每日观察:关注在线游戏玩家的虚拟商品付费情况(8.4)

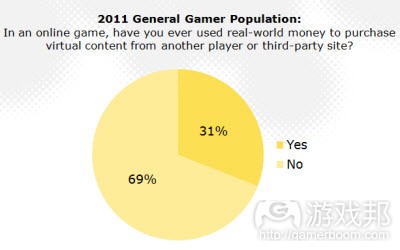

1)Visa旗下的PlaySpan和VG Market最新调查指出,约有三分之一的在线游戏玩家花钱购买虚拟商品(游戏邦注:其调查样本是1000名游戏玩家)

31%的在线玩家通过其他玩家或者是第三方网站花钱购买虚拟商品。其中,在线掌机游戏占虚拟商品交易量的51%,社交游戏占30%,大型多人在线游戏占28%(游戏邦注:有些付费玩家同时在多种游戏中消费)。

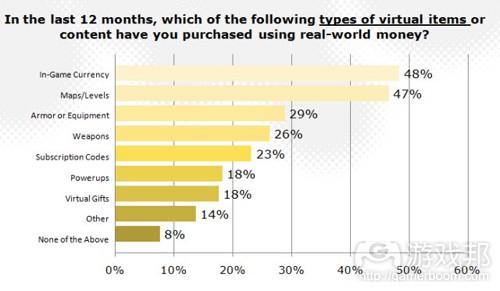

在过去12个月中,约有48%的大众游戏玩家曾花钱购买游戏虚拟货币,约47%为地图和新关卡付费,约29%购买盔甲和装备。约45%玩家每月会购买一次虚拟商品,72%表示自己的消费数额比去年更多,或者与去年相当。约67%玩家称自己比去年多花钱,是因为今年玩在线游戏的时间更长了,而42%玩家则表示自己多花钱是因为今年消费能力更强。32%受访者称支付流程简单易操作,是他们为游戏多花钱的主要原因之一,还有30%则表示自己花钱是为了得到游戏中的奖品。

从使用Facebook Credits购买虚拟道具或内容这个方面来看,女性用户比男性用户所占比例分别是34%和13%,前者是后者的三倍左右。女性玩家在MMO游戏中平均消费数额达111美元,而男性玩家则是74美元;前者在休闲游戏中的平均消费额是86美元,而男性玩家则是77美元。在休闲游戏领域,女性玩家向第一方游戏发行商付费51美元,而男性则是36美元,前者向第三方发行商支付62美元,后者则是28美元。约37%女性用户喜欢购买虚拟道具来装饰页面、人物角色和虚拟形象,但仅19%男性用户乐衷此道。

男性比女性更容易接受电子邮件沟通方式,有49%男性偏爱这种渠道,而作出同样选择的女性仅占38%;约31%女性青睐Facebook推广内容,而具有同一倾向的男性仅占18%。

2)教育类游戏初创企业Airy Labs日前通过Foundation Capital 、Google Ventures和Playdom联合创始人Rick Thompson融资150万美元,意将利用这笔资金设计寓教于乐,培养少儿手动能力的游戏,训练少儿群体的大脑和心理素质,辅助他们的学校教育。该公司推出的首批游戏将锁定5至13岁少儿群体,向他们传授英语、数学知识,通过游戏增强记忆力。

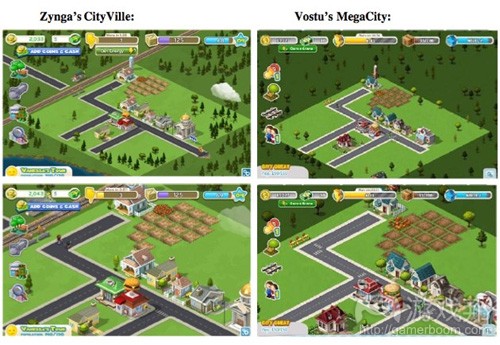

3)据games.com报道,谷歌近日也被卷入了Zynga起诉巴西社交游戏开发商Vostu的侵权风波,原因是Vostu抄袭Zynga的四款游戏均在谷歌社交平台Orkut上运营。Zynga最近在巴西法庭获得了一名法官的支持,法院指令要求Vostu与Orkut在48小时之内将《MegaCity》、《Pet Mania》、《Cafe Mania》和《Vostu Poker》这四款游戏移除,否则这两者就得每天向Zynga支付1万3千美元的赔偿费。

观察者指出,谷歌之前曾“秘密”向Zynga投资,此举或影响Zynga与谷歌之间的合作关系,但谷歌目前尚未对此作出回应。

4)据socialtimes统计,Facebook策略类社交游戏MAU目前已突破8000万,其中最受欢迎的此类游戏包括:

《Empires and Allies》(Zynga):5200万MAU

《Army Attack》(Digital Chocolate):530万MAU

《Backyard Monsters》(Kixeye): 390万MAU

《Dragons of Atlantis》(Kabam):380万MAU

《Global Warfare》(Kabam):280万MAU

《Galaxy Online II》(IGG Inc.,):240万MAU

《Social Empires》(SocialPoint):230万MAU

《Kingdoms of Camelot》(Kabam):150万MAU

《Glory of Rome》(Kabam):149万MAU

《City Wars》(FunStar Studios):130万MAU

《Battle Pirates》(Kixeye): 96.5万MAU

《Doomsday Defense》(IGG. Inc.,):50.9万MAU

《Age of Champions》(KlickNation):50.7万MAU

以上13款顶级策略游戏的MAU约为7900万,DAU已超过1100万,如果再加上其他策略游戏用户,其MAU总数应该已接近8000万。尽管目前领先的是Zynga新作《Empires and Allies》,但Kabam推出的策略类游戏数量最多,其四款上榜游戏的MAU将近1000万。

而DAU数量最高的当属《Backyard Monsters》,约25%的用户每天都会登录游戏。

5)据comScore最新数据显示,截止7月24日,谷歌社交网站Google+独立访问用户已达2500万,每天新增近100万用户,增长速度远超Facebook、Twitter等其他社交网络。

Google+美国用户约为644万,其次是印度用户,数量为362万。但需要指出的是,这一数据仅代表曾访问Google+的用户,并不能反映Google+的实际注册用户,另外也不包括通过移动设备或谷歌状态栏渠道访问该网站的用户。

comScore指出,Google+在7月初的注册用户超过1000万,成为史上发展速度最快的社交网络。与之形成对比的是,Facebook历时三年才吸引了2500万访问用户,Twitter也用了30个月才实现这一目标。

6)《Megaband》是一款由育碧于去年11月发行的Facebook游戏,要求玩家管理自己的乐队,使其成长为世界巨星。该游戏在7月27日跻身用户增长最快的Facebook游戏榜单。据AppData数据显示,《Megaband》当前的MAU是13万2413,DAU是1万8006。

玩家在游戏中可创建6名乐队成员,但需通过赢取经验值升级后才能解琐出所有成员。除了个性化装扮乐队成员,选择不同的服装和乐器,玩家还可以挑不同场地和歌曲,进行彩排和演出。游戏支持玩家招募好友加入乐队,或彼此成为邻居,互相为对方捧场。另外还提供了病毒传播渠道,支持他们炫耀自己的成就或向对方赠送礼物。

7)社交游戏公司King.com最近与雅虎签署协议进行合作,将由Yahoo!Juegos这家新公司向拉美七个国家的Yahoo!Hispanic用户推出一系列目前尚未公布的King.com社交游戏。

King.com目前最热门的Facebook游戏是《Mahjong Saga》,MAU将近270万。目前在拉美最大的社交游戏发行商是Mentez,在Facebook、Orkut和其他社交网络上的用户超过400万,而King.com游戏当前的独立访问用户就超过了2700万,用户每月访问游戏超过8亿次,它有可能在拉美市场获得进一步发展。

8)社交游戏开发商Kixeye(代表作是《Backyard Monster》)日前宣布在第三轮融资中筹得1800万美元,其支持者包括Jafco Ventures、Trinity Ventures和Lightspeed Venture Partner,另外Zynga联合创始人Andrew Trader也将加入公司董事会。

该公司原先名为Casual Collective,在4月份更名为Kixeye。它在18个月时间内,从原来的3人团队规模扩增至60人。据AppData数据显示,该公司游戏当前的MAU已达510万,比今年初增长41%,DAU则是110万,比年初增长37%。

Kixeye的成功得益于与Kabam一样的“硬核”路线,其《Battle Pirates》游戏玩家消费数额比一般社交游戏用户高20倍。但即便如此,该公司还是需要筹集资金以便实现完全盈利,在本轮融资前已筹资450万美元。

9)在本周的DAU增长最快Facebook游戏榜单上,《Texas HoldEm Poker》(最近DAU是682万)、《开心水族箱》(最近DAU是157万)和《Ninja Saga》(最近DAU是74.7万)位列前三甲,根据电视节目改制的游戏《Jersey Shore》排在第8名,最近DAU是14万。除了《开心水族箱》之外,乐元素的另一款游戏《森の物语》同样榜上有名,最近的DAU是12.3万,排在第五名。(本文为游戏邦/gamerboom.com编译,如需转载请联系:游戏邦)

1)More gamers are spending real money on virtual goods, and women are spending more than men

Dean Takahashi

One out of every three online gamers is spending real money on virtual goods, according to a new study by Visa’s PlaySpan and VG Market Study.

The study also shows that men and women are continuing to behave in different ways when it comes to online game spending. This kind of information could help game companies better target their customers.

About 31 percent of the overall online gamer population has used real money to buy virtual content from another player or a third-party web site.

Console games with online play account for 51 percent of virtual purchases using real money. Social networking sites account for 30 percent of the purchases, and massively multiplayer online games account for 28 percent. (Some of the purchasers buy goods in more than one type of game.)

About 48 percent of the general gamer population said they have purchased in-game currency in the past 12 months. About 47 percent have bought maps and new levels. About 29 percent have purchased armor and equipment. Some 45 percent said they buy virtual items once a month, with 72 percent saying they would spend more or about the same compared to last year. About 67 percent said they were spending more because they were spending more time playing online games than last year, compared with 42 percent saying they have more money to spend. About 32 percent said ease of purchase is the reason for the additional spending, while in-game rewards were cited 30 percent of the time.

“The digital goods market may be enormous, but it’s still part of the Wild Wild West in terms of targeting users based on behavior and spending preferences,” said Robb Lewis, director of marketing at PlaySpan, which was acquired by Visa earlier this year.

Females are three times more likely than men (34 percent vs 13 percent) to use Facebook Credits to purchase virtual items or content. Females spend $111 vs $74 for males in MMOs, and they spend $86 vs $77 for men for casual games. In casual games, women spend $51, or 40 percent more than men ($36) from first-party publishers and $62 vs $28 for men from third-party publishers. About 37 percent of women are likely to buy a virtual item to decorate a page, persona or avatar. Only 19 percent of men spend money on those things.

Those who spend money on sports spend an average of $106 on first-party games and $132 on third-party sites, compared to those who read books, who spend $65 and $49 respectively.

Men are more receptive than women to email communications, with 49 percent of men preferring it compared to 38 percent for women. About 31 percent of women favor Facebook promotions, compared to 18 percent for men.

The data came from July interviews with more than 1,000 gamers who were part of a VG Market database.(source:venturebeat)

2)Educational Start-Up Nabs $1.5M Funding To Make Games That ‘Don’t Suck’

by Frank Cifaldi

Educational games start-up Airy Labs has raised $1.5 million in funding to “make games that parents can feel good about handing to their kids…and that don’t suck.”

The funding comes from Foundation Capital, Google Ventures, and Playdom co-founder Rick Thompson, according to The Wall Street Journal’s All Things Digital blog.

“Our games are designed in the spirit of ‘learning through play’ and ‘learning by doing,’ with the fundamental philosophy that learning is fun and the best games are the ones where kids are having fun playing and learning at the same time,” Airy says on its website. “They will have learning value across a broad landscape, including academic courses and skills, brain and psychological training, and broader life skills that aren’t taught in school.”

The initial games will teach English, math and memory building to kids age 5-13.

Airy’s funding came after founder Andrew Hsu attracted the interest of PayPal co-founder Peter Thiel’s “20 Under 20″ grant program for young entrepreneuers, which provided the company $100,000. (source:gamasutra)

3)Zynga drags Google into legal battle with Vostu, but aren’t they bros?

by Joe Osborne

Ever since Google “secretly” invested in Zynga last year, we thought so too. But apparently not, as TechCrunch reports that the creator of FarmVille has filed suit against the search giant for its involvement with Brazilian social games developer Vostu. Zynga claims that Vostu has copied four of its games. (Keep in mind, Vostu has since filed a countersuit against Zynga for the very same thing.) Google has been dragged into this scrap because Orkut, a social network popular in Brazil that hosts the very games Zynga is targeting, is a Google property.

And, according to TechCrunch, Zynga filed another lawsuit against Vostu in a Brazilian court. Better yet (for Zynga, at least), a Brazilian judge has sided with Zynga and granted it a preliminary injunction against Vostu. The injunction, or court order, demands that Vostu and Orkut must remove four games–MegaCity, Pet Mania, Cafe Mania and Vostu Poker–within 48 unless the two want to pay a fine of about $13,000 USD every day until they are removed.

“Professor Bruno Feijó, from Pontifícia Universidade Católica do Rio de Janeiro and Chief of Vision Lab, analyzed the games and concluded that: ‘the four games from Vostu characterize a clear case of copying Zynga’s games in both visual interface and gameplay,’” Zynga said in a statement. This was affirmed by Professor João Bernardes Junior from the University of São Paulo. At this point, we doubt Google and Zynga will hit the clubs together anytime soon … or whatever bros do. We’ve contacted Google for comment.(source:games)

4)REPORT: Facebook Strategy Games Top 80 Million Users

by Wagner James Au

The rapid growth of Zynga’s Empires and Allies to 50 million players within a month of launching highlights the strength of a fast-rising genre of Facebook games: strategy.

Broadly defined, strategy refers to combat and resource-management games with military themes and conceits, generally played on a map-like field.

They have long been the province of hardcore gamers — predominantly competitive males in their 20s to 40s who are perhaps best represented by PC game hits such as the Starcraft, Command and Conquer, and Civilization franchises.

Since the launch of last year’s Backyard Monsters, strategy games have amassed an extremely large aggregate user base, reportedly earning average revenue per user rates (ARPU) that are typically larger than other Facebook games.

Sizing The Market

SocialTimes Pro estimates that the strategy game market on Facebook represents at least 80 million monthly active users. According to AppData.com, the most popular strategy games on the social network are (listed by title, company, monthly active users and daily active users):

Empires and Allies, Zynga, 52 million

Army Attack, Digital Chocolate, 5.3 million

Backyard Monsters, Kixeye, 3.9 million

Dragons of Atlantis, Kabam, 3.8 million

Global Warfare, Kabam, 2.8 million

Galaxy Online II, IGG Inc.2, 2.4 million

Social Empires, SocialPoint, 2.3 million

Kingdoms of Camelot, Kabam, 1.5 million

Glory of Rome, Kabam, 1.49 million

City Wars, FunStar Studios, 1.3 million

Battle Pirates, Kixeye, 965,000

Doomsday Defense, IGG. Inc., 509,000

Age of Champions, KlickNation, 507,000

The Totals

The top 13 entries together have around 79 million monthly active users and over 11 million daily active users. Many additional titles attract monthly actives by the hundreds of thousands — and that brings the total number of people playing strategy games to over 80 million.

While Zynga’s Empires and Allies has the lion’s share of this market, Kabam has the largest library of hit strategy games, with four titles accounting for nearly 10 million monthly active users.

Digital Chocolate’s Army Attack, a turn-based strategy game in the vein of the Nintendo hit Advance Wars, has enjoyed tremendously strong growth since launching last June, and has even attracted a following of seasoned game developers like BioShock lead designer Ken Levine.

The game with the highest number of daily active users in relation to monthly active users is probably Kixeye’s Backyard Monsters, with nearly 25 percent of the user base logging in daily to play. (However, Kabam cites internal data in order to claim even higher numbers.)

While Zynga’s Empires and Allies is far and away the genre’s market leader, it’s important (as with all titles by this manufacturer) to factor in the company’s massive, pre-existing user base from legacy games such as FarmVille and Texas Hold ‘Em, who are all likeliest to try out new titles.

Learn more about how strategy games are engaging and attracting new users on Facebook by clicking here to read the latest report from Social Times Pro. If you’re not already a subscriber, click here to become one or buy the individual report.(source:allfacebook)

5)Google+ has 25M unique visitors, but it’s not fair to compare it to Facebook

Sean Ludwig

Google+, the new social network from Google, is growing at a gargantuan pace. The social destination has now hit 25 million unique visitors, reaching that milestone faster than Facebook, Twitter or other social networks, according to new comScore data.

Social pundits are keeping a close eye on Google+ to see how it disrupts the current social framework comprised of Facebook, Twitter, LinkedIn and other networks. Tracking unique visitor counts helps assess just how widespread content from Google+ is around the web and whether it’s reaching beyond the early adopter crowd.

The network, which has captured a lot of attention since its launch, specifically had more than 25 million unique visitors as of July 24 and is growing at a rate of roughly one million visitors a day, comScore said. The majority of visitors came from the U.S., with 6.44 million uniques, followed by India, with 3.62 million uniques.

These numbers are not a representation of Google+ registered users, however. Rather, the figure only represents individuals who have visited a Google+ page. Nor do the figures include visits from mobile devices or activity from Google’s black status bar.

In early July, Google confirmed that the network had more than 10 million registered users. This number makes Google+ the fastest-growing social network in the web’s history.

But with its 25 million unique visitors and 10 million users so quickly, is it fair to compare these numbers to the likes of Facebook and Twitter? comScore compared Google+’s numbers with these networks and noted that it took Facebook nearly three years to attract 25 million visitors, while it took Twitter about 30 months.

While Twitter is fair for comparison, we’d argue that it’s not fair to directly compare to Facebook, which started with a gated approach focused on colleges. Google+ might be gated slightly with its invite-only processes, but there are plenty of invites out there now.

Facebook now has 750 million users, while Twitter has 200 million and LinkedIn has 100 million. We will certainly keep an eye on these figures and see if Google+ is able to continue its rapid ascent in the social media world.(source:venturebeat)

6)Megaband Gets Players to Tune in, Hits the Charts

By Randy Nelson

Launched in November of last year, Megaband from Ubisoft puts players in charge of their own band, tasking them with rising from an aspiring garage start-up to an international sensation. The title made ISG’s list of fastest-growing Facebook games for the week of July 27.

According to our traffic tracking service AppData, Megaband currently has 132,413 monthly active users and 18,006 daily active users.

In Megaband, players create avatars for up to six band members, starting with one and unlocking more as they level up by gaining experience points. After picking a name for their band, dressing up its first member and choosing an instrument (guitar, drums, keyboard, vocals) players must rehearse before playing a gig. During rehearsal, players’ avatars have “mega needs” — clicking on the avatar initiates a simple matching game, with rewards given for finding and matching as many similar tiles as possible under a time limit. After the rehearsal has finished, players can choose from several venues, such as a concert hall and disco, in which to play their main gig. The game offers multiple songs in several music genres to “play.”

Once a song has been chosen, the gig begins. Players place their band members on stage and the music starts, at which point the audience begins throwing various items (ice cream cones, underwear and other oddities) on-stage. Clicking these items rewards the player with experience points. Crowd surfers and other, stranger “guest characters” will also appear in the audience and can be clicked for XP. The player has a “Rock Out Bar” that is filled while rehearsing and can be spent to boost the amount of XP gathered by clicking the various objects that appear on-screen.

In addition to clothing and accessories for their band avatars, players must also purchase décor for their pads. Depending on the items purchase and placed, players receive boosts to their attack and defense stats that come into play when accessing the Battle Center. This portion of the game allows players to go up against others playing the game in a simple stats-based battle that requires no direct interaction. The winner comes away with a reward of cash and XP. Expanding the player’s pad also extends their stamina, which allows them to play more gigs before needing to wait for it to refill, or purchasing more.

Players can recruit friends to join their bands, and also make them neighbors, which serves to increase their health for Battle Center matchups and allows them to visit one another’s pads to collect bonus XP. The game also lets players brag about their accomplishments through viral channels and send/receive gifts.(source:insidesocialgames)

7)King.com and Yahoo! Take Social Tournament Games To Latin America

By Azam Khan

As the competitive gaming market heats up, King.com and Yahoo! have struck a multi-national agreement to bring social tournament games to the Latin American market. More after the jump.

The foray into the Latin American market is an extension of King.com‘s deal with Yahoo! to market its portfolio of games to Yahoo!’s users. Dubbed Yahoo! Juegos, the new venture will provide Yahoo! Hispanic consumers across seven countries with a plethora of games that have not been disclosed.

King.com has been actively making strides when it comes to cross platform games, but the definition remains ambiguous. Regardless, King.com’s roll out of Mahjong Saga on Facebook has been seeing strong growth and currently has close to 2.7MMAUs. With a solid focus on individual games and developing a community around them. These casual social games, or social tournament games, are casual in nature but induce players with a competitive spirit. Such social puzzle games were pioneered by PopCap’s Bejeweled Blitz on Facebook and now many companies including SocialPoint have an array of casual games with leaderboards, virtual items, and quick game play. In addition, players can challenge each other and participate in time-limited competitions in order to win virtual currency, items, or even real gift cards.

In February SuperData Research released a report that anticipates the Brazilian virtual goods market to reach $642M by 2014 with Brazil comprising the majority of that share (~320M). The most popular social game publisher in Latin America is Mentez, with over 4M users across Facebook, Orkut and other SNS. King.com could see solid growth in Latin America as it currently has over 27 million unique visitors and more than 800 million games played per month globally. King.com offers more than 200 exclusive games in 14 languages across the globe through its premier destination, King.com (www.king.com), on Facebook and on mobile devices.(source:socialtimes)

8)Kixeye Raises $18M Third Round, Brings Zynga Co-Founder Trader to Board

By AJ Glasser

Backyard Monsters developer Kixeye announced a third round of funding today totally $18 million from Jafco Ventures, Trinity Ventures and Lightspeed Venture Partner. Additionally, Zynga co-founder Andrew Trader will join the developer’s board.

Back in April, the company formerly known as Casual Collective re-branded as Kixeye and focused all development on the Facebook platform. Since that time, the developer has launched Battle Pirates and is set to bring out a third Facebook-only game, War Commander, later this summer. The total employee headcount of the developer has gone from 3 to 60 in the last 18 months and our AppData traffic tracking service puts its overall growth in monthly active users up 41% to 5.1 million and its daily active users up 37% to 1.1 million since the start of 2011.

The key to Kixeye’s success appears to be targeting a niche “hardcore” market in a manner similar to Kingdoms of Camelot developer Kabam. These focused approaches appear to be paying off; Kixeye claims that Battle Pirates players spend 20 times the industry average. Even with revenues like that, however, the developer has had raise some capital to become completely profitable, netting $4.5 million in funding prior to this round.(source:insidesocialgames)

9)Texas HoldEm Poker, 開心水族箱, Ninja Saga Top This Week’s List of Fastest-Growing Facebook Games by DAU

By AJ Glasser

Zynga’s Texas HoldEm Poker, 開心水族箱 (Happy Aquarium), and Ninja Saga top this week’s list of fastest-growing games by daily active users.

TV tie-in game Jersey Shore makes an appearance at No.8 just as the show on which it’s based prepares to enter its fourth season. It’ll be interesting to see what kind of growth the social game supports while new episodes air. The premier airs August 4.

開心水族箱 developer Happy Elements has a second game on this week’s list of DAU gainers with 森の物語 (Forest Adventure). The game is essentially a FrontierVille clone set in a jungle as opposed to the American West, though the style of the character customization feels distinctly different. It’ll be interesting to see if “regional reskins” like 森の物語 transcend the clone label on account minimal audience cross-over.(source:insidesocialgames)

闽公网安备35020302001549号

闽公网安备35020302001549号