传统开发商进军社交游戏领域之市场分析

游戏邦注:本文作者是Mike Turner,他是Bitfold Online Games的任事股东,Bitfold是致力Facebook原生社交游戏IP、国际社交网络和移动设备的独立开发商。

社交游戏无疑是游戏领域的新事物。顶级社交游戏开发商的作品覆盖数百万用户,每月创收数百万美元。但多数社交领域成功者都是Zynga之类的新兴公司,或Popcap games和King.com之类的休闲游戏公司。瞄准其他游戏平台的开发商和发行商只有少数有所成就。为何如此?

我们认为这是因为,休闲游戏公司和初创公司都抱着冒险和试验态度进军该领域。通过大量试验,这些公司已知晓如何创造社交网络玩家希望体验的优质内容。致力掌机或MMO等其他平台的开发商缺少类似举措。因此他们不知如何促使玩家参与游戏,因而惨遭失败。

但在我们看来,这完全可以避免。我们相信若新手开发者能够制作社交玩家愿意体验的游戏内容,学会如何刺激玩家持续体验和消费,他们也能取得成功。

本文旨在阐述制作具有持久生命力的杰出社交游戏的成功要诀,主要针对那些已在其他平台有所建树,但意图进军社交领域的开发商或发行商。

大型公司的社交游戏市场

在进入新市场前,首先要把握市场潜在回报,判断回报是否能够平衡投资风险和成本。此部分旨在提供做此决策所需的相关信息,主要包括如下内容:

1. 社交游戏市场的定义

2. 成功社交游戏开发商的表现以及新兴开发商的市场定位

3. 社交游戏开发商的普遍发展趋势和成功要诀

4. 进军社交领域的成本

5. 品牌社交游戏的运作情况

如何定义社交游戏市场?

社交游戏在不同人眼中有不同含义,通常是指搭载社交网络的游戏或能同现实好友共同体验的游戏。下面就来谈谈这些游戏主要搭载的平台。

Facebook有近7亿用户和3.5-4亿月活跃用户,显然是全球最活跃的社交网络。据ALLFacebook.com显示,有53%的Facebook用户都在该平台玩游戏。平台具有高度活跃的用户基础以及大多用户都分布在“富裕”国家,因此是个能够创造高消费用户的重要平台。但去年以来,Facebook的用户获得成本大幅提升。据某Facebook广告公司预测,该平台付费安装的成本约在0.5-3美元/次。因此在Facebook发行游戏通常需要投入高额营销预算,以获得大量用户。

其他社交网络

除Facebook外,目前还存在众多其他社交网络。这些网络可分为几大类。

1. 本土热门网络:如Orkut (巴西)、StudiVZ(德国)和Vkontakte(俄国)。

2.二级英语社交网络:如Bebo、Blackplanet和Tagged。

3. 瞄准特定主题的专业网络:如游戏(IMVU)和日志(Livejournal)。

每个网络都有200万(IMVU)-5000万(Orkut)的月活跃用户。但全部合起来就有上亿活跃用户。所以,同时瞄准多个社交网络的游戏就有机会额外增加上万或上百万用户(游戏邦注:将游戏移植至其他平台的主流Facebook开发商有LOLapps、Wooga、OMGPOP和Kixeye)。

手机社交游戏

如今越来越多手机游戏开始引入社交功能。目前这些社交功能纷繁复杂,从简单的排行榜,到同其他陌生玩家互动,再到同Facebook好友互动。最后这项(同Facebook好友互动)需要应用植入Facebook Connect。这促使玩家能够通过移动设备体验所有Facebook游戏。一个典型的例子是Capcom的《Smurf’s Village》。手机社交游戏在西方国家还属于新兴领域,目前尚无充足数据衡量其潜力。但随着连网智能手机的增加,这个市场有望获得大幅发展。

80家顶级开发商的市场运作情况(及新开发商的市场定位)

假设你投资社交游戏领域的预算在几十万到几百万之间。你会从中获得多少投资回报?要回答这个问题,首先先来了解其他开发商的营收情况,这样你就有参照标准。下面我们就来估量80家顶级社交游戏开发商的营收情况。

营收估算法

我们之前曾谈到基于日活跃用户数量估算营收。这个方法来自RockYou首席执行官Lisa Marino的“Monetization of Social Games”演讲。在Lisa的营收估算模式中,多数游戏的1000 DAU收益在10-30美元之间,而运作杰出的游戏则达100美元/1000 DAU。

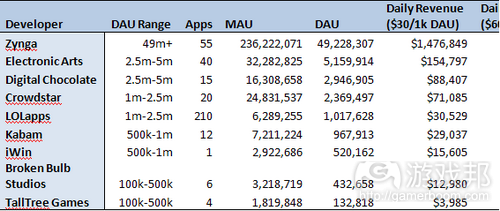

要使用此方法,我们首先要把握这80家游戏开发商在Appdata.com的DAU数量。我们根据数量划分5个DAU数值范围,如图一所示。接着套用Lisa的估算法,算出各个数值范围内两家开发商代表的收入估值(游戏邦注:如以下表格一所示)。这让我们能够获悉各社交游戏开发商的大致营收情况。

注意此营收估算法非常基础,目的只是提供社交游戏收益的基本概况。若要准确估量社交游戏营收,则需要更复杂的统计方法和更完整的数据资料。

80家顶级应用开发商的DAU范围介于4900万(Zynga)-15万之间。除去Zynga,按照此近似估算法得出的结果是:若创收基准是30美元/1000 DAU,日收入就在0.4-15.4万美元之间;若创收基准是60美元/1000 DAU,日收入就介于0.8-30.9万美元。

数据分析和诠释

根据上述数据,我们可以发现下述趋势:

* Zynga无疑是其中的佼佼者,其DAU数量超过紧随其后9家开发公司的DAU总和。

* 只有16家开发公司的DAU突破100万。当然这1年内还出现波动,但这些数据说明只有少数开发商能够在社交领域获得高收益。但提供优质作品的开发商总是能够获得可观收益。

* 有63家开发商的DAU超过10万,根据近似估算法,这些开发商的年收益大概在100万左右。因此即便你1年只有1款DAU为10万的作品,你也能够创收数十万。

* 通过分析30美元/1000 DAU和60美元/1000 DAU之间的差异,我们可以发现若游戏运作杰出,营收将非常高。

总而言之,我们可以发现多数开发商都成绩平平,而少数提供热门作品的开发商却能够创收数百万。

新手开发商的市场定位

这取决于你是否采取明智策略进军市场。若你花时间分析成功开发商的制胜法宝,尝试制作优质作品,制定有效运营和营销策略,不断试验,而且意图长久立足社交市场,你就能够跻身高收益者行列。若你忽略这些方面,那你只能勉强存活或失败收场。

那么这些成功社交游戏开发商究竟有何制胜法宝?

80家杰出Facebook开发商的主要发展趋势

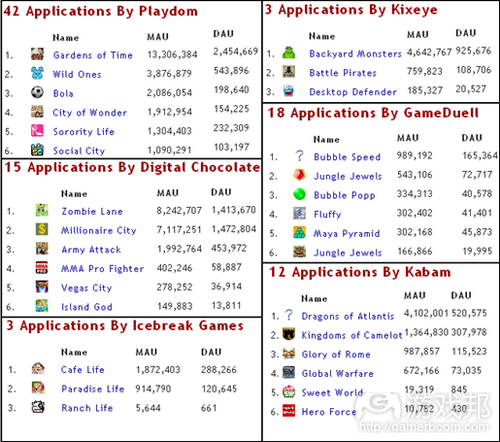

要把握顶级开发公司的成功秘诀,最好先看看他们在市场的运作情况,看看这些开发商是否遵循某些普遍趋势。通过观察顶级公司的MAU和DAU、体验其游戏,以及分析他们的财政状况,我们发现如下趋势。

1. DAU数量介于10万-4900万。

2. 很多成功开发商都有1款以上作品。

3. 很多开发商的活跃用户量都是所发行游戏的总和,但其中多数用户都来自少数几款非常杰出的作品。

4. 在多数开发商的作品中,都存在几款表现平平或糟糕至极的作品。

5. 具有多款作品的开发商能够交叉推广其他作品。这促使开发商能够把已放弃某游戏的用户转移至其他游戏,从而留住这些用户。

6. 杰出作品持续添加新功能和内容(游戏邦注:通常每日或每周)。

7. 众多顶级开发商都有雄厚投资资本或预存运营资本支撑项目开发和营销。

制胜要诀

根据上述趋势,我们可以总结出下述开发商制胜要诀。

1. 制作用户希望的高质量社交游戏。

2. 具备雄厚资金,通过广告获取大量用户。

3. 开发众多作品。

4. 积极试验不同游戏构思和玩法。

5. 持续完善游戏内容,促使用户持续参与和体验。

总之,这算不上什么大秘密。他们创社交玩家希望体验的游戏内容,进行合理营销,不断完善游戏内容。

这是社交开发新手应该学习的策略。新手需着眼于制作有趣游戏,维持游戏运作,试验不同游戏理念和玩法,制定获取用户的明智策略。

开发成本

假设你已准备好迎接进军社交游戏领域所面临的挑战。在这过程中你需付出多大成本?这里我们将进行分析。

社交游戏开发成本主要分3大块:开发、营销和运营,比例如下:

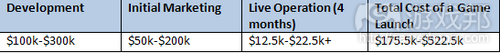

* 开发:据Zynga表示,每款游戏的制作和发行成本在10-30万美元之间。

* 营销:有关Facebook平台的营销费用,社交游戏广告公司Adparlor表示,游戏刚问世的广告成本是0.5美元/安装,后期成本则变成3美元/安装。根据广告购买量的不同,发行成本也各不相同,从几万到几十万不等。

* 运营:持续维护和更新内容需要活跃团队。作品会产生资金消耗率,这取决于团队规模和工资水平。假设是个小规模团队:1个开发人员、2个美工、1个兼职测试员,还有1个营销和虚拟交易专业人员,运营团队需支付4.5人工月。根据运营团队的驻扎地不同,成本在1.25万/月-2万/月不等(假设前者的每人工月成本是2500美元,后者的每人工月成本是5000美元)。

* 总成本:

产品线成本

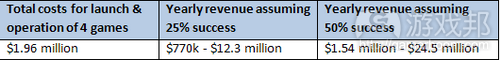

就如上面所说,很多公司都在短期内发行多款游戏。这旨在试验不同设计理念和创建供玩家转移的关联游戏群。对开发新手来说,在头一年推出多款作品是个好策略,因为这能够帮助你试验不同游戏机制和主题。下面是此策略的成本分析。

要完成此估算,我们需要进行某些假设。在这个例子中,我们要做出的假设有:所开发的游戏数量、每款游戏的成本、成功作品数量、多少DAU算是“成功作品”以及成功作品的创收利率。给出的假设如下:

* 假设游戏数量:4款

* 每款游戏的年平均DAU:10-80万

* 成功游戏的数量:1-2款

* 每款游戏的平均开发成本:18万美元

* 每款游戏6个月内的平均营销成本:13万美元

* 每款游戏6个月内的运营成本:12万美元

* 假设创收率:30美元/1000 DAU-60美元/1000 DAU

* Facebook的分成比例:30%

粗略计算,我们会发现,若游戏表现平平,就会带来损失。但若游戏大受欢迎,将给新开发公司带来可观收入,树立其在社交游戏领域的地位。因此通常来说,公司会竭尽所能制作出备受追捧的畅销作品。

品牌和既有IP在社交领域的运作情况

在其他游戏平台有所建树的开发商都有几款经典IP。因此,这些作品是否是他们立足社交领域的筹码?

据数据显示,这并非什么优势。

在于社交领域发行作品前,最好先来看看各品牌在该领域的表现。于是我们锁定前500款Facebook应用中的品牌游戏,分析其在2011年3月的表现情况。

我们把品牌内容分成如下几类:

* 休闲技能类型(如《宝石迷阵》和《泡泡戳戳戳》)

* 体育游戏(如《Soccer》、《American Football》和《Baseball》)

* 众所周知的棋盘和纸牌游戏(如《优诺牌》、《梭哈》、《大富翁》和《Farkle》)

* 电视节目游戏(如《家庭问答》和《叫对价》)

* 源自其他平台的游戏(游戏邦注:如掌机游戏、硬核游戏和基于电视节目/书籍的游戏)

* 休闲可下载游戏(如隐藏物品游戏和管理游戏)

* MMO游戏

下图呈现各类游戏的运作情况

计算图表中的相关数据,我们会发现在上述所有品牌中,源自其他平台IP(如PC可下载、掌机和MMO)的DAU仅占顶级品牌游戏的12%。

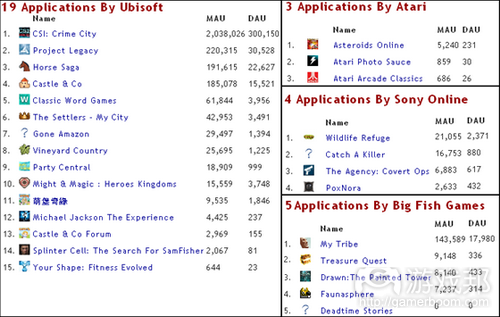

而在前500款应用之外,我们发现几款大型发行商推出的Facebook版本。在下述图表中,我们发现在17款知名开发商移植至Facebook的游戏中,只有1款的DAU超过10万。这说明品牌和既有IP在社交领域的表现不尽人意。

为何数据会呈此态势?为何电视节目游戏、纸牌/桌面游戏、体育和技能游戏能够在社交领域取得突出成就,但风靡其他平台的IP却以失败收场?我们认为是由于如下3大因素。

1. 社交玩家不是重口味玩家。其实社交网络用户就是普通网民。他们是你的父母、配偶,或者育有2子女的忙碌好友,而不是沉迷游戏的玩家。他们大多是游戏新手,或者是曾偶尔玩过游戏,所以他们也许从未听过你的品牌,因此不会产生体验欲望。

他们希望体验的品牌是那些大家都在玩,都觉得有趣的内容。《宝石迷阵》、《梭哈》、《大富翁》、《家庭问答》和《soccer》都是公认富有趣味,值得重玩的品牌。但若这不是大家熟知,倍受欢迎的内容,品牌就很难令你处在有利位置。

2. 令IP系列风靡的机制并不一定适合Facebook:令众多IP系列在其他平台大受欢迎的机制在Facebook的表现并不突出。

3. 品牌有时会限制作品在众多高质量游戏中脱颖而出:社交领域的成功表现在促使玩家产生体验欲望。制作品牌社交游戏时存在玩法和主题限制。品牌限制条件会束缚你进行创新设计(游戏邦注:而这可以让游戏在同类游戏中脱颖而出)。

是否要把既有IP打造成社交游戏?

据数据显示,既有IP的表现都不尽人意。因此专业建议是不要进行移植,除非游戏具有全球知名度,游戏机制能够适应社交网络,富有趣味。若你需要绞尽脑汁思考如何把游戏变得富有趣味,如何与同类Facebook相抗衡,那你最好还是放弃。

例外情况包括:

* 若你的IP知名度很高/融入具有高重玩价值的休闲机制。

* 若你的IP比同类Facebook游戏更适合平台某些群体。

若你打算将既有品牌移至社交领域,需确保游戏机制比同类竞争对手更别具一格,更富趣味。仅凭IP辨识度远远不够。(本文为游戏邦/gamerboom.com编译,如需转载请联系:游戏邦)

Breaking Into Social Gaming — A Must-Read Guide To Entering the Facebook Game Space

By Mike Turner

Mike Turner is a managing partner for Bitfold Online Games, an independent social game developer that focuses on original social game IP for Facebook, international social networks, and mobile devices. Read more about Bitfold after the article.

The social gaming market is without doubt the new buzz in the world of gaming. The top companies in the social market have launched games which have millions of users and million in monthly revenue. However, most of the successful companies in the space are either totally new companies like Zynga or casual gaming companies like Popcap games or King.com. Only a small handful of developers & publishers established on other gaming platforms (consoles, MMO, etc.) have had any success in the social market.

Why is this?

In our opinion it’s because these casual gaming companies & new upstarts have gone into the space with the exclusive intention to take risks & experiment within the space. Through extensive experimentation, these companies have learned how to make good games that social networking users want to play. Developers established in other platforms such as consoles or MMOs do not possess similar experience. They therefore have had a much harder figuring out how to make games users want to play their games and have experienced many failures in the space.

In our view however, this doesn’t have to be the case. We believe that if any new entrant is able to create games that social networking users love to play and learn how to incentivize these users to keep playing & spend money, they can be successful.

This article attempts to explain the keys to creating a successful long-term presence in the social gaming market. It is targeted at any developer or publisher who has had success in other markets and wants to get into social gaming.

Part 1 – The social gaming market for large game companies

Before entering a new space, it’s first important to determine what return is likely in the market and decide whether this return is enough to justify the risk and cost of entering it. This section tries to provide the information required to make that decision by providing the following information:

1. Definition of the social gaming market

2. Performance of successful social game developers and where new entrants can realistically hope to place among them

3. The key trends among successful social game developers that make them successful

4. The cost of entering the social market

5. The performance of brands in social games

How do you define the social gaming market?

Social games sometimes mean different things to different people. Most often though, it is used to describe games that are played primarily on social networking sites or games that can be played with a person’s real world social graph. The primary platforms on which these games are played are described below.

With nearly 700 million registrations and 350-400 million active users monthly, it is undoubtedly the most popular social networking platform in the world. According to ALLFacebook.com, 53% of these users play Facebook games. Because of this highly active userbase and a high percentage of users in “rich” countries, it presents a great platform for gaining lots of high-monetizing users. However, in the last year, the cost of acquiring users on Facebook has risen sharply. Adparlor estimates that purchasing installs can cost anywhere from $.50 – $3 per install. Thus launching a game on Facebook often requires heavy marketing investment to gain a large number of users.

Other Social Networks

There are many other social networks outside of Facebook. These networks fall into several categories.

1. Regionally popular general social networks such as Orkut (Brazil), StudiVZ (Germany), Vkontakte (Russia), and more.

2. Secondary English speaking networks (Bebo, Blackplanet, Tagged, etc.)

3. Specialty networks focused around specialized themes such as gaming (IMVU) or Journaling (Livejournal).

Individually, each network only has around 2 million (IMVU) to 50+ million (Orkut) monthly active users a piece. Added together however, the combined active userbases add up to hundreds of millions of active users. Therefore, games that target a large number of social networks at once have the possibility to gain several tens of thousands or millions of extra active users. Among those who have ported their games to outside social networks are leading Facebook developers LOLapps, Wooga, OMGPOP, and Kixeye.

Mobile Social Games

A growing number of mobile games are including social functionality. This social functionality varies wildly at the moment, ranging from simple leaderboards, to interaction with strangers who also have the game installed, to interaction your Facebook friends. The latter option (playing with your Facebook friends) is enabled by integrating Facebook Connect into the app. This option enables full social games of the type that would be seen on Facebook to be played on mobile. A great example of this is Smurf’s Village by Capcom. Mobile social games are still a very young market in Western countries, and at the moment there are not huge volumes of data to gauge its potential. However, as adoption of internet capable smartphone devices is currently increasing, it is a market with potential for high growth.

Market Performance of the Top 80 Developers (and where you might place)

Let’s imagine that you have several hundred thousand to a few million dollars to invest in entering the social gaming market. What can you realistically expect out of your investment? To answer this, it’s helpful to know how much money other developers are making so that you have a reference for what your earning potential is. To establish this reference, we provide an estimate of gross revenue of the top 80 developers below.

Methodology for Revenue Estimation

In our last article published in Socialtimes, we quoted a very basic method for calculating revenue based upon the amount of daily active users (or DAU for short) that a developer has. This method is borrowed from Lisa Marino, CEO of RockYou in her presentation titled “Monetization of Social Games”. Her method of revenue approximation states that most games monetize between $10 and $30 for every 1000 DAU, and that well monetized games can earn upwards of $100 per 1000 DAU.

To use this method, we first take the total DAU count of each of the top 80 game developers from Appdata.com. From this we establish 5 ranges of DAU counts, pictured in Figure 1. Next, we apply Lisa’s approximation and provide revenue estimates for two developers within each range (shown in Table 1). This provides us with a general range of what social game developers are earning.

Please note that this revenue estimation method is very basic and only intended to provide a basic idea of social game revenues. Estimating social game revenues rigorously would require more sophisticated statistical methods and a more complete dataset than is used in our estimation.

Looking at the top 80 app developers, we see DAU ranging from over 49 million at the top (Zynga) to under 150k at the bottom. Excluding Zynga, this rough approximation predicts daily earnings of $4k to $154k assuming $30/1000 DAU and daily earnings of $8k to $309k assuming $60/1000 DAU.

Analysis & Interpretation of the Numbers

Looking at these numbers we can identify the following trends

* Zynga is the undisputed leader, they have more DAU than their 9 top competitors combined

* Only 16 developers had DAU above 1 million. This will of course fluctuate throughout a year, but the data indicates that only a handful of developers have managed to achieve top earnings in the social market. Those that do make enough good games to place into this bracket however will earn handsomely.

* 63 developers have achieved DAU counts over 100,000, which our approximation predicted would earn 1 million a year or more in revenue. Thus even if you only end up with 1 game that averages 100k DAU in a year, you’ll at least have several hundreds of thousands of dollars in return.

* By looking at the differences between $30/1000 DAU and $60/1000 DAU, we see that if games are well monetized, game revenues can be very high.

Overall, we see that a lot of developers are achieving moderate success, and the few that have immensely popular games are achieving earnings in the tens of millions.

Where can you Expect to Place?

It depends on your will to enter the space with a smart strategy. If you take time to really understand what makes successful developers successful, try to create excellent games, create proper live operation & marketing strategies, experiment rigorously, and commit to a long-term stay in the social market, you could find yourself on the top earners. If you do anything else, you’ll likely find yourself in the lower end of the success scale or in the social deadpool entirely.

What are the key market players doing to be successful?

Key Trends Among the Top 80 Successful Facebook Developers

To understand what top companies are doing to be successful, it is helpful to look at their performance in the market and see if there are any common trends these companies follow. By looking at the MAU, DAU of the top companies, playing their games, and examining their financial history, we notice the following trends.

1. DAU counts range from 100k DAU to 49 million DAU

2. Many successful developers have more than one game.

3. The total active userbase of most developers is gained from the combined userbases of the games they operate, but a majority of their active users come from only a few highly successful games.

4. In most developer’s portfolios, there are several games which have mediocre performance or are complete failures.

5. Developers with multiple games cross-promote their other games. This allows these developers to pass users which have stopped playing one game to another, allowing them to retain that user.

6. New features & content are added to the successful games constantly (usually daily or weekly)

7. A large percentage of the top developers have had either heavy capital investment or pre-existing operating capital with which to develop & market with.

Keys to Success

From these above trends, we can draw a few general conclusions about what core steps these developers are taking to create their success.

1. Creation of high quality social games that users want to play

2. The financial resources to acquire millions of users with advertising

3. Development of multiple game products.

4. Heavy experimentation with different game concepts & gameplay mechanics that has led to both failures & successes.

5. Consistent ongoing improvements to games to keep users engaged & playing

In short, it’s no big secret. They create good games tailored to what social networking users want to play, market them properly, and constantly improve them.

It’s these measures that new entrants should try to emulate. New entrants should be prepared to focus on making fun & appealing games, to support their games long-term, to experiment constantly with different game concepts and gameplay mechanics, and to create a smart strategy for user acquisition.

Cost

So, let’s assume you are ready to take on the challenge of entering the social gaming market. What kind of costs will you incur in doing so? This section provides an answer to that question.

In social game development cost boils down to three main areas: development, marketing, and live operation. The magnitude of these costs is explained below:

* Development: According to Zynga, each game costs $100k to $300k to make & launch.

* Marketing: To market on Facebook, Adparlor (a leading social game advertising company) states that ads cost anywhere from $.50 per install when a game is first launched and up to $3 per install at the later stages of a game’s lifecycle. Depending on how many ads are purchased, the cost for a launch could range from several tens to hundreds of thousands of dollars.

* Live Operation: Ongoing maintenance & content updates will require a live team. Your game will thus have a burn rate that varies depending on the size of your live team and their salary. Assuming a minimal team of 1 developer, 2 artists, 1 half time tester, and 1 marketing & monetization specialist, your live operation team would require a payment of 4.5 man months each month. Depending on where your live team is, this could cost anywhere from $12.5k (assuming $2500 average man-month cost) monthly to over $20k (assuming a $5000 average man-month cost) monthly.

* Totals:

The Cost of a Product Line

As illustrated above, many companies launch multiple games within short time periods. This is generally done both to experiment with different designs and to establish a network of related games that users can migrate between. For first time entrants, launching multiple games in the first year can be a good strategy as it will let you test the waters with different gameplay mechanics and themes. An estimation of what such a strategy would cost is done below.

To do the estimation, we need to make some assumptions. In this example, we will make assumptions about how many games are developed, what each game costs, how many games are successful, what DAU count constitutes a “successful game”, and what rates the successful games monetize at. These assumptions are provided below:

* Assumed number of games: 4

* Average daily DAU for each successful game in a year: 100k – 800k/li>

* Number of successful games: 1-2

* Average development cost of each game: $180k

* Average marketing costs of each game over 6 months: $130k

* Live operation costs for each game over 6 months: $120k

* Assumed monetization rates: $30/1000 DAU – $60/1000 DAU

* Assumed revenue cut to Facebook: 30%

From these rough estimates, we see that if games are only mediocre successes, losses will likely be incurred. However, if a few games become very popular, it can be an outstanding new revenue source for a new entrant that will allow them to establish themselves even further into the social game market. Therefore naturally, a company will want to do everything in its power to make games that can be popular.

How do brands & existing IPs perform in the social space?

Developers successful in other gaming markets have several successful IP lines that are tried and true. Therefore, these IPs are their best bet for a success in the social space right?

Well, according to the numbers, maybe not.

Before launching brands into the social space, it’s good to look at how brands perform in this space. To answer this question, we performed an analysis of the performance of branded games in the top 500 apps on Facebook in March 2011. The results of this analysis are explained below.

We broke brands down into the following categories.

* Casual skill game IP (Bejeweled, Bubble Pop, etc.)

* Sports games (Soccer, American Football, Baseball, etc.)

* Well known board or card games (Uno, Poker, Monopoly, Farkle, etc.)

* Gameshows (Family Feud, The Price is Right, etc.)

* Game IP ported from other platforms (console game IPs, hardcore games, TV shows/books, etc.)

* Casual downloadable game IP (Hidden Object, Management, etc.)

* MMO Games

The following table shows the performance of each of these genres

Doing the math on the number in this table, we see that out of all of the brands listed above, existing IPs ported from other gaming platforms such as PC downloadable, console, and MMO account for only 12% of the DAU in the top branded games.

Looking further outside the top 500 apps, we find several more Facebook versions of existing IPs created by large name publishers. Listed in the image below, we find 17 existing game IPs ported from other platforms to Facebook by several famous game publishers. Out of these 17 IPs has, only one has managed to get over 100k DAU. That’s a bad indication for the performance of brands & existing IPs in the social space.

Why are the numbers like this? Why do gameshow, card/table, sports, and skill games do well in the social space, but IPs popular on other platforms fail? There are 3 reasons for this in our opinion.

1. Social Gamers are not heavy gamers.The fact is that social network users are the general internet using population of the world. They’re your parents, your spouse, your busy friends who just had two kids, not avid gamers. A lot of them are either entirely new to gaming or have been only occasional gamers in the past so they probably haven’t heard of your brands before the thus majority of users have no incentive to play them.

What they do have incentive to play are brands that everyone has played and knows is fun. Bejeweled, Uno, Monopoly, Family Fued, and soccer are brands that everyone knows which are fun & have lots of replay value. However, if it’s not something everyone knows and likes, your brand’s name is not too likely to bring you any great benefit.

2. Mechanics that make the IP line popular don’t usually fit well into Facebook:The mechanics that make many IP lines so popular on other platforms don’t work well on Facebook.

3. Brands sometimes limit the ability for a game to be unique among other high quality games:Success in the social space is about making games users want to play. When making a branded game, its gameplay mechanics & theme are restricted to what the brand permits. These brand restrictions may limit the ability for you to make innovative design decisions that will make the games more appealing to users than competing games.

Should you make your Existing IPs into Social Games?

According to the numbers, existing IPs have historically performed terribly. Therefore, our professional recommendation would be not to unless they have immense worldwide name recognition and game mechanics that will very clearly be fun on a social network. If you have to struggle to think about how your IP will be fun for users and compete against other games of its type on Facebook, then it’s likely it won’t do either.

The exceptions are:

* If your IP is extremely well known and/or has casual mechanics that have high replay value.

* Your IP can fill some a niche on Facebook better than its competitors.

If you are intent on bringing a brand to the space, you must make the gameplay more unique and fun than other games competing for the demographics you’re targeting! IP recognition alone won’t cut it.(Source:socialtimes)