每日观察:关注Google+或向游戏开发商抽成20%(7.6)

1)据Gamezebo报道,有知情者透露,谷歌有可能将针对Google+平台的游戏的微交易抽成20%的收益,其分成比例比Facebook低10%。

观察者称,完全免费策略对开发商和发行渠道双方都不利,而营收抽成政策则可将二者利益捆绑在一起,发行渠道为了创造更大收益,就会想方设法为开发商打造更好的运营环境,这样才能实现彼此的双赢。由此来看,谷歌抽成20%的政策或许是一个智举,既不会陷入完全免费而让人心存疑虑的尴尬,又会比Facebook更具价格竞争力,有可能吸引开发商聚集到谷歌新游戏平台。

或者谷歌可采用其他策略,例如向首批入驻该平台的开发商提供限时优惠政策,以此扩大自身平台的游戏人气。假如这20%抽成的传言无误,那么我们很显然可以看出,谷歌这一次真的准备在社交游戏领域施展拳脚了。

2)彭博社网站日前发布了一个有点奇怪的新闻视频,日本社交平台GREE首席执行官Yoshikazu Tanaka在其中出现了短暂的数十秒时间,透露出GREE不排除未来或于海外证券交易所上市的可能。只是观察者认为,包括GREE在内的日本网络公司一向甚少在非日本媒体中露面,这则新闻报道存在不少令人困惑之处,例如视频中的记者为何只引用Tanaka所说的话,而不直接以Tanaka的发言作为报道内容。

3)据Venturebeat报道,Zynga在今年第一季度收益为2.35亿美元,其中广告收益达990万美元,多数收益来自虚拟商品交易。Zynga游戏在该时期的MAU为2.36亿,所以每季度每用户平均收益约1.04美元,或者每年每用户平均收益4.16美元。

Zynga并未透露具体的付费用户比例,外界猜测这一比例约1%至3%左右。假如这一数据属实,那么Zynga游戏的付费用户每人每季度平均消费金额约为32至95美元,每月平均数值就是10.67至31.66美元(游戏邦注:动视暴雪游戏《魔兽世界》的每用户每月平均付费14.95美元)。

不过Zynga也在S-1文件中指出,并非每款游戏的虚拟商品都能顺利创收,例如《Treasure Isle》就因虚拟商品不受欢迎而鲜有付费用户捧场。今年第一季度每件虚拟商品的平均寿命是12个月,而一年之前则是14个月。

为增强用户游戏体验,Zynga正逐渐减少游戏中的广告植入,第一季度广告收益仅占其总营收的4%。

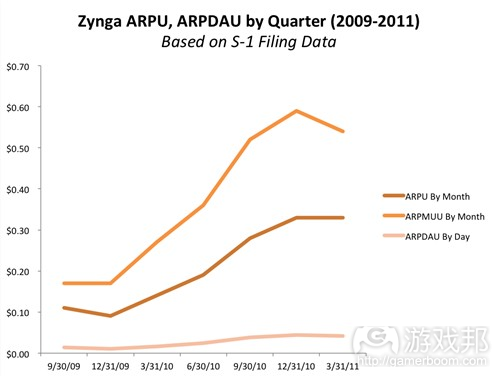

4)据insidesocialgames报道,如果将Zynga第一季度收益与其MAU数据相联系,可以推算出Zynga今年第一季度的每月ARPU已从去年同期的0.14美元,增长至目前的0.33美元。

如果从每月独立用户(MUU)来看,该公司第一季度的MUU平均收益也已从去年同期的0.27美元,双倍增长至现在的0.54美元(游戏邦注:但这里的MUU并未区分同时在Facebook和手机平台登录游戏的用户)。

从每日活跃用户平均收益(ARPDAU)来看,这一数据在第一季度也已从去年同期的0.01674美元,双倍增长至当前的0.04219美元。

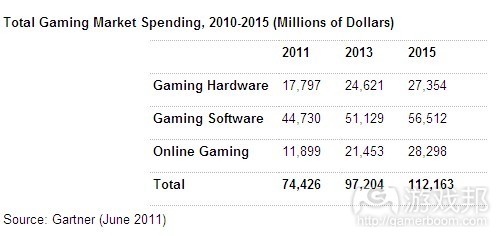

5)市场调研公司Gartner最新报告预测,今年全球电子游戏产品总收益将达740亿美元;2015年这一数据将增至1120亿美元,比2010年的670亿增加两倍。

在游戏软件市场,发展潜力最大的是手机游戏,该领域市场份额将从去年的15%增长至2015年的20%。尽管面临在线及社交游戏领域的挑战,掌机游戏收益仍将占据最大份额,其比例达三分之二左右(游戏邦注:其软件产品收益达447亿美元,硬件设备的收益是178亿美元)。

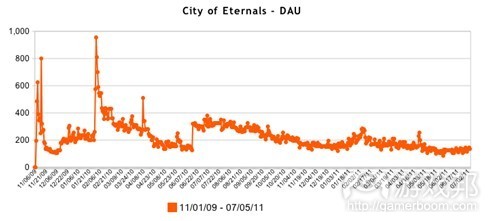

6)据知情人透露,社交游戏开发商Ohai日前以“较低价格”被未知名的买主收购。该公司于2008年由Susan Wu与一批游戏行业元老(游戏邦注:包括Scott Hartsman、Don Neufeld和早期知名社交游戏《Vampires》开发者Blake Commagere)共同创立。

Ohai曾根据《Vampires》这一成功的社交游戏品牌开发了一款Flash MMOG游戏《City of Eternals》,但在游戏发布之前,联合创始人及产品副总裁Scott Hartsman和首席技术官Blake Commagere在就职不到一年时间就离开公司。

据AppData数据显示,《City of Eternals》目前DAU仅1000,该公司另一款游戏《Unicorn Parade》的表现更是平庸,MAU甚至不足1000,Susan Wu的首席执行官位置也已经被前Ohai董事会成员Rex Ishibashi取代。

7)据Venturebeat报道,Zynga在过去一年中总共花费价值1.23亿美元的现金和股票就收购了12家公司,投入最大的一笔交易是收购手机游戏工作室Newtoy(成交额为5300万美元)。这笔款项仅是迪士尼收购Playdom一家公司的七分之一左右(游戏邦注:迪士尼收购Playdom成交额达7.63亿美元),也只是将近EA收购Playfish的三分之一(EA在2009年斥资4亿美元收购Playfish)。

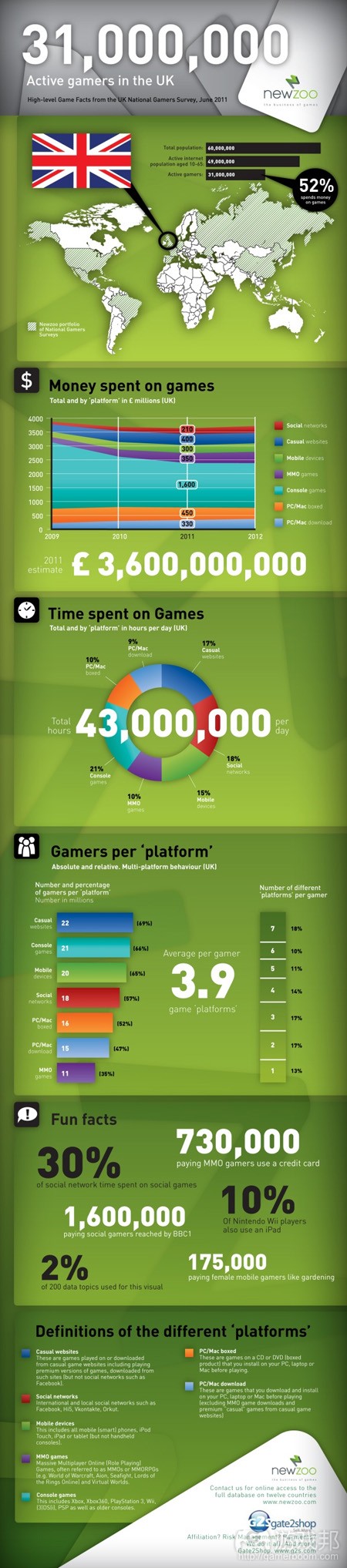

8)Newzoo最新调查报告预测,2011年英国游戏市场规模将达36亿英磅(约合58亿美元),略低于2010年的37亿英磅(约合59.5亿美元)。其中盒装掌机游戏、PC和Mac游戏销售额将下降10%,MMO游戏将上升40%,可下载游戏增长11%,手机游戏增加6%,休闲游戏网站增长4%。

该报告指出,手机、在线及可下载游戏将占英国游戏总收益的44%左右(游戏邦注:Newzoo预测此类游戏在美国游戏市场所占收益份额达55%)。

在英国6000万人口中,约有52%用户自称是“活跃游戏玩家”,但在这些玩家当中,又仅有52%受访者曾为游戏掏钱,其余用户一般只体验免费游戏。

Newzoo报告表明,用户在免费游戏中的投入时间与金钱并不成正比,他们在手机及在线游戏中的投入时间占据60%,但在这类游戏中的支出仅占35%。

休闲游戏网站最受欢迎,约69%的活跃用户在这种平台玩游戏,居于其次的是活跃用户比例达66%的掌机游戏,手机游戏则以65%的活跃用户比例位于第三。MMO是该调查中人气最低的游戏类型,活跃用户比例仅35%。

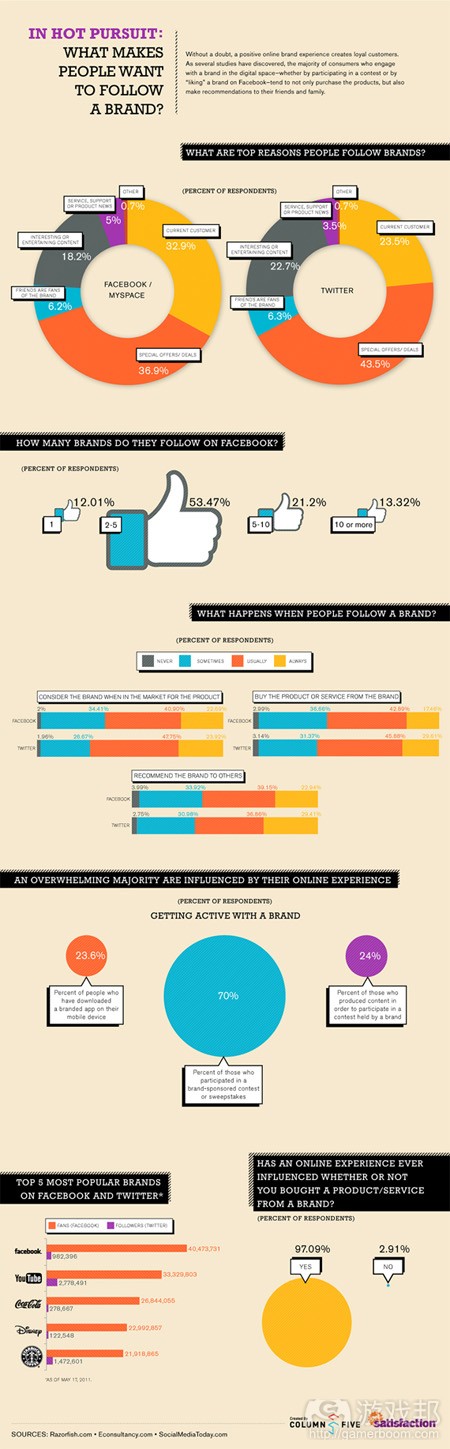

9)Get Satisfaction最新发布的信息图表显示,积极的在线品牌体验有助于增强用户粘性,从而将Facebook和Twitter等社交网络用户转化为忠诚的品牌用户。

其主要调查结果如下:

·97.99%受访者表示,在线体验会影响他们购买产品或服务的决策;

·约36.9%的Facebook/Myspace用户,以及43.5%的Twitter用户表示,他们支持一个品牌的首要原因是特价优惠活动,其次就是他们原本就是该品牌用户,或者他们认为该品牌内容很有趣。

·多数人承认他们成为一个品牌粉丝的时候,会优先考虑购买该品牌产品,并向他人推荐该产品。

·每名受访者在Facebook上平均支持2至5个品牌。(本文为游戏邦/gamerboom.com编译,如需转载请联系:游戏邦)

1)Google to charge game developers 20% for Google Games? AndroidFacebook

By Joel Brodie

Last week, I speculated on what Google plans to do in terms of charging for distribution on Google Games which is coming out very shortly.

Today, I spread rumors. I have heard from 3 anonymous developers in the past week that Google plans to charge 20% for micro-transactions within Google Games.

This, of course, is 10% less than Facebook and their mandatory cut of 30% for Facebook Credits. If this is the case, Google is finally being smart about games and could be successful.

Here’s why I say this. In the past, Google’s game efforts have been varied but chaotic. Google’s tendency is: give it all for free, make money on ads, and have engineers in different parts of the company do game initiatives that do not connect with each other.

Not charging developers anything may sounds great for developers but in fact, it’s bad strategy and bad for developers. By giving away your distribution for free, the distributor has no incentive to invest in creating a viable ecosystem and channel for games. Short-sided game developers may like it, but the distributor treats it as an experiment and nothing is worse than having your sole means of making money be tied to someone else’s experiment.

That’s why its good that Apple charges 30% for iTunes and that Facebook is now charging 30% for Facebook Credits. Because Apple and Facebook have skin in the game, they will help grow their distribution channels with game developers.

If Google charges 20% its smart, because it’s 10% less than what Facebook is charging as of today. Facebook has much higher distribution now, but if Google can offer a better deal, game developers will migrate over and try out Google Games when it launches.

As mentioned in my article from last week, it’s doubly smart because by actually charging a distribution fee, now Google can offer special discounts to big developers to offer them limited time exclusivity for new games which could drive huge penetration among early adopting gamers.

The big surprise from Zynga’s S1 is that there is not a special deal or discount for Facebook Credits. Zynga has to pay Facebook 30% for Credits just like everyone else, in addition to the millions it spends on advertising (maybe that is where the special deal is?)

Anyway, by charging 20%, Google can then offer a 10% deal for the first 12 months if a developer launches its social game for the first month only on Google. The devil is in the details, since the first month with social games is often beta, but you get the idea. By charging instead of giving it for free, Google has the option to make it free for special deals. This is something that Facebook is likely not to do (though they can).

If this rumor of 20% is true, it means Google is taking Games seriously, and not as some pet project for its engineers, which is why its been so plagued with social and games in the past.

Time will tell if this 20% cut is true or speculation.(source:gamezebo)

2)Bloomberg: GREE May List Outside Japan In Future

by Dr. Serkan Toto

Bloomberg posted a pretty weird video report on GREE on their website today. The report makes it look like the reporter had an interview with GREE CEO Yoshikazu Tanaka, but Tanaka himself can be seen speaking in the report for only 10 seconds or so.

The main bullet point here is that GREE apparently doesn’t rule out getting listed at a stock exchange outside Japan at some point in the future – not a total shocker, but interesting.

But then again, it’s just the reporter talking there, quoting Tanaka: why don’t they show him speaking?

And I am sure Tanaka does know what Farmville is, the game was also released in Japan on Mixi by Zynga Japan just a few months ago…

So it’s not really a good report, but it’s rare to see GREE (or any other web company, for that matter) covered by a non-Japanese news source.(source:serkantoto)

3)Even with half the users, Zynga’s FarmVille made more money than ever before in Q1

Dean Takahashi

Game maker Zynga‘s break-out hit, FarmVille, saw record revenue in the quarter ended March 31, 2011, even while its monthly active user count dropped from 83 million in the spring of 2010 to about 39 million monthly active users now.

That fact is an important point contained in Zynga’s filing with the Securities and Exchange Commission for an initial public offering. Since Zynga filed the papers on Friday, the social game industry has a wealth of new details as guideposts for the best-run business on the Facebook platform. In this post, we’ll take a look at some interesting facts about Zynga that weren’t known until now.

FarmVille launched in June 2009 and became the fastest-growing game in history at the time, putting Zynga into the undisputed lead role as the biggest social game company on Facebook. Now, four of the top five games on Facebook are Zynga titles, and it has never lost the lead position since the launch of FarmVille. The company keeps players happy thanks to weekly content releases in each game. In March, Zynga released an expansion for FarmVille — FarmVille English Countryside — that no doubt accounted for the record revenue for FarmVille.

In the first quarter, Zynga generated about $235 million in revenue. Ad revenue in the quarter was $9.9 million, and most of the money came from virtual goods sales. In that quarter, it had about 236 million monthly active users. So Zynga generated roughly $1.04 per user per quarter, or $4.16 per user per year. But Zynga acknowledges that a very small percentage of its players actually pay money. Unfortunately, Zynga didn’t say exactly what percentage of players pay. It is supposedly around 1 – 3 percent. If that is true, then the average revenue per paying user per quarter is likely to be $32 to $95, which breaks down to $10.67 to $31.66 per paying player per month.

When you think about it, that’s not an insane amount for Zynga’s paying players to be paying each month. World of Warcraft, the massively multiplayer online fantasy role-playing game, generates about $14.95 a month per player in revenue for Activision Blizzard. But it’s very interesting that this amount of revenue from 1 – 3 percent of Zynga’s players is enough to pay for the costs of all of the others and then generate some profit for Zynga. If Zynga can keep adding more interesting virtual goods to its existing games, tempting more players to pay for virtual goods, it can then generate a significant increase in revenues. That explains why FarmVille can generate more money than ever before even though it is at half of its peak users.

Zynga’s games are free-to-play, where users can play for free and pay real money for virtual goods such as tractor fuel in FarmVille. One of the most successful virtual goods were the colorful sheep, pictured above, which users could breed and send as gifts to their friends. On average, Zynga says that paying users will keep on buying virtual goods in a game for 10 months to 25 months.

Not every game that Zynga launches makes money. Zynga said in its filing that two or three games account for most of its revenue. For instance, Zynga’s Treasure Isle game reportedly didn’t make a lot of money, since the game didn’t really have the right virtual goods built into it.

Zynga has figured out ways to promote branded virtual goods in order to raise more money than it otherwise might. In October 2010, Farmers Insurance Group offered FarmVille players a free in-game Zeppelin airship that provided “wither protection” (to keep their crops from dying) for players’ crops for 10 days. Players chose to “insure” their crops with the free branded Zeppelin, providing players with a voluntary, enhanced in-game experience. Farmers Insurance offered a similar one day campaign in 2011. During the 24 hours of this campaign, over two million new fans joined Farmers Insurance’s Facebook fan page. Such promotions generate advertising money for Zynga and temporarily increase its virtual goods sales.

The filing had other interesting details. In May, 2010, Zynga struck a deal with Facebook to adopt its Facebook Credits virtual currency, which gives Facebook a 30 percent cut of every virtual goods transaction. Previously, Zynga used virtual currency providers that charged only 2 – 10 percent per transaction. Zynga said it completed the transition to Facebook Credits by April, 2011. That means that, for the first quarter, Zynga probably generated revenue of $335 million but paid about $100 million to Facebook. (We’re assuming that Facebook accounts for substantially all of Zynga’s revenue, which is not precisely correct).

Zynga said its advertising revenue has decreased over time because it has reduced the number of ads that its users see in order to improve the user experience. Only about 4 percent of Zynga’s revenues came from ads in the first quarter.

Overall costs for making games have gone up steadily. Zynga’s costs include web-hosting fees, depreciation and amortization expenses, consulting and headcount costs. Payment processing fees have dropped because of the transition to Facebook Credits. Zynga’s rising web-hosting costs are due to the fact that it has to pay more for additional computing capacity with unexpected high demand for games.

The average life of a virtual good was 12 months for the first quarter, compared to 14 months a year earlier.

Another item worth noting: Zynga has one issued patent and 78 patent applications pending review.(source:venturebeat)

4)Zynga Doubled ARPU From Last Year Even as Facebook Platform Changes Slowed Growth

By Kim-Mai Cutler

With Zynga’s IPO filing on Friday, we finally got some numbers to bear out what had been common, but unproven, industry knowledge: that Zynga had been able to overcome handing 30 percent of its revenue to Facebook and weakening virality on the platform by monetizing its existing user base better.

The company appears to have more than doubled average revenue per user across a number of metrics from the first quarter a year ago. So caveat to these figures first: they aren’t perfect estimates since Zynga broke out revenue on a quarterly basis, but showed uniques and actives on a monthly or daily basis. Nor do we have any ARPU figures for individual games, because Zynga did not break out revenue per title in its filing.

But it looks like Zynga boosted monthly ARPU (or average revenue per user) to $0.33 in the first quarter of this year from $0.14 in the same time period a year earlier. We get this figure by dividing reported revenues for that quarter by the number of monthly actives, then dividing again by three for individual months in the quarter.

If we take average revenue per monthly unique user (MUU), which won’t double-count users who play more than one Zynga game on Facebook, it also doubled to $0.54 from $0.27 in the first quarter from the same time period a year earlier. However, Zynga’s “monthly unique users” metric doesn’t de-duplicate people who play Zynga titles on both Facebook and mobile devices.

A more closely watched metric, ARPDAU (or average revenue per daily active user), also more than doubled from $0.01674 to $0.04219 in the first quarter of this year from a year earlier.

The reason this is important to note is that last year, Zynga’s growth in terms of acquiring new users slowed dramatically as Facebook phased out notifications, which made it easy for people to invite their friends to games. Zynga also started phasing in Credits, for which it had to give a 30 percent revenue share to Facebook.

The nagging question at that point in time was whether Facebook would effectively kill its golden goose by making its platform less profitable and attractive to developers. These numbers suggest no — at least for the very biggest companies that secured first-mover advantage.(source:insidesocialgames)

5)Gaming Spending to Total $74B This Year, Gartner Says

By Agam Shah

Worldwide spending on electronic gaming products will total US$74 billion this year, and be driven in the coming years by fast growth in mobile and online games, Gartner said in research released on Tuesday.

Total gaming spending this year will grow by 10.4 percent compared to the previous year, when spending on gaming products was $67 billion. A bulk of the gaming expenditure this year will be to tied to consoles, which will total $44.7 billion on software, and $17.8 billion on hardware, Gartner said.

But in the future, online gaming could take over a larger share of overall spending as social networks and new gaming models take shape, Gartner said. Many online games are currently provided on a subscription basis, but could be provided for free, with developers earning money through in-game advertising and sale of value-added services or virtual goods.

Mobile devices such as tablets and smartphones are also becoming popular devices for gaming, and the growing number of paid game downloads from online application stores should aid growth in overall game-related spending, said Tuong Nguyen, principal research analyst at Gartner, in a statement.

Mobile games are the most downloaded applications in app stores, Nguyen said. Gaming applications such as Angry Birds, which is available for multiple OS platforms, have been downloaded millions of times on smartphones and tablets. Games also rank as some of the top downloaded apps from Apple’s App Store in some countries.

“Mobile gaming will continue to thrive as more consumers expand their use of new and innovative portable connected devices,” Nguyen said.

Microsoft and Sony host online gaming services through their Xbox and PlayStation gaming consoles, respectively, while multiplayer role-playing game services such as World of Warcraft and Lord of the Rings Online are available on a subscription basis for laptops. Microsoft is trying to promote online gaming through smartphones based on its Windows Phone 7 OS, which hosts games for the Xbox Live online gaming service.(source:pcworld)

6)Mystery buyer purchases sinking startup Ohai

by Kinsey Jamison

An unnamed buyer has reportedly paid “a relatively low price” for social game startup Ohai, according to VentureBeat. Ohai, which has been shopping around for buyers for quite some time according to an unnamed source, were established in 2008 by Susan Wu. A former venture capitalist and competitive gamer, Wu formed the company in 2008 with many game industry veterans including Scott Hartsman and Don Neufeld, and Blake Commagere (noted developer of the popular early social game Vampires).

Ohai had early promise as an social game startup. TechCrunch referred to their “superstar team” in early 2009, and CEO Susan Wu has been present on multiple “best of” lists including Most Creative People 2010. Ohai had the advantage of using the existing successful social game brand, Vampires, and built their Flash MMOG City of Eternals based on its IP. Prior to its launch, co-founder and VP Production Scott Hartsman and Blake Commagere (CTO) left the company after working with Ohai less than one year. The game launched without them to early promise yet little followthrough.

According to AppData, City of Eternals never reached 1,000 daily active players. The game did end up launching on its own standalone destination site, but never made waves in the social game space. Ohai began work on another title, Unicorn Parade, a clunky Facebook game that has soft released but currently has less than 1,000 monthly active players and feels unpolished and not ready for primetime. Susan Wu is now no longer CEO and has been replaced by Rex Ishibashi, former Ohai board member.

With a history like this, we’re not sure what this mystery buyer is hoping to get from Ohai. It could be the acquisition of in-house developed technology. It could be an inexpensive talent acquisition, though the majority of Ohai’s talent has since moved on to other things. Blake Commagere has been working on his own stealth startup, and Scott Hartsman left with much of his former team to run the development at Trion Worlds (publisher and developer of the game Rift). (source:games)

7)Add CommentTweetZynga buys 12 companies for fraction of what Disney spent on Playdom

by Joe Osborne

Has Disney been shopping in the wrong places? VentureBeat reports that Zynga spent a total of $123 million in cash and stock for 12 companies over the past year.

That number is about a seventh of what Disney paid–around $763 million–for a single company, Playdom. Not to mention that it’s a third of what EA paid for Playfish in 2009: around $400 million.

Of course, Zynga has bought considerably smaller companies, but it’s also a sign that Zynga has been far more savvy in its purchases (and its uses for them) than its competitors. The most it paid for a studio was $53 million for Newtoy, the creators of Words with Friends and now Hanging with Friends under the big red dog.(source:games)

8)Survey: UK Games Market To Reach £3.6B In 2011

by Kyle Orland

A new survey of the consumer games market in the United Kingdom estimates total sales across all formats will total £3.6 billion ($5.8 billion) in 2011.

The number is down slightly from Newzoo’s £3.7 billion ($5.95 billion) industry size estimate for 2010, with a 10 percent decrease in boxed console, PC and Mac game sales dragging down growth in MMOs (up 40+ percent), downloadable games (up 11 percent), mobile games (up 6 percent) and casual gaming sites (up 4 percent).

Revenue from mobile, online and downloadable games will represent nearly 44 percent of all money spent on UK gaming in 2011, according to the report, flipping results from Newzoo’s recent U.S. market survey which showed such games representing a 55 percent majority of spending.

Just under 52 percent of the UK’s 60 million people are characterized as “active gamers” in the report, but only 52 percent of those gamers actually spends money on games, Newzoo said, with the remainder playing only free titles.

The rise of these free players has caused a disconnect between the time and money spent on various types of gaming in the UK, Newzoo said, pointing out that online and mobile gaming represents 60 percent of time but only 35 percent of money spent on games.

“We expect the free-to-play business models on all platforms, including consoles, to not only push the UK market back to growth but also decrease the current gap between time and money spent,” Newzoo CEO and co-founder Peter Warman said in a statement.

Casual gaming web sites provided the most popular gaming option detailed in the report, used by 69 percent of all active gamers, followed closely by console games (66 percent) and mobile games (65 percent). MMOs were the least popular of all measured game types, played by only 35 percent of gamers.(source:gamasutra)

9)What Makes People Want To Follow Brands? [Infographic]

A positive brand experience online leads to more sharing and engagement and, as a result, more business. But what is it that makes people want to follow a brand? A new infographic from Get Satisfaction explores this question.

In Hot Pursuit: What Makes People Want To Follow A Brand? explores the top reasons that people follow brands, how many brands the average person follows on Facebook, what happens when people follow a brand and more.

Some of the key findings are as follows:

A whopping 97.09% of respondents said that an online experience has influenced whether or not they bought a product or service from a brand.

The number 1 reason for following a brand is access to special offers and deals (36.9% of Facebook/Myspace users, 43.5% of Twitter users). The runners up for top reasons people follow brands are that they are current customers or that they are following because of interesting and entertaining content.

Most admit that when they are following a brand they are more likely to consider the brand when in the market for the product, buy the product from the brand and recommend the brand to others.

On average, people follow between 2 and 5 brands on Facebook. How many are you following? (source:socialtimes)

闽公网安备35020302001549号

闽公网安备35020302001549号