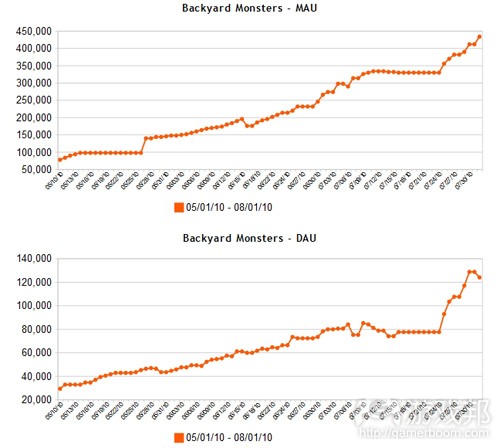

就像我们所看到的,在这款游戏发行的头两个月,MAU和DAU(虽然在7月份增速开始减缓)以迅猛的势头快速增长着。从这里我们可以看到上述提到的两大因素,即持续增长的MAU以及稳固增长的DAU。

现在,让我们论述《Backyard Monsters》中两大与AppData内容相矛盾的因素。在发行之时,Kixeye(游戏邦注:原名是Casual Collective)并没有其它大型社交游戏能够帮助《Backyard Monsters》进行交叉推广,也还未建立起相关品牌。所以开发商便通过外部网站以及一些品牌内容帮助《Backyard Monsters》进行交叉推广,很大程度上要归功于其著名的小游戏《Desktop Tower Defense》。根据谷歌搜索,我们也发现这款游戏在主要的科技/游戏博客中的新闻报道也远远不够。

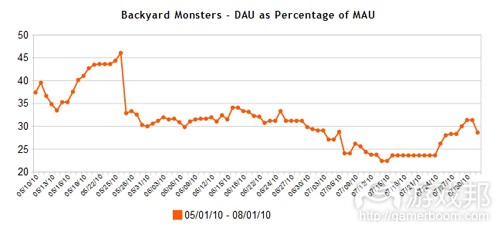

终端用户体验:可以说,基于我们自己在头三个月的游戏体验,《Backyard Monsters》真的是一款富有创造性且足够吸引人的好游戏。尽管在过去5个月的时间里这款游戏都未推出一些新功能,但是它却仍然是一款做工精良的策略管理游戏,并且也吸引了许多硬核游戏玩家的注意。除此之外,《Backyard Monsters》也支持Facebook平台上的短时间游戏过程和PvP的竞争模式。《Backyard Monsters》的魅力在它发行三个月后的DAU/MAU比值中展露无遗:

的确,与早前大多数游戏相比,《Backyard Monsters》的DAU/MAU比值在发行的第一个月算是非常高了。而到了第三个月,这款游戏的DAU/MAU值甚至还维持在25%上下。这也能够阐述我们所提到的五大成功因素之一的:发行三个月后相对较高的DAU/MAU比值。

根据这个案例分析,我们可以肯定,《Backyard Monsters》在发行三个月后确实在Facebook上取得了“突破性成功”。

案例分析:Mob Science旗下的《inFamous Anarchy》

《inFamous Anarchy》是一款改编自PS3掌机游戏《inFamous 2》的重战斗型角色扮演类社交游戏,玩家将在游戏中探索一个时空转移的城市,并在游戏中搜索更多资源而打败怪兽。这款游戏发行于去年6月,包含了PvP机制以及农场模拟类游戏中的收集资源机制。虽然这款游戏的开发很大程度上是为了帮助推销PS3版本的《inFamous 2》,但是它同样也希望能够作为一款独立社交游戏并赢得更多利益。

然而,虽然这款游戏在头两个月享受到较高的MAU增长率,但是随后马上面临到了同样高的用户流失率,甚至第一个月的DAU值就已经开始下滑了。结果是,该款游戏的DAU/MAU比值在发行后的第一个月迅速下跌:

回顾我们之前提到的整体因素,《inFamous Anarchy》在发行前便获得了一定的媒体曝光度,即索尼在官方网站上向其原有玩家宣传这款游戏。其中包括提供了关于《inFamous 2》PS3游戏的一些特殊内容,并且让玩家可以在Facebook上玩到这款游戏,继续获得升级等。

截止今日,该款游戏仅剩下2千DAU与4万MAU。关于它在Facebook页面中的论述,我们可以发现《inFamous Anarchy》的开发者投入于该款游戏的精力越来越少了:最近的更新是关于推销其PS3游戏,而上一次更新是在9月份关于Facebook版游戏的一些内容,这是继7、8月份关于游戏相关推广以及内容更新以来的唯一一次更新。再次,按照我们所定义的5大因素,该款游戏并不属于突破性成功的案例。

虽然《inFamous Anarchy》的开发者希望这款游戏能够取得成功,但是不容置疑的是,他们的主要目的还是希望能够借此推广掌机游戏。这款游戏的生命周期与其掌机游戏是直接联系在一起,也就是说如果其掌机游戏广受好评并且成功进行了多次更新,那么这款游戏便能够生存下去。举个例子来说,EA的一款Facebook游戏《龙腾世纪传奇》也是改编自掌机游戏,发行于2011年3月。这款游戏在发行三个月后获得了重生,主要还是归功于与掌机游戏的联系,它本身的扩展以及开发商针对于这款Facebook游戏所做的交叉推广。现在,这款游戏将DAU/MAU比值稳定地维持在13%,并且拥有2万DAU与15万的MAU值。

预测雅加达《Heroes of Neverwinter》成功率

《Heroes of Neverwinter》是改编自10年前一款非常有名的桌面角色扮演游戏《龙与地下城》。多亏了原来畅销的电脑游戏–《Neverwinter Nights 1》和《Neverwinter Nights 2》,以及与即将发行的在线游戏《Neverwinter》(预计发行于2012年)具有一定的兼容性,所以这款游戏在一发行便拥有很高的品牌认知度。《Heroes of Neverwinter》在2011年9月进行了公开测试,但是因为雅加达在Facebook的影响力比较有限(该公司的Facebook页面只有8万名粉丝),所以它不可能利用Facebook进行交叉推广;而且因为它收获了许多硬核游戏媒体的报道,所以受到那些《龙与地下城》忠实粉丝的关注。如果从这些因素来看,这款游戏有可能借助宣传和现有品牌认知度而走向成功。

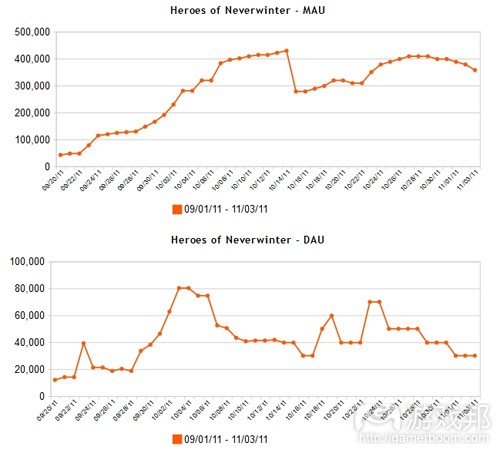

自从9月份公测以来,《Heroes of Neverwinter》的月活跃用户指数一直呈现上升趋势,但是对比那些重要的社交游戏,这种上升幅度还是相对缓慢:

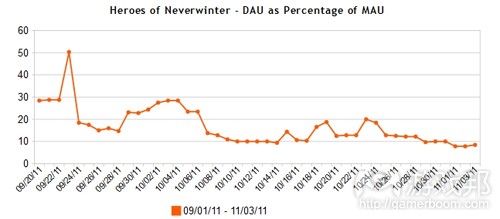

同时,《Heroes of Neverwinter》的DAU值在发行一个月后就达到了高峰,随后开始呈现下滑趋势。需要关注的是,该游戏的DAU/MAU比值在发行一个月内从最高点50%滑落至现在的15%:

这些数据表明《Heroes of Neverwinter》并不符合我们所提到的5大因素中的其中3点,虽然它拥有较强的品牌认知度。

从用户的游戏体验来看,《Heroes of Neverwinter》所体现出的一些设计和执行挑战都是导致它发展放缓的重要原因。比起绝大多数Facebook游戏,该款游戏的用户界面显得较为杂乱且复杂,所以很难能够留住那些非RPG玩家;而游戏的黑暗和暴力画面也许能够吸引大量男性玩家的注意,但是却难以触及更广大的Facebook用户。除此之外,这款游戏并不适用于Facebook平台,因为既不能够提供给玩家社交互动性,也不具有社交游戏所要求的短时间体验特点。

这样看来,《Heroes of Neverwinter》便缺少能够取得突破性成功的元素了。但是尽管如此,具有快速迭代设计的社交游戏能够推动雅加达不断完善现有的游戏,从而呈现给广大玩家更加优秀的游戏体验。也许这些开发者在下个月的更新便能带给我们不一样的惊喜。(本文为游戏邦/gamerboom.com编译,拒绝任何不保留版权的转载,如需转载请联系:游戏邦)

How to Spot a Breakout Facebook Game

James Au

It can be valuable to take a look at the early life cycle of a social game to determine whether or not a Facebook game is likely to be a success on its own merits or a flash-in-the-pan whose growth is driven through less sustainable forms of user acquisition.

Thanks to Facebook’s large userbase, it’s very easy for a new social game to gain millions or even tens of millions of players within the first few weeks of its launch. When a game gets these kinds of numbers, some triumph the explosive growth as a “breakout success.” However, if we’re to define “success” as a game with high engagement rates and revenue, appearances can be deceiving. Often, a Facebook game that garners millions of players in the first month will lose most of them in the next few — or, just as concerning, gain millions of players who fail to visit the game on a daily basis (which generally translates into lower monetization rates).

Fortunately, there are a number of factors that consistently correlate to games with strong revenue generation potential. Some pertain to monthly and daily active user growth rates and fluctuation, and can be reviewed using our AppData traffic tracking service. Beyond the numbers, however, deeper analysis requires a holistic look at a game and its performance. In the next section, we’ll characterize some of these factors and then put them in context using case studies of two older social games for Facebook. In the final section, we’ll do a case study of a recent game.

Useful Metrics-Based Signals for Potential Success

Continued Growth of MAU After Third Month of Launch

New games from leading developers often experience a large growth period during the first three months of official launch. This growth is often due to cross-promotion through the company’s other titles and targeted advertising across Facebook. However, if the game does not gain a base of users that return on a consistent, daily basis to the game, growth of monthly active users (or MAU) tends to drop off at quick pace, due in large part to attrition of one time-only users.

Steady Growth or Levels of DAU After Third Month of Launch

Daily Active Users (or DAU) are a game’s most important metric, since a game’s daily players are the most apt to monetize. For this reason, a game with a large absolute number of DAUs — say, six figures or higher — is almost always a successful one in terms of revenue, no matter its DAU-to-MAU ratio (see section below). Again, keep in mind that a game with heavy promotion will show strong DAU in the first two and three months, reflecting first-time installs. The real test is continued growth of DAU past the third month.

Relatively High DAU-to-MAU Percentages After Third Month of Launch

The most important indicator of a breakout success is a relatively strong DAU-to-MAU percentage. In general, a rate of 20% or higher suggests healthy retention and consistent monetization, as supported by data from our Inside Virtual Goods series. Once again, remember that this is an indicative metric three months after the initial launch, when the “try once” users have dropped off. Note that DAU-to-MAU percentages tend to appear low during the first month or so post-launch, as MAU climbs rapidly; it may also appear artificially high in the first month if the title is available on Facebook as a closed beta accessible by only a select pool of users. It’s far more important to have a high ratio of people playing every day, months afterward.

Broader, Subjective Measures of Early-Stage Potential

Brand Awareness, Publisher Size, News Coverage, Advertising, Etc.

A new game will often experience atypical growth rates due to a number of external factors. For instance, cross-promotion in already successful games from the same developer, preexisting brand awareness (e.g. The Smurfs & Co. or The Sims Social), targeted advertising (in particular on Facebook), and prominent coverage in the tech/gaming/mainstream media. A Google search on the game’s title will often reveal such news coverage (if any), while a scan of similar, popular Facebook games will often reveal a game’s advertising campaign (if any). As a general rule, the larger a company is, the larger its advertising campaign for a new game will be. Extenuating factors such as these may at first make a game appear more of a breakout success than it is.

Other factors can slow a game’s growth. For instance, technical or deployment issues which cause high quit rates. In principle, these issues are resolvable over time, which might then lead to a recovery of growth. Also keep in mind that some games are not developed with breakout success as a foremost goal. In particular, games that are made to promote an external property for a limited about of time, such as the small-scale Game of Thrones: Battle for the Iron Throne game available on the TV show’s Facebook page, exist to drive attention to the product rather than as standalone experiences designed to monetize.

Hands-on Review of End User Experience

While overall usage data is crucial for determining a game’s breakout potential, a hands-on review of the game itself is also recommended. Some social games launch with technical issues, are not a natural fit to the Facebook platform, or are not appealing to its intended audience. Others are not well localized, or come with a confusing/unappealing user interface that might impede growth. A short play session will often reveal such issues (if any).

In the same vein, also beware of games with excessive, mandatory virality: i.e., Facebook games which require players to add their friends to progress through primary gameplay objectives. While excessive, mandatory virality can boost install rates, it can also boost quit rates, as many players resist “spamming friends.”

Case Study: Kixeye’s Backyard Monsters

Launched in May 2010, Kixeye’s strategy game Backyard Monsters remains a relatively popular Facebook game, now with 800,000 DAU and 3 million MAU for an impressive DAU-to-MAU of 28%. In the game, players harvest resources to build a base from which to launch attacks, while warding off attack from players and non-player enemies. Could we have made an educated guess that it would be a breakout success early on in the game’s life cycle? Here’s its performance after the first three months:

As we can see, growth in MAU continues at a strong rate after the first two months of game launch, as does growth in DAU (though growth slowed toward the end of July). Here we can see two of our factors at work — continued growth in MAU and steady or continued growth in DAU.

Now let’s review the two holistic factors that cannot be checked with AppData. At the time of launch, Kixeye (then named Casual Collective) did not have other large social games to cross-promote Backyard Monsters, and was not based on a preexisting brand. The developer did cross-promote Backyard Monsters through its external website and had some brand awareness, in great part through its popular Flash game Desktop Tower Defense. Based on a Google search, however, we can see that the game did not get much prominent coverage on major tech/gaming blogs at launch.

Hands-on review of end user experience: We can say, based on our own gameplay experience during the first three months, that Backyard Monsters proved itself innovative and engaging. Even without features added over the past five months, the game was a well-made resource-management strategy title with special appeal for “hardcore gamers.” Backyard Monsters also supported short gameplay sessions and player-vs-player competition that fit well with the Facebook platform. The proof of its appeal is suggested in Backyard Monster’s DAU-to-MAU percentage three months after launch:

As is the case for most games in the early days, Backyard Monsters’ DAU-to-MAU ratio was extremely high for the first month. Going into the third month, however, the game maintained a retention rate of just under 25% DAU-to-MAU. This illustrates one of our five factors for success: A relatively high DAU-to-MAU percentage three months after launch.

Based on this case study, we can see that an assessment of Backyard Monster as a “breakout success” made after three months on Facebook would be accurate in this case.

Case Study: Mob Science’s inFamous Anarchy

A social game tie-in for PlayStation 3 console game inFamous 2, inFamous Anarchy is a combat-heavy role-playing game in which the player explores a post-apocalyptic city to earn resources and defeat monsters. Launched last June, the game also includes a player-versus-player component as well as farming simulation elements in the resource-gathering portion of the game. While it was developed in great part to promote the PS3 game, it was also intended to be a social game that could be played and monetized as an independent product.

However, while the game enjoyed very strong MAU growth in its first two months, a strong dropoff rate began soon afterward, with DAU falling even before the first month. As a result, DAU-to-MAU fell even faster in that first month:

Reviewing our holistic factors, inFamous Anarchy received some press coverage ahead of launch while Sony promoted it to existing fans of the franchise on its websites. This included an offer of special content for the inFamous 2 PS3 game, obtainable by playing the Facebook game and leveling up.

As of today, the game has just 2,000 DAU and 40,000 MAU. Based on a review of its Facebook page, developer activity around inFamous Anarchy is currently sparse: The latest updates are promotions related to the PS3 game, and the last update pertaining to the actual Facebook game is from September (the only update for that month), following frequent Facebook game-related promotional/new content updates in August and July. Again, going by the five factors we’ve identified, it would’ve been clear early on that inFamous Anarchy wasn’t a breakout success.

While the developer did intend for inFamous Anarchy to succeed on its own, bear in mind that its main intent was primarily as a cross-promotion for the console title. Its life cycle is directly tied to the fate of the console game, which can work out if the console game is well received and supported by frequent updates. Take for example EA’s Facebook game Dragon Age Legends, another tie-in for a console franchise that officially launched in March 2011. This game saw a resurgence in traffic after its first three months, thanks in part to connectivity with the console game, its expansions, and an open web tie-in game with cross-promotion for the Facebook title. Today, the game maintains a steady 13% DAU-to-MAU ratio with a user base at 20,000 DAU and 150,000 MAU.

Predicting the Success in Atari’s Heroes of Neverwinter

Heroes of Neverwinter is a Facebook game tied to one of gaming’s most well-known brands: Dungeons & Dragons, which rose to fame decades ago as a table-and-dice role-playing game. It has some brand awareness due to the bestselling PC-based game franchise, Neverwinter Nights 1 and 2, and is expected to have some cross-compatibility with the upcoming online game, Neverwinter (set to launch in 2012). Heroes of Neverwinter entered open beta in September 2011, and while it didn’t have the benefit of strong cross-promotion on Facebook on account of Atari’s light presence on Facebook (the company’s page has less than 80,000 fans), it received positive media coverage on consumer-oriented video game publications, thus attracting potential interest from an audience loyal to the Dungeons & Dragons franchise. Taking into account these extenuating variables (one of our five factors), it’s probable that the game enjoyed at least some additional growth due to publicity and existing brand awareness.

Monthly active growth of Heroes of Neverwinter since September has trended upward, for the most part, but at a slower rate compared to leading social games:

At the same time, DAU for Heroes reached a peak less than a month after launch, and started trending more or less downward since then. More concerning, DAU as a percentage of MAU has within a month of launch dropped from a high of 50% to under 15% now:

This data puts Heroes of Neverwinter at a disadvantage in three of our five factors, even with brand awareness working for it.

In hands-on review of the product, Heroes of Neverwinter reveals some design and execution challenges which may be contributing to its slow growth. The user-interface is cluttered and more complex than most Facebook games, making retention of non-RPG gamers difficult; the game’s dark and violent artwork, which may appeal to male gamers, are barriers to reaching Facebook’s broader audience. Further, the game doesn’t seem to be a natural fit to the Facebook platform as it fails to fully leverage the social graph and does not support short play sessions usually associated with social games.

As it stands, there’s no evidence that Heroes of Neverwinter is a breakout hit. Even so, the beauty of social games is rapid iterative design that empowers Atari to improve upon the existing game for a higher trafficking product. It may be that the developer introduces updates in the next month that drive growth.(source:insidesocialgames)

上一篇:剖析社交游戏的潜在老虎机博弈模式

闽公网安备35020302001549号

闽公网安备35020302001549号