每日观察:关注PayPal游戏虚拟商品交易情况(8.2)

1)日本手机社交游戏巨头DeNA日前公布2011财年第一季度(截止6月30日)财报,其净销售额达346亿日元(约合4.49亿美元),比去年同期增长43%;净收益达94.6亿日元(约合1.23亿美元),同比增长45%。

由于该公司投入巨资在全球打造Mobage平台,并积极向Android领域扩张,其运营现金流同比去年已减少93亿日元(约合1.2亿美元)。

DeNA目前约有400名开发人员,预计韩国及瑞典工作室开业后,再加上伦敦、新加坡以及其收购的荷兰工作室Rough Cookie成员,这一数据将超过1000人。

DeNA在该季度的共有509亿日元(约合6.6亿美元)的现金和现金等价值,比上一季度减少118亿日元(约合1.5亿美元)。

Mobage平台目前在手机及PC端的用户已超过2970万,该平台现有1000多款游戏,用户每月使用10亿个平台虚拟货币Moba-coin,而PC端的Yahoo!Mobage用户每月也消费1亿个Moba-coin。该季度用户共投入4.33亿美元用于购买Moba-coin、支付每月会员费等服务。

从该公司的社交媒介业务来看,88%销售额来自应用内置付费功能,游戏内置广告和联属广告。还有6%来自虚拟形象个性化服务,5%来自其他广告渠道。

自2010年12月登陆智能手机平台以来,Mobage的每用户平均收益增加了9倍以上,比今年4月引进运营商计费系统时增加了将近两倍。

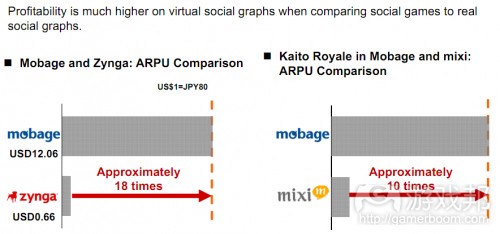

DeNA预测日本国社交游戏市场规模将从2011财年的26亿美元,增长至2013财年的39亿美元。该公司称自己的用户价值比Zynga用户高18倍,比竞争对手mixi高10倍;Mobage每月ARPU值是12.06美元,Zynga则是0.66美元,并且后者的用户远远超过DeNA。

2)Segan LLC公司(游戏邦注:该公司自称为“产品发明和开发公司”)日前起诉社交游戏公司Zynga,称后者侵犯其“通过访问外部网站为人物头像添加内容”解决方案的专利权。该公司虽然并没有开发在线游戏,但在2000年申请并于2006年获得了这项专利权。

这项专利的具体内容包括,支持用户访问一些提供人物头像额外内容的网站地址,以便为其头像添加更多功能(例如在用户设备上呈现动态头像等)。

Zynga游戏支持玩家通过参与一些外部网站提供的广告推广服务,赢取游戏虚拟货币和道具,这种做法已因其误导性的广告策略而备受指责。

Segan的起诉文件要求Zynga赔偿使用这项专利技术的损失,并永久停用该技术,或者选择向Segan支付专利权使用费。

3)Zynga热门手机游戏《Words With Friends》近日登陆Facebook平台,成为Zynga首款从智能手机平台移植到Facebook的游戏。

Zynga在去年12月以5330万美元收购该游戏开发商Newtoy,据称后者被收购后,该游戏每日用户翻倍增长。

4)社交游戏开发商Meteor Games(代表作品包括《Island Paradise》)首席执行官Zac Brandenburg日前表示,公司的终极目标是吸引中间派游戏玩家,即介于Kabam硬核玩家以及妈妈级休闲玩家之间的用户。他称中间派用户规模很庞大。据其所称,Meteor已拥有不少鲸鱼用户,他们一年在游戏中投入超过1000美元,甚至还有超级鲸鱼玩家在游戏中消费超过1万美元。

他表示Meteor游戏并不侧重于社交层面,而是通过高质量的游戏体验让玩家自动回访游戏。他认为只要游戏够出色,玩家不需要好友邀请也会回访游戏,就算只有一小撮消费能力比一般玩家高50倍的用户,那也能够让游戏获得成功。

5)刚合并不久的社交游戏公司6waves Lolapps日前再度融资3500万美元,主要支持者是Insight Venture Partners,后者曾在1月份助6waves融资1750万美元。

6waves Lolapps旗下游戏《Ravenwood Fair》在2月份的MAU超过1000万,但据AppData数据显示,其当前用户已下滑至500万左右。

6)在今年8月份的前25强Facebook游戏榜单上,Zynga游戏《CityVille》、《FarmVille》和《Empires & Allies》分别位居DAU榜单前三甲,但仅有《Empires & Allies》的DAU比上月略有回升,而另外两者的DAU均出现下滑情况。这种现象不禁让人怀疑传闻中的Facebook帮助Zynga游戏引导流量的消息是否属实。

从MAU情况来看,共有28款游戏流量下降,其中最典型者当属《CityVille》和《FarmVille》,前者比上月流失了862万用户,后者则流失345万用户。值得注意的是RockYou旗下的《Zoo World 2》同时在两个榜单上现身,这是该游戏自6月中旬发布以来,首次跻身前25强榜单。

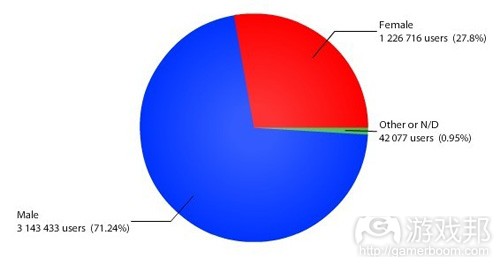

7)来自Bime的最新调查数据指出,谷歌社交网络Google+用户以男性为主(占71.24%),多数用户集中于25至34岁年龄段(占35%)。Google+的美国用户基数几乎是印度用户的三倍。

Google+用户主要来自科技行业,其中工程师占1.77%,开发者占1.02%,设计师占0.82%,软件工程师占0.7%。而最高层的Google+用户显然来自谷歌公司本身。

Bime的数据主要取自第三方用户目录Find People on Plus,该公司调查分析了441万2227名用户(占Google+用户的五分之一以上)的情况,而用户年龄数据则取得comScore调查结果。

8)在线支付服务供应商PayPal日前发布数据显示,该平台超过1200万的每月独立用户付费购买虚拟商品(游戏邦注:这组数据来自Inside Network,适用于美国所有在线用户,并不专指Facebook用户)。

这1200万用户仅相当于7.5亿Facebook用户的1.6%,但已足够为Zynga等社交游戏开发商创造大量收益。

PayPal成立于1998年,并于2002年被eBay收购,其季度营收超过10亿美元,活跃用户超过1亿。

据PayPal所称,超过40%的成人用户是在线游戏玩家,70%以上的所有游戏玩家都是PayPal用户。北美62%的虚拟商品销售是通过PayPal或信用卡进行交易。

eMarketer预计2011年美国虚拟商品交易市场规模将达10亿美元,而Inside Network预测今年美国虚拟商品交易营收将达21亿美元;全球虚拟商品交易市场规模今年将达60亿美元,其中以亚洲国家发展势头最为强劲。

PayPal高级总监Carey Kolaja表示,MMO游戏的付费玩家比例正不断上升,19%用户购买游戏虚拟货币的消费额不足10美元,54%消费额介于10至50美元,27%消费额超过50美元。在社交游戏领域,33%用户消费额不足10美元,58%介于10至50美元,9%消费额超过50美元。在休闲游戏网站中,29%消费额低于10美元,49%介于10至50美元之间,22%消费额超过50美元。

MMO玩家每周平均游戏时间达22小时,40%用户每天都玩游戏;社交游戏玩家一周玩16小时游戏,56%用户每天都玩游戏;休闲玩家一周体验8小时游戏,34%每天都玩游戏。77%的MMO游戏玩家是男性用户,而社交及休闲游戏的女性玩家比例高达59%。

PayPal用户最常玩的游戏包括《魔兽世界》、《最终幻想》、《宝石迷阵》和《FarmVille》。(本文为游戏邦/gamerboom.com编译,如需转载请联系:游戏邦)

1)Despite investing more than $120m in expansion, DeNA sees FY11 Q1 net income up 45% to $123m

by Jon Jordan

DeNA (TYO:2432), the Japanese mobile social gaming company has announced its seventh consecutive set of record financial figures for its FY11 Q1, the three months ending June 30.

Net sales were up 43 percent to ¥34.6 billion ($449 million), compared to the same period in FY10.

Net income was up 45 percent to ¥9.46 billion ($123 million).

Spend to profit

With the company investing heavily in building out its Mobage platform globally, as well as on Android, cash flow from operations was strong negatively, down ¥9.3 billion ($120 million) year-on-year.

In addition, DeNA currently has 400 development staff, but says this number will soon be over 1,000, with a new offices set up in South Korea and Sweden, plus plans for centers in London and Singapore, and the acquisition of Dutch studio Rough Cookie.

It ended the quarter with ¥50.9 billion ($660 million) in cash and cash equivalents, down ¥11.8 billion ($150 million) compared to three months ago.

Core support

The Japanese Mobage platform continues to power DeNA’s revenues. It has 29.7 million subscribers to the mobile and PC service, and there are now over 1,000 mobile games live, while use of its in-platform currency, Moba-coins is growing fast.

On Mobage, more than one billion Moba-coins are being used per month, while on DeNA’s PC-based Yahoo! Mobage more than 100 million Moba-coins a month are being consumed.

During the quarter, ¥33.4 billion ($433 million) was spent on Moba-coins, monthly membership fees and ticket sales.

In terms of what DeNA labels its social media business, 88 percent of sales came from in-app purchases, in-game ads and affiliate advertising. Of the remainer, 6 percent was from avatar customisation and 5 percent from other advertising.

Getting smarter

Looking more closely at how DeNA is try to transition the Mobage’s audience, since what it call ‘Mobage for smartphone’ launched in Japan in December 2010, the company says average revenue per user has risen over nine times, almost doubling since operator billing was added in April.

The smartphone platform now supports 13 native and 54 browser-based titles.

Looking toward future growth, DeNA predicts the Japanese social game market will grow from around ¥200 billion ($2.6 billion) in FY11 to around ¥300 billion ($3.9 billion) by FY13.

And continuing its positive comparations to US company Zynga, DeNa reckoned its users are worth 18 times more than Zynga’s, in part because it thinks “profitability is much higher on virtual social graphs when comparing social games to real social graphs”.

Mobage listed its monthly ARPU as $12.06 compared to Zynga’s $0.66: obviously Zynga’s Facebook titles have a lot more players than DeNA.

Indeed, claiming it will be ‘The world’s top social gaming platform’, it is predicting net half year sales of ¥71 billion ($920 million), with net income of ¥18.6 billion ($240 million).(source:pocketgamer)

2)Zynga Faces Patent Infringement Lawsuit From Segan LLC

by Kyle Orland

Self-described “product invention and development company” Segan LLC has sued social gaming leader Zynga, accusing it of infringing on a patent regarding a “system for viewing content over a network” that facilitates advertising.

While Segan doesn’t develop online games, it does hold a patent, filed in 2000 and issued in 2006, describing in broad terms a method for adding “enhancement content for a character icon” by visiting external web sites.

“The user will select website addresses of subscriber target sites where the user can access enhancement content for the character icon to provide functionality to the character icon such as for animating the character icon on the user device,” the patent reads, in part.

The patent goes on to give examples of a character — who exists in a separate browser window — gaining new outfits, backgrounds, and animated dance moves when a user visits participating web sites.

Zynga’s games offer players in-game currency and items for participating in offers from external sites, a controversial practice that has drawn criticism and class-action lawsuits for allegedly misleading advertising tactics.

Segan’s lawsuit [PDF] seeks unspecified damages and a permanent injunction against Zynga’s use of the patented technology, or an order that Zynga pay royalties to Segan for use of the technology.(source:gamasutra)

3)Zynga Brings Popular iOS Game Words With Friends To Facebook

by Frank Cifaldi

Zynga’s popular smartphone game Words With Friends is now available on Facebook, the company said Monday.

The game, which is similar to the classic board game Scrabble, is currently available only for iOS and Android devices.

The Facebook transition represents the first time that the company has brought a mobile game to Facebook, rather than the inverse.

Zynga acquired With Friends series developer Newtoy for an alleged $53.3 million last December. According to the company, the daily users for the game doubled after the acquisition.

The game continues to chart on the iPhone App Store: it was among the top ten games just this morning. (source:gamasutra)

4)Meteor Games wants to be the Nintendo of Facebook games, not just “for moms”

by Brandy Shaul

While Meteor Games may be a name that’s foreign to most Facebook gamers, with just 1.1 million monthly active users across their entire catalog of Facebook games, that doesn’t mean their games aren’t successful. Just ask CEO Zac Brandenburg. According to Forbes, Meteor finds success in their Facebook games (including their most popular – Island Paradise) because they’re more focused on the long-term when designing a game, rather than on instant success.

“The feature set is much more than a simple compulsion loop,” says Brandenberg, “You need to have different things for players to do, centered around what the plot is going to be.” In an upcoming branded game, released with Viacom, we’ll apparently see that ideology in full effect. Meteor is currently working on three games that are “close to launch,” but Brandenburg didn’t reveal specific details about any of them, other than the fact that they may be “fantasy-themed.”

We do know the company’s end goal, however: to focus on the middle section of gamers. “We don’t think like Kabam with hard core games and we are also not just casual games for moms. There is a middle ground – like with Nintendo. There’s a huge audience in the middle. We’re going to draw from the hard core elements and the super casual side.” Brandenburg says that games don’t need massive audiences to be successful, so long as you’ve given players a high quality experience that engages them over the long term. Of course, high-paying users don’t hurt either.

While Brandenburg refrained from using the term “whales,” Meteor apparently does have them, and in droves. In Meteor’s case, whales are gamers that spend over $1,000 a year on their games, while a handful of Super Whales in each game spend over $10,000 – that’s a lot of premium currency!

Even with all of that being said, Brandenburg made it clear that the company’s focus isn’t so much on a game’s social aspects, but on making an individual user want to come back to the experience just to play the game. “You only play if you actually want to not because your friends want you to. Then you have a smaller audience but the audience may spend 50 times what another gamer (on a different game) spends. You can have a lot of success there.”(source:games)

5)Just-Merged 6waves Lolapps Secures $35 Million Funding

by Frank Cifaldi

Following a merger just weeks ago, the newly-combined 6waves Lolapps has secured an additional $35 million in funding, according to a filing with the Security and Exchange Commission.

The funding was lead by Insight Venture Partners, which also lead a round of $17.5 million funding to 6waves in January.

The two companies merged last month, with 6waves providing Lolapps improved distribution and Lolapps providing 6waves its Filso engine and a showcase title, Ravenwood Fair.

Ravenwood Fair claimed over 10 million monthly acive users back in February. It currently claims just shy of 5 million, according to tracking site AppData. (source:gamasutra)

6)The Top 25 Facebook Games for August 2011

By AJ Glasser

Kicking off the month of August on Facebook are many of the games we’re very used to seeing in the top 10, and most of which belong to Zynga: CityVille, FarmVille, and newcomer Empires & Allies. A couple of up-and-coming games catch our eye, however, toward the lower end of our top 25 Facebook games by daily active and monthly active users. Gardens of Time, meanwhile, maintains steady growth even as Playdom moves on to launching newer titles.

We begin with daily active users, which is a better measure of overall audience engagement. Fourteen games in our list experienced losses in DAU, the largest of which occurring Zynga’s CityVille and FarmVille. Empires & Allies manages a small gain, meanwhile, which makes us wonder about the traffic targets Facebook and Zynga agreed upon in exchange for title exclusivity on the social network as the game’s MAU has remained mostly flat since July 17.

As for games new or at least renewed on this list, we see arcade classic newcomer Tetris Battle moving up half a dozen spots to land at No.19. Playtika’s slot machine sim, Slotomania, lands at No.22, suggesting that despite some reported glitches and gripes among users, the developer is putting funds from its partial acquisition by Caesars Entertainment to good use. Meanwhile, down at No.25, Zoo World 2 makes its first appearance after launching in mid-June. The game is currently being fitted with developer RockYou’s new ad platform.

Moving on to MAU, we count 18 games with traffic losses — again, the heaviest of which coming from CityVille and FarmVille. Mall World and It Girl get enough of a lift to push Ravenwood Fair and MindJolt Games off the rankings, and here again we see the impact of Zoo World 2 on the rise.(source:insidesocialgames)

7)Who Used Google Plus First? Male Geeks From the US

By Jon Mitchell

Many words have been expended covering user demographics on Google Plus, mostly regarding whether or not the newborn social network is dominated by men. The data visualization wizards at Bime have just posted an interactive dashboard of Google Plus data that gives us a much more granular picture.

The data seem to confirm the popular conception that Google Plus users overwhelmingly identify as male (71.24%). The dominant age bracket (35%) is 25-34. The U.S. is by far the most represented country on Google Plus, with roughly three times the user base as India. The top 10 most common occupations of Google Plus users are dominated by tech jobs, with engineers (1.77%), developers (1.02%), designers (0.82%) and software engineers (0.72%) taking the top spots. And, by a wide margin, the top employer of Google Plus users is Google itself.

Bime pulled most of their data from Find People on Plus, a third-party member directory. They analyzed a sample of 4,412,227 users, which, according to estimates, is probably over one fifth of the entire user base. The age distribution data is from comScore, not from Find People on Plus, so the sample is not the same.

Bime admits that the data is “a few weeks old,” so demographics may have shifted. As we noted last week, user behavior on Google Plus appears to be changing. But Bime’s dashboard is still probably a reliable picture of who the early Google Plus adopters are.(source:readwriteweb)

8)PayPal: 12M monthly users are paying for virtual goods

Dean Takahashi

More than 12 million unique users pay for virtual goods each month, according to data released for the first time today by digital payments vendor PayPal.

Update: The figure comes from research by Inside Network, and dates to mid-2010. It applies to the entire online audience in the U.S., not just Facebook, according to Inside Network’s Justin Smith.

For comparison, 12 million is only about 1.6 percent of the 750 million users on Facebook, but it’s enough to create a big social game industry capable of supporting giants such as Zynga, which generates hundreds of millions of dollars in revenue per quarter.

PayPal, which collects a lot of data on online payments, says the monetization of digital content has come a long way since the company was launched in 1998 and sold to eBay in 2002. Now it generates more than $1 billion in quarterly revenue and has more than 100 million active users.

When PayPal launched, it described its payment system as the online equivalent to dropping a quarter in a machine to buy a gumball or play Pac-Man. Now it’s use to purchase everything from news features on FT.com to games on the Xbox Live online gaming service.

According to PayPal, more than 40 percent of adults play online games. More than 70 percent of all gamers are PayPal customers. About 62 percent of North American virtual goods sales are facilitated by PayPal or credit cards. And a significant portion of gamers said they would buy more virtual goods if they could earn loyalty credits as a result.

Carey Kolaja, senior director of emerging opportunities at PayPal, said in an interview that the social game sector has been growing dramatically for the past couple of years.

“The growth of PayPal in games was organic, and now there are more and more ways to pay for goods online,” Kolaja said.

eMarketer says the market will be $1 billion in 2011, while Inside Network estimates that U.S. virtual goods revenue will be $2.1 billion in 2011. Internationally, the virtual goods market is about $6 billion, with huge growth in Asia.

PayPal, a subsidiary of eBay, can be used to pay for physical goods on auction sites. But it’s also used these days to pay for digital goods, such as virtual goods in Facebook games.

PayPal has been able to customize its risk models for gaming to deal with things like fraud. Over a decade, it learned how to spot fraudulent transactions. It uses algorithms, or automatic formulas, to cut off fraud before it is executed, Kolaja said. PayPal also allows disputes in digital payments to be resolved automatically up to certain threshold levels. That allows for a smoother, frictionless, more convenient flow of transactions.

PayPal recently went live on Xbox Live and saw a significant jump in transactions. Of the 12 million monthly game payers on Facebook, more and more are willing to pay for things such as bundles of currency. While currency purchases were small at first, now more people are paying higher and higher amounts.

“In massively multiplayer online games, the number of paying gamers keeps going up,” Kolaja said. “The perception about digital goods is that they lead to micro transactions, which are small. But the average purchase for a paying user is in the mid-20s (in dollars). It is on a positive trajectory.”

In MMOs, about 19 percent of purchases of virtual currency are under $10. About 54 percent are for $10 to $50. And 27 percent are for $50 and up. In social games, 33 percent of purchases are under $10. About 58 percent are $10 to $50. And 9 percent are $50 and more. In casual web site games, 29 percent of purchases are under $10. About 49 percent are $10 to $50. And 22 percent are for $50 and more.

In terms of hours played per week, MMO players play for 22 hours a week and 40 percent play daily; social gamers play 16 hours a week and 56 percent play daily; and casual gamers player for 8 hours a week and 34 percent play daily. About 77 percent of MMO gamers are male, while 59 percent of social and casual gamers are female.

The top games played by PayPal customers are World of WarCraft, Final Fantasy, Bejeweled, and FarmVille.

Kolaja said that alternative payments — where users pay for something without using bank accounts or credit cards — are also a big growth industry.

“We recognize the need to go into that space,” Kolaja said.(source:venturebeat)

闽公网安备35020302001549号

闽公网安备35020302001549号