Forbes报道:休闲游戏公司PopCap十年发展历程

在人们高谈阔论各种收效良好的游戏发展模式的同时,“好游戏无法复制”这一基本道理往往被人们忽略。纵观如今的游戏领域,尤其是休闲游戏领域,基本上没有一家公司可以与PopCap Games相提并论。有数据统计显示,总部设于美国西雅图的PopCap Games公司的热门游戏《宝石迷阵》自2001年发布至今销量已达5000万件,销售额高达3亿美元(数据统计截至至2008年8月)。

今年正值CopCap公司创建10周年,该公司也筹备着各种发展计划。PopCap公司在创建之初便开始盈利,目前公司拥有员工400余人,预计今年的公司年收入将达到1亿美元。在去年10月的首轮集资中,PopCap公司获得了2250万美元投资。运用这笔资金,PopCap公司拓展业务范围,并为明年公司上市积极准备。

对此,公司首席执行官Dave Roberts表示由于众多投资商的期盼,条件允许的话PopCap公司计划在明年下半年,将预计扩招100名员工。

据游戏邦了解,PopCap的成功秘诀在于其善于发现新IP吸引玩家的兴趣。PopCap公司正是由于旗下的各种新奇而创新的游戏而闻名,其开发的休闲游戏受到了广大非游戏玩家人群的热爱。该公司的首款游戏《宝石迷阵》便是一鸣惊人。之后,PopCap更是开发多款热门游戏,如《祖玛》和《植物大战僵尸》等。新奇是PopCap游戏的制胜法宝。

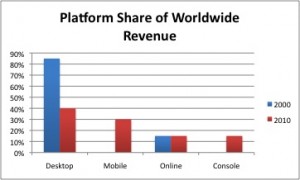

然而近年来,PopCap公司逐渐偏离核心平台和主流游戏人群。首先,PopCap开始进军多种游戏平台。公司成立之初,PopCap游戏主要运营于PC和Mac平台。因此2000年PopCap公司桌面游戏的销售额占公司年度总收入的85%,而“网上”销售收入则仅占15%。

十年后的今天PopCap公司的收入组成发生了翻天覆地的变化。今年,桌面游戏销售额所占总收入的比重首次下降到40%,而手机游戏的比重则上升至30%。另外,网络和平台游戏(如Xbox Live Arcade和索尼PlayStation Network等)分别占总收入的15%。对此,Robert表示PopCap旗下游戏同样适应于智能手机平台。据Apple报导,该公司的两款热门游戏《宝石迷阵2+闪电战》和《植物大战僵尸》均上榜2010年度畅销iPhone/iPod Touch付费游戏。其中《植物大战僵尸》还名列10大畅销iPad游戏。

据游戏邦了解,目前PopCap公司虽然并没有大举进军社交游戏领域,但社交版PopCap游戏也取得了不错的成绩。该公司的首款Facebook游戏《宝石迷阵闪电站》名列Facebook平台热门游戏第5位。排在它之前的4款社交游戏均出自社交游戏巨头公司Zynga。从今年4月开始,PopCap公司也在《宝石迷阵闪电战》中融入了虚拟商品。8月PopCap宣称其虚拟商品销售额达100万美元。PopCap公司计划继续加强其在Facebook社交网站的地位。最近,PopCap公司将旗下另一款热门游戏《祖玛闪电战》搬上了Facebook。目前该游戏已拥有70到80万日活跃用户。2011年Popcap公司计划发布两款新Facebook游戏。

另外,PopCap也有意进军国际市场,单今年一年Popcap便多次与亚洲公司达成合作。首先,PopCap与日本Taito公司合作发布了社交游戏网站Pop tower,为玩家提供《宝石迷阵》和《祖玛》等热门游戏。其次,PopCap与韩国网络游戏公司Ncsoft合作开发了多人网上世界PopCap World,提供13款热门PopCap游戏。另外,PopCap还与中国社交网站人人网合作推出了社交版本地化的PopCap游戏《植物大战僵尸》等。

值得一提的是PopCap公司十分注重开发中国市场。据游戏邦了解,PopCap早在2008年便在上海成立了办公司(此外在都柏林,爱尔兰和旧金山也均设有办公室)。而中国游戏玩家也同样痴迷于PopCap游戏。《植物大战僵尸》和《祖玛》更是在中国获得了巨大的成功,甚至连牙膏广告都出现了《植物大战僵尸》中的角色形象。

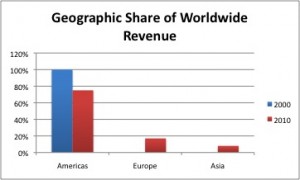

在收入组成方面。PopCap公司的主要营收来自于北美市场,占总销售额的75%,另欧洲17%和亚洲8%。在此,PopCap公司希望加强与亚洲市场的合作,Roberts表示计划在明年与该地区的1至2家公司取得合作。

另外,目前PopCap公司的主要营收渠道仍主要依靠“先试用后购物”的销售模式。玩家可以在试玩游戏后在零售商店购买PopCap游戏的完全版,一般售价为20美元。现在,人们可以在MSN Games和Steam等门户网站享受PopCap游戏,同时也可以在沃尔玛,Target和GameStop等大型零售商店中购买PopCap游戏,这样的广泛营销也是成就PopCap游戏的主要因素。针对营销方式,PopCap也希望在社交游戏等新市场试验不同的营销模式。因此面向日本玩家的Pop Tower就采用“免费游戏,虚拟货币购物”经营模式,而韩国的PopCap World也是在免费游戏的基础上融入了多种付费元素。

在休闲游戏领域,PopCap面对着许多颇具威胁的竞争对手,首当其冲的便是休闲游戏公司Big Fish Games(该公司2010年收入预计将达1亿3000万美元)。然而随着PopCap逐渐进入手机游戏领域,未来Zynga,Electronic Arts等大型公司也将与PopCap同堂竞争。(本文为游戏邦/gamerboom.com编译,转载请注明来源:游戏邦)

There’s a lot of talk about the evolving business models of the game industry, but one fundamental is often overlooked: there’s no substitute for good games. And there are few in the industry, particularly in the casual games genre, who can match the track record of PopCap Games when it comes to hit intellectual property. The Seattle-based casual games developer is, after all, the company behind the popular puzzle game “Bejeweled”, which has sold more than 50 million copies since it launched in 2001, generating at least $300 million in sales (as of August 2008).

Now in its 10th year anniversary, PopCap has aggressive expansion in mind. The company has been profitable since inception, generated $100 million in revenue this year, and currently has 400 employees. PopCap just took its first-ever round of funding, $22.5 million, last year in October. The funding will help PopCap expand, but it will also help the company get ready for a possible public offering in the future, as early as the second half of 2011, PopCap chief Dave Roberts tells me.

“We’ll look at [an IPO] for the second half of next year,” Roberts says. He adds that the company is structurally putting the team and pieces together that could allow it to go public soon. The company may add up to 100 employees next year. But there isn’t any urgency here, Roberts says: “There are no investors pushing for it, so we will really only look at it if the markets align.”

Part of PopCap’s success so far has come from its ability to create new IP that catches on with players. The company is known for its quirky and innovative titles, casual games that are popular with those who don’t consider themselves gamers. The “Bejeweled” franchise was the company’s first game and first hit. But PopCap has been able to create hit after hit since then, with popular franchises like “Zuma”, “Peggle” and “Plants vs. Zombies”. Rare, in fact, is the complete dud for PopCap.

But it is PopCap’s diversification away from its core platform and demographic that tells the story of where the company is headed. One part of that diversification has been PopCap’s expansion onto other platforms. When the company started a decade ago, its games were primarily available for the PC and Mac. In 2000, desktop game sales made up 85% of the company’s revenue, while “online” sales made up a mere 15%.

A decade’s passing shows big changes to PopCap’s revenue split. For the first time this year, desktop sales did not make up the majority of total revenue — they only accounted for 40% of the pie. A growing sector for PopCap is mobile, which now makes up 30% of total revenue. Online and console (i.e. Xbox Live Arcade and Sony’s PlayStation Network) each make up 15% of sales. Roberts says PopCap’s titles translate well for smartphones, and the numbers support his assertion. It had two titles, “Bejeweled 2 + Blitz” and “Plants vs. Zombies”, in the Top-Selling Paid iPhone/iPod Touch Games for 2010, according to Apple, the only game publisher to have two entries in the top 10. “Plants vs. Zombies” is also a top 10 top-selling and grossing iPad game.

Expansion into social gaming hasn’t been quite as strong yet, but PopCap’s games have done well there too. “Bejeweled Blitz” is the fifth highest-played game on Facebook, under the top 4 games created by social games juggernaut Zynga, according to AppData.com. PopCap just introduced in-game virtual goods for purchase into Bejeweled Blitz in April, and says the game hit its first $1 million in August from virtual goods sales. The company plans to continue growing its presence on Facebook. It just launched “Zuma Blitz” two weeks ago, with a healthy 700,000 to 800,000 daily active users. It plans to launch two new games for Facebook in 2011.

International expansion is also a major focus for the company. In just this past year, PopCap has announced a number of partnerships in Asia to help the company grow overseas. In Japan, the company has partnered with Taito, a subsidiary of videogame publisher Square Enix, to launch Pop Tower, a social game network on top of localized versions of top games like “Bejeweled” and “Zuma”, on Japanese mobile social network GREE in early 2011. In Korea, PopCap partnered with online games company NCsoft to create PopCap World, a mass multiplayer online world containing 13 of the company’s top games. And in China, PopCap is partnered with social network Renren to launch social, localized versions of PopCap’s games like “Plants vs. Zombies”.

It’s clear that China is especially important to PopCap. The company opened a Shanghai office in 2008 (it also has offices in Dublin, Ireland, and San Francisco). And Chinese gamers are already taking to the company’s games. Roberts says “Plants vs. Zombies” and “Zuma” are both very successful in China. One local TV commercial for toothpaste even rips off PopCap’s “Plants vs. Zombies” characters.

In terms of revenue, however, North America is still PopCap’s bread and butter, making up 75% of its total sales, with Europe at 17% and Asia at a mere 8%. But PopCap clearly wants to change that with the Asian partnerships. Roberts says the company plans to announce another one or two partnerships in the next six to nine months.

Most of PopCap’s revenue is still made from the try-before-you-buy business model it’s used since the company’s early days. Players can sample the games and then buy the full copy online or in a retail store, typically for around $20. PopCap’s games are found across a number of online portals like MSN Games and Steam, as well as large retailers like Walmart, Target and GameStop. This wide distribution has been a key part of PopCap’s success. But PopCap has shown a willingness to experiment, especially in new markets, like social, as well as new international markets. In Japan, Pop Tower will be free-to-play with in-game virtual goods for purchase. In Korea, PopCap World will also be free-to-play with optional premium paid elements.

PopCap faces competition from other casual game companies like Big Fish Games, which is also doing well (at least $130 million in 2010 revenue) and has many more titles available. But it is increasingly competing with other big players as well, especially as it gets into mobile, like Zynga and Electronic Arts (through its Pogo brand of casual games).

But if PopCap can marry its ability to create catchy games with its expansion efforts successfully, the company’s first decade will just be the beginning of the Bejeweled-maker’s story.(Source:forbes)