App Store游戏发行大PK,Gameloft优势超EA Mobile

说到手机游戏发行领域,就不能不提到EA Mobile和Gameloft这两大发行巨头。

这两家公司财力相当,EA Mobile在2010财年的销售额是2.12亿美元,Gameloft在2010年前九个月的销售额约1.42亿美元。但如果细究它们在苹果App Store这个目前规模最大、透明度最高的应用商店中的表现,就不难发现这两者的运营理念差异不小。以下是Gameloft与EA在游戏发行量、游戏版本数量、授权作品数量、价格波动情况等几个回合的PK情况:

游戏发行量

最令人意外的是,Gameloft的游戏发行量几乎是EA Mobile的两倍,而且它更善于抓住App Store的商机,在2008年发行了22款游戏,而EA在同期仅向该平台发行了6款游戏。

不过如果观察付费游戏发行量,这两者的差距就比较小了,Gameloft现在共有124款付费游戏,EA是78款。

但需要注意的是,Gameloft的免费游戏规模庞大,几乎占该公司发行总量的三分之一,而EA免费游戏仅占其发行总量的四分之一左右。

从中可以看出Gameloft的App Store攻略是,面向iPhone和iPad发行不同的游戏,同时会针对两个平台推出免费版本的游戏。

与其他应用开发商不一样,这两者的游戏并不走iPad高价,iPhone低价的路线。

游戏版本数量

如果再深入分析系列游戏发行量,假如把《FIFA》、《Let’s Golf》、《Scrabble》等每一个系列看成一部作品,那么Gameloft的这类游戏发行量就是72部,而EA是55部。换句话说,Gameloft的这类系列游戏(游戏邦注:包含免费版本、iPhone/iPad版本、续集版本)的发行量将近三分之二,而EA的同一比例则低于二分之一。

这组数据最能说明这两家公司在App Store念的是不同的生意经。

从中可以看出,Gameloft如果发行了一款iOS游戏,那么它就会针对iPhone、iPad全面突破,面向两个平台推出免费、付费版本和继集版本。

反观EA,它在游戏发行上就不那么给力了,最明显的表现是,它的免费游戏发行量实在太少,而且也很少推出继集版本。

授权作品数量

EA对授权作品的依赖性很大,约7%的iOS游戏是基于电影或其他领域的授权作品,还有11%游戏来自海之宝(Hasbro)的品牌授权,还有14%是EA传统游戏的授权产品。

Gameloft当然也发行授权游戏,但仅4%的游戏是来自姐妹公司育碧的PC、掌机游戏授权,还有6%是以电影为主的外部品牌授权。

在EA的iOS游戏中,授权作品的比例高达32%,而Gameloft的这一比例仅10%而已。

价格波动情况

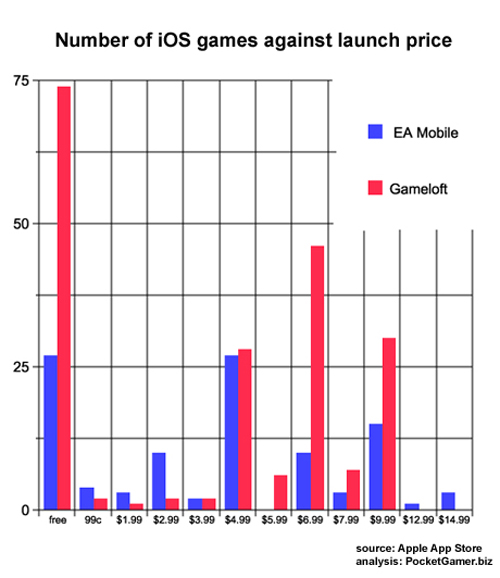

产品定价也是这两者最大的区别之一,虽然它们原先的游戏平均售价差别不大,Gameloft是4.40美元,EA是4.66美元,但游戏价格总会随着时间推移而逐渐走低,所以Gameloft目前的游戏平均零售价是2.72美元,EA是2.95美元。两家公司的游戏价格都下滑了37%左右。

这两者的主打付费游戏的价格点都是4.99美元、6.99美元和9.99美元。

虽然Gameloft最核心的价格点是6.99美元,EA是4.99美元(多数为孩之宝授权作品),但Gameloft还没有一款游戏的价格超过9.99美元,而EA却还有一些游戏的售价高达12.99美元甚至是14.99美元。

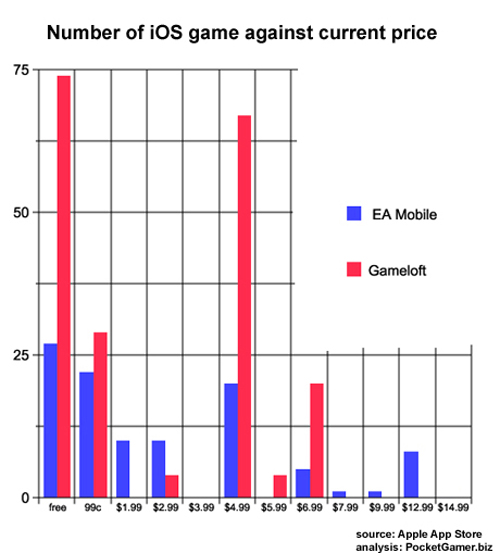

另外,这两者的价格起伏也很值得对比。

有不少EA热门游戏削价时跌到了99美分,这一点在2010年圣诞折扣期间的表现最为典型。而Gameloft的定价策略则相对透明,大部分4.99美元的游戏都能稳定维持原价,多数游戏的售价选项是99美分、4.99美元、6.99美元。

从这一轮对比中可以看中,EA游戏的价格调整幅度真有点大了。虽然《Madden》和《Need for Speed》这类特级游戏调回原价后仍然会很有市场(游戏邦注:它们曾经推出99美分限时特价促销活动),但这种价格大波动实着令用户纠结,因为大多数玩家还是比较支持Gameloft的99美分低价、4.99美元均价、6.99美元高价的稳定政策。

结论

综上所述,Gameloft在App Store中比EA更占优势,因为它发行的游戏数量更多,对外部授权作品的依赖性较小,它以创造自己品牌的游戏为主,致力于游戏项目延伸,而且奉行稳定可靠的价格路线。

EA的运营理念就比较传统了,它大量发行外部授权作品,产品结构比较单一。虽然Gameloft并非十全十美,但至少它的运营方式更灵活有弹性。

另外需要指出的是,Gameloft的大部分游戏都是自产自销,这就很容易掌握游戏继集、免费版本、升级版本的开发情况,而EA发行的不少游戏却是出自第三方工作室之手。

虽然上述的种种分析都很有意思,但相信大多数人最想知道的还是,EA和Gameloft究竟谁在App Store中最能吸金?

不幸的是,这两者都不肯透露具体数据,也许它们到1月底或者2月初的时候才会公布圣诞期间的销售额,让我们拭目以待吧。(本文为游戏邦/gamerboom.com编译,转载请注明来源:游戏邦)

When it comes to mobile publishing arch rivals, there’s only one bout in town – EA Mobile versus Gameloft.

In terms of financial strength, both are roughly equal.

EA Mobile’s sales were $212 million for FY10, while Gameloft did around $142 million for the nine months of the year it’s announced to-date.

However, analysing their performance on Apple’s App Store, which is the biggest and most transparent smartphone marketplace, demonstrates different approaches to the business.

Size is everything

Perhaps the most surprising headline is that Gameloft has released almost twice as many games as EA Mobile; 198 to 104. It was also much quicker to the App Store opportunity, releasing 22 games in 2008 to EA’s 6.

Yet when we consider the number of paid games released, the gap narrows slightly. Gameloft has released 124 paid games to EA’s 78.

This is important to note because Gameloft releases a higher percentage of free games. Around a third of all Gameloft’s releases are freebies compared to a quarter for EA.

This underlines Gameloft’s general App Store strategy, which is to release individual games for iPhone and iPad, usually releasing a free version for each.

Neither company likes the idea of universal apps, preferring the ability to price their iPad games higher than their iPhone releases.

Gotta work it

Digging deeper into the data, we can break down the releases from each publisher into what I call individual titles – ie grouping together series such as FIFA, Let’s Golf, Scrabble etc each as a single title – we can see this more clearly.

Gameloft has 72 ‘titles’, compared to EA’s 55, or in reversed percentage terms, just under two thirds of Gameloft’s releases consist of versions – whether free, iPhone/iPad or sequels – of core ‘titles’. For EA, this figure is just under half.

This is one of the most important statistics in explaining how the two company’s App Store philosophy is different.

Once Gameloft decides to release an iOS game, it works all the angles, typically releasing free and paid versions for iPhone and iPad, and releasing sequels too.

EA, on the other hand, doesn’t work its games so hard. Most obviously, it doesn’t release as many free versions, and it’s also released fewer sequels.

Licence to kill

It also relies much more on licences. Seven percent of EA’s iOS releases are based on films or other licences, while 11 percent are based on Hasbro brands, and a further 14 percent are based on existing EA game licences.

Gameloft does release licensed content of course. Four percent of its games are based on sister company Ubisoft’s PC and console games and a further six percent on other external licences, mainly films.

However, the total comparison is 32 percent of EA’s iOS games are licensed compared to just 10 percent of Gameloft.

The price is right

The other key difference between the two companies concerns pricing.

When it comes to a crude breakdown of average game price, the two are broadly similar. The average price of a Gameloft game at launch is $4.40, while EA’s average is a touch higher at $4.66.

As you’d expect, over time the average price of a game falls steadily. Hence, the average price of a Gameloft game now is $2.72, while it’s $2.95 for EA. That’s a drop of around 37 percent for each company.

Yet the price distribution of their games over time varies considerably.

The bulk of both companies’ releases are launched at $4.99, $6.99 and $9.99.

The pricepoint that gains most Gameloft releases is $6.99, while for EA it’s $4.99 – mainly its Hasbro licences. No Gameloft game has launched at more than $9.99, while EA has released a small number of games at $12.99 and $14.99.

Where you can see the big differences is how prices change over time.

As you’d expect, prices fall. The most popular price point for EA games longterm is 99c – something particularly demonstrated by its Christmas sale, which saw a large number of its games slashed to that level.

Gameloft manages to maintain the majority of its titles at £4.99 however. In fact, it has a much more transparent pricing strategy, with the longterm options being 99c, $4.99 or $6.99.

In contrast, EA spreads its games more widely over available price points.

In some ways, this is positive, as licences such as Madden and Need for Speed mean it can maintain much higher prices (although both those games have been discounted to 99c at certain times).

But it’s more confusing for consumers, who can more easily understand Gameloft’s cheap, average and premium price levels – 99c, $4,99 and $6.99 respectively.

Winning strategy

In conclusion then, my gut feeling from this analysis is Gameloft is making better use of the App Store opportunity than EA.

It’s releasing more games, it’s relying less on external licences, creating more of its own brands and working them harder. Its pricing strategy seems more coherent too.

EA’s approach is far more traditional mobile, based on licences and games as a singular experience. Gameloft – while not perfect – has a more fluid and service-based approach.

In this context, a final point to make is Gameloft develops most of its game inhouse, which enables it to be in control of sequels, free versions and updates. In contrast, many of EA games are developed by thirdparty studios; something the publisher seldom highlights.

Yet, while all this analysis is fascinating, the thing that really matters in the two companies’ rivalry is which is making the most money from the App Store?

Neither break out specific figures, although Gameloft has on occasions commented on the sales or revenue increase it’s gained from Apple devices.

Certainly, it will be fascinating to see how the bumper Christmas season will impact both companies’ earning announcements, due at the end of January/early February.(source:pocketgamer)

闽公网安备35020302001549号

闽公网安备35020302001549号