调查称2010年中国在线游戏市场规模达327亿元人民币

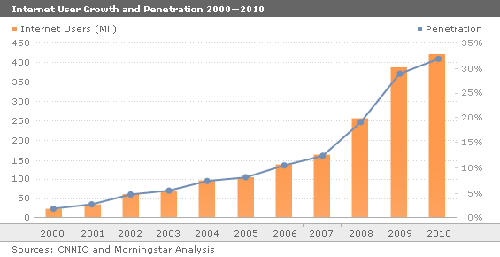

据第三方调查机构艾瑞市场咨询(iResearch)的报告显示,中国在线游戏产业在过去5年中显著发展,2010年的复合增长率达50%,营收为327亿元人民币(约合50亿美元)。游戏邦获悉,在线游戏对于无数的中国年轻网民来说已经是一种颇有吸引力的平价休闲活动,这主要归功于网络覆盖率的增长,固定宽带每月费用降低,以及越来越丰富的游戏大量涌现。

游戏玩家主要分布于十几、二十多岁的独生子女,他们希望摆脱纷扰的现实生活,在虚拟世界寻宝,与恶棍斗争,或者在游戏中展现其他英勇行为。多年来,游戏网站吸引了无数中国网民的注意力,据中国互联网络信息中心(CNNIC)的资料显示,截至2010年末,中国网络游戏玩家已达3.04亿,占中国网民的66.5%。

多样化的游戏及营收方式推动行业发展

据游戏邦了解,中国的在线游戏可分为3大类:大型多玩家在线角色扮演游戏(MMORPGs),休闲游戏和社交游戏。MMORPG通常以冒险和武打动作为主题,以网易和盛大等主要的游戏运营商为代表。但鉴于游戏的强度大,需要投入大把的时间,我们认为这些游戏主要吸引一二十岁的青年男性玩家。该报告认为,这类游戏的未来发展主要取决于每名玩家提高消费水平,而非单纯扩大新用户规模。

休闲游戏和社交游戏并不需要用户花费大量的时间,玩起来很轻松,因此它们吸引的群体更加广泛。这类游戏在女性玩家中特别收欢迎。特别是社交游戏,它已经吸引了2亿多中国用户,它去年的营收增长速度甚至超过了整个在线游戏市场。这些游戏主要通过人人网和开心网等社交网站,以增加玩家的互动性和黏性。该报告认为,虽然目前社交游戏比例占整个在线游戏市场的一小部分,但它的前途无可限量,因为还会有越来越多的中国网民开始玩社交游戏。

目前中国在线游戏的主要营收途径是基于道具的模式,即用户可以免费玩游戏,但得付费购买游戏中的虚拟商品,这些商品有的提供游戏技巧,有的增加用户威力,但都是为了强化用户的游戏体验。这种模式降低了新玩家体验游戏的门槛,盛大和搜狐畅游等MMORPG运营商在2005年就开始广泛采用这种模式,虚拟商品交易至少为它们的在线游戏业务创造了30%的营业毛利。年轻玩家无法抵挡额外技巧和道具的诱惑,他们很舍得在这些道具上花钱,这种模式比基于时间的模式更易吸金,因为这类玩家的一次性消费金额,抵得上后者用户的好几次消费总合。不过游戏运营商网易显然是个例外,它自主运营或授权的游戏仍然坚持基于时间的模式,但营收也相当可观。

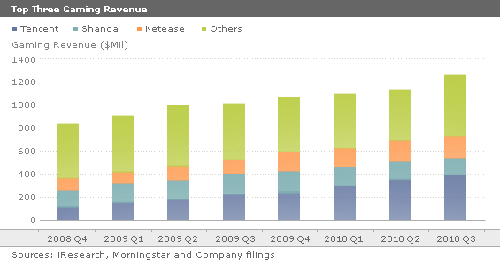

被休闲游戏广泛采纳的是订阅模式,玩家可以根据包月费用选择各种各样的游戏。据游戏邦了解,网络巨头腾讯的游戏营收之所以能够在短短2年内居同行之首,部分归功于它采用了订阅模式,虏获了大量玩家。游戏邦发现,有些游戏运营商也尝试在休闲和社交游戏中植入广告,但广告赞助营收所占比例仍然较少。

大型游戏运营商是投资者的信心保证

中国在线游戏连续10年的稳定发展,吸引了许多游戏运营商和开发商纷纷加入这个行业,导致了它们在用户争夺和成本投入方面的激烈竞争。极少有独立游戏开发公司能够长盛不衰,因为玩家对游戏的喜好变化无常,这个市场又高度分散,而且几乎不存在品牌转换成本。这使在线游戏网站很难拥有长久的竞争优势,创造可观的营收。尽管一些成功的游戏拥有较大的运营优势和较多的现金流量,但游戏运营商仍需将这些资金投入后续的市场调查和广告营销,才能维持业务运营。尽管如此,该报告还是认为已形成气候的在线游戏公司未来仍将获得较大发展,因为人们的可支配收入正逐步增加,而网络费用也正在降低,将有更多人开始玩游戏,花钱买道具。社交游戏和手机游戏等新兴游戏的崛起,也为游戏运营商创造了新的营收渠道。

目前,整个游戏行业目前正出现大量的企业兼并现象,这最终会使拥有庞大用户群、强大营销能力以及雄厚财力的主流游戏运营商从中获益。近年来的行业管制更为严格,这迫使小型游戏工作室面临资金匮乏的困境,只好选择归入大型在线游戏公司的旗下。据游戏邦了解,游戏平台的技术规范越来越复杂,新游戏的市场营销成本求也逐年增加,这些残酷的现实都迫使小型公司不得不投靠经验丰富和资源雄厚的大企业。

该报告认为企业的兼并,小型工作室将逐步淘汰出局,这不但将减少这一领域的市场竞争,而且会促使大型运营商推出一些更有价格竞争力的游戏。小型游戏工作室基本上没有什么出价的权利,因为大型游戏运营商只收购与他们长期密切合作的工作室,以确保它们能够延伸游戏开放和市场营销的合作业务。中国三大主流在线游戏运营商——腾讯、盛大和网易的市场份额已从2008年的42%增长到2010年的60%,预计它们未来将会通过收购企业进一步壮大实力。大公司通过收购小公司,不但可以扩大用户规模和市场营销范围,而且可以产生更大的影响力,顺利实现新游戏的营收。此外,由于大型在线游戏公司会增加新游戏(游戏邦注:重新开发或通过收购获得新游戏经营权)——其网站的影响力也会不断扩大。随着更多用户关注和体验大型游戏开发商的游戏,他们网站的价值在广告商、第三方开发商的眼里也就越大。一个口碑良好的网站可以成为一个收益有保障的商业平台。

对投资商来说,小型的独立在线游戏公司会让他们面临很大的风险,但是大型的游戏运营商会把各种各样的热门游戏组合在一起,实现丰厚的营收和较大的现金流量,甚至可以抵消失败的新游戏造成的消极影响。据游戏邦了解,网易应该可以通过《巫妖王之怒》(Wrath of the Lich King)和《星际争霸II》(StarCraft II)大赚一笔。盛大这几年主要通过积极收购小型工作室来推出新游戏吸引用户。该报告认为盛大在投资方面游刃有余,毕竟它已经是这一行的游戏运营和市场营销老将了。(本文为游戏邦/gamerboom.com编译,转载请注明来源:游戏邦)

Ways to Play China’s Online Gaming Sector

The online gaming industry in China has grown at warp-speed during the last five years, expanding at a compound annual rate of 50% to CNY 32.7 billion (approximately $5 billion) in 2010, according to third-party researcher iResearch. Rising Internet penetration, falling monthly rates for always-on broadband access, and an explosion of titles have made online gaming an attractive and affordable form of entertainment for tens of millions of young Internet users in China.

Gamers, typically in their teens and 20s and often an only child, seek refuge from their hectic real lives and build friendships in the virtual world by hunting treasures, battling villains, and performing other heroic acts. Over the years, gaming sites have built a massive following in China, which, according to the latest report from the official China Internet Network Information Center (CNNIC), included approximately 304 million consumers at the end of 2010, or 66.5% of the Internet user population in China.

Diverse Gaming Categories and Revenue Models Provide Industry Players with Multiple Growth Drivers

Online games in China fall into three categories: massive multi-player online role-playing games (MMORPGs), casual games, and social networking games. MMORPGs, usually with themes of adventures and martial arts, have contributed the bulk of gaming revenue at major gaming operators such as NetEase NTES and Shanda SNDA . But given the intensity of the experience and heavy time commitment required to finish each ?mission,” we believe these games appeal mostly to males in their teens and early 20s. As a result, future growth more likely will come from higher spending per gamer on new releases and upgrades rather than an influx of new gamers.

Casual games and social games, on the other hand, do not require much time and are quite relaxing to play, thus having a much broader appeal. They are especially popular among female gamers. Social games, in particular, have attracted more than 200 million players in China so far and grew revenue at a much faster pace than the overall online gaming market during the last year. These games are mostly provided on social networking sites such as privately held Renren.com and Kaixin001.com to create more interaction among members and increase stickiness of the sites. While currently only a tiny portion of the total online gaming market, social gaming should continue its impressive growth trajectory in the coming years as more people embrace social networking in China, in our opinion.

The prevailing revenue model for online gaming in China is the item-based model, which allows gamers to play for free but charges for the purchase of in-game virtual goods that would provide tricks or additional power to enhance the gaming experience. Widely used by MMORPG providers since 2005 to lower the hurdle for new gamers, the item-based model actually has helped firms such as Shanda and Changyou CYOU generate excellent operating margins of at least 30% in their online gaming businesses. Unable to resist the temptation of extra tricks and equipment that come with a price tag, young gamers often are willing to splurge on virtual purchases that can add up to several times what operators would be able to fetch using a regular time-based model. A notable exception is veteran game operator NetEase, which has stuck to the time-based model for its sought-after in-house and licensed games and has remained profitable as well.

The subscription model is popular in casual games, allowing gamers to sample a wide variety of options for a fixed monthly fee. Internet giant Tencent 0700.HK was able to quickly rise to the top in terms of gaming revenue within a short span of two years, partly due to the successful rollout of a subscription model that tapped its huge user base. Game operators also are experimenting with carefully crafted in-game advertising for both casual and social games, but we think revenues from this model are immaterial at the moment.

Large Gaming Operators Are a Safer Bet for Investors Interested in the Sector

Ten years of uninterrupted growth in online gaming in China has lured hundreds of game developers and operators to the business, resulting in fierce competition for gamer attention and spending. We don?t find many individual online gaming firms with economic moats, as gamer preference tends to be fickle, the market is highly fragmented, and switching costs are virtually nonexistent. This makes it extremely difficult for online gaming sites to build durable competitive advantages and consistently deliver good returns. Despite considerable operating leverage and strong cash flows for successful games, gaming operators need to plow the cash back into further research and marketing to sustain the business. Nonetheless, we believe well-established online gaming firms will enjoy strong growth in the coming years, as rising disposable income and more affordable Internet access drive up the number of gamers and their spending. New types of gaming, such as social gaming and mobile games, also open up new revenue opportunities for gaming operators.

We also believe industry-wide consolidation is now under way, which should eventually benefit top gaming operators with a large player base, strong marketing capabilities, and deep pockets. Tighter regulations in recent years have raised capital requirements for smaller game studios and operators, forcing them into the arms of larger online gaming companies. Increasingly sophisticated technical requirements for gaming platforms and the heavy marketing expenses needed to launch new games have led many smaller firms to give up their independence in exchange for support from more experienced and resource-rich firms.

We think the consolidation should not only reduce competition in online gaming as the smaller firms drop out, but also allow the larger operators to pick up good games at attractive prices. Bidding wars are extremely rare for small game studios, as major game operators usually only acquire those that they have worked closely with for an extended period to ensure a smooth integration for game development and marketing. The market share of the top three Chinese online gaming operators–Tencent, Shanda, and NetEase–expanded from 42% in 2008 to almost 60% in 2010, and we believe they are poised to benefit from further consolidation. Acquiring smaller companies would allow the large players to leverage their large user base and marketing scale advantages to quickly generate buzz as well as revenue for the new games. Additionally, as larger online gaming companies build out the number of games they offer–both organically and through acquisition–a network effect could develop. As more consumers become aware of and use the larger online gaming firms, the more valuable their networks become to advertisers or third-party developers. A well-established network can often lead to an economic moat.

Smaller independent online gaming companies are inherently risky for investors, in our view, but large game operators tend to have a diverse portfolio of popular games and a strong game pipeline that provide fair visibility into future earnings and cash flows and can help cushion the impact of a disappointing new game release. The top game operators that we cover–NetEase and Shanda–are both fairly valued, with price to fair value of 1.00 and 0.95, respectively. We think the launch of popular games Wrath of the Lich King and StarCraft II should provide a strong boost to earnings at NetEase in the near future, but the benefits largely are reflected in the current stock price. Shanda has invested aggressively in small game studios in recent years in a bid to refresh its game offerings after struggling with aging games that no longer dazzle players. We think Shanda is capable of translating its investments into solid top-line and bottom-line gains given its track record of operational and marketing savvy.(Source:Morningstar)

闽公网安备35020302001549号

闽公网安备35020302001549号