分析传统游戏市场和新兴游戏市场的差异

作者:Tim Merel

当今世界,游戏市场从本质上分为两类,就像10年前的媒体市场一样。当时所谓的“旧媒体”嘲笑“新媒体”,称他们不注重内容、运营方式古怪而且产品和服务毫无意义。当时有传言称,新媒体毁坏的价值会比其创造的价值还要多。然而现在又出现了这种情况。

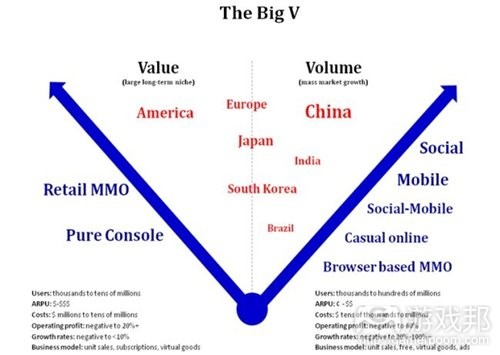

今日的游戏市场从本质上分为“价值”(Value)和“容量(Volum)”两个市场,它们都有着各自的载体和用户。与媒体市场相比,这种分化可能会更迅速地对游戏市场产生更深远的影响。有些类型的游戏迅速崛起,有些游戏却发展缓慢。

首先,让我们为所谓的“价值”和“容量”市场下个定义。

价值市场

用户:数千至上千万

ARPU游戏邦注:即每用户平均盈利):数美元至数百美元

成本:数百万至数千万美元

运营盈利:20%左右

增长率:小于10%

运营模式:零售、订阅、虚拟商品

容量市场

用户:数千至数亿

ARPU:0至数十美元

成本:数万至数百万美元

运营盈利:60%左右

增长率:20%至100%

运营模式:零售、免费、虚拟商品、广告

必须注意的是,这些并非严格的划分界限。但如果用于讨论游戏市场的分化及其意义,这些规则还是很有用的。

价值类别

主机游戏

零售MMO游戏

容量类别

社交网游

休闲网游

手机游戏

手机社交游戏

网页MMO游戏

上述分类可能争议相对较少,但以下所述地区差别或许存在一定的争议。必须注意的是,我们是根据用户市场来将各个地区分类,标准不是开发商。某个地区的公司有可能在其他地区的市场上获得成功,比如美国的Zynga和芬兰的Rovio的全球性成功。

价值游戏地区

北美

容量游戏地区

中国

印度

巴西

混合地区

欧洲

日本

韩国

将上述归类统一起来,我们可以得到下图中的“V”字形。

“V”字形

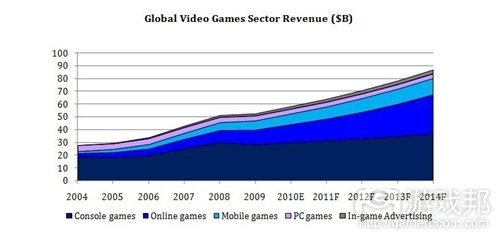

我们预测在线和手机游戏会让电子游戏市场总产值提升至870亿美元,而且这两类将占50%的盈利份额,即440亿美元。此前强势的主机游戏的增加将逐渐趋于平缓随后下滑。

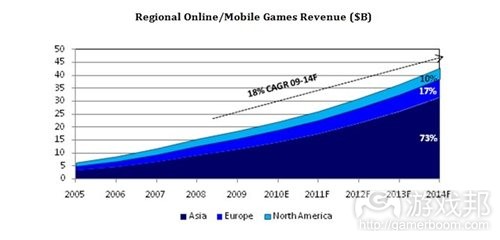

我们预测,在线和手机游戏中,亚洲太平洋和欧洲市场的盈利份额将占90%(游戏邦注:其中中国49%、欧洲17%、日本14%、韩国11%)。北美的地位依然重要。

游戏行业成长和改变的驱动力量是社会人口、文化和技术。其中最重要的是人口,接下来我们以中国为例。

2010年,网络在中国的渗透率为29%,用户在3.82亿左右。也就是说,中国互联网用户数量比美国总人口还要多。到2015年,中国互联网渗透率预计达到56%(游戏邦注:总用户数约7.54亿),用户数超过美国人口的两倍。

然而,中国玩家的ARPU要比美国低得多,但数量众多使得中国网络和手机游戏公司的利润率高达50%-60%。以腾讯公司为例,此刻有款游戏的同时在线用户数高达2000万,这几乎相当于澳大利亚的总人口数。中国及其各种网络和手机游戏公司是容量市场的后起之秀,很符合“大众市场成长”这样的描述。

要讨论价值市场,美国和主机游戏市场是个绝佳的例证。

美国人口数稳定,因而仍然是个巨大的市场。主机市场的增长趋于平缓乃至减慢,尽管近期预计有新硬件发布,但我们仍不确定这种趋势是否会发生改变。然而,美国玩家的ARPU远高于中国,优秀主机游戏的零售价仍然很高(游戏邦注:尽管现在在线购买和数字下载正逐渐流行)。因而美国和主机市场仍不容忽视。

但是与中国之类的国家相比,就玩家数目而言,美国与容量市场相比并不占优势。即便只与欧洲的容量市场相比,美国的玩家数还是较少。因而对于主机市场而言,虽然有《使命召唤》之类的大作,当盈利还是有下滑的趋势。

所以,从全球的态势来看,这些市场会成为大型长期专属市场。这种市场仍然可以铸造出优秀的游戏公司和游戏大作,但就玩家数、成长率和盈利而言,比不上容量市场。

价值市场有部分公司尝试朝容量市场转变,尽管会面临诸多挑战,但依然有可能获得成功。正如之前所述,这期间没有绝对的界限,总是有些例外情况出现。

近期的游戏投资、并购和上市公司估值预示着投资者似乎也有着类似的观点。

那么这种市场变化对你的游戏公司意味着什么呢?

无论你是否同意整个世界投资者的观点(游戏邦注:这些观点确实值得商榷),趋势总是存在的。你不能毫不顾及这种趋势,或许你也应该尝试接受。

你应该在开始时提出几个简单的问题。或许根据这些问题的答案,你会对如何投入成本并利用这个新兴市场来制定计划和运营产生新的想法。

1、用户:你的游戏的目标用户数是多少?数千、数百万还是数亿?

2、ARPU:你以美分还是美元为单位来衡量ARPU?

3、成本:你以千还是百万为单位来衡量游戏开发和用户获取成本?你有适合自己市场的正确成本/盈利模式吗?

4、盈利:你的游戏能获得超多的利润吗?

5、增长率:你的业务的年盈利增长率能达到20%-100%吗?

6、运营模式:何种盈利来源对你的游戏来说最为重要,零售、订阅、虚拟商品(游戏邦注:包括货币和道具)还是广告?

7、地区:你的游戏能否在不同的地区和文化中生存?

8、平台:你的游戏是否只能存在于单个平台上,还是支持跨平台?

9、价值到容量的转化:如果价值市场逐渐转变成容量市场,你还能在价值市场中获得什么呢?这与你现在马上转入容量市场的盈利相比如何?

10、范围:你是否构建起真正带有范围优势的运营平台?

11、退出市场:你的游戏是否能成为价值或容量市场玩家的必需品?如果被迫退出市场会怎样?

你还可以给自己提出更多问题,决定将进驻价值或容量市场会对你将来的游戏开发产生深远影响。(本文为游戏邦/gamerboom.com编译,如需转载请联系:游戏邦)

Analysis: The Big V – The Great Games Market Split

Tim Merel

We are entering a world where the games market is fundamentally splitting in two, like the media market of a decade ago. Back then what we now call “old media” scoffed at “new media” upstarts for giving away content, bizarre business practices, and products and services which made no sense to the wise old birds. “They’ll destroy more value than they’ll create,” was the mantra. Well welcome back to the future.

Today’s games market is fundamentally splitting into “Value” and “Volume” markets, both by sector and geography. The two-speed market this is creating may have more rapid and profound effects on the games market than it did on the media market, with meteoric rises for some and slow going for others.

Let’s start by defining what we mean by “Value” and “Volume.”

Value

-Users: thousands to tens of millions

-ARPU (Average Revenue per User): $-$$$

-Costs: $ millions to tens of millions

-Operating profit: negative to 20%+

-Growth rates: negative to <10%

-Business model: unit sales, subscriptions, virtual goods

Volume

-Users: thousands to hundreds of millions

-ARPU: ¢ – $$

-Costs: $ tens of thousands to millions

-Operating profit: negative to 60%

-Growth rates: negative to 20%-100%+

-Business model: unit sales, free, virtual goods, ads

Please note that these are not hard and fast rules, so there will be exceptions (such as World of Warcraft in retail MMO when we get to sectors). But as a way of thinking about how the games market is dividing and what it means, they are useful rules of thumb.

In terms of thinking about where each games market sectors fits, here’s a starter:

Value sectors

-Pure console

-Retail MMO

Volume sectors

-Social online

-Casual online

-Mobile

-Social-mobile

-Browser-based MMO

This categorization may be relatively uncontroversial, but the geographic divide possibly less so. Please note that for geography we are discussing user markets, not necessarily developer markets. Companies from any geographic location can succeed in other geographic markets, such as Zynga (US) and Rovio (Finland) globally.

Value geography

-North America

Volume geographies

-China

-India

-Brazil

Mixed Value/Volume geographies

-Europe

-Japan

-South Korea

Put all that together, and you get the “Big V”.

The Big V

The eagle eyed will have spotted the small categorizations in brackets under Value (large long-term niche) and Volume (mass market growth) in the Big V chart above. If there is genuine controversy in this world view, it is probably here. So let’s explore.

Our forecasts are that online and mobile games should grow total video games market size to $87B and take 50% revenue share at $44B (18% CAGR 09-14F). The historically strong pure console sector is flat to down.

Our forecasts are that Asia Pacific and Europe should take 90% revenue share for online and mobile games (China 49%, Europe 17%, Japan 14%, South Korea 11% in 2014F). North America remains important.

The drivers of this growing and changing world are socio-demographic and cultural, as well as technological. The most concrete statistics are socio-demographic, for which we’ll look at China as an example.

In 2010 China had 29% internet penetration, with around 382M users. So more Chinese internet users than the entire US population. China is forecast to reach 56% internet penetration (754M users) by 2015, or more than twice the US population, with the bulk of Chinese games played in internet cafes and on mobile phones.

So while ARPU for gamers in China is much lower than America, the huge volumes enable Chinese online/mobile games companies to use incredibly efficient business models to deliver 50%-60% operating margins. To give a sense of scale, Tencent generates up to 20M peak concurrent users, or roughly the population of Australia playing a Tencent game as you read these words. China and the various online/mobile games sectors are the poster children for the Volume market, and fit the “mass market growth” description well.

For the Value side of the divide, the US and Console markets are good examples.

The US population is stable, so remains a large market. The Console market is flat to down, and despite recent and anticipated hardware launches we are unsure that this trend will change. Yet gamer ARPU in the US is much higher than China, and good Console titles still sell for high prices at retail (even if increasingly bought online or with digital downloads). So the US and the Console markets remain great games markets.

Yet compared to countries like China, the US is no longer the leading games Volume market in terms of gamer population. Even compared to Europe, the US is a smaller by volume. When it comes to the Console market, volumes, revenues and profits across the industry are generally trending down despite blockbusters like Call of Duty.

So in global terms these markets look like they may become large long-term niches. Still great places to operate, valuable, capable of producing great games companies and great games, but generally not on the same scale or with the same growth rates and profitability as the Volume markets.

Some of these Value markets are trying to transform themselves into Volume markets, and they may succeed in doing so despite the challenges. As before, this is not absolute and there should be many exceptions.

Recent games investment, M&A and public company valuations indicate that investors may be taking a similar view.

So what does this mean for your games company investment?

Whether you agree with this world view or not (and it’s certainly open to interpretation and discussion), the underlying trends are what they are. They can’t be ignored, so you may as well embrace them.

As a starting point, ask yourself some simple questions. Depending on your answers, you may start thinking differently about how to invest, plan and operate to take advantage of the brave new world.

1. Users: are your games aiming at thousands, millions or hundreds of millions of users?

2. ARPU: do you measure ARPU in cents or dollars?

3. Costs: do you think of game development and user acquisition costs in thousands or millions, and do you have the right cost/revenue model for your markets?

4. Operating profit: can your business be flexed to deliver super-profits?

5. Growth rates: could your business deliver 20%-100%+ annual revenue growth?

6. Business model: what revenue sources are most important for your games – unit sales, subscriptions, virtual goods (currency/items), ads?

7. Geography: can your games operate across geographies and cultures, or are they domestically specific?

8. Platforms: are your games platform specific, or can they operate across sectors?

9. Value to Volume transition: what can you achieve in Value markets as they transform towards Volume, and how does that compare to what you can deliver in existing Volume markets?

10. Scalability: are you building a genuine business platform with scale advantages, or a series of hits?

11. Exit: can you become a “must-buy” for one of the major players in either Value or Volume markets, and what does that look like?

There are many more questions you could ask yourself, but deciding whether you are a Value or a Volume player (and keep in mind it is becoming increasingly difficult to be both) may have a profound impact on the future of your games business investment from valuation, investment, strategic and operational perspectives.

Welcome back to the future – it’s going to be a lot of fun. (Source: Gamasutra)

上一篇:游戏人士称免费模式非通用盈利机制

闽公网安备35020302001549号

闽公网安备35020302001549号